Cryptocurrency trading can be both exciting and challenging, especially when navigating the volatile markets. One of the key tools that successful traders rely on is OQtima signals — real-time, accurate buy and sell indicators that can help you make informed decisions in fast-paced crypto markets. Whether you're new to trading or a seasoned expert, understanding how to utilize these signals effectively can significantly enhance your trading strategy.

Understanding OQtima Signals for Crypto Trading

Cryptocurrency trading requires precise decision-making, where accurate signals can make a significant difference. By understanding how OQtima signals work, traders can better navigate the fast-paced world of crypto markets.

Overview of OQtima Signals:

OQtima signals are real-time buy and sell indicators that provide insights into market trends, helping traders make informed decisions. These signals are generated using advanced algorithms, analyzing both technical and fundamental analysis to ensure high accuracy in predicting market movements.Purpose in Crypto Trading:

The main purpose of OQtima signals in crypto trading is to provide reliable, timely, and actionable information that can reduce the risks associated with volatile markets. Traders use these signals to identify optimal entry and exit points, enhancing profitability.Types of OQtima Signals:

Buy Signals: Indicate when to enter the market with a purchase, based on favorable market conditions.

Sell Signals: Advise when to exit a position to lock in profits or minimize losses.

Real-Time Market Predictions: Offer ongoing assessments of market direction, ideal for traders who need up-to-the-minute updates to act quickly.

Types of OQtima Signals

Buy and Sell Signals:

Buy Signals are typically generated when an asset shows upward momentum, supported by indicators like Moving Averages or RSI.

Sell Signals arise when indicators suggest overbought conditions, signaling a potential market correction.

Real-Time Market Predictions:

These signals provide traders with predictions about short-term price fluctuations, making them vital for scalping or day trading strategies.

Real-time predictions are driven by continuously updated data, incorporating market sentiment analysis, which offers traders the chance to make swift, well-informed decisions.

Timing and Frequency of Signals:

OQtima signals can be provided at varying time intervals, from minute-based signals for scalpers to hourly or daily signals for position traders. The right timing ensures the signals are aligned with a trader’s chosen timeframe.

Signal Accuracy:

OQtima signals have been designed for high accuracy, utilizing a combination of technical indicators like the MACD and Bollinger Bands, alongside market analysis for a more nuanced approach to predicting crypto price movements.

How Accurate Are OQtima Signals for Crypto?

Accuracy in Volatile Markets:

Cryptocurrency markets are notoriously volatile, but OQtima signals are crafted to adapt to these conditions. Their accuracy comes from sophisticated algorithms that incorporate both real-time signals and technical analysis.

Factors Impacting Accuracy:

The effectiveness of OQtima signals depends on market conditions, timeframes, and external factors such as news events. For example, signals generated during a news trading event might experience lower accuracy due to market unpredictability.Improvement Over Time:

As OQtima signals learn from past trading patterns, their prediction models continuously evolve, improving over time. This makes them a reliable tool in achieving profitable results in both short-term and long-term trading.

Why Use OQtima Signals for Free Crypto Trading?

No Upfront Costs:

OQtima free signals provide traders access to valuable information without any initial investment, making them accessible to those new to crypto trading or those seeking a cost-effective solution.Comparison with Paid Services:

While some traders opt for paid services, OQtima free signals can be just as reliable. Unlike some paid services that charge high fees, these free signals offer consistent accuracy and timely delivery, without the financial burden.Wide Range of Signals:

Even the free service offers a comprehensive selection of signals, including buy/sell signals, market predictions, and technical analysis that cater to different trading strategies, such as scalping and day trading.Accessibility and User-Friendly Platforms:

These signals can be accessed through various platforms like MetaTrader 4, MetaTrader 5, and TradingView, allowing traders to easily integrate them into their existing strategies without needing complex setups.Community and Support:

Utilizing free OQtima signals also grants access to a community of traders who share insights and experiences, enhancing the overall learning and trading experience.

How to Integrate OQtima Signals with Your Crypto Trading Strategy?

<step 1> Choosing the Right Strategy:

Different strategies, such as scalping, swing trading, and position trading, can benefit from OQtima signals. For scalpers, real-time signals are essential for making rapid trades. Swing traders, on the other hand, might prefer the longer-term predictions provided by the signals.

<step 2> Align Signals with Indicators:

Combine OQtima signals with technical indicators like RSI, MACD, and Fibonacci retracement to create a multi-layered approach to trading that increases the likelihood of profitable trades.

<step 3> Choose the Right Timeframe:

Adapt your signal usage based on your chosen timeframe. Day traders often work with shorter timeframes like M1, M5, or M15, while position traders can rely on H4 or D1 signals for longer-term trades.

<step 4> Risk Management:

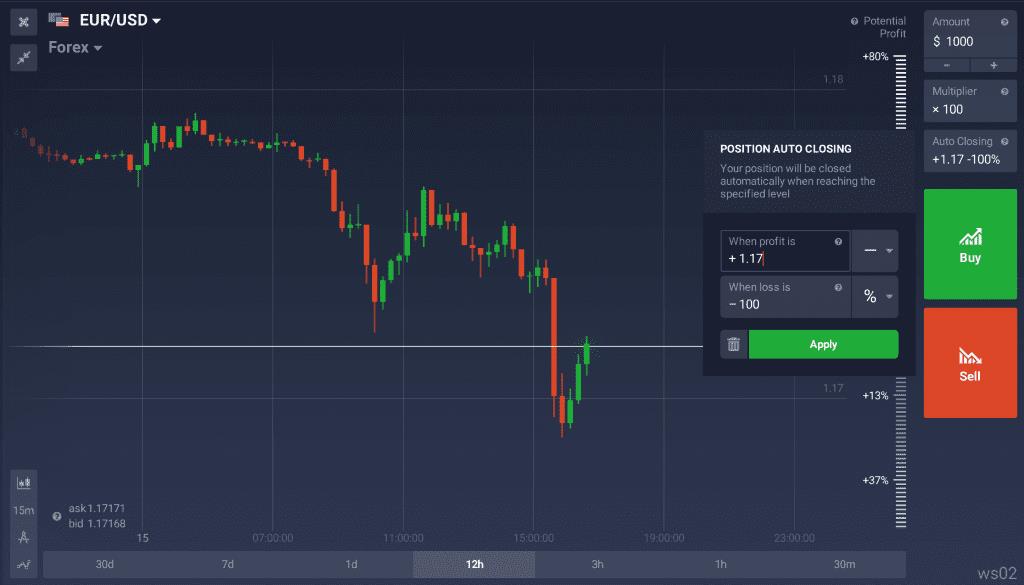

Use OQtima signals to plan your trades while incorporating sound risk management strategies. Setting stop-loss and take-profit levels will help you mitigate potential losses and protect profits.

<step 5> Monitor and Adjust:

Regularly assess the performance of your trading strategy with OQtima signals. As market conditions change, be ready to adjust your approach, such as switching between trend following or contrarian trading strategies based on the signals you receive.

<step 6> Continuous Learning:

Keep improving your skills by learning from the signals provided and refining your strategies. Over time, you’ll better understand the market trends and how to use the signals for maximum profitability.

Key Indicators Used in OQtima Signals

Effective trading requires more than just intuition—it relies on powerful tools and indicators.

Simple Moving Average (SMA) vs Exponential Moving Average (EMA):

SMA gives equal weight to all data points over a specific period, providing a smoother trend analysis.

EMA, on the other hand, assigns more weight to recent price data, making it more responsive to recent market movements.

Role in OQtima Signals:

Both SMA and EMA are used to identify market trends and generate signals. For example, when the EMA crosses above the SMA, it could indicate a potential buying opportunity, signaling an upward price movement.

How Traders Use Moving Averages:

Traders rely on moving averages to confirm the direction of the trend. Combining OQtima signals with these averages helps verify trade setups and reduce false signals.

RSI and MACD: Assessing Overbought and Oversold Conditions

Relative Strength Index (RSI):

The RSI measures the speed and change of price movements. Values above 70 indicate an overbought market, while values below 30 suggest an oversold condition.

Moving Average Convergence Divergence (MACD):

MACD helps determine momentum by comparing short-term and long-term moving averages. A MACD crossover (when the shorter-term moving average crosses above the longer-term) can signal a potential market shift.

Combining RSI and MACD with OQtima Signals:

Using RSI and MACD together can help enhance the accuracy of OQtima signals. If both indicators show overbought conditions while OQtima sell signals are triggered, it strengthens the likelihood of a trend reversal.

Timing and Entry/Exit Points:

RSI and MACD are ideal for day trading and swing trading strategies. They provide insights into when to enter or exit a position, improving the timing of trades and aligning them with OQtima buy/sell signals.

Bollinger Bands and Parabolic SAR

Bollinger Bands:

These bands represent volatility and price levels, consisting of a middle line (SMA) with upper and lower bands. Price touching the upper band signals overbought conditions, while touching the lower band suggests oversold conditions.

Parabolic SAR:

The Parabolic SAR (Stop and Reverse) helps determine potential price reversals. If the SAR dots appear below the price, it indicates an upward trend, while dots above the price suggest a downward trend.

Application in OQtima Signals:

By using Bollinger Bands and Parabolic SAR, traders can spot price breakouts or trend reversals, aligning with OQtima signals to confirm profitable trade opportunities. The combination of these indicators helps reduce risk and increase accuracy.

Fibonacci Retracement for Target Levels in Crypto Trading

Fibonacci Retracement Levels:

These levels (23.6%, 38.2%, 50%, 61.8%, 100%) represent potential support and resistance levels during price retracements, often used to predict where a price pullback may stop.

How Fibonacci Supports OQtima Signals:

OQtima signals can be integrated with Fibonacci retracement levels to set target price points for entry and exit. For example, if a price is retracing to the 61.8% level, it could be an opportunity to enter a buy position.

Using Fibonacci for Stop-Loss Placement:

Traders can place stop-loss orders just beyond key Fibonacci levels to minimize potential losses, ensuring they don’t exit trades too early or late.

Visualizing Price Movements:

By combining Fibonacci retracement with OQtima signals, traders gain a clearer view of potential market moves. This improves the precision of trades and helps identify the best entry points within the broader trend.

Crypto Trading Strategies Using OQtima Signals

Understanding how to use signals in different market conditions is key to maximizing profits while managing risks. Each strategy is designed to leverage the strength of real-time and accurate signals for profitable trading outcomes.Scalping with OQtima Signals.

Fast Execution for High-Frequency Trading:

Scalping involves making numerous small trades to capture quick price movements. With OQtima real-time signals, traders can identify profitable opportunities within seconds, ensuring swift execution.

Key Tools for Scalping Success:

Traders combine OQtima buy/sell signals with short-term indicators like Moving Averages and RSI to identify optimal entry and exit points.

Example Scalping Setup:

<1> Signal Activation: OQtima signals identify a buy opportunity on EUR/USD.

<2> Confirming with Indicators: RSI indicates oversold conditions.

<3> Trade Execution: Enter buy position with a tight stop-loss.

<4> Exit: Close position after a small profit or when the signal reverses.

Swing Trading with OQtima Signals

Capturing Short- to Medium-Term Price Movements:

Swing trading involves holding positions for several days or weeks. OQtima signals provide critical insights into short-term price swings, helping traders capture moves in volatile markets.

Using Indicators for Confirmation:

Combine OQtima signals with MACD and Bollinger Bands for trend identification and confirmation of price breakouts.

Optimal Timeframes for Swing Trading:

Traders often use H1, H4, and D1 timeframes to match OQtima signals with broader market trends.

Example Swing Trading Setup:

After a buy signal from OQtima, the trader waits for a MACD crossover above the signal line, confirming the uptrend. The position is held for several days until the Bollinger Bands tighten, indicating a possible reversal.

Position Trading: Leveraging Long-Term OQtima Signals

Position trading is suited for traders who want to capture long-term market trends. It requires patience and a strategic approach, using OQtima signals to enter and exit positions based on long-term trends.

Long-Term Trend Analysis:

OQtima signals identify sustainable market trends, often based on fundamental factors or long-term technical indicators like Moving Averages.

Strategic Entry and Exit Points:

Position traders rely on OQtima buy/sell signals triggered at key support or resistance levels, with the aim of holding a position for weeks or months.

Using OQtima for Risk Management:

Implementing stop-loss orders based on key levels identified through Fibonacci retracement can help position traders minimize losses.

Example Position Trading Setup:

A trader enters a buy position on GBP/USD after a bullish OQtima signal is confirmed by the 200-period SMA. The position is held for several weeks, adjusting the stop-loss as the trend strengthens.

Day Trading: Real-Time OQtima Signals for Quick Gains

High-Frequency, Short-Term Profits:

Day trading focuses on capturing small but consistent profits within a single trading day. OQtima real-time signals provide traders with opportunities to enter and exit the market throughout the day.

Timeframes for Day Trading:

M5, M15, and M30 are the most commonly used timeframes for day trading with OQtima signals, providing a quick overview of price movements.

Using Indicators for Precision:

Combine OQtima signals with tools like RSI, MACD, and Bollinger Bands for precision in capturing rapid price movements.

Examples of Day Trading Setup:

<1> Signal Detection: OQtima provides a buy signal on USD/JPY.

<2> Indicator Confirmation: RSI shows oversold conditions.

<3> Execution: Enter position immediately.

<4> Exit: Close position before the market closes or when a reversal signal occurs.

Risk Management in Day Trading:

Utilize tight stop-loss levels to protect profits and avoid large losses, especially when trading on high volatility forex pairs like USD/JPY or EUR/USD.

Contrarian Trading and OQtima Signals: Going Against the Crowd

Contrarian Trading Strategy:

Contrarian traders go against the prevailing market sentiment. By using OQtima signals, these traders identify when the market is overly bullish or bearish, presenting opportunities to trade against the crowd.

Indicators for Contrarian Trading:

Combining OQtima signals with RSI and MACD helps identify extreme market conditions, such as overbought or oversold situations, which are prime for contrarian trades.

Example Contrarian Trading Setup:

When OQtima sell signals emerge on an overbought market condition (e.g., EUR/USD with RSI > 70), a contrarian trader may enter a short position expecting a market reversal.

Benefits and Risks of Contrarian Trading:

While contrarian trading can yield large profits in a market reversal, it also involves high risk. Traders must exercise caution when the overall trend is very strong.

Best Timeframes for Crypto Trading with OQtima Signals

Timeframes are a crucial component in crypto trading. The timeframe you select can impact the effectiveness of OQtima signals and ultimately determine the success of your trading strategy. Understanding how timeframes influence your trades is essential for optimizing the use of OQtima real-time signals.

How Timeframes Impact the Accuracy of OQtima Signals

Relationship Between Timeframes and Signal Reliability:

Different timeframes affect the accuracy and reliability of OQtima signals. Shorter timeframes (e.g., M1, M5) offer faster signals, which are highly effective for strategies like scalping or day trading. However, these signals may be more prone to noise and market fluctuations.

On the other hand, longer timeframes (e.g., H4, D1) smooth out market volatility, providing more reliable signals for swing trading and position trading.

Higher Timeframes for Long-Term Trends:

OQtima signals on H1, H4, or D1 allow traders to capture long-term trends and make informed decisions based on stronger market momentum. These timeframes reduce false signals and focus on macro-level market movements, making them ideal for position traders and swing traders.

Shorter Timeframes for Quick Trades:

For day trading and scalping, OQtima signals on short timeframes (such as M1, M5, and M15) allow traders to react quickly to market movements and capitalize on small price changes. While these signals may be more volatile, they offer more opportunities to trade within a day.

Which Timeframe Is Best for Day Trading with OQtima Signals?

Fast-Paced Trades on Short Timeframes:

Day trading focuses on capturing quick, short-term price movements, making M1, M5, and M15 ideal timeframes for applying OQtima signals.

M1 Timeframe – Ultra-Short-Term Signals:

The M1 timeframe offers highly granular data, allowing traders to execute scalping strategies in rapid succession. It’s perfect for capitalizing on small price movements and making multiple trades throughout the day.

M5 and M15 for Slightly Longer Position Holds:

While the M1 timeframe might be too fast for some traders, M5 and M15 offer a more balanced approach for day trading. These timeframes provide enough price action for traders to capture a trend over several minutes while minimizing market noise.

Optimal Strategy with OQtima Signals on Day Trading Timeframes:

Step 1: Choose M5 or M15 to receive clear signals for short-term trend reversals.

Step 2: Apply OQtima buy/sell signals to confirm trend direction.

Step 3: Use RSI or MACD to confirm overbought or oversold conditions, then execute your trade.

Step 4: Set tight stop-loss orders to limit potential risks and ensure a high-risk/reward ratio.

Long-Term Strategies: Using H1, H4, and D1 for OQtima Signals

For swing traders and position traders, longer timeframes such as H1, H4, and D1 are the most suitable for OQtima signals. These timeframes help traders capture substantial market trends while avoiding the noise often found in shorter timeframes. Below is a table that outlines how to use each timeframe effectively for long-term strategies:

| Timeframe | Best For | Recommended Strategy | Signal Type to Focus On | Example Currency Pairs |

|---|---|---|---|---|

| H1 | Swing Trading | Capture medium-term trends, hold positions for several hours to days. | OQtima buy/sell signals combined with Moving Averages for trend confirmation. | EUR/USD, GBP/USD |

| H4 | Trend Following, Swing Trading | Capture larger market movements, positions held for several days to weeks. | OQtima real-time signals with Bollinger Bands for breakout confirmation. | USD/JPY, EUR/GBP |

| D1 | Position Trading | Hold trades for weeks or months, capitalizing on long-term market trends. | Use OQtima buy/sell signals combined with Fibonacci retracement for trend reversal points. | AUD/USD, USD/CAD |

Example Strategy for Position Trading:

A trader might use the D1 timeframe to identify a buy signal for EUR/USD, confirmed by a break above the 50-day moving average. The trader would then hold the position for several weeks, adjusting the stop-loss based on price movements.

Platforms to Use for Trading with OQtima Signals

The right trading platform is essential for executing OQtima signals effectively. Choosing the best platform that fits your trading style ensures that you can leverage accurate signals, improve execution speed, and access powerful tools to enhance your trading performance.

MetaTrader 4 and OQtima Signals

MetaTrader 4 (MT4) is one of the most widely used platforms in the trading world. Known for its user-friendly interface and extensive range of technical analysis tools, MT4 is a great choice for traders using OQtima signals.

Charting Tools: MT4’s charting capabilities are highly beneficial for visualizing OQtima signals. Traders can plot RSI, MACD, and Bollinger Bands directly on their charts, allowing them to use real-time signals alongside other indicators to refine their strategy.

Automation: MT4’s Expert Advisors (EAs) allow users to automate trading strategies. This means you can set up automatic trading based on OQtima buy/sell signals without needing to manually execute each trade.

Order Execution: With MT4, traders can place and modify orders quickly, crucial for reacting to fast-moving signals like those provided by OQtima. The platform supports limit, market, and stop orders, allowing for flexible execution.

Backtesting: One of MT4’s standout features is the ability to backtest trading strategies. Traders can apply OQtima signals to historical data to evaluate their effectiveness and fine-tune strategies for maximum profitability.

TradingView: Visualizing OQtima Signals for Crypto Trading

Advanced Charting:

TradingView offers powerful charting tools, making it ideal for visualizing OQtima real-time signals. With a broad range of indicators like Ichimoku Cloud and Stochastic Oscillator, traders can combine technical analysis with OQtima signals for deeper market insights.

Customization:

Traders can customize their charts with different timeframes such as M5, H1, or D1, adapting OQtima signals to fit their trading strategies. Customizable alerts ensure that you never miss a critical signal.

Social Trading:

TradingView’s community feature lets you follow other traders’ ideas, share your charts, and discuss strategies. This can enhance the effectiveness of OQtima signals when compared with the insights of experienced traders.

Multi-Device Support:

Whether you're at home or on the go, TradingView syncs across devices, allowing you to monitor OQtima signals and execute trades from your desktop, tablet, or smartphone.

cTrader: Enhanced Execution with OQtima Signals

cTrader is an advanced platform that emphasizes fast order execution, making it a solid choice for traders who rely on OQtima signals for quick decision-making. Here’s a breakdown of the platform’s features:

| Feature | Benefit for OQtima Signals | Ideal for |

|---|---|---|

| Order Execution Speed | cTrader’s rapid order execution ensures that OQtima signals are executed promptly. | Scalpers, Day Traders |

| Advanced Charting | Supports advanced chart types and indicators like Parabolic SAR for in-depth analysis of buy/sell signals. | Trend Following |

| One-Click Trading | Allows traders to place trades with a single click, which is useful when reacting to real-time signals. | Quick Traders |

| Level II Pricing | Real-time market depth display helps traders make informed decisions when interpreting OQtima buy/sell signals. | Experienced Traders |

Execution Precision:

cTrader’s enhanced execution engine allows OQtima signals to be acted upon with minimal slippage, ensuring that orders are filled at the optimal price.

Algorithmic Trading:

Traders can use OQtima signals with cAlgo to set up automated strategies that react instantly to changing market conditions.

NinjaTrader: Advanced Crypto Trading with OQtima Signals

(Problem-Solution Format)

NinjaTrader is a robust platform, especially suited for backtesting and strategy development. It’s an excellent choice for traders looking to optimize their strategies with OQtima signals.

Problem:

Many traders struggle with backtesting and evaluating the effectiveness of their trading strategies when using real-time signals.

Solution:

NinjaTrader provides an extensive backtesting framework, allowing traders to apply OQtima signals to historical data. Traders can optimize their strategies by testing different parameters, such as stop loss levels or risk-to-reward ratios, to identify the most profitable settings.

Strategy Builder:

Traders can build and test strategies based on OQtima buy/sell signals with the help of NinjaTrader’s Strategy Builder. This tool allows for advanced algorithmic trading, ensuring that signals are used effectively and automatically execute trades according to pre-set conditions.

Real-Time Market Data:

NinjaTrader integrates seamlessly with real-time market feeds, ensuring that OQtima signals are based on the most current data available.

Advanced Charting & Analysis:

With NinjaTrader, traders can integrate various technical indicators like ADX and MACD to validate OQtima signals for a well-rounded trading strategy.

Comprehensive Market Analysis with OQtima Signals

Effective market analysis is essential for successful trading, and when paired with OQtima signals, it becomes an even more powerful tool for gaining an edge in the market.

Technical Analysis: Leveraging OQtima Signals for Market Insights

Technical analysis plays a central role in understanding market trends, and integrating OQtima signals with various technical indicators can significantly enhance trading decisions.

RSI and OQtima Signals

Use the Relative Strength Index (RSI) to gauge overbought or oversold conditions. Combine it with OQtima buy/sell signals for precise entries and exits.

MACD for Trend Confirmation

The MACD (Moving Average Convergence Divergence) is a versatile tool for confirming the strength of trends. OQtima signals can align with MACD crossovers, offering higher probability trades.

Fibonacci Retracement with OQtima Signals

When markets retrace, the Fibonacci tool helps predict reversal points. By incorporating OQtima signals at key Fibonacci levels, traders can optimize their strategies.

Bollinger Bands and Market Volatility

Combine OQtima signals with Bollinger Bands to take advantage of periods of low volatility before a breakout, ensuring better market entries.

OQtima Signals Integration:

OQtima signals provide actionable insights that traders can use to refine technical setups. For instance, buy signals from OQtima at the oversold level of RSI can lead to more profitable trades.

Fundamental Analysis: Enhancing OQtima Signals with Market News

Fundamental analysis involves evaluating economic, financial, and geopolitical factors that impact market movements. By combining OQtima signals with fundamental analysis, traders can gain deeper insights into potential price movements, making trading decisions even more precise.

For instance, traders might follow key economic indicators such as interest rate decisions, GDP data, and non-farm payrolls for the US dollar. A positive fundamental shift (e.g., a favorable jobs report) could trigger OQtima buy signals for USD/JPY. Conversely, negative news such as interest rate cuts might prompt OQtima sell signals for the same pair.

Real-Time Data:

Access to real-time news and economic calendars ensures traders can correlate the OQtima signals with market-moving events, improving the accuracy of their trades.

Impact on Strategy:

Traders may choose to use OQtima signals in conjunction with sentiment analysis, understanding how market reactions to economic events can provide entry or exit points. For instance, a hawkish Fed statement might validate a buy signal for EUR/USD from OQtima.

Sentiment Analysis: Understanding Market Psychology with OQtima Signals

Sentiment analysis gauges the mood of the market, typically through trader behavior and news sentiment. By combining OQtima signals with sentiment data, traders can better predict potential price movements based on the psychology of the market.

| Sentiment Indicator | Benefit for OQtima Signals | Trading Strategy |

|---|---|---|

| Retail Trader Sentiment | Offers insight into contrarian trading opportunities. | Contrarian trading |

| News Sentiment Analysis | Helps in identifying market reactions to news events. | News trading |

| Open Interest Analysis | Helps assess whether a trend is likely to continue. | Trend following |

| Volume Analysis | Indicates the strength of a move when paired with OQtima signals. | Scalping & Day trading |

Retail Sentiment:

By using OQtima signals alongside sentiment analysis from retail traders, traders can identify contrarian opportunities. For instance, if the majority are bullish on a currency pair, but OQtima signals suggest a sell, it could signal a reversal.

Market Reactions to News:

OQtima signals can be used alongside sentiment analysis to validate reactions to news events. For example, a positive earnings report from a cryptocurrency project might trigger a buy signal from OQtima, which can then be cross-referenced with market sentiment.

Combining OQtima Signals with Price Action for Optimal Trades

Price action trading is one of the most effective ways to understand market movement and anticipate future price behavior. By integrating OQtima signals with price action, traders can refine their strategies for maximum profitability.

Price action involves studying historical price movements on charts to identify patterns, such as support, resistance, candlestick formations, and trendlines. These patterns provide essential insights into where the market might move next.

When combined with OQtima signals, price action traders gain additional context for their decisions. For example, a bullish engulfing candlestick pattern at a support level could coincide with an OQtima buy signal. This combination of price action and signal strengthens the probability of a successful trade.

Key Benefits:

Price action helps to refine the entry and exit points triggered by OQtima signals, ensuring that trades align with the broader market context.

By observing key price patterns, traders can use OQtima signals to validate their decisions and avoid entering trades prematurely or in the wrong market conditions.

Actionable Insights:

OQtima signals, when used with price action, enable traders to not only follow trends but also predict potential reversals and breakouts with high precision. This combination is particularly useful in volatile markets like cryptocurrencies.

Conclusion

Incorporating OQtima signals into your crypto trading strategy can dramatically improve your ability to make informed decisions in a market that’s known for its rapid shifts and high volatility. By understanding how these signals work, using key indicators, and applying appropriate trading strategies, you’ll be able to maximize your chances of success. Whether you're day trading, swing trading, or looking for long-term opportunities, OQtima signals provide you with the real-time insights needed to stay ahead. Keep in mind that trading always involves risk, but with the right tools and a solid strategy, you can navigate the crypto landscape with greater confidence and precision.

OQtima signals are real-time, data-driven indicators that alert traders to potential buy and sell opportunities in the cryptocurrency market. These signals are generated using a combination of technical analysis and market data, helping traders make more informed decisions.

The accuracy of OQtima signals largely depends on market conditions and how well the trader implements them. However, OQtima signals are designed to offer high-quality, reliable predictions based on comprehensive analysis, giving traders an edge in the market.

While forex signals focus on currency markets like the USD or EUR, OQtima signals are specifically tailored for the crypto market. The two may use similar methods of analysis, but OQtima signals are optimized for the high volatility and unique patterns of cryptocurrency trading.

Yes, OQtima signals are highly effective for scalping strategies. Scalping involves making many quick trades to profit from small price movements, and OQtima signals provide real-time, actionable buy and sell alerts, making them a great tool for this high-speed trading style.

Indicators like moving averages help to smooth out price action and identify trends. When integrated with OQtima signals, they can provide additional confirmation for entry and exit points, enhancing the reliability of the signals.

For day trading, the best timeframes to use with OQtima signals are generally the shorter ones, such as M1, M5, or M15. These timeframes allow traders to capture fast market movements and make decisions based on the latest signals.

Trend following strategies involve identifying and riding a prevailing market trend. By using OQtima signals, you can receive alerts when a new trend is starting or when a current trend is likely to continue, helping you stay aligned with market movements.

You can integrate OQtima signals with popular trading platforms like MetaTrader 4, MetaTrader 5, and TradingView. These platforms offer comprehensive charting tools and real-time execution, making them ideal for trading based on OQtima signals.