The best time to trade Forex, and be successful, is the period of the day when trading volumes and volatility levels are large enough to fill retail orders and the markets are trending.

This period happens from Monday to Friday, in a short window of four hours when the two most active sessions, with the highest FX trading volumes (Europe and America), overlap each other.

Table of Contents

The sessions overlap is also characterised by different high-impact news announcements like Central Banks rates decisions, employment and inflation forecasts and GDP reports, that are associated with extreme volatility and price spikes.

The combination of all these factors, in this crucial and market trend changing 4-hour overlap, is considered by many traders as the "hot-zone", and therefore the best time to trade the FX market.

KEY TAKEAWAYS

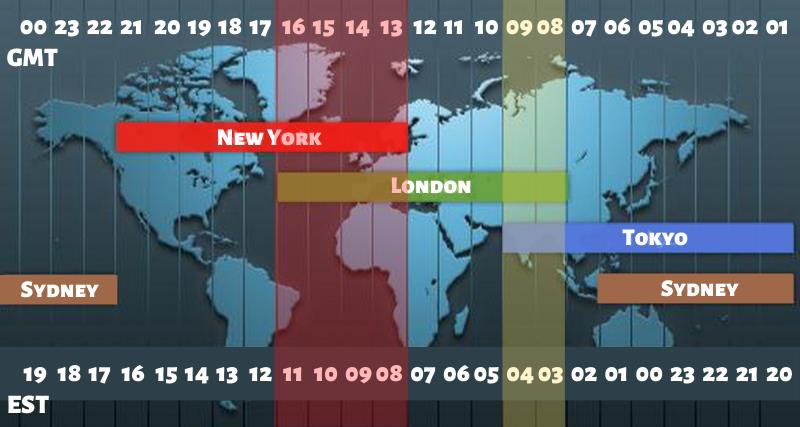

The 3 main Forex sessions are Asia (Sydney and Tokyo), London and New York.

The best trading hours are when the London and New York sessions overlap, meaning more liquidity and lower spreads.

Sessions overlap occurs in the US from 8 am to 11 am EST, in the UK from 1 pm to 4 pm GMT and in South Africa from 3 pm to 6 pm SAST.

The best weekdays for Forex trading are Wednesday and Thursday, when trading volumes and daily pips range are higher, due to most economic news release.

Live Forex Sessions by Time Zone

It is great that Forex is a market that can be traded around the clock, 24 hours, 5.5 days a week, 12 months a year. Being open all day and most of the week brings to the market a greater liquidity than otherwise, and it gives traders from around the world the flexibility to trade when they want. They can trade as little or as often as they want, during their business hours, after work or even in the middle of the night.

However, there are drawbacks to having the market being open 24-7. It is nice to have the flexibility to trade at any time, but we are also human, which means that we must sleep, eat or relax, and cannot be monitoring our positions all day and all night.

There will always be times of missed opportunities or jumps in price that will move against established positions when we are not around. This is a human limitation, and that is why in Forex it is advisable to choose the best time to trade based on one’s own available time and strategy logic. At the end of this article find out also when you should not trade.

Forex Market Session Times

Although there is always liquidity in each session, they are not created equal: there are periods when price action is consistently volatile and periods when it is muted.

Moreover, currency pairs exhibit varying activity over certain times of the trading day in relation to the demographics of the participants online at the time. In the 24-hour, fast-paced Forex market, timing is critical and choosing the best Forex market session to trade can add to one’s profit potential. There are 3 main Forex market sessions globally.

Tokyo Session: 9 am to 6 pm JST

The first session of the week, and of every trading day, is the Asian session. The opening starts very early with Sydney, Australia, but only when Tokyo, the financial capital of Asia, joins in one hour later, the market picks up on momentum.

In fact, Tokyo is the first important Forex session to open, and is a major financial centre for several economies around Asia. In fact, Tokyo represents approximately 6% of all global FX transactions during the complete Asian trading session.

Many large market participants are active during the Asian session to position their orders accordingly the market dynamics. In fact, this session is characterised by market consolidation, and currency prices move along a narrow range.

Most retail traders scour for trading opportunities, by preparing to trade any possible and upcoming price breakouts on the following sessions. This usually coincides with the time when the Tokyo session briefly overlaps with the Frankfurt session (opening at 8 am CET) and gradually shifts to the London session, resulting in increased volatility and trade volumes.

The Japanese Yen, the Australian dollar and the New Zealand dollar are amongst the favourites during this session as traders and businesses from the large Asian economies use their domestic currency in their currency exchange transactions.

London Session: 8 am to 5 pm GMT

Given that 34.1% of the world daily turnover occurs in the United Kingdom (London) and that another 7.5% occur in the nearby time zones of France, Germany and Denmark, it is easy to see why the European session is one that should not be ignored.

A large number of market participants has made London the world’s most volatile market for trading currencies. And it links with both the Asian and the American sessions. The problem for the US trader is that they might have to get up very early (or stay up very late) to trade a European session that runs from 2 am to 12 pm EST.

Of course, this session is ideal for the European trader, and it is also not too bad for the Asian Trader who can trade the European session during his evening (3 pm to Midnight, Hong Kong Time). Currencies like the Euro, British Pound and Swiss Franc are most active during this session as traders from the European countries use their domestic currency in their foreign exchange transactions.

New York Session: 8 am to 5 pm EST

Given that 16.6% of the world daily turnover occurs in the United States (NYC), and that most of the world financial markets seem to follow what trends and numbers that are put out by Wall Street, it is likewise easy to see that the United States session is highly important.

Most can trade this session, providing they do not have to go to a job during the day. Europeans, however, need to be the ones to stay up late to trade this session, and the Asians are probably already in bed.

Outside of the two best market sessions, there are two “hot zones” to trade when two market sessions are both open at the same time (called a session overlap). This session overlap represents a time of peak liquidity and it occurs twice:

Best Time of Day to Trade Forex

The best time of the day to trade Forex are the hours when volume and volatility levels are at its highest level. High trading volume means that more lots of a particular currency pair are being bought and sold and high volatility means that the currency pair is moving fast and trending quickly.

High volume and strong volatility cause large pip movements during the best trading hours. Moreover, the spreads become narrower during high volume trading hours, and narrow spreads mean lower transaction costs.

Outside of the two best market sessions, there are also two “hot zones” for traders. These hot zones happen when two market sessions are both open at the same time (called a session overlap). This session overlap represents a time of peak liquidity and it occurs twice in every trading day:

The Asian-European Overlap (8 am to 9 am GMT)

The first overlap happens in the morning for European traders (in the evening for Asian traders) from 8 am GMT to 9 am GMT (5 pm JST to 6 pm JST in Tokyo).

During this time there is a 1-hour overlap between the Asian and the European markets. Important economic numbers from both continents are also released at this time. Unsurprisingly, the EUR/JPY and the GBP/JPY pairs become more volatile at this time.

The US-European Overlap (8 am to 11 am EST)

The second and most explosive overlap happens in the morning for US traders (in the afternoon for European traders) from 8 am to 11 EST (1 pm GMT to 4 pm GMT). This is the time when the European traders are trading alongside US traders in the 4-hour overlap between the two sessions (finishing by noon EST).

It is the time when the world’s two most active trading centres cross — as the European session is closing and the US session is opening. It is a small, but very active, window that some currency traders call the “hot zone”.

This second overlap also coincides with the release of important economic numbers from two major global economies, the Eurozone and the US. Several reports and high impact news are released during the trading day including Central Banks reports and forecasts, such as the Eurozone and the UK interest rates, macro-economic data, such as the Zew index and the NFP report and so on. Trading the EUR/USD and the GBP/USD would give traders the best results during this overlap.

Because of the overlap and its economic importance, this period represents the times of greatest liquidity and movement in the markets, so traders need to pay careful attention to them. With high volatility comes higher risks. Although these are the best trading hours of the day, they are also the riskiest ones.

Best Days of the Week to Trade Forex

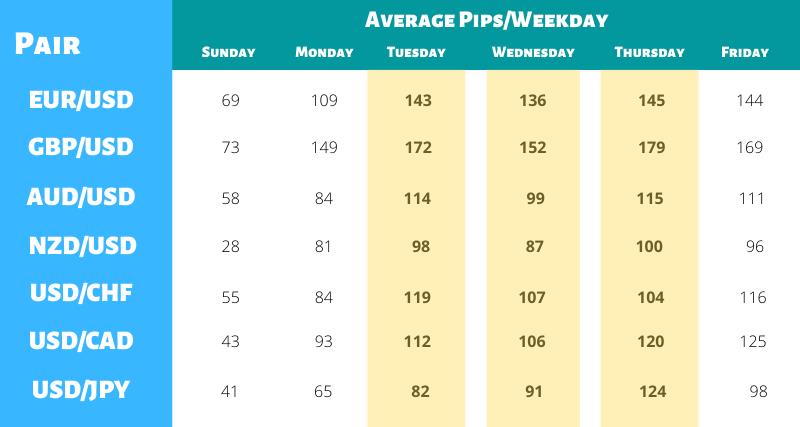

Forex allows us to trade 5.5 days a week, including Sunday, but that does not mean that every day gives an equal trading opportunity. Some days are more desirable to trade, in terms of volume and pip range, while others are less desirable.

As you can see from the image above, the rule of thumb regarding the days of the week with a higher average pip range are the middle days. So, the best days of the week to trade Forex are Tuesday, Wednesday and Thursday, when the pairs receive the most action. So, if you want to trade just three days a week, these would be the best days.

Days to be Cautious About When Trading Forex

Sunday: This is the day when everyone is still enjoying their weekend, so don’t expect much movement here, unless there has been a critical news announcement during the weekend. Sometimes there are trends continuation or reversals happen on Sunday, depending on what had happened at the end of Friday.

Monday: Though trading has been underway since Sunday, Monday still represents less of a pip-range than the middle three days. It is still early week and traders are still waiting for the economic news and numbers to come out during the week. You can trade Monday as it can be still very profitable and you don’t want to miss out on the beginning of a move. But watch out for corrective moves against the main trend on Monday that later get reined in by Tuesday or Wednesday. These can lead to false trades.

Friday: This is virtual half-day because trading is busy until 12:00 pm EST and then nearly dies down in activity until it closes at 5:00 pm EST. There are still trading opportunities that can be found during the first half of Friday. But one should be on guard: this can be the day of reversals from the main trend. Be particularly on guard the second half of Friday, as the volume can drop way down, causing spreads to greatly increase.

Other Days you Should be Cautious of:

Non-Farm Payrolls report release — occurs the first Friday of every month at 8:30 AM EST. This can be an extremely volatile time to trade, and subsequent whipsaw moves can damage many open positions with stops that trade at this time.

Major News Events — these could be the speeches of Fed chairman, acts of war or terrorism. These days can be so volatile that you can be whipsawed.

Holidays (especially major holidays like July 4th, Thanksgiving, Christmas eve and New Year eve) – all the big money traders are on holiday, so don’t expect the market to move. It generally moves sideways during these times.

Best Months to Trade Forex

The whole year can be divided in thirds, starting with the three terrible months of Summer, the four best months of Autumn, and the four decent months of Winter-Spring.

The THREE worst months (Summer): June, July, and particularly, August.

The FOUR best months (Autumn): September, October, November, and December.

The FIVE good Months (Winter-Spring): January, February, March, April, and May

Any holiday period represents drying up the trading volume, and the months following these holidays represent a refreshing return to trading, like rain after a drought.

The Big Drought: The Summer holiday months of June, July and August

Research data from the S&P indicates that the summer months provide weak returns for most financial markets for many countries in Europe. The old adage traditionally used across London trading floors ‘Sell in May and go away’ still holds its own, according to an analysis by S&P Indices. It is the last four months of the year that contribute most to full year returns.

The theory behind this maxim is that the summer months are characterized by sluggish performance or a loss. By selling out your holdings in May, and reinvesting them only when the summer is over, you protect your portfolio and potentially achieve better returns.

By analysing the monthly performance of sixteen European markets in the S&P Global Broad Market Index over the ten-year period from January 2000 to December 2009, S&P has shown that this trading strategy still holds good across Europe.

For most European countries, and also for the US, the June-August period averages out to be slightly negative. The preceding Jan-May period averages out to be 3%, with the bulk of the gains falling in the last four months of the year (Sept-Jan).

The last four months remain the most important for contributing to full year returns, meaning that even after experiencing a poorly performing summer there is still the chance to improve returns.

August is the Worst Summer Month

The summer, especially August, is the worst period to trade with many institutional traders in Europe on holidays and North America on vacation as well. That leads to less trading and big price swings. The best strategy many suggest is to simply go on vacation and resume trading when September comes around.

Who have often traded during the summer, regretted it after. The currency markets become very erratic and unpredictable.

If you have to trade during the summer, be ready for the sideways action. Trade a range-based system (also called trend-fading strategy). Sell a currency at the top of its range, buy at its bottom, rinse and repeat. Or zoom into smaller time frames (M5 or M15) to trade the mini-trends.

Sooner or later the sideways trend breaks, and that is usually right after the Labor Day holiday in the US, everyone takes a break and summer is unofficially over after that.

Post-Summer Months (September to December) Offer Up the Best Trading Period, as Markets Rebounds from Summer Drought

The reason why the best months to trade occur just after summer, from September to December, is because these months represent a surge of trading activity after the summer holiday lull. If one were to choose just a few months to trade, these would be it.

Second Holiday Spot: Second Half of December

There is a “Winter Month” for slow trading. The second half of December has the same low volumes as August. The weeks around and past Christmas are as slow as August and the beginning of January is not that great as well.

Winter-Spring Action Still Good

Just after the second holiday period in December, there is a pick of trading activity that lasts from January to May. It may not be as powerful a trading period as the one in Autumn, but it does provide many months of an excellent opportunity.

High Volatility and News Releases Impact

The first thing that traders need to pay attention to it’s the risk in Forex trading. Ultimately, without a proper money management plan, traders can and will go broke trading and lose all trading capital. That’s always going to be the first thing traders should consider of when searching for the best time to trade the FX market.

Knowing which are the best days and times to trade Forex is an advantage. Still, there is one major part that should be considered: news release.

High impact reports or financial news have the power to spike up a slow trading period. Often, when a major report is published, especially on the occasions that the results are against the predicted forecast, a currency can lose or gain value within a matter of seconds.

Generally, the less economic growth a country produces, the less positive the economy is seen by international investors. Thus, institutional traders, acting mostly on behalf of businesses and investors, take these news and reports very seriously as capital tends to flow to the countries that are believed to have higher growth prospects. Subsequently, this represents better investment opportunities, leading to the strengthening of one currency against another. The problem is, all this can happen in a matter of seconds!

The Forex market becomes extremely active near the scheduled times of very important economic reports, with spreads widening and prices moving fast. This is because extremely large volumes of orders by institutional traders are being presented for execution within a very short timeframe.

To sum up, traders must become aware of the risks and high volatility that can be created during news release times. This is because Forex can move so quickly and in such a powerful way that it can render several trading techniques practically redundant.

The only strategy traders can deploy to minimise the risks when these reports and news are announced is to simply avoid trading at these times. Five of these significant, high volatility and impact releases include:

Central Banks - interest rate decisions by Central Banks are the mirror of the state of the the country economy. Higher rate, stronger econonomy and vice-versa

CPI data - an indicator measuring inflation and impacting on Central Banks policies

Unemployment rates - measuring the unemployed workforce. Since lower unemployment percentages tend to be translate to growth, consumer spending and a stronger currency

Gross Domestic Product or GDP data – an indicator measuring a country economy by the level of goods and services produced

Consumer confidence - measures how consumers feel about the country economy, thus impacting consumer spending

We suggest traders to use our Economic Calendar, always updated with the scheduled news releases, through the trading day (and week).

Worst Times to Trade Forex

Not counting the high risks of trading on news release, that are not advisable at all, there are also some more worst times to trade Forex, that traders should avoid, especially the times when the markets are in “sleep mode”.

The least active times to trade are the quiet zones of the Sydney and Tokyo Sessions, which is a combined 10 hour stretch of time. Unless you are scalping during this session, hoping that your scalping system can take advantage of the lower liquidity, it is a good time to take a break and rest.

The trading volume is very thin (relatively speaking) and few trends ever develop during this time. Most of the European traders have already gone to bed and the US traders have gone home to their families or have gone to bed themselves. If you are awake and have free time, it can be a good time to get prepared for the opening of the European session.