Are you looking for an answer to how to trade forex? Great! You are on the right page! In this guide, you will find out how you can use technical and fundamental analysis to identify market opportunities, how to develop a trading plan, how to efficiently use and implement a money management system to protect your account, and so much more. Learn how you can enhance your skills to master this market and become a successful trader with our step-by-step guide to kick-off your trading.

Table of Contents

Choose the right forex pair: Finding a trending currency pair

Identify a market opportunity: Using technical analysis to find entry levels

Open your trade: Using money management to protect your account

Monitor your trade: Partially closing your position in profit

Choose the right forex pair: Finding a trending currency pair

The first step on how to trade forex successfully is to find a trending currency pair. No-one wants to open a position on a pair that is ranging and be stuck with an open trade that isn’t going anywhere, possibly accumulating swap fees, and slowly eating your account margin.

When we say a trending pair, we mean a forex pair trending on higher time-frames. Not on M5 time-frame! To find a trending forex pair, you should always look at higher TFs. Anything below the D1 time-frame, not only will be a risk to trade, but you would not be able to see if there’s a trend or not.

Some traders prefer to trade on monthly charts, some the weekly, but on this guide, we recommend, at least, using the daily time-frame. And by doing so, you will have more chances to be trading the trend where smart money, like banks and funds, are also trading.

To start finding a trending pair you should first “listen” to the fundamentals. Is the country represented by that currency in a stable economic or political position? Check the economic, political and social factors that can affect the demand and supply of a currency.

The purpose for this fundamental analysis is to try to predict if the current, or future, economic outlook of a country's is good, and if so, their currency should strengthen versus the quote currency, or vice-versa.

As the financial say goes “sell the rumour, buy the news”. So, if the country’s economic outlook is rumoured to be negative, you should think about positioning yourself short. If the outlook is positive then you should consider long positions.

Now it’s time to find a trend within the price action. If the currency pair you choose to trade has the right balance of fundamental factors, open a daily chart (on your trading platform), and let’s try to identify the trend.

How to identify a trend in a forex pair?

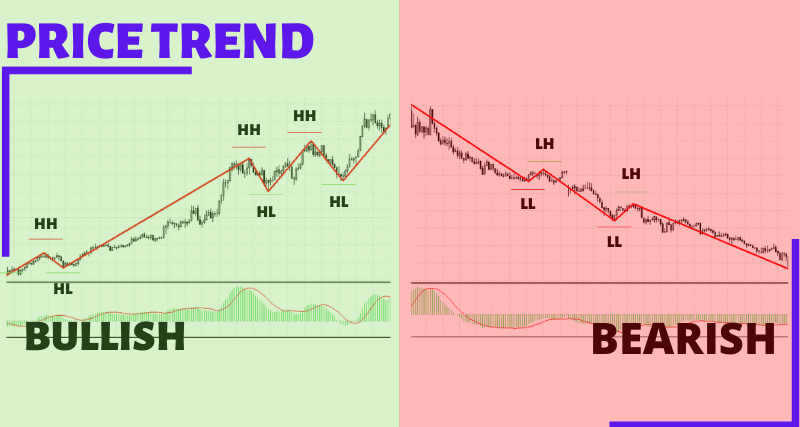

Well, it’s quite simple actually. The assumption behind a trending forex pair is that on an uptrend the price is making higher highs, followed by higher lows, called retracements.

If the quote is in a downtrend, then the price will be making lower lows, followed by lower highs, also retracements. No trend ever goes up or down in a vertical line. Trends are made of longer direction impulses and retracements, in a zig-zag shape, which translates on entry opportunities within the trend.

Identify a market opportunity: Using technical analysis to find entry levels

The second step on our guide is to identify a market opportunity that allows you to enter the predominant currency pair trend. Just because you found a trending pair and the fundamentals are good you are not opening a position at whatever market price.

The key to trend trading is to buy low and close high on an uptrend and to sell high and close low on a downtrend. Therefore, to identify an entry opportunity, you will need to identify the trend retracements. These pullbacks are small corrections within the main trend and the entry levels to open your trade. You can use your favourite technical analysis indicators to identify the trend, like Par Sar or MACD.

We recommend the use of MACD to visually identify the main trend. MACD is the abbreviation for Moving Average Convergence Divergence, a trend-following indicator that shows changes in the strength, the direction, the momentum, and the duration of a trend. It is also a reliable technical analysis indicator widely used by all types of traders including professional traders. Now, with the main trend identified, you will need to find a good entry-level. This is the second part of the technical analysis.

How to find an entry-level in a trending forex pair?

To find an entry-level you should try to draw the trendlines on your price chart. Trendlines are fundamental tools used in technical analysis to identify the support and resistance levels of a trading asset. The support levels on an uptrend and the resistance levels on a downtrend should be your entry levels.

These levels are a follow up on that we saw previously; higher highs (resistance breakout) and higher lows (support level) on an uptrend and lower lows (support breakout) and lower highs (resistance level) on a downtrend. So, to find an entry-level all you have to do is to find and mark these levels within the trend. If you would like to learn more about trading with trendlines, then check out our article on how to plot trendlines.

Decide to enter the market: Defining a precise trading plan

Our third step on how to trade forex will cover the need to define a trading plan. You can’t just enter the market without one. A trading plan is a set of guidelines, elaborated according to a trader’s circumstances, that takes into consideration several variables including the trade time length, the trade risk-reward, the trade goals and more.

A trading plan outlines how a trader will define the trade conditions, how large should the position be, managing the trade and adding more positions or partially close the trade, calculating the risk-reward ratio to check if the trade it’s worth the risk or not.

How to build a sustainable trading plan?

A good trading plan should, at least, include these three main variables:

Establish and define your goals for the trade (i.e. increase account equity by 5%)

Evaluate the risk-reward ratio for the trade (i.e. 100 pips loss/300 pips profit)

Determine a solid money management system for the trade (remember the 2% rule)

With these guidelines in mind, let’s look in more detail at each one of them. You should start by including on your trading plan the time-frame that you which to trade (we recommend at least the D1 time-frame) and then set your goals. Scrap the idea of doubling your account balance with one trade, that’s pure fiction (more likely you can blow-up your account with one trade).

Establish a reasonable objective for your trade, like a 5% account equity increase. If you have a $1000 trading account that will be a $50 profit. Too low? Well, not really, especially if you consider how much the banks pay you on your savings account… like a miserable 0.10% interest. On a $1000 that is a $1 interest. So, if you manage to gain $50 on your forex trading account with one trade, you should be smiling. Always decide on a reasonable goal for your trade.

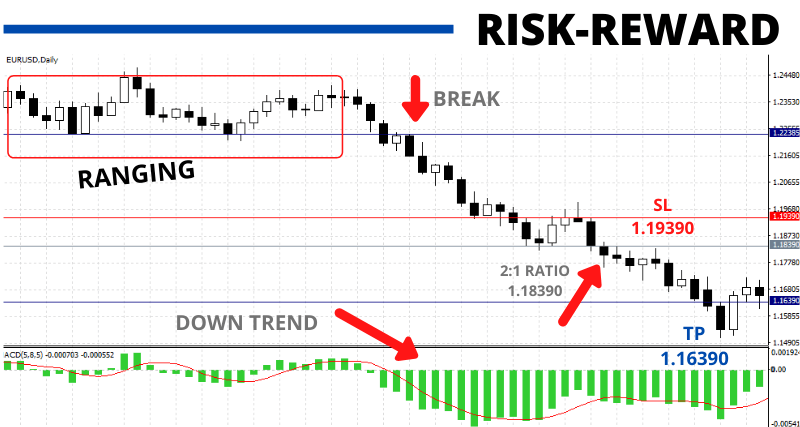

Next, on your trading plan, you should include the calculation of the risk-reward ratio for the trade. The risk-reward ratio measures the distance between a trade’s entry price to a stop-loss level and a take-profit level. Before pushing the buy or sell button, you have to decide for yourself what’s your acceptable risk-reward ratio.

The minimum ratio that gets the interest of most traders is 2:1. This means risking a mini lot position, let’s say $20, depending on the account leverage, to profit $40, the double. The risk-reward ratio for the trade should be calculated taking into account the entry price, the stop-loss price and the take profit price. Here’s an example of a 2:1 risk-reward ratio.

You have a forex trading account with a $1000 balance. You found an entry opportunity to go long on the EUR/USD at 1.0925. With a 2:1 risk-reward ratio your levels would be the following: Entry price @ 1.0925, stop loss @ 1.0825 and take profit @ 1.1125.

This means you are willing to risk a loss of 100 pips to earn a profit of 200 pips. But this ratio can be adjusted to your preference or the market conditions, just to clarify, 2:1 is the minimum acceptable by most traders.

You can use our handy Position size and risk calculator to find your ideal risk-reward ratio and to complement your money management system for the trade we also recommend the use of our Pip value calculator.

Open your trade: Using money management to protect your account

On our next step in this guide, we will look at the importance of solid money management to protect your trade. You should use an effective money management policy to protect your trade and your account equity in the event of a violent market change against your position, something that can quite naturally happen with forex trading.

To preserve your account equity as much as possible, you should follow this important rule: Risk only a small fraction or percentage of your account, ideally a maximum of 2% of your equity on any single trade. On a $1000 trading account that’s $20. By only risking 2% of your equity, you can have a streak of 10 losing trades in a row and still retain 80% of your account’s equity. So, a sound money management system will give you the ability to carry on trading for much longer.

What to consider for an efficient money management plan?

To create a robust money management plan to keep you trading for longer in the forex market you should include:

Using leverage effectively. Don’t be fooled by the 400:1 ratio. It’s paramount that you learn how to use leverage efficiently. Trading with big lots on a small account it’s not an effective way of using leverage. Sudden price movements can suddenly kill an over-leveraged trading account.

The risk-reward ratio per trade. More experienced traders always try to find trading opportunities with a minimum of 2:1 risk-reward ratio to make a bigger profit without losing too much.

Risking a maximum of 2% per trade. You must define the risk per trade professionally. Risking more than 2% of your account equity per trade is not professional, but more like gambling. You might be fortunate and make a 25% gain, but you might also slowly develop the habit of gambling. And eventually… ruin your trading career.

Using a protective stop loss. Always use a protective stop-loss, according to the risk-reward ratio and as per your trading plan to protect your trade from unexpected price movements and spikes.

Control your emotions. Learn to control your emotions and stick to the trading plan. Emotional traders tend to place random trades, without an adequate fundamental or technical analysis, or a trading plan, in an attempt of recovering for previous losses, with high-risk trades that will only add up to more losses and ultimately burn their account. You might lose most of the trades if you fail to control your emotions.

Monitor your trade: Partially closing your position in profit

Did you know that you can partially close your trade with the MT4 and MT5 trading platforms? Yes, to secure part of your profits, or to further minimise the trade risk. Let’s imagine that you have a $1000 trading account and that you have risked a 2% trade with a long position of 0.20 lot ($20) on the EUR/USD @ 1.0925 with an SL @ 1.0825 and a TP level @ 1.1125. Price is going up and your trade is already in a good profit.

Due to some last-minute, not so positive political event in the Eurozone, the EUR/USD quote is currently finding some unexpected resistance @ 1.1035. You are afraid that the recent news might bring a trend reversal and that the trade might turn into a loss.

But on the other hand, market analysts are saying that this event was already priced into the quote and the price should carry on with the main long trend. So, what to do? Well, you can partially close your trade (let’s say 50% = 0.10 lot, half of your 0.20 lot original position), secure some profits (0.10 lot with 110 pips profit) and let the remaining 0.10 lot run until price reaches your TP @ 1.1125 (or get you stopped out).

By closing, half of your original 0.20 lot position, not only you have managed to secure some profits, but you have also reduced your trade risk as your current position is now $10. Even if you get stopped out, you will lose just $10, instead of the original $20 trading position.

How to partially close a position with MT4 and MT5.

Open the trade explorer and find the position which you want to partially close.

Double click on in.

Select the “Volume:” field, below the “Symbol:” field.

Adjust the volume to, for example, 0.10 lot, half of the original 0.20 lot and press the yellow button “Close by market”.

That’s it, done. You can now let the remaining half run until the market goes to your TP or SL level. Let’s not forget that even if your remaining 0.10 lot gets stopped out with 100 pips stop loss, overall, it will not be a losing trade as the 0.10 lot that you partially closed got you a 110 pips profit!

Close your trade: Post-trade analysis

The final step on our how to trade forex guide is the post-trade analysis. What happened? Was the trade executed following your trading plan rules? Was it a successful one, or a loss? After your trade closed, by reaching the TP level or by being stopped out, it is time to understand the trade dynamics and write down some notes.

A post-trade analysis is a way of keeping a track record of what worked and what you should change (hopefully nothing, if you have followed these steps) so that you can trade better in the future. On your post-trade analysis consider the following questions:

Did you find a trending currency pair?

Did you use the right technical analysis to find the entry levels?

Did you define a precise trading plan?

Did you use money management to protect your trade?

Did you manage to control your emotions?

These questions should help you understand the reasons and factors behind the trade outcome. If all went well just keep repeating what you did. But if your trade was a loss, the reasons behind failure could be many. Let’s have a look at the main factors in case of loss:

Perhaps the forex pair was in a range trend going nowhere and then went against your position.

Maybe you didn’t use the technical analysis tools correctly, or you were using too many and simply got confused.

Maybe your trading plan and objectives were not realistic.

Perhaps your money management system needs some adjustments.

Maybe you panicked and closed the trade prematurely. Or maybe you got greedy and the profitable trade turned into a loss.

If your trade didn’t turn out as expected, you should stop trading and analyse what went wrong. Close your trading platform and try to find an answer by asking yourself the above questions. Try to find the logic behind the trade execution and write down what you did.

Take this exercise with a professional attitude, especially, if you are a new trader. It will give you a clear perspective regarding your trading ability to be a successful trader. Don’t be shy, to master this market you will need two things; discipline and practice. And hopefully with our step-by-step guide to kick-off your trading you will be a better trader.