In the fast-paced world of Forex trading, understanding market dynamics is crucial to making informed decisions. One of the foundational concepts every trader must grasp is the identification of support and resistance in Forex. These levels act as price barriers, where the price tends to either reverse or consolidate, making them critical for determining entry and exit points. By recognizing these key levels, traders can better predict market movements, manage risks, and enhance their trading strategies. In this guide, we'll explore various methods and tools, from technical indicators to chart patterns, to help you identify and effectively use support and resistance in your Forex trades.

Basic Concepts of Support and Resistance in Forex

Understanding the fundamental principles of support and resistance is key to mastering Forex trading. These levels serve as psychological barriers, guiding traders in making informed decisions and managing risk.

1. What are Support and Resistance?

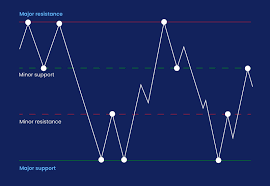

Support and resistance are two fundamental concepts in Forex trading that define price levels where the market tends to stop and reverse direction. Support refers to a price level where a downtrend can be expected to pause due to a concentration of demand. In contrast, resistance is a level where an uptrend may stall or reverse, as selling pressure exceeds buying pressure. These levels act as "psychological barriers," often driven by historical price action and trader sentiment.

Visualizing these concepts on a price chart makes it easier to identify points where price action typically fluctuates, providing traders with valuable clues for predicting future movements.

2. The Importance of Support and Resistance Levels in Forex Trading

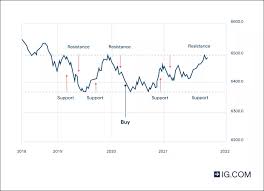

Support and resistance play a pivotal role in price action, influencing key decisions such as entry and exit points. Traders use these levels to gauge potential market reversals or continuation patterns. A breakout above a resistance level can signal a bullish trend, while a breakdown below support often points to a bearish trend. Identifying these levels helps in making more precise trading decisions, optimizing risk management strategies, and determining where to set stop-loss orders.

Here’s how support and resistance affect trading strategies:

| Action | Effect on Price | Trading Strategy |

|---|---|---|

| Breakout | Price moves above resistance | Buy signal, potential for trend continuation |

| Breakdown | Price falls below support | Sell signal, potential for trend reversal |

| Bouncing | Price tests but doesn’t break through | Indication of range-bound market, consolidate trades |

3. Types of Support and Resistance

There are two types of support and resistance levels: static and dynamic. Static levels are horizontal lines based on historical price action, providing clear reference points where price tends to reverse or stall. These levels remain fixed over time. On the other hand, dynamic support and resistance are constantly changing, typically represented by moving averages, Bollinger Bands, or the Ichimoku Cloud. These levels adjust with market movement and provide a more fluid approach to understanding support and resistance.

4. The Role of Support and Resistance in Trend Reversals and Continuations

Support and resistance levels are not just barriers; they are also key indicators of trend behavior. When a price reaches a support level during a downtrend and then reverses, it may signal a trend reversal. Conversely, when price approaches resistance during an uptrend and struggles to break through, it could indicate the end of a bullish phase. Understanding these levels is essential for anticipating market movements and determining when to enter or exit positions.

In many cases, price will either bounce off a support level in a range-bound market or break through a resistance level, signaling a continuation of the current trend. This dynamic interplay of support and resistance is critical for identifying where trends may change or persist.

Using Technical Indicators to Identify Support and Resistance

In this cluster, we will explore how various technical indicators can help identify and confirm key support and resistance levels, enhancing your ability to trade effectively in the Forex market.

1. How to Use Moving Averages for Support and Resistance

Moving averages are one of the most common tools for identifying dynamic support and resistance levels. A moving average smooths out price fluctuations, revealing underlying trends and potential turning points. In Forex, the 50-period moving average is often seen as a significant support or resistance level, as it represents a midpoint of recent price action. When the price is above the moving average, it often acts as a support level; conversely, when the price is below, it can act as resistance. Moving averages adapt to changing market conditions, making them valuable for dynamic support and resistance identification.

2. Fibonacci Retracements: A Tool for Identifying Key Levels

Fibonacci retracements are a powerful tool for pinpointing potential support and resistance levels. These levels are based on the Fibonacci sequence and typically occur at key percentage points: 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels are used by traders to identify areas where price corrections may end, providing opportunities to enter the market at favorable levels. Fibonacci retracement levels are often drawn between a recent swing high and swing low to map out potential support or resistance zones.

| Fibonacci Level | Common Reaction in Price | Trading Strategy |

|---|---|---|

| 23.6% | Shallow pullback | Continuation of trend |

| 38.2% | Moderate pullback | Potential reversal point |

| 61.8% | Deep retracement | Strong support or resistance |

| 78.6% | Very deep pullback | Often signals trend reversal |

3. Pivot Points: Calculating Support and Resistance Levels

Pivot points are another commonly used indicator for determining support and resistance levels in Forex. These points are calculated using the previous day’s open, high, low, and close prices. The primary pivot point (PP) serves as the central level, while additional support and resistance levels are calculated above and below it. Pivot points are widely used for intraday trading and help provide daily, weekly, and monthly support and resistance levels.

4. Relative Strength Index (RSI) and Its Relationship to Support and Resistance

The Relative Strength Index (RSI) is a momentum oscillator that helps identify overbought or oversold conditions in the market. RSI values above 70 indicate that the market is overbought, while values below 30 indicate an oversold condition. These levels often coincide with potential support and resistance zones. For example, when the RSI reaches overbought levels at resistance, it could signal that the price will reverse. Similarly, an oversold RSI near support could suggest a potential rebound.

5. How the MACD Indicates Breakouts and Support/Resistance Levels

The Moving Average Convergence Divergence (MACD) is another useful tool for confirming potential support and resistance breakouts. The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. When the MACD line crosses above the signal line, it suggests potential upward momentum, confirming a breakout above resistance. Conversely, a cross below the signal line can indicate downward momentum, confirming a breakdown below support.

Chart Patterns to Confirm Support and Resistance

Chart patterns are essential for confirming support and resistance levels. In this cluster, we will explore several common patterns that help traders identify potential price reversals or breakouts at key levels.

1. Head and Shoulders: Reversal Patterns at Key Levels

The Head and Shoulders pattern is a classic reversal pattern that signals a change in trend direction. It forms at critical support or resistance levels and consists of three peaks: the left shoulder, the head, and the right shoulder. When the price breaks below the "neckline" of the pattern, it often signals a reversal from an uptrend to a downtrend (or vice versa for an inverse Head and Shoulders). This pattern is commonly seen near major resistance or support levels, providing a confirmation of trend reversals.

2. Double Tops and Bottoms: Key Reversal Patterns

The Double Top and Double Bottom patterns are strong indicators of trend reversals, commonly found at significant support or resistance levels. A Double Top occurs after a strong uptrend and marks a resistance level where the price fails to break higher twice, signaling a potential downward move. Conversely, a Double Bottom forms after a downtrend and marks a support level where the price fails to break lower twice, indicating a possible upward reversal. These patterns often suggest that market sentiment has shifted.

| Pattern | Indication | Action |

|---|---|---|

| Double Top | Potential resistance reversal | Sell on breakdown |

| Double Bottom | Potential support reversal | Buy on breakout |

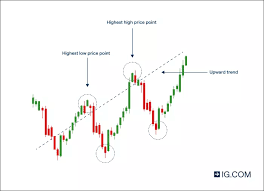

3. Triangles: How to Use Breakouts to Identify Support and Resistance

Triangles—ascending, descending, and symmetrical—are consolidation patterns that form within support and resistance zones. They represent a battle between buyers and sellers. In an ascending triangle, the price forms higher lows, indicating rising support, with a flat resistance level. A descending triangle has lower highs and a flat support level, indicating potential resistance. A symmetrical triangle shows converging trendlines, with breakout points providing clear signals for trades at critical support or resistance levels.

4. Flags and Pennants: Continuation Patterns in Forex

Flags and Pennants are continuation patterns that often form after a strong price move, indicating that the prevailing trend is likely to continue once the pattern completes. These patterns typically form at support or resistance levels, where price consolidates before making the next move. A Flag resembles a small rectangle that slopes against the prevailing trend, while a Pennant is a small symmetrical triangle that forms after a sharp move. Traders often look for a breakout from these patterns to confirm the continuation of the trend.

5. Cup and Handle: Bullish Continuation Patterns at Support Levels

The Cup and Handle pattern is a bullish continuation pattern that typically forms at a key support level. The pattern resembles a "cup" shape, where the price dips and then gradually rises, followed by a consolidation phase (the "handle"). Once the price breaks out above the handle, it signals the continuation of an uptrend. This pattern is particularly effective when it forms at or near a major support level, confirming that the market is likely to maintain its upward momentum.

Candlestick Patterns and Support/Resistance Levels

Candlestick patterns are powerful tools for confirming or rejecting key support and resistance levels. In this cluster, we will explore how these patterns can signal potential reversals or breakouts at critical price levels.

1. Doji Candlesticks: Support/Resistance Reversal Signals

A Doji candlestick occurs when the opening and closing prices are nearly identical, creating a small body with long upper and lower shadows. This pattern often signals indecision in the market, especially when it appears at key support or resistance levels. A Doji at resistance may indicate that buyers are losing momentum, suggesting a potential reversal to the downside. Similarly, a Doji at support could signal that sellers are losing strength, and the price might reverse upward. Therefore, Doji candlesticks are essential for spotting potential turning points at critical levels.

2. Engulfing Candlestick Patterns at Key Levels

The Engulfing candlestick pattern consists of a larger candle completely engulfing the previous smaller candle. This pattern can signal a strong reversal, especially when it appears at support or resistance. A bullish engulfing pattern at support suggests a potential upward movement, as it indicates that buyers have overpowered sellers. Conversely, a bearish engulfing pattern at resistance can indicate that sellers are in control, signaling a possible price drop. These patterns are particularly effective at validating reversal points at established levels.

| Pattern | Indication | Action |

|---|---|---|

| Bullish Engulfing | Reversal at support | Buy after confirmation |

| Bearish Engulfing | Reversal at resistance | Sell after confirmation |

3. Hammers and Shooting Stars: Reversal Patterns at Support and Resistance Levels

Hammers and Shooting Stars are both single candlestick reversal patterns that are highly significant when they appear at support or resistance levels. A Hammer forms after a downtrend and signals a potential reversal to the upside when it appears at support. It has a small body with a long lower shadow. On the other hand, a Shooting Star appears after an uptrend and signals a potential reversal to the downside when it forms at resistance. It has a small body with a long upper shadow, indicating that buyers tried to push the price higher but were rejected.

4. Morning and Evening Star Patterns at Support/Resistance Areas

The Morning Star and Evening Star are three-candle patterns that provide clear indications of trend reversals at key levels. The Morning Star appears at support levels after a downtrend and signals a bullish reversal. It consists of three candles: a long bearish candle, a small-bodied candle (indicating indecision), and a long bullish candle. The Evening Star, on the other hand, forms at resistance levels after an uptrend, signaling a bearish reversal. Both patterns are highly reliable when confirmed by other technical indicators or price action.

Practical Strategies for Trading with Support and Resistance

In this final cluster, we’ll explore actionable strategies for utilizing support and resistance levels in your Forex trading. These practical techniques will help you make more informed decisions and enhance your trading success.

1. How to Trade Breakouts from Support and Resistance Levels

A breakout occurs when the price moves beyond a significant support or resistance level. Trading breakouts can be highly profitable, as they often indicate the start of a new trend. To trade breakouts effectively, wait for the price to close beyond the level and confirm the momentum using indicators like the RSI or MACD. Once the breakout is confirmed, enter the trade in the direction of the breakout. It’s crucial to set a stop loss just below the breakout point to minimize risk, as false breakouts can occur.

2. Using Multiple Time Frames for Support and Resistance Analysis

Analyzing support and resistance levels across different time frames helps create a more comprehensive trading strategy. For example, the daily chart can give you an overview of major support and resistance zones, while shorter time frames like the 1-hour or 15-minute charts can help identify more precise entry and exit points. This approach strengthens your analysis by confirming key levels and aligning shorter-term trades with the broader market trend.

| Time Frame | Purpose | Application |

|---|---|---|

| Daily | Identify long-term trends | Major support and resistance |

| 1-Hour | Spot entry/exit points | Short-term trade setups |

| 15-Minute | Timing the trade | Fine-tune entries and exits |

3. Risk Management in Support and Resistance Trading

Effective risk management is essential when trading around support and resistance levels. Set stop-loss orders just beyond key levels to limit losses in case the market moves against your position. Additionally, define your take-profit levels based on the next support or resistance zone, ensuring that your potential reward outweighs your risk. Proper risk management enhances your ability to withstand market fluctuations and protects your capital in volatile conditions.

4. The Role of Support and Resistance in Scalping Strategies

Scalpers use support and resistance levels to make quick trades, typically holding positions for only a few minutes. By identifying strong support and resistance on short time frames (like the 1-minute or 5-minute chart), scalpers can enter and exit trades rapidly as the price oscillates between these levels. The key to scalping success is tight risk management, using small stop-losses and frequent exits based on price action around these levels.

5. Using Support and Resistance for Long-Term Trend Following

Long-term traders rely on support and resistance levels to align their positions with the prevailing market trend. By identifying significant support and resistance zones on higher time frames (like the weekly or monthly chart), traders can hold positions for weeks or months, capitalizing on longer-term market movements. Combining support and resistance with trend indicators like the Moving Average or MACD helps ensure that trades are aligned with the broader market direction.

Conclusion

In this comprehensive guide, we have explored how to identify support and resistance in Forex trading and how to leverage various tools and strategies for more effective decision-making. From understanding the basics of support and resistance levels to utilizing technical indicators, chart patterns, and candlestick patterns, each method provides unique insights that can help you confirm, reject, or refine key price levels. Additionally, by integrating risk management strategies and trading techniques across multiple time frames, you can improve your accuracy and profitability. Ultimately, mastering support and resistance is essential for all traders, whether you're executing short-term scalping strategies or long-term trend-following positions.

Support and resistance are price levels where the market tends to reverse or consolidate. Support is a level where the price tends to find buying interest, preventing it from falling further. Resistance is a level where selling pressure tends to emerge, preventing the price from rising further.

Breakouts occur when the price moves beyond established support or resistance levels. To trade breakouts: - Wait for the price to close above resistance or below support. - Confirm the breakout with indicators like RSI or MACD. - Set a stop loss just below the breakout point to manage risk.

Fibonacci retracements are used to identify potential support and resistance levels based on key percentage points (23.6%, 38.2%, 50%, 61.8%). These levels often align with price corrections and can signal areas where the price may reverse.

Moving averages help identify dynamic support and resistance levels by smoothing price data over a specific period. The 50-period moving average is particularly useful in Forex, often acting as support when the price is above it and resistance when the price is below.

A Doji candlestick occurs when the open and close prices are almost the same, indicating indecision in the market. At key support or resistance levels, a Doji can signal a potential reversal, as the market is uncertain whether to continue the trend or reverse.

Engulfing candlesticks indicate a reversal. A bullish engulfing pattern at support signals a potential upward move, while a bearish engulfing pattern at resistance suggests a possible downward move. The larger engulfing candle confirms a stronger shift in momentum.

Hammers and shooting stars are candlestick patterns that indicate a potential reversal. A hammer at support signals a bullish reversal, while a shooting star at resistance signals a bearish reversal. These patterns, combined with the support or resistance level, provide strong reversal signals.

For long-term trend following, traders use support and resistance levels to identify areas where price may pull back before continuing the trend. This approach allows traders to position themselves at favorable entry points, typically buying at support during an uptrend or selling at resistance during a downtrend.