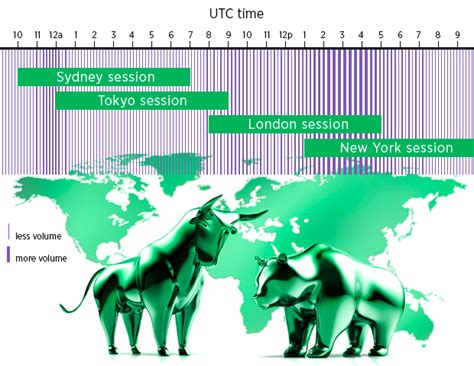

The global financial market operates continuously, creating opportunities for traders worldwide. The forex market is open 24 hours a day, five days a week, with trading sessions spanning multiple time zones, including Sydney, Tokyo, London, and New York. Understanding when different sessions open and close is essential for traders looking to maximize liquidity and take advantage of market movements. Overlapping trading hours often lead to increased volatility, making certain times more favorable for executing trades. Various factors, including economic data releases, geopolitical events, and institutional activity, influence how the market behaves during different sessions. Recognizing these dynamics helps traders develop effective strategies and optimize their trading performance.

The forex market remains open 24 hours a day, operating through different global financial centers. Trading activity shifts across regions, influencing liquidity, volatility, and price fluctuations. Each session holds unique characteristics, impacting how traders approach their strategies.

The global structure of forex trading revolves around four major sessions: Sydney, Tokyo, London, and New York. Each session impacts price movements based on market participant activity and economic events.

Sydney Session (Australian Dollar & New Zealand Dollar Focus)

Opens first, setting the initial price trends for the week.

Less volatile but crucial for positioning trades ahead of the Asian session.

Tokyo Session (Yen-Dominated Market)

Involves heavy participation from commercial banks, central banks, and investment funds.

Higher liquidity for USD/JPY, EUR/JPY, and GBP/JPY pairs.

London Session (Euro & Pound Liquidity Surge)

The most active session, contributing to nearly 35% of total forex volume.

High-impact releases like Inflation reports, GDP figures, and interest rate decisions influence volatility.

New York Session (Dollar-Dominated Trading)

Strong movements in USD pairs due to economic announcements such as Consumer Confidence and Non-Farm Payrolls.

Liquidity remains high until the market transitions toward the Sydney session.

The periods when two sessions are active simultaneously often experience the highest liquidity and price fluctuations. These overlaps allow hedge funds, money managers, and retail traders to capitalize on sharp price movements.

Tokyo-London Overlap

Short-lived but volatile for GBP/JPY, USD/JPY, and EUR/JPY.

Influenced by economic releases from Japan and early European news.

London-New York Overlap (Most Active Period)

The highest trading volume occurs as the two largest financial hubs operate together.

Major economic indicators like Trade Balance, Retail Sales, and Unemployment Rate impact market sentiment.

Sydney-Tokyo Overlap

Moderate liquidity, with Asian markets leading trends for the day.

Key movements in AUD, NZD, and JPY pairs due to policy changes and Reserve Bank of Australia decisions.

Understanding when to trade specific pairs helps traders optimize their strategies. Each currency pair experiences unique volatility levels based on session activity.

| Currency Pair | Best Trading Hours | Key Market Participants | Main Economic Drivers |

|---|---|---|---|

| EUR/USD | London & New York Overlap | Commercial Banks, Hedge Funds | ECB Policy, U.S. Non-Farm Payrolls |

| USD/JPY | Tokyo & London Sessions | Central Banks, Investment Funds | BOJ Rate Decisions, U.S. Inflation Data |

| GBP/USD | London & Early New York | Retail Traders, Brokers | UK GDP, U.S. Consumer Confidence |

| AUD/USD | Sydney & Tokyo Sessions | Money Managers, Corporations | RBA Announcements, Chinese Trade Data |

| USD/CAD | New York Session | Oil Companies, Central Banks | Crude Oil Prices, Canadian Jobs Data |

Understanding these trading windows allows traders to align their strategies with liquidity spikes and economic data releases.

Even though the forex market operates five days a week, price gaps frequently occur between Friday’s closing price and Monday’s opening price. These gaps arise due to geopolitical events, policy changes, and central bank interventions over the weekend.

Causes of Weekend Gaps

Elections and political instability shifting investor sentiment.

Unexpected interest rate changes announced outside market hours.

Trade wars and international agreements creating uncertainty.

How Traders Handle Weekend Gaps

Using stop loss orders to prevent excessive risk from price jumps.

Monitoring global events before markets reopen.

Analyzing liquidity levels before entering new positions.

Recognizing potential weekend volatility enables traders to prepare effective risk management strategies before the next market open.

The forex market operates through the participation of multiple entities, each contributing to liquidity, price movements, and overall market efficiency. From central banks to retail traders, different participants shape trading conditions and volatility. Understanding their roles allows traders to anticipate fluctuations and adjust strategies accordingly.

Central banks such as the Federal Reserve, European Central Bank, and Bank of Japan play a fundamental role in forex market stability. Their influence extends through various policy tools:

Interest Rate Decisions: Higher interest rates strengthen a currency by attracting capital inflows, while lower rates weaken it.

Quantitative Easing (QE): Injects liquidity into the financial system, often leading to currency depreciation.

Direct Currency Intervention: Some central banks, like the Swiss National Bank, intervene by buying or selling large volumes of currency to stabilize exchange rates.

Inflation Control Policies: Inflation affects purchasing power, leading central banks to adjust monetary policies accordingly.

Shifts in these policies often result in major price swings, requiring traders to monitor central bank decisions closely.

Hedge funds and large investment funds engage in high-frequency and long-term trades, influencing price trends. Their strategies include:

Leveraged Speculation: Large funds use high leverage to amplify profits, increasing market volatility.

Algorithmic Trading: Sophisticated models execute trades based on economic indicators such as GDP, unemployment rates, and consumer confidence.

Risk Hedging: Funds hedge against geopolitical risks, including trade wars and political instability, shifting positions accordingly.

Massive capital inflows from these institutions create ripple effects across forex markets, affecting liquidity and trend formation.

The forex market is driven by the contrasting behaviors of retail traders and institutional investors. Their differences stem from capital size, execution methods, and access to market data.

| Factor | Retail Traders | Institutional Traders |

|---|---|---|

| Capital Size | Smaller accounts, typically under $100,000 | Millions to billions in managed assets |

| Market Access | Retail brokers, trading platforms like MetaTrader | Direct interbank access, prime brokers |

| Trading Strategy | Scalping, day trading, trend following | Quantitative trading, long-term investments |

| Risk Management | Stop-loss and leverage management | Hedging through options, futures, and swaps |

| Execution Speed | Market and limit orders | Algorithmic execution with minimal slippage |

Retail traders often react to volatility, while institutional players focus on macroeconomic trends and liquidity accumulation.

The role of commercial banks extends beyond corporate transactions, significantly impacting forex market liquidity. Their functions include:

Market Liquidity Provision:

Facilitate large-scale currency exchanges for corporations and governments.

Influence bid and ask spreads by adjusting order flows.

Interbank Forex Trading:

Engage in forex trading on behalf of clients, influencing major currency pairs like EUR/USD, USD/JPY, and GBP/USD.

Hedge against fluctuations using forex derivatives.

Foreign Exchange Risk Management:

Adjust positions based on economic indicators such as trade balance and inflation reports.

Participate in currency swaps to stabilize holdings.

Banks contribute significantly to forex liquidity, making their trading patterns an important consideration for market participants.

Forex brokers and market makers ensure smooth market operations by providing liquidity and executing trades efficiently. Their roles vary based on market structure:

Market Makers:

Offer bid and ask prices, ensuring there is always a counterparty for a trade.

Reduce spread volatility and improve execution speed.

Retail Brokers:

Provide platforms for margin trading, allowing access to leverage.

Facilitate order execution, including market orders, stop-loss orders, and take-profit orders.

ECN and STP Brokers:

Offer direct access to interbank markets for enhanced price transparency.

Reduce slippage and provide lower spreads based on liquidity conditions.

By ensuring smooth transactions, brokers and market makers maintain forex market efficiency, enabling traders to enter and exit positions effectively.

The forex market reacts sharply to economic indicators, as they provide insight into the financial health of an economy. Key factors such as interest rates, inflation, GDP, and consumer confidence drive currency fluctuations. Traders analyze these data points to anticipate market movements and adjust their strategies accordingly.

Central banks set interest rates to control economic stability, making them a crucial driver of currency movements. Higher rates attract foreign capital, strengthening the currency, while lower rates lead to depreciation.

Hawkish Policy (Rate Hikes)

Attracts investors seeking higher returns, increasing demand for the currency.

Strengthens pairs like USD/JPY, GBP/USD, and EUR/USD if the U.S. Federal Reserve or Bank of England raises rates.

Dovish Policy (Rate Cuts)

Weakens the currency due to lower yields on deposits and bonds.

Often follows signs of economic slowdown, impacting forex trading sentiment.

Forward Guidance Impact

Markets react to central bank statements regarding future policy direction.

Federal Reserve, European Central Bank, and Bank of Japan decisions influence global forex volatility.

Inflation affects purchasing power and exchange rates, with central banks adjusting policies in response.

High Inflation Effects

Reduces currency value as consumer prices increase, lowering purchasing power.

Forces central banks to hike interest rates, leading to speculative forex movements.

Low Inflation or Deflation

Signals weak demand, prompting monetary easing measures.

Increases demand for safe-haven currencies such as the Swiss Franc and Yen.

Impact on Currency Pairs

Rising inflation in the U.S. strengthens the Dollar, while similar trends in the Eurozone can weaken the Euro if policy response lags.

Gross Domestic Product (GDP) serves as a primary indicator of economic strength. A growing economy attracts forex investors, while contraction leads to capital outflows and weaker currencies.

| GDP Trend | Market Impact | Currency Effect | Example Pairs Affected |

|---|---|---|---|

| Strong Growth | Higher consumer spending, job creation | Currency appreciation | USD rises with strong U.S. GDP data |

| Slow Growth | Lower investor confidence | Currency stagnation | EUR sees volatility with weak EU GDP |

| Contraction | Risk aversion increases | Safe-haven currencies strengthen | JPY and CHF gain during GDP contractions |

| Recession | Stimulus measures introduced | Lower interest rates weaken currency | GBP weakens in prolonged U.K. slowdown |

Market participants adjust positions based on GDP trends, particularly in major economies such as the U.S., Eurozone, and Japan.

The unemployment rate serves as an indicator of economic stability and consumer spending power.

Rising Unemployment

Indicates weakening economic growth, leading to currency depreciation.

High unemployment in the Eurozone weakens the Euro, while U.S. job losses can impact the Dollar.

Low Unemployment

Reflects strong labor demand, increasing wages and spending.

Encourages central banks to raise rates, strengthening the currency.

Non-Farm Payrolls (NFP) Report

Released monthly in the U.S., influencing USD pairs like USD/JPY and EUR/USD.

A strong report supports the Dollar, while a weak one triggers market corrections.

The trade balance reflects the difference between exports and imports, impacting currency valuation.

Trade Surplus (Exports > Imports)

Increases demand for the local currency, strengthening exchange rates.

China’s trade surplus supports the Renminbi, while Germany’s strong exports influence the Euro.

Trade Deficit (Imports > Exports)

Weakens the currency as more domestic currency is sold to pay for foreign goods.

U.S. trade deficits often pressure the Dollar, leading to speculative forex movements.

Geopolitical Impact

Trade wars and international agreements alter trade flows, shifting forex trends.

Tariffs imposed on imports weaken affected currencies, as seen in U.S.-China trade disputes.

Consumer confidence measures public perception of economic conditions, influencing spending and investment trends.

High Consumer Confidence

Signals strong job security and increased retail spending.

Boosts currency demand, as seen in rising Retail Sales data in the U.S. supporting the Dollar.

Low Consumer Confidence

Indicates caution among consumers, reducing GDP growth prospects.

Weakens the currency, triggering volatility in forex markets.

Key Reports Impacting Sentiment

University of Michigan Consumer Sentiment Index (USD Impact)

GfK Consumer Confidence (Eurozone Impact)

Westpac Consumer Sentiment (Australian Dollar Impact)

By analyzing consumer confidence trends, traders can anticipate shifts in forex market behavior and risk sentiment.

Different forex trading strategies align with specific market hours, influencing volatility, liquidity, and profitability. Traders adapt their approach based on session activity, time zone differences, and currency movements.

Short-term trading strategies capitalize on liquidity spikes during major forex sessions. These strategies rely on quick execution and technical indicators.

Day Trading

Focuses on intraday price movements, closing all positions before the session ends.

Works best during London and New York overlaps, where currency pairs such as EUR/USD, GBP/USD, and USD/JPY experience high volatility.

Requires monitoring of economic indicators like inflation reports and interest rate announcements.

Scalping

Aims to make small profits from rapid price fluctuations.

Executed during highly liquid periods such as the opening of the London session.

Traders use tight stop losses and leverage to maximize gains while minimizing exposure.

Both strategies demand precise timing, access to fast order execution types like market orders and limit orders, and advanced risk management techniques.

Swing trading and position trading are designed for traders who prefer longer-term trends over quick intraday movements.

Swing trading follows market cycles, where traders hold positions for a few days to a few weeks. Technical analysis indicators like moving averages and Fibonacci retracements help identify entry and exit points.

Position trading focuses on macroeconomic trends rather than daily fluctuations. Traders consider interest rate changes, GDP growth, and political stability before taking positions. Currency pairs such as USD/CHF and AUD/USD are commonly used for this strategy due to their response to long-term economic trends.

| Strategy | Timeframe | Best Market Conditions | Key Trading Indicators |

|---|---|---|---|

| Swing Trading | Days to weeks | Medium volatility periods | RSI, Moving Averages, Trend Lines |

| Position Trading | Weeks to months | Stable macroeconomic conditions | GDP Growth, Central Bank Policies, Inflation Rates |

Traders using these approaches must adapt to major economic releases that could disrupt trends, such as interest rate changes or geopolitical events.

Carry trading is a forex strategy where traders borrow a currency with low interest rates and invest in a currency with higher yields. The profit is derived from the interest rate differential between the two.

Identifying Currency Pairs for Carry Trading

Pairs such as AUD/JPY, NZD/JPY, and USD/TRY are common due to interest rate differentials.

The strategy works best in low-volatility sessions, typically during the Asian market hours.

Impact of Interest Rate Changes

If central banks adjust interest rates, carry trade profitability can shift suddenly.

Inflation and economic stability affect whether traders continue holding their positions.

Risk Considerations

Carry trades are vulnerable to market crashes and geopolitical events.

Currency fluctuations and trade balance shifts impact long-term returns.

Carry trading remains a profitable strategy when executed with proper risk management and an understanding of global macroeconomic trends.

Effective risk management in forex trading depends on selecting the right order types based on market conditions. Different sessions experience varying levels of liquidity and volatility, making it essential for traders to apply the most suitable execution methods.

Market orders and limit orders are fundamental execution types that impact trade efficiency and pricing.

Market Orders

Execute instantly at the current price, ensuring immediate entry or exit.

Suitable for high-liquidity sessions such as the London and New York overlaps.

Can lead to slippage in volatile conditions, especially during major economic indicator releases.

Limit Orders

Executed only when the price reaches a specific level, ensuring price control.

Ideal for low-volatility periods, such as the Sydney session.

Helps traders avoid poor entry points during market fluctuations.

Traders must evaluate market conditions before choosing between speed (market orders) and precision (limit orders).

Stop loss and take profit orders help traders automate exits to protect against unpredictable price swings.

Setting a Stop Loss

Protects capital by closing trades at a predefined loss.

Crucial during high-impact events like interest rate announcements.

Using Take Profit

Locks in profits when a set target is reached.

Helps traders avoid reversals during volatile periods.

Adjusting for Market Conditions

Wider stop losses in high-volatility sessions.

Tighter take profit levels for scalping and short-term trading strategies.

Traders use these orders to manage risk effectively, preventing emotional decision-making during market turbulence.

Trailing stop orders allow traders to secure profits while keeping trades open as long as the trend continues. This order type moves dynamically with price movements, adapting to volatility levels.

| Trailing Stop Feature | Benefit to Traders | Best Market Session |

|---|---|---|

| Moves with market trends | Maximizes gains without manual adjustments | London session (high liquidity) |

| Protects against sudden reversals | Automatically locks in profits if price retraces | New York session (volatility spikes) |

| Adjustable to different pip distances | Adapts to varying currency pair behaviors | Tokyo session (stable trends) |

Trailing stops work best for trend-following strategies, ensuring that traders capture long-term price movements while limiting downside risk.

OCO orders automate decision-making by allowing traders to place two orders simultaneously, where one cancels the other when executed. This strategy is useful in fast-moving markets where price direction is uncertain.

Breakout Trading

Places a buy stop order above resistance and a sell stop order below support.

If price breaks upward, the sell order is canceled, and vice versa.

News Trading Strategy

Executes based on economic reports like GDP growth or unemployment rate data.

Ensures quick response to unexpected price spikes.

Hedging Against Market Risk

Protects positions by setting opposing orders in case of sudden reversals.

OCO orders provide a structured approach to risk management, helping traders execute trades efficiently in volatile conditions.

Forex market openings are influenced by geopolitical events, which create volatility and impact liquidity levels. Factors such as elections, trade wars, and international policy changes cause fluctuations in currency demand, affecting trading strategies and market sentiment.

Political uncertainty increases market volatility, affecting currency valuations before and after elections. Traders monitor these events to anticipate potential swings.

Election Cycles and Currency Reactions

Presidential and parliamentary elections introduce uncertainty in major economies like the U.S., Eurozone, and the U.K..

Political shifts influence interest rate policies, taxation, and international trade agreements.

Political Instability and Currency Devaluation

Countries facing political instability often experience capital flight, weakening their currency.

Safe-haven currencies like the Swiss Franc and Yen gain strength during uncertain periods.

Case Study: Brexit Impact on GBP

The British pound experienced extreme volatility during Brexit negotiations due to policy uncertainty.

Sharp movements in GBP/USD and EUR/GBP reflected investor sentiment towards future trade conditions.

Traders incorporate political risk assessments to adjust forex positions and hedge against potential downturns.

Trade conflicts disrupt global supply chains, altering currency demand and trade balances. Countries imposing tariffs often experience depreciation due to reduced exports.

| Trade War Event | Currency Impact | Affected Pairs |

|---|---|---|

| U.S.-China Tariff Dispute | Chinese Renminbi weakened, U.S. Dollar strengthened | USD/CNH, EUR/CNH |

| Brexit-Induced EU-UK Trade Uncertainty | British Pound volatility increased | GBP/EUR, GBP/USD |

| Russia-Ukraine Conflict | Eurozone currencies saw sharp declines | EUR/USD, EUR/CHF |

| U.S. Sanctions on Iran | Market uncertainty led to Dollar strength | USD/JPY, USD/CAD |

Trade tensions create long-term structural shifts in currency markets, forcing traders to adjust fundamental analysis strategies.

Government policy changes and economic agreements redefine currency movements by influencing international capital flows and investor confidence.

Interest Rate Policies and Monetary Easing

Central banks adjusting interest rates impact forex liquidity.

Countries like Japan and Switzerland implement long-term monetary easing, affecting carry trade opportunities.

International Trade Agreements

Free trade agreements strengthen regional currencies due to increased export growth.

The USMCA trade deal impacted the Canadian Dollar and Mexican Peso, shifting forex demand.

Tax Reforms and Corporate Investment Strategies

Lower tax rates attract foreign investment, strengthening the currency.

The U.S. corporate tax reform in 2017 led to a surge in USD demand as companies repatriated profits.

Traders closely monitor policy changes to position trades accordingly, anticipating shifts in economic stability and forex volatility.

Global currency trading operates around the clock, providing traders with opportunities to engage in the forex market at various times depending on their strategy and preferred trading sessions. Liquidity and volatility fluctuate throughout the day as different financial centers open and close. Market participants, such as central banks, commercial institutions, and retail traders, influence price movements, while economic indicators drive fluctuations in currency values. Understanding these elements allows traders to align their approach with market hours, optimize their use of different trading strategies, and manage risk effectively through strategic order types. Political and economic events further shape market sentiment, reinforcing the need for continuous analysis. By leveraging the most active sessions and recognizing external influences, traders can make informed decisions and enhance their market performance.

The forex market follows a decentralized structure, meaning it operates 24 hours a day from Monday to Friday. The first major session begins in Sydney at 10:00 PM GMT, followed by Tokyo, London, and New York.

Liquidity is highest when major sessions overlap, such as:

London and New York (1:00 PM – 5:00 PM GMT)

Tokyo and London (8:00 AM – 9:00 AM GMT)

These overlaps create increased volatility and better trading opportunities.

Interest rates, inflation, and GDP are among the most influential indicators. Central banks adjust monetary policies based on these data points, leading to fluctuations in currency prices.

Central banks impact exchange rates through interest rate decisions and market interventions.

Hedge funds and investment funds execute large trades that shape trends.

Retail traders contribute to short-term price fluctuations.

Different trading strategies are suited to specific sessions. Scalping and day trading work best during high-volatility periods, such as the London-New York overlap, while position trading is more effective for long-term trends based on fundamental analysis.

Major geopolitical events, such as elections and policy changes, often cause sudden price swings. Unexpected announcements can lead to volatility, particularly at market openings.

While interbank trading continues in limited capacity, most retail trading platforms are closed due to lower market activity. Weekend gaps can occur as a result of news events or economic developments.

Stop-loss orders protect against excessive losses by closing a trade at a predetermined level.

Take-profit orders secure gains when a price target is reached.

Trailing stops adjust automatically to lock in profits during trends.

The most active currency pairs depend on the session. EUR/USD, GBP/USD, and USD/JPY see the highest trading volumes during the London and New York sessions, while AUD/USD and NZD/USD are more active in the Asian session.