In the ever-changing world of finance, investors are constantly seeking the best stock signals to guide their investment decisions. As we look ahead to 2023, here are some of the top signals to consider.

1. Moving Average Crossover

A moving average crossover occurs when a shorter-term moving average crosses above or below a longer-term moving average. This signal can indicate a shift in the stock's price trend, providing an opportunity for investors to buy or sell.

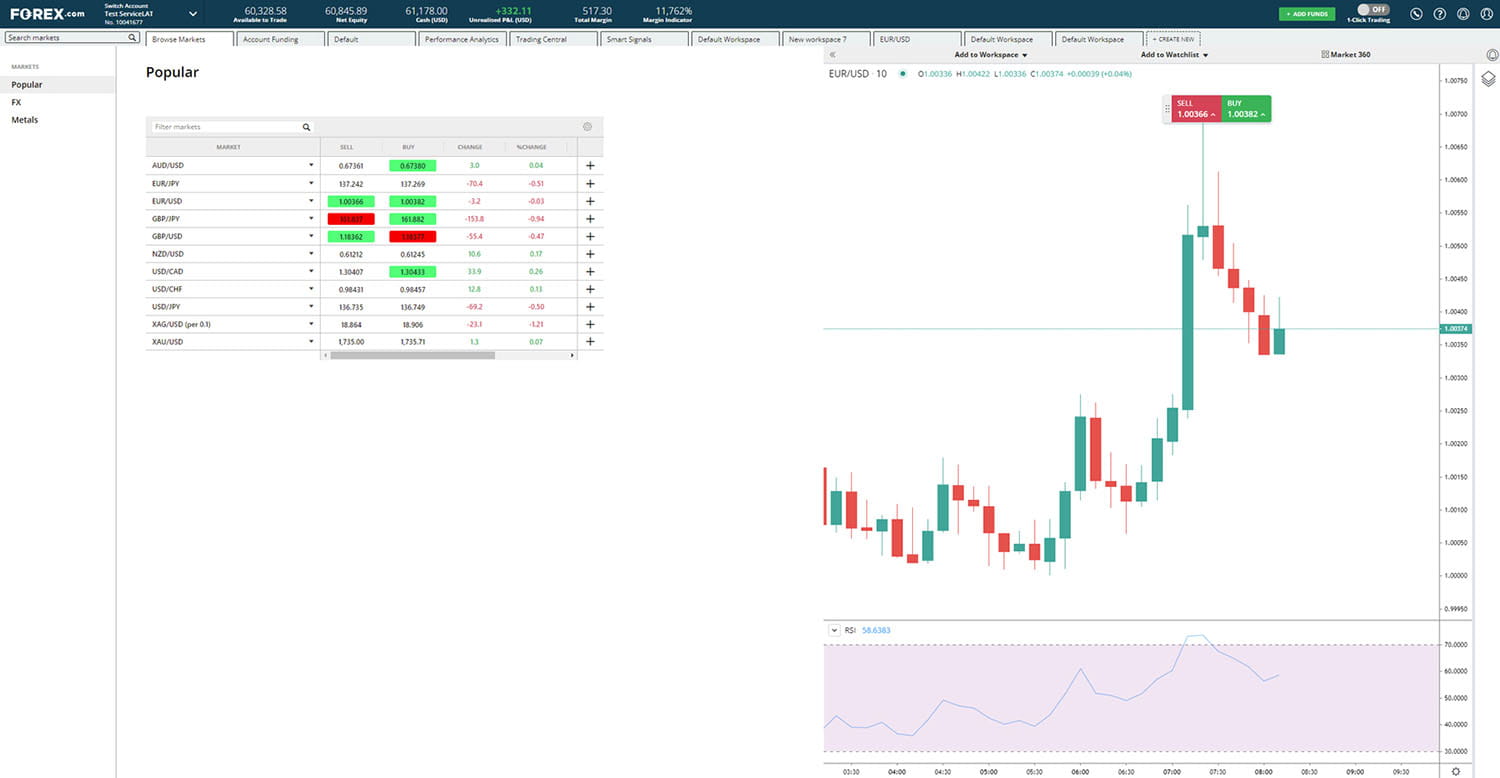

2. Relative Strength Index (RSI)

The RSI is a popular momentum indicator that measures the speed and change of price movements. An RSI reading above 70 indicates that a stock may be overbought and due for a price correction, while a reading below 30 suggests it may be oversold and due for a rebound.

3. MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a stock's price. When the MACD line crosses above the signal line, it generates a bullish signal, indicating a potential upward movement in the stock's price.

4. Volume Breakout

A volume breakout occurs when a stock's trading volume exceeds its average volume by a significant margin. This can indicate increased investor interest and potential price movement. Traders often use volume breakouts to identify potential entry or exit points.

5. Fundamental Analysis

In addition to technical indicators, investors should also consider fundamental analysis. This involves analyzing a company's financial statements, management team, industry trends, and other factors that can impact its stock price. By understanding the underlying fundamentals, investors can make informed decisions about the stock's potential.

While these signals can provide valuable insights, it's important to remember that no signal is foolproof. Market conditions can change rapidly, and it's essential to conduct thorough research and use a combination of signals to make the best investment decisions.