Introduction:

In today’s competitive trading landscape, selecting the right platform is crucial for success. Axi stands out as a reliable online trading service that caters to both beginner and experienced traders. This cluster will dive into the essential features of the Axi trading platform, from its account types to the tools it offers, helping users understand how it aligns with their trading goals. By highlighting key features, we can clearly illustrate what makes Axi a strong contender in the crowded trading platform market. Whether you're looking to trade forex, commodities, or cryptocurrency, Axi offers versatile tools and services for your needs.

1: Account Types and Benefits at Axi

Axi offers various account types tailored to different trading needs, whether you're just starting out or you’re an experienced trader. The Standard Account provides access to competitive spreads, while the Pro Account gives advanced traders tighter spreads and more flexibility with pricing. These accounts also come with access to powerful trading tools like MetaTrader 4, widely recognized for its robust charting and analytical capabilities. This variety ensures that traders can select the account that best suits their trading style, from casual investors to active day traders.

2: Axi’s Trading Platforms: MetaTrader 4 and MetaTrader 5

Axi provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms globally. MT4 is known for its simplicity and effectiveness in executing trades, while MT5 expands on this with additional features such as more timeframes, an integrated economic calendar, and enhanced charting options. These platforms are ideal for traders looking for both speed and precision, allowing them to execute forex and commodity trades efficiently. Additionally, Axi supports web-based platforms for easy access without needing to install any software, making it easier for traders on the go.

3: Axi’s Low Spreads and Competitive Commission Structure

When it comes to trading, costs are a major consideration. Axi offers low spreads on forex and commodity pairs, allowing traders to make the most of their trades. For those seeking even tighter spreads, the Pro Account offers a more competitive structure, including lower commissions. This competitive pricing structure is attractive to both individual traders and institutions looking to minimize trading costs while maintaining a high level of liquidity. Axi's transparency in pricing helps establish trust and ensures traders are not hit with unexpected fees.

4: Axi’s Educational Resources and Support

For traders looking to expand their knowledge, Axi provides a comprehensive suite of educational resources. From webinars and tutorials to in-depth trading guides, new and experienced traders alike can benefit from the wide range of learning materials. The platform also offers access to expert insights and market analysis, ensuring traders stay up-to-date with current market trends. Axi’s support team is available 24/5, providing responsive customer service to address any issues traders may encounter. This support infrastructure makes it easier for traders to focus on their strategies, knowing they have the resources to back them up.

| Feature | Standard Account | Pro Account |

|---|---|---|

| Account Type | Basic/Standard | Advanced |

| Spread Type | Variable | Variable |

| Commission Structure | No Commission | Low Commission |

| Supported Platforms | MetaTrader 4/5 | MetaTrader 4/5 |

| Tools & Resources | Standard tools | Advanced tools and educational resources |

| Support Availability | 24/5 | 24/5 |

Conclusion:

Axi provides a comprehensive trading environment that is both flexible and competitive, ensuring that traders have the tools they need for success. Whether you are just starting with a Standard Account or looking for more advanced features with the Pro Account, Axi caters to various levels of trading expertise. By offering a blend of powerful platforms, low spreads, and valuable educational support, Axi solidifies its position as a top choice for traders worldwide. Understanding these features can help you navigate the platform with confidence, making it easier to develop and execute effective trading strategies.

Introduction:

Axi equips traders with an array of advanced tools and resources designed to enhance their trading experience. From powerful platforms like MetaTrader 4 and MetaTrader 5 to in-depth market analysis tools, Axi provides a comprehensive suite that meets the needs of both novice and professional traders. In this cluster, we will explore the various tools and educational resources available to Axi traders, highlighting how they contribute to a more informed and effective trading journey. Whether you're trading forex, indices, or commodities, Axi’s tools give you the edge in a fast-moving market.

1: Axi’s Market Analysis Tools

Axi offers a range of market analysis tools that assist traders in staying ahead of the curve. These include technical analysis indicators like moving averages, Bollinger Bands, and RSI, which can be easily accessed via the MetaTrader platforms. Additionally, fundamental analysis tools such as economic calendars and news feeds provide essential market insights, keeping traders informed of global events that could impact their positions. These combined tools help create a strategic approach to trading, enabling traders to make better-informed decisions based on both technical and fundamental factors.

2: Educational Resources and Trading Guides

To support traders of all levels, Axi offers extensive educational resources. The Axi Academy provides online tutorials, webinars, and articles covering a wide range of topics, from the basics of forex trading to advanced strategies. This ensures that traders can continuously develop their skills, enhancing their ability to navigate volatile markets. The platform also offers demo accounts, which allow traders to practice strategies in a risk-free environment before committing real capital. These resources make Axi an attractive platform for beginners who want to learn while trading.

3: Axi’s Trading Tools for Automation

For more experienced traders, Axi’s offering of automated trading tools is a game-changer. Using Expert Advisors (EAs) on the MetaTrader 4 platform, traders can automate their trading strategies, enabling them to execute trades at optimal times without being glued to their screens. This allows for faster reactions to market fluctuations, particularly in the fast-paced forex market. Axi also supports the integration of trading algorithms, which can be customized and backtested to refine trading strategies before going live.

4: Axi’s Social Trading Features

Social trading is becoming increasingly popular, and Axi has embraced this trend by offering features that allow traders to interact and share strategies. Through the Trading Signals feature, users can follow experienced traders and mirror their trades. This is an invaluable resource for beginners looking to learn from more seasoned professionals. Additionally, Axi’s community forums and social media channels provide platforms for traders to share insights, strategies, and tips, fostering a collaborative trading environment.

Infographic:

Here’s an infographic to summarize the key trading tools and resources available at Axi:

| Tool/Resource | Description | Benefit |

|---|---|---|

| Market Analysis Tools | Technical and fundamental tools, including news feeds and economic calendars. | Provides timely insights for informed decisions. |

| Educational Resources | Access to the Axi Academy, tutorials, and webinars. | Perfect for both beginner and advanced traders. |

| Automated Trading (EAs) | Allows traders to automate strategies via MetaTrader. | Automates trading and improves efficiency. |

| Social Trading | Follow and mirror trades of experienced traders via trading signals and forums. | Learn from peers and enhance trading knowledge. |

Conclusion:

In conclusion, Axi’s trading tools and resources give traders the necessary features to succeed in various markets. From educational materials that enhance trader knowledge to automated trading options that optimize execution, Axi provides the tools for every level of trader. By incorporating advanced market analysis tools and social trading features, Axi empowers traders to engage with the market effectively, ensuring they are equipped with the best tools to navigate the dynamic world of forex and commodities trading.

Introduction:

Understanding the cost structure of a trading platform is essential for making informed decisions. Axi’s trading fees, spreads, and commission structure are designed to be transparent, competitive, and flexible, catering to a wide range of traders. Whether you're trading forex, commodities, or indices, the cost of trading can significantly impact your profitability. In this cluster, we will explore the key elements of Axi’s fee structure, including spread types, commission charges, and any additional costs associated with trading on this platform. With a clear understanding of Axi’s cost system, traders can optimize their strategies and make cost-effective trading decisions.

1: Understanding Axi’s Spread Types

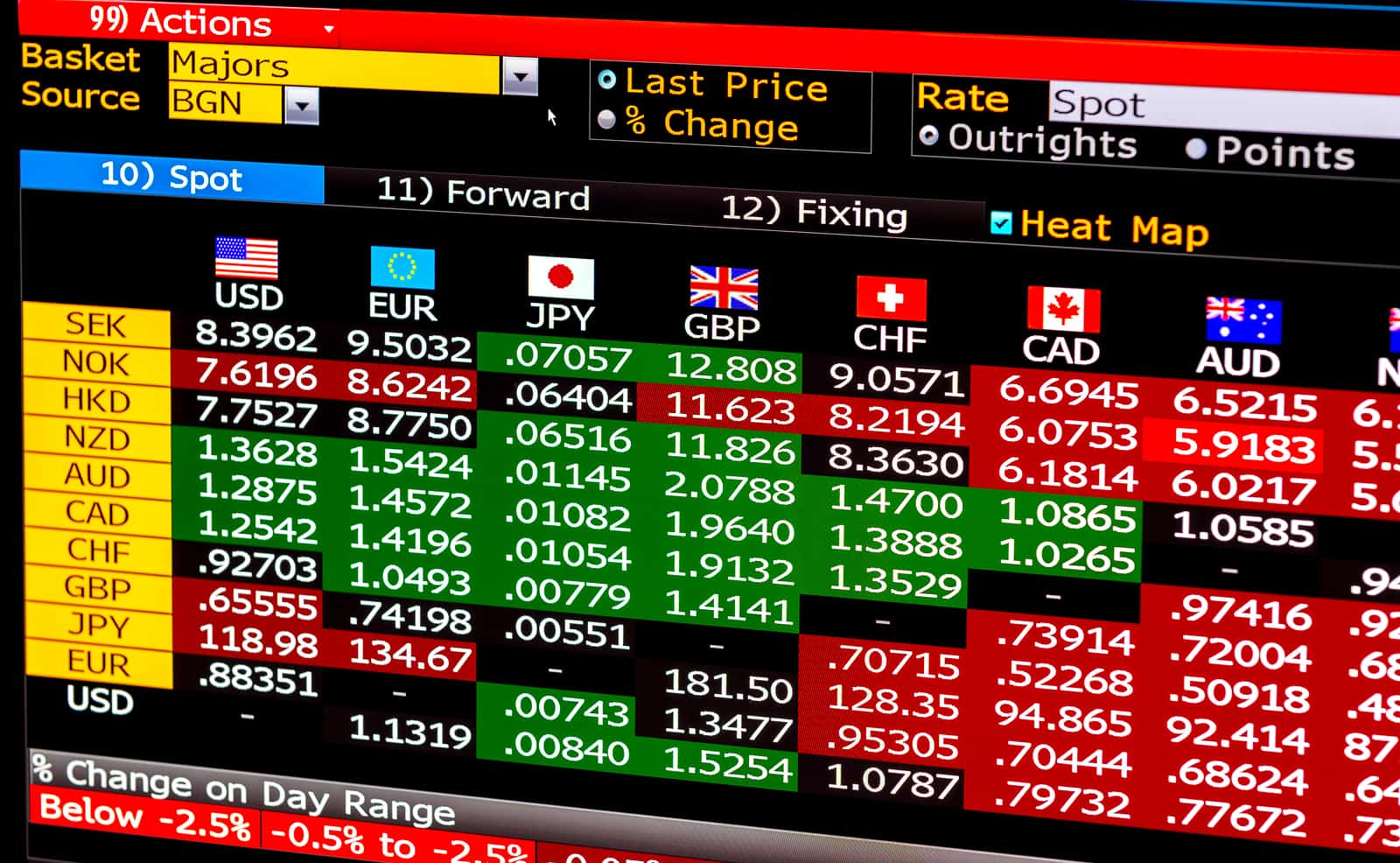

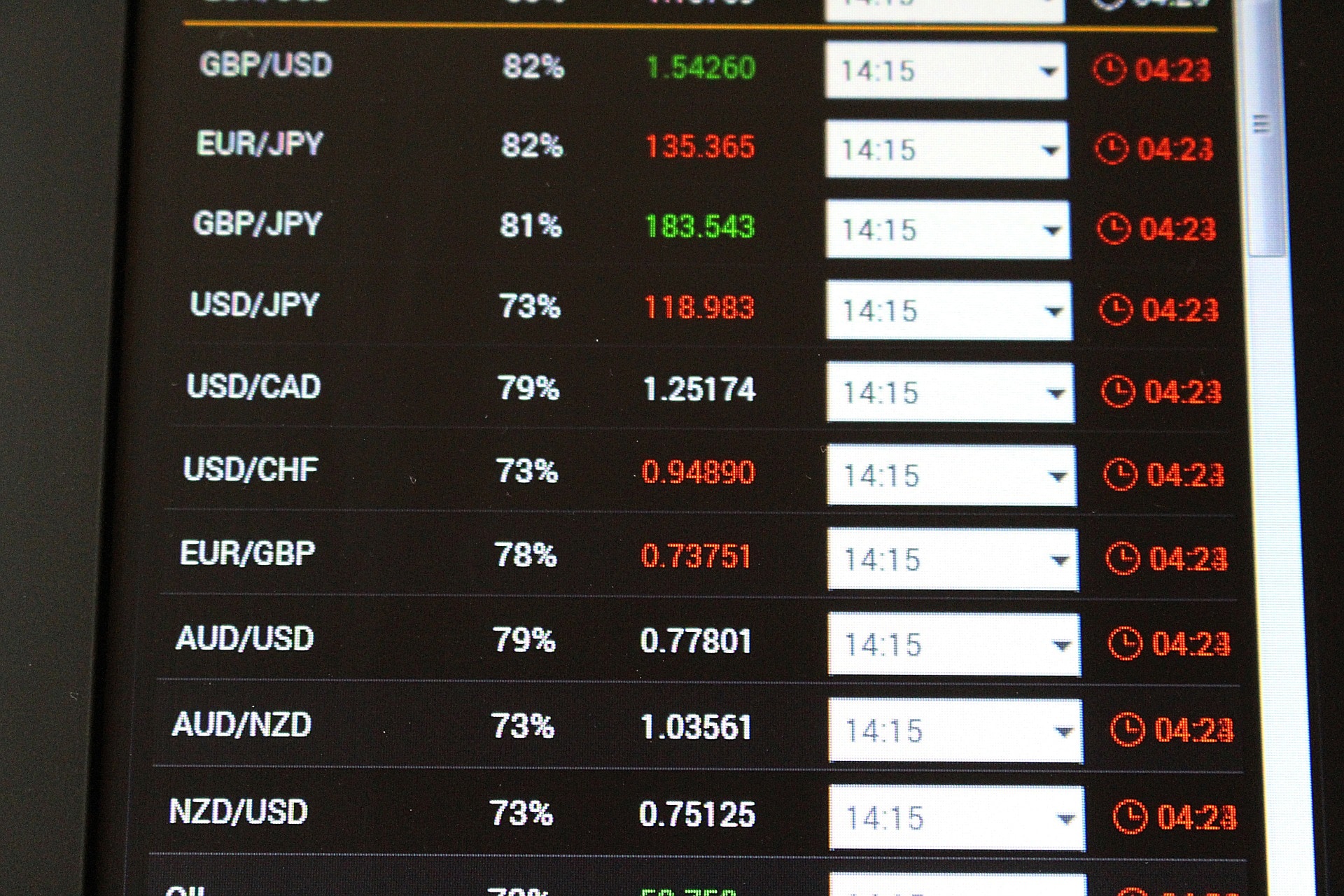

Axi offers variable spreads that adjust according to market conditions, ensuring that traders get competitive rates. The spread is the difference between the buy and sell price, and Axi's spreads are based on the liquidity of the market at any given time. For popular pairs like EUR/USD or GBP/USD, the spread can be as low as 0.0 pips, making Axi an attractive choice for traders seeking tight spreads. The platform uses raw spreads for its Pro Account holders, meaning they only pay for the cost of the spread without additional markup, which is ideal for high-frequency traders who need low-cost execution.

2: Axi’s Commission Charges for Pro Accounts

For traders using the Pro Account, Axi charges a commission per trade in addition to the spread. This structure is designed to benefit active traders who prioritize low spreads and execute high volumes of trades. The commission is relatively low and is charged based on the size of the trade. This can be advantageous for traders who focus on scalping or day trading, as the low commission and tight spreads result in overall lower transaction costs compared to other platforms.

3: Additional Costs and Fee Transparency

While Axi's core fee structure is straightforward, it’s important to be aware of potential additional fees that may apply. These could include overnight financing charges for positions held overnight, as well as fees for certain payment methods. Axi is committed to fee transparency, meaning that all costs are clearly disclosed before executing trades. Traders can find a detailed list of all fees in their account, and the platform provides access to real-time data on spread and commission charges. This transparency helps traders understand the full cost of their trades and avoid unexpected charges.

4: How Axi Compares with Other Trading Platforms

When comparing Axi’s fees to other forex trading platforms, Axi stands out with its competitive spreads and low commissions. For instance, many platforms charge higher spreads or commission fees, especially for active traders. Axi’s pricing model, which combines tight spreads with low commissions, ensures that traders can maximize their returns without being burdened by excessive costs. The fee structure is tailored to meet the needs of both casual and professional traders, making it an appealing option for anyone from beginners to experts.

Infographic: Axi Trading Fees Overview

Below is a summary table outlining the key aspects of Axi’s fees, spreads, and commission structure:

| Cost Component | Standard Account | Pro Account |

|---|---|---|

| Spread | From 1.0 pip | From 0.0 pip |

| Commission | None | $3.50 per lot (per side) |

| Overnight Financing | Variable, based on position | Variable, based on position |

| Deposit Fees | Free | Free |

| Withdrawal Fees | Free (Bank transfer fees may apply) | Free (Bank transfer fees may apply) |

This infographic provides a quick reference for Axi’s pricing structure, helping traders compare the different account options and decide which suits their trading style.

By exploring these core elements—spread types, commission structure, and additional costs—traders can get a clear picture of Axi’s fee framework. This helps them make informed decisions on whether Axi aligns with their trading strategies, ensuring cost-effective trading practices.

Introduction:

When selecting an online trading platform, ensuring your funds and personal information are secure is a top priority. Axi prioritizes security with robust protocols to protect its users' assets, while also offering comprehensive customer support to assist traders at any stage of their journey. This cluster will explore the security measures Axi employs to safeguard user data and funds, as well as the customer support services available to traders. Whether you're an individual trader or managing a portfolio, knowing your trading platform has your back in terms of both security and support is crucial.

1: Axi’s Robust Security Measures

Axi employs cutting-edge security technology to protect its traders. It uses SSL encryption (Secure Sockets Layer) to secure data transmission between traders and the platform. This ensures that all personal and financial information remains confidential and safe from unauthorized access. Additionally, Axi adheres to strict regulatory compliance standards, which means that user funds are kept in segregated accounts in line with financial regulations, offering traders extra peace of mind. These security measures are vital for ensuring that funds and trading activities remain secure, especially for traders dealing with large volumes.

2: Multi-Factor Authentication and Account Protection

To further enhance security, Axi offers multi-factor authentication (MFA). MFA adds an extra layer of protection by requiring users to provide two or more verification factors to access their accounts. This could include something the user knows (password), something the user has (a mobile device for verification), or something the user is (fingerprint or facial recognition). This additional step makes unauthorized access far more difficult, offering an essential safeguard for traders, particularly those with high-value accounts or sensitive financial data.

3: Axi’s 24/5 Customer Support

Axi understands that timely customer support can make all the difference, especially when facing issues with your trading account or platform. Their 24/5 customer support is available through various channels, including live chat, email, and phone. Whether you need technical assistance with the MetaTrader platforms, have questions about account management, or seek guidance on trade execution, Axi’s support team is equipped to handle a wide range of inquiries. This round-the-clock support is particularly beneficial for traders operating across different time zones, ensuring that help is always available when needed.

4: Axi’s Knowledge Base and Self-Help Resources

In addition to live support, Axi offers a comprehensive knowledge base that includes tutorials, FAQs, and troubleshooting guides. These resources are ideal for users who prefer to resolve issues independently or learn more about the platform at their own pace. The knowledge base covers everything from account setup to advanced trading techniques, providing valuable self-help options for traders. Additionally, Axi regularly updates these resources, ensuring they stay relevant and informative.

Infographic: Axi's Security Measures and Customer Support

| Security Feature | Description |

|---|---|

| SSL Encryption | Secures data transmission between users and platform to prevent unauthorized access. |

| Regulatory Compliance | Ensures funds are held in segregated accounts, adhering to financial regulations for security. |

| Multi-Factor Authentication | Adds an extra layer of protection by requiring multiple verification factors to access accounts. |

| 24/5 Customer Support | Available via live chat, email, and phone to address trader inquiries around the clock. |

| Knowledge Base & Self-Help | Comprehensive guides and FAQs to help users solve problems independently. |

This table summarizes Axi's core security features and customer support offerings, providing traders with essential information about the platform’s safeguards and support systems.

Introduction:

As with any trading platform, it's important to weigh the pros and cons of using Axi for your trading needs. While Axi offers numerous benefits for traders, such as low spreads, robust security features, and powerful trading tools, there are also aspects that might not suit every trader's preferences or requirements. In this cluster, we will evaluate the advantages and potential drawbacks of trading with Axi, helping you make an informed decision. Understanding these key aspects will enable you to better navigate the platform and determine whether Axi aligns with your trading goals.

1: Advantages of Trading with Axi

Axi offers numerous advantages that make it a top choice for both beginner and advanced traders. One of the biggest benefits is its competitive pricing, with low spreads and commission-based accounts that reduce costs for high-volume traders. The platform also provides access to powerful tools like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), giving traders a wide range of charting and analysis features. Additionally, Axi is regulated by reputable authorities, which ensures a high level of financial security and transparency for its users. These factors combine to create an environment that helps traders maximize their potential profits while minimizing risks.

2: Potential Drawbacks of Axi Trading Services

Despite its many benefits, there are some drawbacks to consider when trading with Axi. While the platform offers competitive spreads, high-frequency traders may find that the costs can add up quickly, especially for certain instruments that may have wider spreads during off-hours or volatile market conditions. Additionally, Axi does not offer as many financial products as some larger brokers, which may limit options for traders who wish to diversify their portfolios beyond forex or commodities. Traders who are looking for a broader selection of asset classes, such as stocks or ETFs, may find Axi’s offerings limited.

3: What Makes Axi Stand Out from Other Brokers

Axi distinguishes itself from many competitors in the market due to its focus on transparency and regulatory compliance. It is a well-established brand with a solid reputation for reliable customer service and low-cost trading options. Axi’s education center also sets it apart, offering comprehensive tutorials and learning materials to help traders improve their skills. Furthermore, Axi’s tight spreads and raw pricing models appeal particularly to active traders who rely on cost-effective execution for success. These elements make Axi an appealing choice for those seeking a reliable and transparent trading environment.

4: Comparing Axi with Other Popular Platforms

When comparing Axi with other brokers like IG, OANDA, or Pepperstone, it becomes clear that each platform has its strengths and weaknesses. Axi’s focus on forex and commodities makes it an excellent choice for currency traders, but it may not provide the same variety of asset classes as some larger brokers. In terms of fees, Axi’s commission-based structure is a standout feature that can benefit high-volume traders, while others may prefer brokers with fixed spreads. Ultimately, the right choice depends on individual preferences, trading style, and asset focus.

Infographic: Axi vs Competitors Comparison Table

| Feature | Axi | IG | OANDA | Pepperstone |

|---|---|---|---|---|

| Spreads | From 0.0 pips (Pro Account) | Variable, from 0.6 pips | Variable, from 1.0 pips | From 0.0 pips |

| Commission | Low commission (Pro Account) | Commission-free or included in spread | No commission on most accounts | Low commission on Pro Account |

| Platform Options | MT4, MT5 | WebTrader, MT4 | MT4, OANDA platform | MT4, MT5 |

| Educational Resources | Comprehensive tutorials | Limited resources | Good resources | Limited resources |

| Asset Range | Forex, Commodities | Forex, Stocks, Indices | Forex, Commodities | Forex, Commodities |

| Regulation | FCA, ASIC, CySEC | FCA, ASIC, NFA | CFTC, FCA, ASIC | ASIC, FCA |

This infographic helps provide a clear side-by-side comparison of Axi with other popular trading platforms, highlighting key differences in spread types, commission structures, and regulatory compliance. By evaluating these factors, traders can make a more informed choice based on their unique needs.