Navigating the world of cryptocurrency trading requires precision, strategy, and effective risk management. A crypto position size calculator is an indispensable tool for traders looking to minimize losses and optimize returns in this volatile market. Whether you’re trading Bitcoin, Ethereum, or altcoins on platforms like Binance and Coinbase, understanding how to calculate the ideal position size can make a significant difference in your trading outcomes. This guide will explore everything you need to know about leveraging these calculators, from risk management strategies to integrating technical indicators, ensuring your trades are backed by data-driven decisions.

Introduction to Crypto Position Size Calculators

Understanding position size calculators is essential for navigating the volatile world of cryptocurrency trading. By integrating tools like stop-loss strategies and market trends, traders can optimize risk management across platforms like Binance and Kraken.

1. What is a Position Size Calculator in Crypto Trading?

A position size calculator helps traders determine the ideal investment amount for each trade. This tool considers account balance, stop-loss distance, and risk tolerance.

Key features:

Precision: Avoid over-leveraging by calculating exact trade amounts.

Efficiency: Quickly adjust to market trends, such as Bitcoin volatility spikes.

Platform Integration: Usable on exchanges like Coinbase and Kraken.

A calculator transforms how traders interact with market trends and manage their capital effectively.

2. Why Use a Crypto-Specific Position Size Calculator?

Reasons for Using Crypto-Specific Calculators:

Market Volatility Management:

Cryptos like Bitcoin and Solana exhibit sharp price swings.

A calculator helps reduce risks by adjusting for volatility metrics.

Cross-Platform Usage:

Supported by Binance, Kraken, and Bybit.

Customizable for different trading fees and leverage ratios.

Risk-Reward Optimization:

Simplifies calculations for stop-loss and risk-reward ratios.

Ensures consistent position sizing across assets like Ethereum and Cardano.

3. Benefits of Position Size Calculators for Risk Management

Benefits in Practice:

Risk Mitigation: Protect your portfolio from extreme market shifts in volatile assets like Litecoin and Dogecoin.

Stop-Loss Precision: Define precise levels based on liquidity and trading volume.

Improved Strategy: Enhance day trading, swing trading, and scalping by integrating technical indicators like RSI or Bollinger Bands.

Example of Risk Management Using Position Size Calculators

| Cryptocurrency | Risk Tolerance (%) | Account Size ($) | Stop-Loss Distance ($) | Position Size ($) |

|---|---|---|---|---|

| Bitcoin | 2% | 10,000 | 500 | 400 |

| Ethereum | 1.5% | 15,000 | 300 | 750 |

| Litecoin | 1% | 20,000 | 100 | 2000 |

By using this calculator, traders can adapt to various market scenarios while maintaining consistent risk exposure.

Risk Management Essentials in Crypto Trading

Effective risk management is the cornerstone of successful cryptocurrency trading. This section explores key strategies like stop-loss integration, diversification, and risk-reward optimization to help traders navigate volatile markets like Bitcoin and Ethereum.

1. Understanding Risk Tolerance in Crypto Trading

Risk tolerance is the foundation of any trading plan, reflecting how much loss a trader is willing to bear. This is influenced by:

Market Volatility: Cryptos like Dogecoin or Solana often have significant price swings.

Personal Financial Goals: A day trader may accept higher risk compared to a long-term investor.

Trading Experience: Novices often have lower tolerance than seasoned traders.

Identifying your risk threshold helps align your position sizes with your comfort level, ensuring consistent decision-making.

2. Integrating Stop-Loss Strategies with Position Size Calculators

Stop-loss orders are critical for minimizing losses in trades. Integrating these with position size calculators allows traders to:

Calculate Loss Limits: Define the exact loss percentage for assets like Polkadot or Avalanche.

Adapt to Volatility: Tools adjust stop-loss levels based on assets' trading volume.

Ensure Discipline: Automation prevents emotional decision-making.

Stop-Loss Strategies for Popular Cryptocurrencies

| Cryptocurrency | Risk Tolerance (%) | Stop-Loss Distance ($) | Recommended Trade Volume |

|---|---|---|---|

| Bitcoin | 2% | 1000 | Medium |

| Ethereum | 1.5% | 500 | High |

| Solana | 1% | 50 | Small |

By automating these calculations, traders on platforms like Binance or Bybit can avoid common pitfalls.

3. Diversification in Cryptocurrency Portfolios

Diversification is essential for mitigating risks associated with volatile markets. A well-diversified portfolio might include:

Bitcoin and Ethereum: As stable assets with high liquidity.

Cardano and Polkadot: Emerging cryptocurrencies with growth potential.

Dogecoin and Litecoin: For speculative opportunities.

This approach reduces exposure to a single asset's volatility, ensuring balanced returns.

4. The Role of Risk-Reward Ratios

Risk-reward ratios evaluate potential gains against possible losses. A common ratio like 1:3 ensures potential rewards are three times higher than risks.

For example:

Bitcoin Trade: Risking $1000 to gain $3000.

Ethereum Trade: Risking $500 for a $1500 profit.

Adjusting these ratios using position size calculators can optimize outcomes, particularly for strategies like swing trading or scalping.

5. Common Mistakes in Crypto Risk Management

Traders often make avoidable errors, including:

Overleveraging: Excessive use of leverage on Bybit or Kraken.

Ignoring Market Trends: Failing to adjust for bearish or bullish sentiment.

Unrealistic Expectations: Expecting outsized returns on small investments.

By addressing these issues, traders can achieve more consistent results across platforms and strategies.

Using Position Size Calculators on Popular Trading Platforms

Position size calculators enhance trading precision across major platforms like Binance, Bybit, and Kraken. This section explores step-by-step guides, use cases, and insights into leveraging these tools for various trading strategies.

1. How to Use a Position Size Calculator on Binance

Steps to Calculate Position Size on Binance:

Log in: Open your Binance account and navigate to the trading section.

Choose Your Pair: Select a cryptocurrency pair, like Bitcoin/USDT or Ethereum/BUSD.

Input Data: Enter your account size, risk tolerance (e.g., 2%), and stop-loss distance.

Calculate Position Size: Use Binance’s integrated tools or external calculators.

Execute the Trade: Adjust the position size in the order form before confirming.

Tip: This is particularly useful when trading high-volatility assets like Dogecoin or Solana.

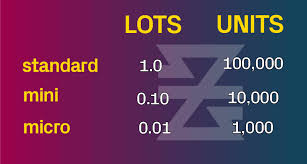

2. Position Sizing for Futures Trading on Bybit

Futures trading on Bybit often involves higher risks due to leverage. A position size calculator helps traders manage this effectively by:

Limiting exposure based on account balance and risk tolerance.

Accounting for fees and funding rates.

Supporting multiple leverage levels (e.g., 10x or 20x).

Example of Position Sizing on Bybit Futures

| Leverage | Account Balance ($) | Risk Tolerance (%) | Stop-Loss Distance ($) | Position Size ($) |

|---|---|---|---|---|

| 10x | 1000 | 2% | 100 | 200 |

| 20x | 1500 | 1.5% | 50 | 450 |

| 5x | 2000 | 1% | 200 | 400 |

Using this approach, traders avoid overexposure while optimizing returns.

3. Position Size Calculator Integration with Coinbase Pro

Coinbase Pro offers seamless integration with external position size calculators, enabling precise risk management for assets like Polkadot and Avalanche. By using these tools, traders can:

Automate calculations for spot and margin trades.

Manage portfolios with real-time updates on risk-reward ratios.

Adjust positions dynamically based on market trends.

4. Case Study: Kraken’s Advanced Position Sizing Tools

A trader used Kraken’s position sizing tools during Ethereum’s price surge. By calculating optimal trade sizes, they:

Avoided overleveraging while maintaining steady profits.

Adjusted stop-loss levels based on Bollinger Bands and RSI.

Achieved a 3:1 risk-reward ratio, ensuring consistent gains even in a volatile market.

This real-world example highlights how position size calculators on Kraken empower traders to navigate market trends with confidence.

Advanced Tools and Indicators for Position Sizing

Position sizing can be fine-tuned using advanced tools and indicators like RSI, Bollinger Bands, and Fibonacci retracements. These tools enable traders to align position sizes with market trends and volatility for optimized risk management.

1. Combining Moving Averages with Position Size Calculators

Moving averages provide critical trend data, helping traders decide when to increase or decrease position sizes.

Simple Moving Average (SMA): Use a 50-day SMA to assess long-term trends for Bitcoin or Ethereum.

Exponential Moving Average (EMA): Ideal for short-term trades on volatile cryptocurrencies like Dogecoin.

Integration with Calculators: By analyzing the crossover points, traders can adjust stop-loss levels and position sizes.

2. Using RSI and MACD for Precision in Sizing

RSI (Relative Strength Index):

Measures market momentum, identifying overbought or oversold conditions.

Example: An RSI above 70 for Solana signals caution, encouraging smaller position sizes.

MACD (Moving Average Convergence Divergence):

Highlights trend reversals, perfect for swing trades on assets like Litecoin.

Traders can scale position sizes when MACD crosses above the signal line.

3. Bollinger Bands and Volatility Adjustments

Understanding Bollinger Bands:

Bollinger Bands visualize volatility, helping traders adjust position sizes dynamically. Narrow bands suggest low volatility, while wide bands indicate high volatility.

Position Sizing Based on Bollinger Band Widths

| Cryptocurrency | Band Width | Market Condition | Position Size Adjustment |

|---|---|---|---|

| Bitcoin | Wide | High Volatility | Reduce |

| Ethereum | Narrow | Low Volatility | Increase |

| Dogecoin | Moderate | Balanced | Maintain |

By monitoring Bollinger Band widths, traders ensure optimal sizing for any market condition.

4. Fibonacci Retracement in Position Sizing

Fibonacci retracement is a powerful tool for determining entry and exit points.

Key Levels: 38.2%, 50%, and 61.8% are crucial support/resistance levels.

Application in Position Sizing: Traders can allocate larger sizes when prices approach strong support zones, like Cardano at the 50% retracement level.

5. Customizing Position Sizing with Market Sentiment Analysis

Market sentiment gauges traders’ collective emotions, influencing decision-making. For example:

Bullish Sentiment: Larger sizes for high-confidence assets like Bitcoin.

Bearish Sentiment: Smaller sizes or hedging strategies with Ethereum.

This flexible approach ensures traders stay aligned with the market's psychological landscape.

6. Integrating Technical and Fundamental Analysis

Combining technical tools like RSI and Fibonacci with fundamentals such as market capitalization and trading volume provides a comprehensive strategy.

Example: During a spike in Avalanche's trading volume, Fibonacci levels paired with Bollinger Bands pinpoint optimal position sizing.

This holistic strategy balances data-driven decisions with broader market insights.

Position Sizing Strategies for Different Trading Styles

Position sizing strategies vary significantly between trading styles such as day trading, swing trading, and scalping. Aligning position sizes with specific styles helps optimize risk management and returns in volatile markets like Bitcoin and Ethereum.

1. Day Trading Position Sizing

Day trading involves rapid buying and selling of cryptocurrencies like Solana and Dogecoin within a single trading session. Effective position sizing for day trading requires:

Setting Tight Stop-Loss Orders:

Protects against unexpected volatility in assets like Polkadot.

Smaller Position Sizes:

Limits risk exposure due to the fast-paced nature of trades.

Using Indicators:

Rely on RSI and Bollinger Bands for precise entry and exit points.

2. Swing Trading Position Sizing

Swing trading, ideal for assets like Ethereum and Litecoin, focuses on capturing price swings over several days or weeks. Position sizing here involves a balance between risk and potential reward:

Medium Risk Tolerance: Larger position sizes compared to scalping but smaller than long-term trades.

Utilizing Fibonacci Retracement: Helps identify entry points and adjust position sizes.

Consideration of Volatility: Higher volatility assets like Avalanche may require smaller sizes.

3. Scalping with Precise Position Sizing

Scalping demands swift decision-making with small but frequent profits. Successful scalping relies on:

High Leverage: Common on platforms like Bybit and Kraken.

Very Small Positions: Minimizes exposure during quick trades.

Technical Indicators: MACD and moving averages are pivotal for timing entries.

Scalping Position Sizing with Leverage

| Cryptocurrency | Leverage | Account Balance ($) | Risk Tolerance (%) | Position Size ($) |

|---|---|---|---|---|

| Bitcoin | 10x | 1000 | 1% | 100 |

| Dogecoin | 20x | 2000 | 0.5% | 200 |

| Litecoin | 5x | 1500 | 2% | 300 |

Traders must ensure these trades are executed in highly liquid markets to avoid slippage.

The Future of Position Sizing in Crypto Trading

Position sizing in crypto trading continues to evolve with advancements in technology and changing market conditions. This section explores innovations like AI tools, emerging cryptos, and regulatory influences shaping the future of trading strategies.

1. AI-Driven Position Sizing Calculators

Artificial intelligence (AI) is revolutionizing position sizing. AI-based calculators can:

Analyze Market Trends in Real-Time: Spot trends in cryptocurrencies like Bitcoin and Ethereum.

Provide Dynamic Recommendations: Adjust for volatility and liquidity in assets such as Solana.

Streamline Decision-Making: Enable faster and more precise sizing for day traders on Binance and Kraken.

AI tools also incorporate sentiment analysis, making them indispensable for high-frequency trading.

2. Position Sizing for Emerging Cryptos

Emerging cryptocurrencies like Polkadot and Avalanche require tailored position sizing due to their volatility and lower market capitalization. Traders can:

Assess Liquidity: Ensure sufficient trading volume to avoid slippage.

Set Conservative Sizes: Account for the heightened risk in newer markets.

Leverage Technical Analysis: Use Fibonacci retracement and MACD to guide entries.

3. Position Sizing in Automated Trading Systems

Automated trading systems integrate position size calculators seamlessly, enhancing precision in high-frequency trades.

Advantages of Automation in Position Sizing

| Feature | Impact on Position Sizing | Example Application |

|---|---|---|

| Real-Time Market Scanning | Adapts to volatility in Bitcoin prices | High-frequency trading on Bybit |

| Risk Management Rules | Ensures adherence to stop-loss thresholds | Swing trading Ethereum on Coinbase Pro |

| Speed and Precision | Reduces execution delays | Scalping Solana on Kraken |

This combination of automation and precision mitigates risks in volatile markets.

4. Adapting Position Sizing for Regulatory Changes

The evolving regulatory landscape impacts position sizing. For instance:

Leverage Caps: Platforms like Binance have reduced leverage limits, necessitating smaller position sizes.

Compliance Requirements: Traders must adhere to anti-money laundering (AML) and know-your-customer (KYC) rules, affecting risk exposure.

Adapting to these shifts ensures compliance while maintaining profitability.

Conclusion

Position sizing is an essential skill for every cryptocurrency trader looking to manage risk effectively while maximizing profit. A crypto position size calculator plays a vital role in ensuring that your trades are based on sound risk management principles, tailored to your unique trading strategy and platform preferences. As the cryptocurrency market continues to evolve, integrating advanced tools like AI-driven calculators and leveraging risk management techniques will become even more crucial in maintaining consistency and profitability. Whether you're a day trader, swing trader, or long-term investor, understanding and using the right position size calculator can make a significant difference in your trading success.

By focusing on the right combination of tools, market indicators, and personalized strategies, traders can gain a competitive edge. From Binance to Kraken, these calculators empower traders across exchanges, allowing for optimized position sizes in real-time. As the landscape of crypto trading evolves, staying updated with these tools will be key to navigating market volatility and ensuring long-term profitability.

A **crypto position size calculator** is a tool that helps traders determine the ideal amount of capital to risk per trade, based on factors such as stop-loss distance and risk tolerance. By calculating position size, traders can better manage risk and avoid over-leveraging.

A **position size calculator** allows traders to calculate the amount of capital they should allocate to a trade while ensuring that they are not risking more than they are comfortable with. It factors in stop-loss levels and account balance to prevent significant losses.

Yes, Binance offers integrated tools that allow you to calculate position size directly within the platform. Additionally, you can use external calculators for more advanced position size calculations that factor in various risk parameters.

The stop-loss is crucial in position sizing because it determines the maximum loss a trader is willing to accept. By calculating position size based on the stop-loss, traders can limit their exposure to risk and prevent significant losses.

For day trading, position sizing typically involves calculating a smaller position to limit risk, as trades are opened and closed within a single day. Traders often use tight stop-loss orders to protect their positions from sudden market fluctuations.

Factors such as account balance, risk tolerance, stop-loss level, and the volatility of the cryptocurrency being traded influence position size. The more volatile the asset, like **Bitcoin** or **Ethereum**, the smaller the position size should generally be.

AI-driven **position size calculators** use artificial intelligence to analyze market data in real time and recommend the optimal position size for a trade. These calculators can adapt to changing market conditions and trader preferences, making them an advanced tool for traders.

For **swing trading**, a position size calculator helps determine the amount to risk on each trade based on your stop-loss levels, account balance, and the expected trade duration. This approach helps optimize risk while capturing medium-term market moves.