Forex scalping is a popular trading strategy among forex traders. It involves making quick trades for small profits multiple times a day. This strategy requires traders to have a high level of concentration and the ability to make fast decisions. In this article, we will discuss how to start scalping forex and some key points to consider.

1. Choose the Right Broker

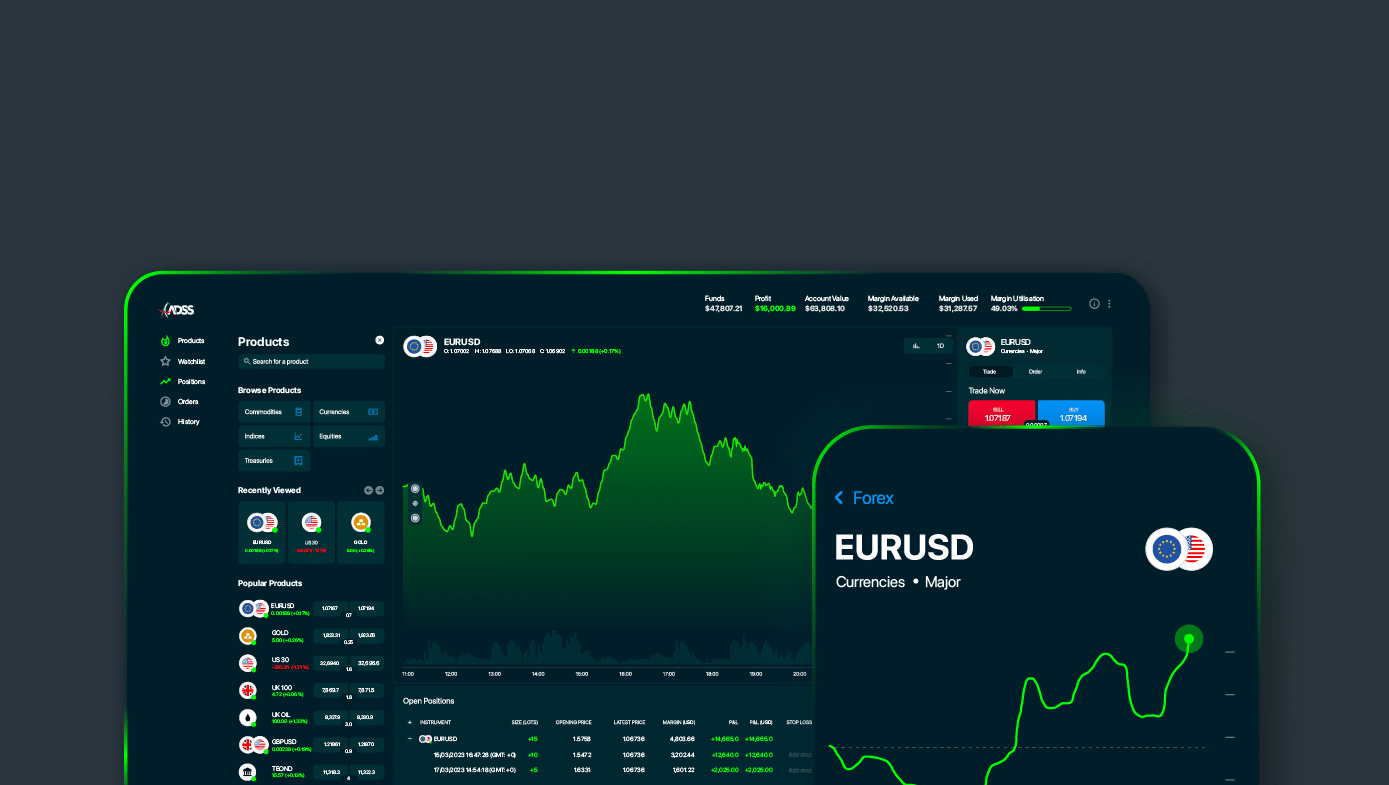

The first step to start scalping forex is to choose a reliable broker that offers tight spreads and fast execution. Since scalpers aim to make small profits from quick trades, it is important to have a broker that provides low-cost trading and fast order execution.

2. Master Technical Analysis

Technical analysis plays a significant role in forex scalping. Traders use various indicators and chart patterns to identify short-term price movements. It is crucial to master technical analysis and understand how different indicators work together to generate signals for entering and exiting trades.

3. Use Scalping Indicators

Scalping indicators are specifically designed for this trading strategy. They help traders to identify buy and sell signals with higher accuracy. Some popular scalping indicators include moving averages, Bollinger bands, and stochastic oscillators. Traders should test different indicators and find the ones that work best for their trading style.

4. Set Realistic Profit Targets and Stop Loss

Scalpers aim for small profits on each trade, typically a few pips. It is important to set realistic profit targets and have a tight stop loss in place to protect against potential losses. Scalpers must be disciplined and exit trades when the market moves against them.

5. Practice on a Demo Account

Before using real money, it is recommended to practice scalping on a demo account. This allows traders to get familiar with the trading platform, test different strategies, and build confidence without risking any capital. It is important to treat the demo account as if it were real to simulate the real trading environment.

6. Develop a Scalping Plan

A well-defined trading plan is crucial for success in forex scalping. Traders should determine their preferred trading sessions, currency pairs to trade, and timeframes to use. They should also define their risk tolerance and trade management rules to avoid impulsive decisions and emotional trading.

7. Manage Risk

As with any trading strategy, risk management is vital in scalping forex. Traders should never risk more than a small percentage of their trading capital on a single trade. They should also use appropriate position sizing and set stop loss levels to limit potential losses.

Scalping forex can be highly profitable if done correctly. However, it requires a lot of practice, discipline, and continuous learning. Traders should constantly monitor market conditions, adapt their strategies when necessary, and always stay updated with the latest economic news and events that can impact the forex market.