EUR/USD Technical Analysis and Forecast

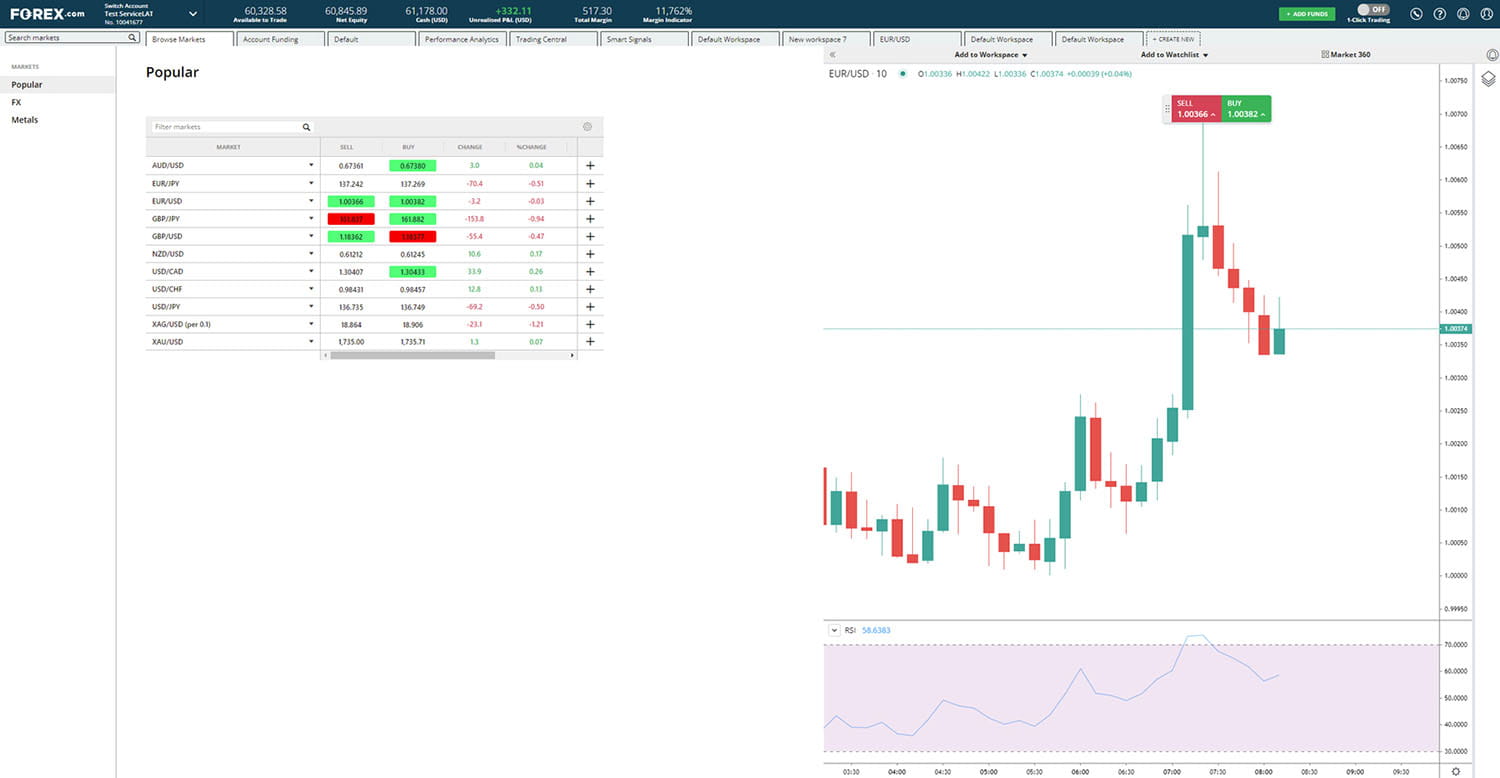

The EUR/USD pair has been trading in a range for the past week and is currently consolidating around the 1.1800 level. The pair has been supported by the 50-day moving average and is showing signs of bullishness. However, there are still some key resistance levels that the pair needs to overcome before a sustained uptrend can occur.

Looking at the daily chart, we can see that the pair has been forming higher lows and higher highs, indicating that there is buying pressure in the market. The next challenge for the pair is to break above the 1.1850 resistance level, which has been acting as a significant barrier in recent weeks.

If the pair manages to break above the 1.1850 level, it could potentially rally towards the next resistance level at 1.1900. A successful break above this level would confirm a bullish trend and open the door for further gains towards the 1.2000 psychological level.

On the downside, if the pair fails to break above the 1.1850 resistance level, it could retest the 1.1750 support level. A break below this level could signal a reversal in the trend and open the door for a potential decline towards the 1.1700 level.

Overall, the EUR/USD pair is currently in a consolidation phase, but the bias remains bullish. Traders should watch for a break above the 1.1850 resistance level for confirmation of a sustained uptrend. A break below the 1.1750 support level would indicate a potential reversal in the trend.