In the world of cryptocurrency trading, managing risk effectively is crucial to long-term success. One of the most important aspects of risk management is understanding how to calculate your crypto position size when using leverage. A crypto position size calculator with leverage can help traders determine the optimal amount of capital to risk on each trade, ensuring they avoid overexposure and minimize potential losses. Whether you're trading Bitcoin, Ethereum, or other altcoins, knowing your position size is key to staying within your risk tolerance and maximizing your trading potential. This guide will explore the role of position size calculations in leveraged crypto trading and how specialized calculators can make this task easier and more accurate.

Understanding Crypto Leverage and Position Size

When trading crypto with leverage, it's essential to accurately calculate your position size to manage risk effectively. A crypto position size calculator with leverage helps you determine the optimal amount to trade while staying within your risk tolerance.

1: What is Leverage in Crypto Trading?

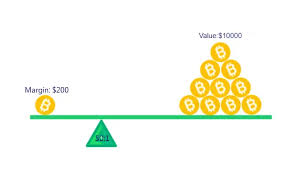

Leverage Definition: Leverage allows traders to control a larger position than their initial investment. For example, a 10x leverage means that with $100, you can trade $1,000 worth of crypto.

Effect on Profit and Loss: Leverage amplifies both potential profits and losses, making it a powerful yet risky tool.

Leverage in Popular Cryptos: Platforms like Binance and Kraken offer leverage options for cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

2: How to Calculate Position Size with Leverage

Formula:

Position Size = (Account Equity x Leverage) / Market Price

This formula helps determine the number of units you can buy/sell based on your available equity and leverage.Example Calculation:

Let's say your equity is $500, and you choose a leverage of 10x to trade Bitcoin at $50,000.

Position Size = (500 x 10) / 50,000 = 0.1 BTCFactors Affecting Position Size:

Account Equity

Leverage Ratio

Market Price of Cryptocurrency

Risk Tolerance

Practical Tips:

Use a position size calculator to simplify the process.

Always ensure you’re not over-leveraging, as it can lead to significant losses if the market moves unfavorably.

3: Risk Management When Trading with Leverage

Importance of Risk Tolerance:

Your risk tolerance determines the amount of capital you're willing to lose in a trade. Setting stop-loss orders can protect against major losses.Risk/Reward Ratio:

The risk/reward ratio helps you understand potential losses and gains. A common strategy is a 1:2 risk/reward ratio, meaning for every $1 risked, $2 is targeted in profit.Capital Management Strategies:

Avoid using all your capital in a single trade.

Diversify across different cryptos or financial instruments like futures or options to minimize risk exposure.

4: The Role of Position Size Calculators in Risk Management

Position size calculators help you tailor your trade size based on your available capital and risk parameters. Here's how they assist:

Risk Control: By entering your risk tolerance, the calculator adjusts the position size to minimize the potential for excessive loss.

Leverage Management: The calculator shows how leverage impacts your position size, helping you avoid over-exposure.

Trader Confidence: With a clear position size, traders can enter trades with a better understanding of potential outcomes.

Position Size Calculation for Various Leverage Ratios

| Leverage Ratio | Account Equity ($) | Cryptocurrency Price ($) | Position Size (BTC) |

|---|---|---|---|

| 5x | 1,000 | 30,000 | 0.17 |

| 10x | 1,000 | 50,000 | 0.2 |

| 20x | 1,000 | 60,000 | 0.33 |

By using a crypto position size calculator, traders can easily assess their exposure and make informed decisions.

Understanding leverage and position size is critical to managing risk in crypto trading. A position size calculator streamlines this process, helping you make data-driven decisions for improved risk management.

Crypto Leverage and Risk Management

Effective crypto trading hinges on understanding leverage and implementing proper risk management strategies. This cluster explores how these concepts interconnect and their importance in safeguarding investments.

1. Understanding Leverage in Crypto Trading: What Traders Need to Know

Leverage amplifies the potential for both profits and losses in crypto trading. Here’s a quick breakdown:

<1> Definition of Leverage: It refers to borrowing funds to increase the size of a trade. For example, with 10x leverage, a $1,000 investment can control $10,000 worth of assets.

<2> Leverage and Risk: The higher the leverage, the greater the risk. A small price movement can result in a large gain or loss.

<3> Popular Leverage Ratios:

2x – Low risk, lower return.

5x – Moderate risk, moderate return.

10x and higher – High risk, high reward.

Leverage is a double-edged sword. Traders must use it cautiously, ensuring their strategy includes solid risk management practices to minimize potential losses.

2. The Role of Risk Management in Crypto Trading: Protecting Your Investment

Effective risk management is crucial to protect against market volatility and large losses. Here are strategies to implement:

<1> Diversification: Spreading investments across multiple assets (like Bitcoin, Ethereum, Litecoin) reduces the risk of a significant loss in any one trade.

<2> Position Sizing: Only risk a small percentage of your capital per trade. For instance, risking 1-2% per trade ensures that multiple losses don’t wipe out your portfolio.

<3> Stop Loss and Take Profit: Always use these features to automate exit points, securing profits and limiting losses.

Multi-paragraph format:Proper risk management is about more than just limiting losses. It’s about creating a balanced approach that incorporates analysis, planning, and discipline. Effective crypto traders always incorporate risk management strategies into their trading plans, ensuring they don’t get swept up in the volatile nature of the market. By diversifying across different crypto assets, adjusting leverage, and setting precise exit points, traders can navigate the market without risking their entire portfolio.

3. Calculating Position Size: How to Manage Risk Effectively

Calculating position size is essential to ensuring that leverage doesn’t overwhelm your trading strategy. Here’s how you can calculate it:

<1> Determine Capital at Risk: Decide the percentage of your portfolio you're willing to risk on a single trade.

<2> Calculate the Dollar Value: If you’re willing to risk 2% of your $10,000 capital, that’s $200 per trade.

<3> Adjust for Leverage: If you're using 10x leverage, your $200 capital would control $2,000 worth of assets.

This process helps maintain consistency and prevent overexposure to single trades.

Table format:Here’s an example of how to calculate position size with different leverage levels:

| Capital at Risk | Leverage | Dollar Value Controlled | Position Size |

|---|---|---|---|

| $200 | 2x | $400 | 20% |

| $200 | 5x | $1,000 | 10% |

| $200 | 10x | $2,000 | 5% |

4. Risk/Reward Ratio: How to Maximize Profit While Minimizing Risk

The Risk/Reward Ratio helps traders evaluate if a potential trade is worth the risk. Here's why it's essential:

<1> Risk/Reward Formula: Risk/Reward Ratio = (Target Price – Entry Price) / (Entry Price – Stop Loss)

<2> Optimal Ratio: A good ratio is 1:2 or higher, where the potential reward is twice as large as the potential loss.

<3> Evaluating Trades: If the risk of a trade is $100 and the reward is $200, then the risk/reward ratio is 1:2, indicating a favorable trade.

By maintaining a strong risk/reward ratio, traders increase their chances of long-term profitability.

5. Choosing the Right Trading Platform: Which Crypto Exchanges Offer the Best Leverage and Risk Management Tools?

Not all crypto exchanges offer the same leverage or risk management tools. Here’s what to look for:

<1> Binance: Offers leverage up to 125x on futures with robust risk management features like stop loss and take profit.

<2> Kraken: Known for its margin trading tools, Kraken provides leverage up to 5x with options for diversified crypto investments.

<3> Bybit: Bybit allows leverage up to 100x and provides a risk management dashboard to monitor exposure.

Comparative Table:

| Exchange | Max Leverage | Risk Management Features | Fees |

|---|---|---|---|

| Binance | 125x | Stop loss, Take profit, Margin call | Low |

| Kraken | 5x | Stop loss, Take profit | Medium |

| Bybit | 100x | Risk management dashboard, Alerts | Low |

In conclusion, understanding leverage and risk management is fundamental to becoming a successful crypto trader. By carefully calculating position sizes, setting up stop losses, and maintaining an appropriate risk/reward ratio, traders can reduce their exposure to significant losses while maximizing the potential for gains. Using the right tools on the best platforms will further enhance your risk management strategies.

Crypto Trading Platforms & Leverage Tools

The increasing popularity of cryptocurrency trading has led to the rise of various crypto trading platforms and leverage tools. These platforms offer innovative features such as margin trading and position sizing, helping traders manage risk and maximize potential returns.

1. Popular Crypto Trading Platforms: Features and Benefits

The market offers a variety of cryptocurrency trading platforms. Here are some of the key players:

<1> Binance: Known for its wide selection of cryptocurrencies and advanced trading tools like futures and margin trading.

<2> Coinbase: Simple and beginner-friendly, Coinbase supports popular coins like Bitcoin and Ethereum and provides educational resources.

<3> Kraken: With strong security and advanced charting features, Kraken is ideal for experienced traders.

<4> Bybit: Specializes in derivatives and offers high leverage options, appealing to more aggressive traders.

<5> KuCoin: A multi-asset platform that offers everything from spot trading to advanced leverage tools.

Key Benefits:

Binance: High liquidity, global availability, and robust trading tools.

Coinbase: Easy-to-use interface and strong customer support.

Kraken: Reliable for security-conscious traders.

Bybit: Best for leverage-based strategies and high volatility assets.

KuCoin: Offers a variety of crypto assets and flexible trading options.

2. Crypto Leverage Tools: How They Impact Your Trading Strategy

Leverage tools are a critical component in crypto trading, providing traders with the ability to magnify potential profits while managing risk.

<1> Leverage Ratios: These determine how much capital you can borrow for your trades. Common ratios range from 2x to 100x, depending on the platform.

<2> Margin Trading: Allows you to borrow funds to open positions larger than your initial capital. This increases both your profit potential and risk exposure.

<3> Liquidation Risk: If your trade moves against you, the platform may liquidate your position to cover the borrowed capital. This can happen quickly with high leverage.

<4> Stop-Loss Orders: A key risk management tool to minimize potential losses by automatically selling assets if their price hits a predetermined level.

Using leverage tools effectively requires careful consideration of risk tolerance. Traders should avoid excessive leverage to prevent the risk of liquidation.

3. Leverage and Position Size Calculation Table

Understanding how much leverage to use and how to calculate your position size is essential for managing risk. Below is a table illustrating how leverage and position size affect your trading:

| Leverage Ratio | Position Size | Entry Price (USD) | Total Exposure (USD) | Risk/Reward Ratio |

|---|---|---|---|---|

| 10x | 0.01 BTC | 30,000 | 300,000 | 1:2 |

| 20x | 0.005 BTC | 30,000 | 100,000 | 1:3 |

| 50x | 0.002 BTC | 30,000 | 100,000 | 1:5 |

| 100x | 0.001 BTC | 30,000 | 100,000 | 1:10 |

Explanation:

Leverage Ratio: The amount of borrowed capital you use for trading.

Position Size: The amount of cryptocurrency you're buying or selling.

Total Exposure: The total amount you control, including the borrowed funds.

Risk/Reward Ratio: The potential risk compared to the potential reward. A higher leverage typically increases the risk and reward ratio.

4. Margin Trading and Risk Management

Margin trading involves borrowing funds to increase your trading position. While it can amplify profits, it also increases the potential for significant losses. The key is to balance leverage with sound risk management.

Traders should consider the following when using leverage:

Risk Tolerance: Assess how much risk you're willing to take based on your capital.

Capital Management: Ensure you never risk more than a small percentage of your total capital on one trade.

Diversification: Spread your investments across different cryptocurrencies or trading strategies to manage risk.

By setting appropriate stop-loss levels and using lower leverage, traders can minimize the risk of liquidation while taking advantage of leverage tools. Effective capital management is crucial in volatile markets like cryptocurrency.

5. Comparison of Leverage Tools across Major Platforms

When selecting a trading platform, it is important to compare leverage tools offered by each platform. Here’s a quick comparison:

| Platform | Max Leverage | Margin Type | Supported Assets | Fees |

|---|---|---|---|---|

| Binance | 125x | Isolated/ Cross | BTC, ETH, ADA, SOL | 0.10% |

| Coinbase | 3x | Cross Margin | BTC, ETH, LTC | 1.49% |

| Kraken | 5x | Isolated/ Cross | BTC, ETH, XRP | 0.26% |

| Bybit | 100x | Isolated/ Cross | BTC, ETH, EOS | 0.075% |

| KuCoin | 100x | Isolated/ Cross | BTC, ETH, DOT | 0.10% |

While some platforms offer extremely high leverage, such as Binance and Bybit, others like Coinbase provide lower leverage with more beginner-friendly features. Understanding the differences in margin types and fees will help you choose the right platform for your trading style.

By using the appropriate platforms and leverage tools, traders can maximize their trading potential while managing the risks associated with cryptocurrency markets.

Advanced Leverage Strategies in Crypto Markets

In the volatile world of crypto trading, advanced leverage strategies are crucial for maximizing profit potential. Leverage allows traders to control a larger position than their initial capital, but with higher risk.

1. Leverage Ratio and Risk Management in Crypto Trading

Leverage ratios in crypto trading can significantly impact both your potential profits and risks. The higher the leverage, the higher the risk of liquidation if the market moves against you. Understanding how to balance leverage with effective risk management is critical for success.

Leverage Ratios Explained:

1x - 5x Leverage: Suitable for conservative traders, offering lower risk but also limiting profit potential.

10x - 20x Leverage: Popular among experienced traders, it increases profit potential but also exposure to risk.

50x and above Leverage: Used for high-risk, high-reward trades, but comes with a significant chance of liquidation.

Effective Risk Management Strategies:

Use Stop Loss orders to limit losses.

Diversify your portfolio to spread risk.

Regularly assess your Risk/Reward Ratio to ensure favorable odds for each trade.

2. Benefits of Using Perpetual Contracts for Leverage

Perpetual contracts are a unique financial instrument that allows traders to use leverage without an expiration date. This feature makes them ideal for long-term leverage strategies.

Key Benefits of Perpetual Contracts:Perpetual contracts on platforms like Binance and FTX give traders more freedom to manage leverage positions in a constantly moving market.

No expiration dates, allowing traders to hold positions indefinitely.

Ability to apply high leverage, typically up to 100x on some exchanges.

Flexible trading: can be used for both long and short positions.

3. Calculating the Liquidation Price in Leverage Trades

When using leverage, calculating your liquidation price is essential to avoid unexpected losses. The liquidation price is the price at which your position is automatically closed if the market moves against you.

Liquidation Price Calculation for 10x Leverage

| Entry Price | Leverage | Position Size | Liquidation Price |

|---|---|---|---|

| $10,000 | 10x | 1 BTC | $9,000 |

| $5,000 | 10x | 2 BTC | $4,500 |

| $2,000 | 10x | 5 BTC | $1,500 |

Liquidation Formula:

Liquidation Price = Entry Price – (Entry Price / Leverage)

This calculation is crucial in volatile markets to prevent significant losses.

4. Advanced Strategies for Maximizing Leverage in Margin Trading

Margin trading allows traders to borrow funds to increase their exposure to a given market. However, maximizing leverage in margin trading requires a sound understanding of market trends, entry points, and exit strategies.

Steps to Maximize Leverage in Margin Trading:

<step 1>Choose the right leverage:

Start with a lower leverage ratio (such as 5x) until you're comfortable with the risk.

<step 2> Utilize stop orders:

Set up automated stop-loss and take-profit orders to minimize risks.

<step 3> Monitor the market:

Keep a close eye on volatility, liquidity, and price swings.

Potential Pitfalls:

Over-leveraging can lead to rapid liquidation if the market swings against you.

Not accounting for market fees can erode profits significantly.

5. Impact of Market Volatility on Leverage in Crypto Trading

Crypto markets are notorious for their volatility, and leveraging during these turbulent times requires more precision. Volatility can cause rapid price movements, which can either lead to substantial profits or trigger liquidations if leveraged too heavily.

Effect of Volatility on Leverage:

High Volatility: When markets are highly volatile, leverage should be used cautiously to avoid forced liquidations.

Low Volatility: Using leverage during periods of low volatility can lead to smaller profits but reduced risk.

Tip: Use Volatility Indicators and Market Depth analysis tools to determine the best time to enter and exit leveraged positions.

Calculators and Algorithms in Leverage Position Sizing

In the fast-paced world of leveraged trading, understanding the tools and algorithms used to calculate position sizes is crucial. Leverage calculators and sophisticated algorithms help traders manage risks effectively and optimize their strategies.

1. How Leverage Calculators Simplify Risk Management

Leverage calculators are essential tools for traders looking to manage risk effectively. They help traders determine the optimal position size based on several factors, including account balance, leverage, and risk tolerance.

Risk Tolerance: Determines how much capital you are willing to risk per trade.

Leverage Ratio: Indicates how much greater your exposure is compared to your initial margin.

Position Size: Calculates how large a position you can take without exceeding your risk tolerance.

By inputting these factors into a leverage calculator, traders can easily assess their risk and adjust their positions accordingly.

2. The Role of Algorithms in Position Size Calculation

Algorithms are often used to automate the calculation of position sizes and adjust them dynamically based on market conditions. This removes the need for manual calculations, improving both accuracy and speed.

Dynamic Adjustments: Algorithms update position size based on changes in leverage, stop loss, and other market variables.

Real-Time Risk Management: Helps track risks during high volatility and adjust positions automatically to maintain a balanced portfolio.

Algorithmic Efficiency: Reduces human error and the time spent calculating complex position sizes, enabling quicker decision-making.

By leveraging advanced algorithms, traders can better protect their capital and avoid overexposure to risk.

3. Popular Leverage Position Sizing Algorithms

The most commonly used algorithms in position sizing include the Kelly Criterion and Fixed Fractional method. Here's a comparison:

| Algorithm | Key Feature | Pros | Cons |

|---|---|---|---|

| Kelly Criterion | Maximizes long-term growth | Maximizes growth, optimal bet sizing | Complex to understand and implement |

| Fixed Fractional | Allocates a fixed percentage | Easy to implement, consistent | May not be optimal during high volatility |

| Risk-Based Model | Adjusts based on risk tolerance | Tailored to individual risk | May overestimate position size in volatile markets |

The choice of algorithm can significantly impact a trader's success, as each has its strengths and limitations depending on the market environment.

4. Step-by-Step Guide to Using Leverage Calculators

Using leverage calculators is a simple yet powerful way to manage trading risks. Here’s how to use them effectively:

<step 1> Input Account Balance: Enter the amount of capital available for trading.

<step 2> Set Leverage: Choose your desired leverage ratio (e.g., 5:1, 10:1).

<step 3> Define Risk Tolerance: Decide the percentage of your capital you're willing to risk per trade.

<step 4> Select Stop Loss: Set a stop loss level to limit potential losses.

<step 5> Calculate Position Size: The calculator will compute the appropriate position size based on your inputs.

By following these steps, traders can easily determine the ideal position size and avoid taking on too much risk.

5. The Impact of Market Conditions on Position Sizing Algorithms

Market conditions play a significant role in determining position sizes, especially in leveraged trading. Algorithms that adjust position sizes dynamically based on market volatility or liquidity can help mitigate risks in fast-moving markets.

For instance, during periods of high volatility, position sizes might be reduced to ensure that the trader does not incur large losses due to rapid market movements. Conversely, in low volatility environments, the algorithm may increase position sizes to take advantage of more stable price movements.

Adapting algorithms to respond to real-time data allows traders to stay in control even when market conditions shift unexpectedly.

Conclusion

Leverage position sizing tools and algorithms are vital for managing risk and optimizing trading strategies in leveraged markets. Whether through simple leverage calculators or sophisticated algorithms like the Kelly Criterion, traders can fine-tune their positions to align with risk tolerance, account balance, and market conditions. The use of algorithms that adjust to dynamic market environments provides real-time risk management, enhancing the efficiency and effectiveness of trading decisions. By incorporating these tools into their trading strategy, traders can maximize their profitability while minimizing the risk of significant losses.

A leverage calculator helps traders determine the appropriate position size based on their risk tolerance, leverage ratio, and account balance. It simplifies the process of managing risk and ensures that traders don’t overexpose themselves to potential losses.

Leverage algorithms adapt to market conditions by modifying position sizes dynamically. They take into account factors like volatility, liquidity, and stop loss levels to reduce risk during high volatility and optimize trading opportunities in stable conditions.

The Kelly Criterion is used to calculate the optimal bet size for maximizing long-term capital growth. It helps traders balance risk and reward by recommending the percentage of capital to risk on each trade, based on potential returns.

Yes, leverage calculators are often used in cryptocurrency trading, particularly on platforms like Binance or Bybit. They help traders determine the right position size for leveraged margin trading or futures contracts.

Position sizing is crucial in leveraged trading because it helps determine how much capital to risk per trade. Without proper position sizing, traders risk exposing themselves to significant losses that could wipe out their account balance.

Several factors influence position size calculation: - Account balance - Leverage ratio - Stop loss - Risk tolerance

The Fixed Fractional method involves risking a fixed percentage of your account balance per trade. This method is easy to implement and ensures consistent risk management, though it may not be the most optimal in highly volatile markets.

Algorithms reduce human error by automatically calculating and adjusting position sizes based on real-time data. They eliminate mistakes that might occur from manual calculations, ensuring that traders make more accurate and timely decisions.