Backtesting is an essential step for any trader looking to optimize their strategies before applying them in live markets. When it comes to evaluating trading strategies, MT4 backtesting software plays a crucial role, allowing traders to simulate past market conditions and assess performance using historical data. This powerful tool within MetaTrader 4 helps traders fine-tune their Expert Advisors (EAs), manual strategies, and other automated systems. Whether you're focusing on optimizing your algorithms or testing specific trading strategies, understanding how to use MT4 backtesting tools effectively can significantly improve your chances of success.

Essential MT4 Backtesting Tools

Backtesting is fundamental to refining trading strategies, and using the right MT4 backtesting software can make all the difference. In this section, we explore the key tools and features available for traders looking to optimize their strategies within MetaTrader 4.

MetaTrader 4 Strategy Tester Overview

The MT4 Strategy Tester is the built-in tool within the platform, allowing traders to test strategies on historical data. It's an essential feature for anyone serious about algorithmic trading or Expert Advisors (EAs). While the tool provides a solid foundation for backtesting, it does come with its limitations, particularly in terms of data accuracy and testing speed.

Top 5 MT4 Backtesting Software Solutions

Here are five top-tier MT4 backtesting software options that enhance the native functionality of MetaTrader 4:

<1. Forex Tester 4

A highly-rated software, Forex Tester 4 offers advanced features for backtesting strategies using historical data. It includes tick-by-tick data and multi-currency testing.

<2. Tick Data Suite

This tool is renowned for its precise historical tick data, which significantly improves backtest accuracy.

<3. StrategyQuant X

It focuses on automatic strategy generation and testing, making it ideal for traders looking for complex algorithmic backtesting.

<4. QuantConnect

Known for its ability to integrate with MT4, QuantConnect is a powerful cloud-based backtesting platform that supports multiple asset classes.

<5. Backtest Wizard

A simple, user-friendly backtesting tool that allows traders to quickly test strategies without extensive coding experience.

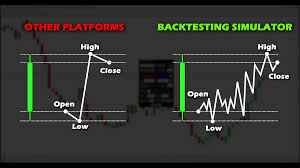

Visual Backtesting Tools for MT4

Visual backtesting is a method that allows traders to run simulations and visually track the performance of their strategies. With tools like Visual Strategy Builder, traders can drag and drop strategy elements to simulate real-time trading conditions. This hands-on approach helps traders understand how their strategies will perform in live markets.

EA Testing Tools in MT4

Testing Expert Advisors (EAs) is crucial for ensuring that an automated trading system functions as expected. Tools like MT4 Strategy Tester and third-party EAs specifically designed for testing help traders run simulations of their automated strategies on historical data. These tools help traders evaluate performance metrics such as win rate, drawdown, and profit factor to optimize their EAs.

Broker-Specific Backtesting Tools

Some brokers offer custom MT4 tools to enhance the backtesting experience by providing high-quality data feeds. For example, brokers like IC Markets and Pepperstone offer access to tick data, which significantly improves the accuracy of backtests.

Table: Broker-Specific Tools and Features

| Broker | Backtesting Tool | Features | Data Type |

|---|---|---|---|

| IC Markets | MetaTrader 4 Strategy Tester | Advanced reporting, custom indicators | Historical tick data |

| Pepperstone | VPS Backtesting Tool | High-speed simulations, multi-timeframe | Tick-by-tick data |

| OANDA | AutoChartist | Automated charting, risk management | Historical data |

These tools are designed to give traders a deeper insight into the performance of their strategies based on broker-specific market conditions.

Key Features for Effective MT4 Backtesting

Effective backtesting hinges on various factors, from data accuracy to advanced testing techniques. In this cluster, we’ll explore the key features that ensure your MT4 backtesting software provides accurate and reliable results for strategy optimization.

Historical Data Accuracy in Backtesting

Accurate historical data is crucial for the success of any backtest. Inaccurate or incomplete data can lead to misleading results, potentially causing traders to make flawed decisions. Here's how to ensure the reliability of historical data for MT4 backtesting:

Source Data: Always use high-quality data providers, such as brokers or professional tick data services.

Data Cleaning: Remove any discrepancies or gaps in the data to avoid introducing errors.

Data Integrity: Verify that the historical data matches the market conditions accurately, including spread, slippage, and execution quality.

Getting accurate data from brokers or specialized tick data providers is the first step to reliable backtesting. Many third-party services offer downloadable files in formats compatible with MT4.

Tick Data for Accurate Backtesting

Tick data is essential for traders looking to achieve highly precise results from backtesting. Unlike minute or hourly data, tick data records every price change, providing a granular view of market movements.

<1. Why Tick Data is Important:

Higher Precision: Tick data captures every market fluctuation, leading to more accurate results.

Improved Strategy Evaluation: Fine-tunes strategies by accounting for every price movement.

Better Execution Simulation: Helps simulate real-life trading conditions more accurately.

<2. How to Use Tick Data in MT4:

Obtain tick data from reliable tick data providers.

Import data into MT4 backtesting software.

Select the "tick-by-tick" option in the Strategy Tester for more precise backtesting.

Here’s a table comparing different data sources based on accuracy and cost:

| Data Source | Accuracy | Cost | Pros |

|---|---|---|---|

| Broker Data | Moderate | Free/Low | Easy integration with MT4 |

| Tick Data Providers | High | Paid | Granular data, perfect for EAs |

| Public Free Data | Low to Moderate | Free | Limited and may have inaccuracies |

Forward Analysis for Robust Strategy Testing

Forward analysis is an advanced technique that involves testing a strategy on a fresh set of data that was not used in the backtesting phase. This method reduces overfitting and ensures that the strategy has generalizable results.

By applying forward analysis to your MT4 backtesting, you can:

Test the robustness of your strategy under new market conditions.

Confirm that the strategy is not overfitted to historical data.

Evaluate performance across different timeframes and market conditions.

Incorporating forward analysis allows for a more reliable assessment of how your strategy will perform in the live market.

Optimization and Parameter Variations

Optimizing your strategy and testing it across different parameter sets is an essential part of improving your backtesting results. MT4 backtesting tools offer parameter optimization features that allow you to:

Test different combinations of parameters: Use MT4's built-in Genetic Algorithm for faster optimization.

Analyze performance metrics: Look for combinations that maximize profit factor, win rate, and minimize drawdown.

Avoid overfitting: Set realistic limits on the range of parameters to prevent curve fitting.

By systematically testing variations, you ensure that your strategy is adaptable and robust. Proper optimization reduces the likelihood of unexpected losses when the strategy is deployed in live trading.

MT4 Backtesting Metrics and Performance Evaluation

Evaluating the performance of trading strategies in MT4 backtesting software goes beyond just running simulations. Key metrics provide valuable insights into the strategy's effectiveness and risk profile. In this cluster, we explore the essential metrics every trader should understand when assessing their trading strategies.

Understanding Profit Factor and Risk-Return Ratio

The profit factor is a vital metric that helps traders evaluate the profitability of a strategy relative to its risk. It’s calculated by dividing the total gross profit by the total gross loss. A profit factor greater than 1.0 indicates that the strategy is profitable.

Profit Factor Formula:

Profit Factor = Gross Profit / Gross LossRisk-Return Ratio:

This ratio is essential in understanding the trade-off between risk and reward. It measures how much reward a trader gets for each unit of risk.

A high profit factor, ideally above 2.0, indicates a robust trading strategy. Traders should consider both these metrics when analyzing MT4 backtesting results to ensure that the strategy provides adequate returns while controlling risk.

Drawdown Analysis in Backtesting

Drawdown analysis is crucial for evaluating the risk of a trading strategy. A drawdown refers to the peak-to-trough decline in the equity curve of a trading account. It shows the potential for loss and helps traders assess the strategy's stability.

Maximum Drawdown:

The largest peak-to-trough decline during a specific period of trading.Average Drawdown:

The average of all drawdowns during the backtest period.

<1. How to Analyze Drawdowns:

High drawdowns indicate higher risk.

Strategies with low drawdowns are generally more stable.

Use drawdown analysis to set risk tolerance limits and optimize strategies.

Here's a table comparing different drawdown levels:

| Drawdown Level | Risk Profile | Suitability |

|---|---|---|

| Low (0%-10%) | Low Risk | Conservative traders |

| Medium (10%-25%) | Moderate Risk | Balanced traders |

| High (25%+) | High Risk | Aggressive traders |

Sharpe Ratio: A Key Risk-Adjusted Metric

The Sharpe Ratio is a key metric for evaluating the risk-adjusted return of a strategy. It measures the excess return per unit of risk, helping traders understand how much return they are getting for the risk they are taking on.

Formula:

Sharpe Ratio = (Mean portfolio return – Risk-free rate) / Standard deviation of portfolio return.

A higher Sharpe ratio indicates a better risk-adjusted return. It is especially useful when comparing different strategies, as it takes both return and volatility into account.

Win Rate and Expected Return

Win rate and expected return are foundational metrics for evaluating the profitability of a trading strategy.

Win Rate:

This is the percentage of trades that are profitable. It is calculated by dividing the number of winning trades by the total number of trades.Expected Return:

Expected return is the average amount a trader expects to make (or lose) per trade. It is calculated by multiplying the probability of winning by the average win, and the probability of losing by the average loss.

These two metrics provide insights into how frequently a strategy wins and how much it can be expected to return over time.

Equity Curve and Performance Visuals

Equity curves visually represent the performance of a trading strategy over time, illustrating the progression of an account’s balance. Traders can assess the consistency of gains and identify periods of high volatility or loss.

A steady upward equity curve indicates a reliable and consistent strategy.

A volatile equity curve suggests higher risk or inconsistency in performance.

Using visual tools to track the equity curve helps traders make informed decisions about their strategies and understand their overall risk exposure.

Comparing Backtesting Results Across Multiple Platforms

Comparing MT4 backtesting results with results from other platforms like MetaTrader 5 or TradingView helps traders validate their strategy across different environments.

MT4 vs. MT5:

MT5 offers more advanced features like multi-currency testing and improved optimization capabilities, which can lead to different results compared to MT4.MT4 vs. TradingView:

TradingView focuses more on charting and analysis, while MT4 offers detailed backtesting and automated trading functionalities.

This comparison ensures that the backtesting results are reliable and not platform-specific, which is vital for traders using different tools for strategy development.

Programming and Scripting for MT4 Backtesting

For traders who want to enhance their MT4 backtesting software experience, mastering programming and scripting can unlock new possibilities. In this cluster, we explore how to use MQL4 to create custom scripts, optimize performance, and improve the accuracy of backtesting.

Introduction to MQL4 for Backtesting

MQL4 (MetaQuotes Language 4) is the programming language used to create custom indicators, Expert Advisors (EAs), and scripts for MT4 backtesting. By learning MQL4, traders can automate their strategies and conduct more sophisticated backtests.

Key Concepts:

Expert Advisors (EAs): Automate trading strategies.

Custom Indicators: Tailor technical indicators to fit specific strategies.

Scripts: Simplify repetitive tasks like opening or closing orders.

MQL4 allows traders to write custom backtesting scripts that enable more precise evaluations of trading strategies. Traders can access a wealth of online resources, including forums and tutorial websites, to get started with writing MQL4 scripts for backtesting.

Optimizing Backtesting Code to Speed

One of the challenges traders face when working with MT4 backtesting is speed. Long testing durations can slow down strategy optimization and the analysis of results. Here are a few MT4 backtesting optimization tips:

Use

iBarsFunction: Limit the number of bars to minimize memory usage during tests.Avoid Complex Calculations: Simplify complex mathematical operations within scripts.

Limit Symbol Testing: Test strategies on fewer symbols or timeframes to speed up results.

<1. Other Optimization Tips:

Optimize loops and reduce redundant function calls.

Use compiled versions of MQL4 scripts to speed up execution.

Test during off-peak hours to avoid platform lag.

These optimizations significantly reduce the time it takes to run simulations and improve the overall testing experience.

Advanced Scripting for Custom Indicators

Custom indicators enhance the evaluation of trading strategies by providing tailored metrics that aren't available in default MT4 indicators. Advanced scripting can help you integrate unique market signals and testing parameters into your backtest.

For example, creating a custom Moving Average Convergence Divergence (MACD) or a Relative Strength Index (RSI) with different settings can give traders better insights into price momentum and overbought/oversold conditions.

Developing these indicators involves understanding how to manipulate MQL4 code to create custom formulas that evaluate unique market conditions. For instance:

<1. Steps to Develop a Custom Indicator:

Define the Formula: Write the equation based on your strategy.

Implement Functions: Use built-in MQL4 functions to handle data.

Test the Indicator: Ensure accuracy by backtesting with known data.

Here’s an example of a custom indicator’s structure:

| Custom Indicator Component | Functionality | Example Code |

|---|---|---|

| Initialization | Defines input parameters like period, price type | int period = 14; |

| Calculation | Computes indicator value over time | double macd = iMACD(...); |

| Display | Plots the result on the chart | SetIndexBuffer(...); |

Debugging MQL4 Code to Improve Backtesting Accuracy

Debugging MQL4 code is crucial to ensuring that backtesting results are accurate. Errors in custom scripts can lead to incorrect strategy evaluations, making it essential to troubleshoot any issues.

Common Debugging Techniques:

Print Statements: Use

Print()statements to display variable values and check the flow of the code.Step-by-Step Execution: Use MetaEditor’s debugger to step through your script and find errors.

Error Handling: Implement

try-catchmechanisms to handle exceptions.

<1. Common Issues in MQL4:

Incorrect initialization of variables.

Logical errors in trade execution functions.

Inconsistent data handling.

By systematically debugging, traders can fix errors and refine their backtesting scripts to ensure better accuracy and reliability in their results.

Integrating Data Feeds and Brokers for Backtesting

When conducting MT4 backtesting, it's essential to integrate high-quality external data feeds and choose the right broker. The accuracy and effectiveness of backtesting results heavily rely on the data used and the platforms chosen for testing. This cluster explores how to integrate external data sources and brokers to enhance the robustness of your backtesting process.

Choosing the Right Broker to Get Accurate Data

The data provided by your broker directly affects the accuracy and quality of MT4 backtesting results. Brokers with poor data feeds can lead to inaccurate backtests, especially when testing automated strategies or custom indicators.

Considerations for Selecting a Broker:

Data Feed Reliability: Choose brokers with high-quality, consistent data feeds, including historical data and tick data.

Spread & Slippage: Low spreads and minimal slippage are crucial for testing real-world trading conditions.

Execution Speed: Opt for brokers with fast order execution to minimize the impact of delays in backtesting results.

Platform Compatibility: Ensure that the broker offers MT4 support with the necessary features for backtesting.

A reliable broker can ensure that your backtesting process reflects realistic trading conditions, helping to identify the true potential of your strategies.

Using Quote Data Providers to Get Reliable Historical Data

Quality historical data is fundamental for accurate backtesting. Data from trusted quote data providers plays a critical role in delivering precise results. Many traders rely on specialized providers to supply high-quality market data, including tick data and price data.

Benefits of Quote Data Providers:

High-Quality Tick Data: Essential for precise backtesting of short-term strategies such as scalping.

Wide Range of Market Data: Providers offer extensive coverage across different currency pairs, commodities, and indices.

Accurate Price Data: Ensures realistic price movements during backtesting.

<1. Recommended Quote Data Providers:

FXCM

Dukascopy

Interactive Brokers

Using reputable data providers ensures that your MT4 backtesting results are accurate, reflecting real-world conditions. The quality of historical data can make or break your testing process.

Comprehensive Testing with Multiple Currency Pairs

Backtesting a strategy on a single currency pair may provide an incomplete view of its effectiveness. Multi-currency testing is essential to evaluate the robustness of your trading strategy across different markets. Here's why:

Advantages of Multi-Currency Testing:

Diverse Market Conditions: Testing across multiple pairs simulates various market scenarios, improving the strategy’s adaptability.

Risk Diversification: Strategies can be evaluated for their ability to manage risk across different currency pairs, avoiding overfitting to a single pair.

Increased Data: More data allows for more accurate testing and validation of a strategy.

<1. Steps to Perform Multi-Currency Testing in MT4:

Select Currency Pairs: Choose a diverse set of pairs such as EUR/USD, GBP/USD, and USD/JPY.

Set Timeframes: Test across different timeframes to account for different trading horizons.

Optimize Strategy: Use the backtesting data to optimize your strategy’s parameters across the selected currency pairs.

This approach provides a more holistic understanding of how a strategy performs under varying market conditions.

Conclusion

Incorporating the right tools, data feeds, and techniques into your MT4 backtesting software can significantly enhance your ability to test and optimize trading strategies effectively. By utilizing MQL4 scripting, optimizing backtesting code, and integrating reliable data sources like brokers and quote providers, you can ensure that your backtests closely mirror real-world trading scenarios. This comprehensive approach allows traders to make more informed decisions, optimizing strategies for long-term success.

The integration of historical data, tick data, and multi-currency testing further strengthens the reliability of the results, ensuring that strategies perform under various market conditions. When done correctly, these processes lead to more accurate performance evaluations, giving traders the edge they need in the competitive world of algorithmic trading.

MT4 backtesting software is used to test trading strategies by simulating their performance using historical market data. It allows traders to analyze how strategies would have performed in the past, helping them identify potential strengths and weaknesses.

MQL4 is the programming language used to write custom Expert Advisors (EAs) and indicators for MT4 backtesting. It enables traders to automate their strategies and fine-tune them to optimize performance based on historical data.

Provides a realistic simulation of how a trading strategy would perform in the past.

Helps assess the profitability and risk of a strategy over time.

Ensures that the MT4 backtesting results are grounded in actual market conditions.

To ensure accurate MT4 backtesting, choose a broker that offers:

High-quality historical data and tick data.

Low spreads and minimal slippage.

Fast execution and platform compatibility with MT4.

Tick data provides the most granular level of market information, capturing every price change. Using tick data in MT4 backtesting enables more accurate results, especially for strategies that require precise entry and exit points, like scalping.

Yes, multi-currency testing allows you to evaluate how your strategy performs across different currency pairs, enhancing its robustness and providing a more accurate representation of how it would fare under various market conditions.