Introduction: Copy trading has become a popular way for traders to profit without needing to master the complexities of the market. Platforms like Axi make it easy to follow and copy the trades of expert traders. This strategy opens doors for both new and experienced traders, offering a way to leverage the skills and knowledge of seasoned professionals. In this cluster, we’ll explore what copy trading is, how it works on Axi, and why copying expert traders could be a game-changer for your trading journey. By focusing on trading platforms, trading strategies, and performance metrics, we will guide you through the benefits of using Axi’s copy trading features effectively.

Copy trading, often referred to as social or mirror trading, allows traders to copy the positions of expert traders in real-time. It’s a form of automated trading where the trades made by an expert are replicated in the follower's account. Unlike traditional trading, where individuals must actively manage their trades, copy trading offers a more passive approach to gaining exposure to financial markets. This method is particularly appealing to beginners who lack the experience or time to analyze the markets extensively.

The essential benefit here is that traders can tap into high-frequency trading strategies, such as scalping or day trading, without needing to execute them manually. Through platforms like Axi, traders can copy forex or copy cryptocurrency trades, following professionals who specialize in different types of assets.

Axi offers a seamless copy trading experience through its platform, where users can browse a range of expert traders to follow. After registering and linking their accounts, traders can select professionals based on their trading style, performance, and risk profile. The Axi platform automatically copies the trades executed by the expert to the user’s account.

The platform provides flexibility in terms of the trading strategy employed. Whether you’re interested in trend following, position trading, or swing trading, Axi allows users to find experts that align with their investment goals. It’s an excellent choice for individuals who want to reduce risk by replicating trading strategies with proven success rates.

With Axi’s copy trading tool, users can also adjust the risk-reward ratio of their trades, ensuring they’re comfortable with the amount of risk involved. This feature helps traders align their personal risk management strategies with the trades they copy.

Copying expert traders has significant advantages, especially for traders who are just getting started. It removes much of the guesswork and trial-and-error that often comes with trading. Instead of learning the hard way, you can learn from traders who have honed their skills over time.

Additionally, copying expert traders means you don’t need to follow every market fluctuation or watch charts all day long. The automated trading feature that Axi offers ensures that expert trades are executed automatically, allowing you to earn without constant oversight. For those new to technical analysis or fundamental analysis, copying experienced traders can also be a learning tool, giving you insight into their decision-making processes.

However, it’s crucial to understand that no trader can guarantee profits. Even expert traders face losses, so it’s important to choose experts whose strategies align with your risk tolerance and financial goals. On platforms like Axi, this can be easily managed by filtering experts based on performance metrics like return on investment (ROI) or maximum drawdown.

For beginners, it’s essential to choose a trading strategy that matches your risk profile and learning capacity. Many new traders start with more conservative swing trading strategies that focus on longer-term price movements rather than rapid fluctuations.

When selecting an expert trader to copy, pay attention to their risk level and their leverage practices. For example, some experts might engage in hedging strategies to limit potential losses. Beginners should seek out traders who employ low-risk strategies and offer diversification across multiple financial instruments like stocks, commodities, and forex.

The beauty of Axi’s platform is that it allows you to filter traders based on these criteria, giving you greater control over the kind of expert you decide to copy.

Overview of Copy Trading on Axi

| Feature | Description |

|---|---|

| Platform Type | Axi (Supports MetaTrader 4, MetaTrader 5, cTrader, etc.) |

| Types of Strategies | Scalping, Swing Trading, Position Trading, Trend Following |

| Financial Instruments Available | Forex, Commodities, Cryptocurrencies, CFDs |

| Risk Management Tools | Stop-Loss, Take-Profit, Leverage, Drawdown |

| Performance Metrics | Return on Investment (ROI), Maximum Drawdown, Risk-Reward Ratio |

| Copy Trader Selection | Filter by Strategy, Risk Profile, Performance |

The interconnectedness of these sub-topics emphasizes the practical steps a trader should take to get started with copy trading on Axi. First, the user gains a solid understanding of the copy trading concept and the platform's core features. Then, they move on to how to choose the right expert based on performance, risk tolerance, and strategy type. By the end of the cluster, they understand not only the strategies they can follow but also how to make informed decisions about who to copy and why it’s important to align with their financial goals.

This flow creates continuity and relevance for the user, guiding them from understanding what copy trading is, how it works on Axi, to the practical steps of choosing the right expert and applying strategies that fit their profile. The focus on trading strategies, risk management, and financial instruments ensures that each section naturally leads into the next, offering readers a comprehensive and actionable roadmap.

Introduction:

When it comes to copy trading, selecting the right expert to follow is crucial. With Axi’s advanced copy trading platform, you have access to a wide range of expert traders, each with their own approach to the markets. Understanding how to choose the right expert can significantly impact your performance metrics and overall success in the market. In this cluster, we’ll explore how to select expert traders on Axi, the tools that help you assess their performance, and why making the right choice is so important in achieving your financial goals.

Selecting the right expert trader to copy on Axi involves considering several factors that match your trading strategy and risk management preferences. Axi allows you to filter and search for traders based on key attributes such as risk level, trading style, and asset focus (e.g., forex, stocks, or commodities). By looking at their risk-reward ratio, drawdown, and return on investment (ROI), you can align with traders who share similar goals.

For instance, if you prefer lower risk, you might opt for traders with a conservative trading style, such as position trading or swing trading. On the other hand, if you're looking to achieve faster returns, traders who specialize in scalping or high-frequency trading may be more appropriate. Axi’s platform provides transparent performance metrics, so you can confidently assess how an expert trader aligns with your risk tolerance and profit goals.

It’s not just about choosing any expert; it’s about selecting one with a consistent track record. Look for traders who have shown profitability over a significant period. Success in automated trading strategies doesn’t come from short-term wins alone—it’s about sustained, strategic growth. You should examine their historical performance and whether their trading strategy aligns with your long-term financial goals.

Performance indicators like maximum drawdown, trade frequency, and win rate are critical when evaluating potential experts. Traders with higher return on investment (ROI) and risk-adjusted returns might be more suitable for aggressive investors, whereas those with moderate but steady growth could be better for more conservative traders. This careful evaluation ensures that your copy trading experience with Axi is both rewarding and aligned with your objectives.

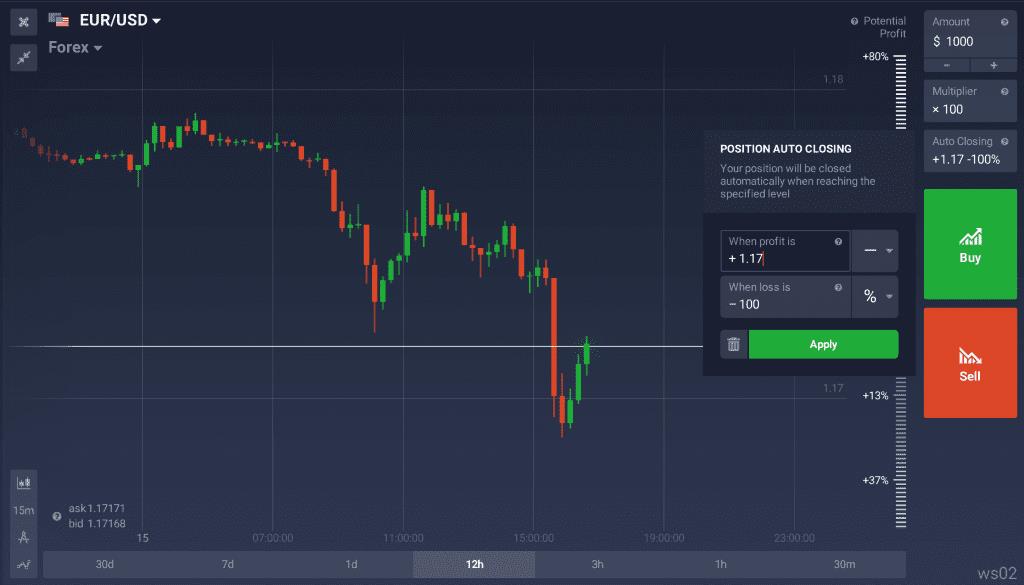

When copying an expert trader, risk management is paramount. Even though Axi offers a simple way to follow experts, the risks involved in trading forex or copying cryptocurrencies can be unpredictable. Each expert trader has their own way of managing stop-loss orders, take-profit levels, and overall position sizing. Understanding how they manage risk can give you insights into how aggressive or conservative their strategy is.

Axi's copy trading platform allows you to adjust your own risk management settings, so you can decide whether you want to mirror the expert’s risk profile or reduce exposure. This customization ensures that even if you follow high-risk traders, you can still maintain a level of control over your potential losses.

Copy trading is not a one-time decision; it’s an ongoing process. The markets are constantly evolving, and so are the strategies of the traders you follow. Regularly checking the expert’s performance is important to make sure they continue to meet your expectations. Axi’s platform provides real-time updates on traders' performance, enabling you to make informed decisions.

If an expert trader’s performance declines or no longer fits your risk profile, you can always adjust your strategy by choosing a new trader to follow. This ongoing monitoring ensures that your copy trading strategy remains dynamic and aligned with your goals.

Infographic: Key Metrics to Look for When Choosing an Expert Trader on Axi

| Metric | What to Look For | Why It Matters |

|---|---|---|

| Risk-Reward Ratio | Look for a ratio that matches your risk tolerance | Ensures you’re comfortable with the potential gains vs. losses |

| Return on Investment | Steady ROI over a long period | Indicates long-term profitability and consistency |

| Drawdown | Low to moderate drawdown | Helps assess the potential risk of significant losses |

| Win Rate | Percentage of profitable trades | Gives an indication of the trader’s overall success rate |

| Trade Frequency | Daily, weekly, or monthly trading | Determines how active the trader is and whether it suits your trading style |

In summary, choosing the right expert to copy on Axi involves a careful evaluation of their performance, trading strategy, and risk management techniques. By focusing on key metrics like return on investment, drawdown, and risk-reward ratio, you can ensure that you are following traders whose approach aligns with your financial goals and risk tolerance. Staying informed and making adjustments along the way will help you optimize your copy trading experience for long-term success.

Introduction:

When you first start copy trading on platforms like Axi, choosing the right trading strategy is essential for your success. Whether you are looking to trade forex, stocks, or cryptocurrencies, understanding different trading strategies and their risks is crucial. Copy trading allows beginners to follow expert traders, but knowing how to select the best strategies can significantly improve your performance and help you achieve your financial goals. This cluster will explore the best copy trading strategies for beginners, highlighting easy-to-follow approaches that suit new traders' needs while balancing risk and reward.

As a beginner, it's important to start with strategies that are easy to understand and manage. Trend-following strategies are often recommended because they capitalize on existing market movements, which makes them easier to predict. For instance, if an expert trader is using a trend-following strategy, you can copy their positions and follow the market’s momentum. This approach works well in markets like forex or commodities, where price movements can be more predictable.

Another simple strategy suitable for beginners is swing trading, which involves holding positions for several days or weeks to capture medium-term market movements. By following experts who focus on swing trading, you can benefit from their analysis of key market trends, such as price breakouts and support/resistance levels. Both of these strategies provide opportunities for beginners to learn without requiring complex technical analysis or advanced market timing skills.

Before copying a trader, it’s important to understand their trading style. Not all traders are the same, and their approach may vary depending on whether they focus on scalping, position trading, or automated trading. Scalpers, for example, aim for small, frequent profits by making multiple trades throughout the day. While this can be highly profitable for experienced traders, beginners may prefer the more relaxed pace of position trading or swing trading.

By closely examining an expert's performance metrics, such as return on investment (ROI) and maximum drawdown, beginners can assess whether a trader’s style aligns with their own risk tolerance and financial goals. It’s crucial to ensure that the expert you choose practices a strategy that suits your risk management preferences, as following a trader with a high-risk profile might lead to more significant losses.

One of the most important aspects of any trading strategy is risk management. When selecting a trader to copy, always consider their approach to managing stop-loss orders, take-profit orders, and position sizing. Axi’s platform offers users the ability to see how experts handle risk through their trading history.

Beginners should focus on traders who utilize a low-risk, high-reward strategy, ensuring that their drawdown levels remain manageable. Additionally, adjusting leverage and using stop-loss orders to limit potential losses can protect your capital while allowing you to take advantage of profitable trades.

Automated trading is an appealing option for beginners who prefer a hands-off approach. Through Axi’s automated trading tools, beginners can easily copy trades from experts who use algorithmic trading or high-frequency trading strategies. These automated systems remove the need for manual analysis and execution, offering a more efficient way to follow expert traders.

However, it’s essential to evaluate the underlying strategies of these automated systems and ensure that the trader’s algorithms align with your goals. Automated trading can be a powerful tool, but it requires careful selection of the right expert and constant monitoring to ensure the system remains profitable.

| Strategy Type | Ideal for Beginners | Key Focus Areas | Risk Level | Best for Assets |

|---|---|---|---|---|

| Trend-following | Yes | Market momentum, price direction | Low to Medium | Forex, Stocks, Commodities |

| Swing trading | Yes | Market cycles, support/resistance levels | Medium | Stocks, Forex, Indices |

| Scalping | No (High Risk) | Small profits, frequent trades | High | Forex, CFDs |

| Position trading | Yes | Long-term trends, fundamental analysis | Low | Stocks, Commodities |

| Automated trading | Yes | Algorithm-driven trades, high-frequency execution | Low to Medium | Forex, Cryptocurrencies |

By choosing the right strategy and aligning it with your financial goals, you can improve your chances of success in copy trading. Understanding performance metrics and evaluating trading strategies will help you make informed decisions and optimize your trading experience on Axi.

Introduction:

While copy trading offers great opportunities, it also comes with its own set of risks. Understanding these risks is essential for anyone considering copy trading on platforms like Axi. By choosing the right experts and using appropriate risk management strategies, you can minimize potential losses and optimize your profits. In this cluster, we’ll explore the various risks associated with copy trading, including market volatility, trader performance, and emotional factors, and discuss ways to mitigate them effectively.

Market volatility is one of the most significant risks in any form of trading, including copy trading. Volatile markets can cause sudden price fluctuations, leading to unexpected gains or losses. Traders who use high-leverage strategies, such as scalping or high-frequency trading, are particularly vulnerable to these fluctuations.

When copying expert traders, it’s crucial to understand how they manage risk in volatile conditions. For example, an expert may use stop-loss orders to automatically close a position if the market moves against them. As a beginner, it’s important to learn from these practices and incorporate them into your own copy trading strategy to avoid significant losses during periods of high market volatility.

Another risk in copy trading is the performance of the expert trader you are copying. While past performance may indicate the trader’s skill, there’s no guarantee that future results will be the same. Traders may experience drawdowns or face market conditions they are not prepared for, affecting their profitability.

To mitigate this risk, Axi provides detailed performance metrics that allow you to track the expert trader's risk-reward ratio, maximum drawdown, and return on investment (ROI) over time. By monitoring these metrics, you can adjust your copy trading settings or even switch to another trader if their performance begins to deteriorate.

One of the most overlooked risks in copy trading is the emotional aspect. As a beginner, you might feel tempted to deviate from the strategy, especially during periods of drawdown or loss. This can lead to impulsive decisions, such as prematurely stopping a copy trade or moving to a new expert.

The key to managing emotional risk is discipline. Set clear goals and stick to your trading plan. By focusing on long-term gains rather than short-term market movements, you can avoid the emotional pitfalls that often lead to poor trading decisions.

Infographic: Risk Management Strategies for Copy Trading

| Risk Factor | Impact on Copy Trading | Mitigation Strategy |

|---|---|---|

| Market Volatility | Sudden price fluctuations can cause unexpected losses. | Use stop-loss orders, take-profit orders, and diversify risk. |

| Trader Performance | Expert trader’s performance may decline unexpectedly. | Monitor performance metrics, switch traders if necessary. |

| Emotional Risks | Impulsive decisions during losses or gains. | Stick to a long-term strategy, avoid knee-jerk reactions. |

In conclusion, while copy trading can be a powerful tool, understanding and managing risks is key to maximizing its potential. By leveraging Axi's performance tracking tools and focusing on effective risk management techniques, you can minimize the impact of market volatility, trader performance fluctuations, and emotional biases.

Introduction:

As you begin your copy trading journey on platforms like Axi, it’s essential to monitor and adjust your strategy over time to ensure success. Copy trading allows you to follow the trades of experts, but your involvement doesn’t end once you’ve selected a trader to copy. Continuous monitoring of performance, risk, and strategy alignment with your financial goals is crucial to long-term profitability. In this cluster, we will explore how to track your copy trading progress, when to make adjustments, and how to optimize your strategy for better outcomes.

One of the most effective ways to ensure the success of your copy trading strategy is to regularly track the performance of your selected expert traders. Axi provides detailed performance metrics for each trader, including ROI, maximum drawdown, and risk-reward ratios, allowing you to assess their effectiveness over time. By analyzing these metrics, you can determine whether the trader’s performance aligns with your expectations.

It’s essential to track these metrics regularly, as the performance of even the best traders can fluctuate with changing market conditions. If a trader’s performance begins to decline, it may be time to re-evaluate their strategy or switch to a more consistent performer. This proactive approach helps mitigate risk and ensures you stay on track to meet your financial goals.

Adjusting your copy trading strategy is an important part of staying successful. There are several situations in which adjustments may be necessary:

To maximize your copy trading success, it's important to continuously optimize your strategy. This means regularly reviewing your chosen trader’s performance and adjusting your selection based on their success in achieving your financial goals. Additionally, be mindful of your risk management settings on the Axi platform. Setting stop-loss orders, adjusting your leverage levels, and diversifying across multiple traders can help reduce potential losses and improve your overall profitability.

An effective strategy also includes a diversified portfolio. Copying traders who specialize in different asset classes, such as stocks, commodities, or cryptocurrencies, helps spread risk and protect your investments in volatile market conditions.

| Metric | What to Track | Why It Matters |

|---|---|---|

| ROI (Return on Investment) | Percentage of profit relative to the amount invested | Determines the trader’s overall profitability and helps assess long-term success. |

| Risk-Reward Ratio | Ratio of potential profit to potential loss | Helps ensure the trader’s strategy is worth the risk taken. |

| Maximum Drawdown | Maximum percentage loss from peak to trough | Shows the worst-case loss and helps assess risk levels. |

| Leverage | Amount of leverage used in trading | Affects risk—higher leverage increases both potential profits and losses. |

| Diversification | Spread across different asset classes or traders | Reduces risk by avoiding concentration in a single market or trader. |

By following these guidelines and using Axi’s advanced tools, you can effectively monitor and adjust your copy trading strategy, optimizing it for long-term success. This proactive approach ensures that you stay aligned with your financial goals while minimizing risk in the ever-changing trading environment.