When it comes to navigating the world of online trading, understanding the costs associated with your trading account is essential for making informed decisions. If you're considering OQtima for your trading journey, it’s important to know the OQtima trading account fees and how they can impact your overall trading strategy. Whether you're a beginner or an experienced trader, being aware of the various fees—such as commission charges, spreads, and inactivity fees—will help you optimize your approach and avoid unnecessary costs.

OQtima Trading Account Fees Overview

Understanding the OQtima trading account fees is crucial for traders seeking to manage their costs effectively.

1. Understanding the Structure of OQtima Trading Account Fees

When it comes to trading with OQtima, the fee structure is designed to be straightforward but varied depending on the type of account and instruments traded.

Commission fees: OQtima charges a fixed or variable commission fee depending on the type of account and the asset being traded.

Spreads: This refers to the difference between the buying and selling prices of financial instruments, and it can vary based on market conditions and trading volume.

Inactivity fees: If your account remains inactive for a set period, you may be subject to a monthly inactivity fee.

2. How OQtima's Fee Structure Compares to Other Platforms

OQtima's trading account fees are competitive, but they vary based on your activity level and the instruments you're trading. When compared to other brokers like eToro or IG Markets, OQtima tends to offer lower commission fees, but the spreads might be slightly higher depending on the market.

Commission fees at OQtima are often lower than brokers like eToro.

Spreads can be tighter on platforms like IG Markets but may differ depending on the instrument.

Inactivity fees are comparable to industry standards but can vary based on your trading volume.

3. Fee Transparency and Hidden Charges

A key aspect of trading with OQtima is their transparency regarding fees. While most of the fees are clearly outlined, traders should be aware of indirect charges that might not always be immediately apparent.

Visible charges: Most fees related to trades and account management are clearly disclosed during account creation and on the trading platform.

Potential hidden charges: Swap rates (for holding positions overnight) and conversion fees (when trading in foreign currencies) may not be immediately apparent.

4. How Fees Differ Across Trading Instruments

The fee structure varies depending on the type of asset being traded on the OQtima trading platform. Each instrument, from stocks to forex, incurs different costs.

Stocks: Commission fees are charged based on the value of the trade.

CFDs: CFD trading involves slightly higher spreads, especially on less liquid instruments like commodities.

Forex: Spreads for forex trading can fluctuate significantly based on currency pairs and market conditions.

Options & Futures: Generally involve higher commission fees due to the complexity and volatility of the instruments.

5. How Trading Volume Affects Fees

OQtima offers volume-based fee discounts, making it crucial for frequent traders to be aware of how their trading activity impacts the cost structure.

Larger trades: OQtima provides lower spreads and commission rates as you trade larger volumes.

Frequent trading: Regular traders may see a reduction in fees due to volume-based incentives.

Breakdown of OQtima Trading Account Fees

| Fee Type | Low Volume Trading | High Volume Trading | Instruments Affected |

|---|---|---|---|

| Commission Fees | Higher | Lower | Stocks, ETFs, Options |

| Spreads | Wider | Tighter | Forex, CFDs |

| Inactivity Fees | Yes | Yes | All Accounts |

| Swap Rates | Variable | Variable | Forex, CFDs |

In summary, understanding OQtima trading account fees is essential for traders to make informed decisions and optimize their trading strategy. Each fee is structured to cater to different types of traders, whether you are trading in high volumes or focusing on specific instruments.

OQtima Account Management and Trading Tools

Managing your OQtima trading account efficiently is a critical aspect of your trading experience. From account opening and closing to utilizing advanced trading tools, understanding these processes can help reduce fees and optimize trading results.

1. Opening and Closing Your OQtima Trading Account

Opening an account with OQtima is designed to be straightforward, providing you with the access to a wide range of trading instruments like stocks, forex, CFDs, and ETFs. Here’s what you can expect:

<step 1> Account Opening

Fill out an online application form

Submit necessary identification and proof of address for account verification

Choose your preferred trading platform (web, mobile app, or desktop)

<step 2> Account Closure

Request closure via the platform

Ensure that all positions are closed and balances are cleared

If inactive for a long period, you may incur an inactivity fee before closure

2. Funding and Withdrawing from OQtima Trading Accounts

Funding your OQtima account is essential for activating your trading account, and multiple options are available, each with associated fees. These methods range from traditional bank transfers to e-wallets and credit/debit card payments.

Bank Transfer: Typically free but may take a few days for funds to appear.

Credit/Debit Card: Instant funding but may incur transaction fees depending on the payment provider.

E-wallets: Faster, but watch out for potential e-wallet processing fees.

Cryptocurrency: Some accounts allow crypto deposits, providing a faster, lower-fee alternative.

3. How OQtima’s Platform Helps Minimize Trading Fees

OQtima provides several tools and features that help traders minimize their fees while maximizing their potential profits. By taking full advantage of these platform features, traders can optimize their strategies to reduce unnecessary costs.

Low Spreads: OQtima offers competitive spreads across all instruments, which can lower the total cost of trading, especially for forex and CFDs.

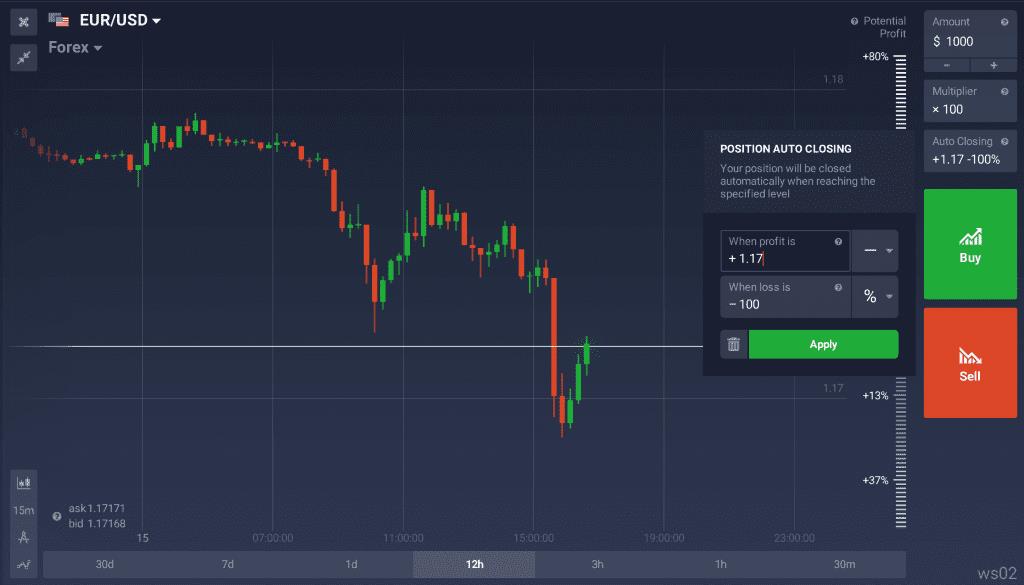

Order Types: Using more precise order types like limit orders and stop-loss orders can help control entry and exit points, reducing slippage and extra charges.

Account Types: Higher-tier accounts offer more favorable fee structures for high-volume traders.

4. Account Security and Fee Implications

Account security is crucial for maintaining the integrity of your funds and data on the OQtima platform. Certain security measures may affect your account access and potential fees.

2FA (Two-Factor Authentication): Essential for securing your account, ensuring that only authorized users can access it.

Account Verification: The account verification process helps prevent fraud and secures transactions but may incur small fees for document processing.

Account Freeze: In rare cases of suspected fraud, your account may be temporarily frozen, leading to delays in trading or withdrawing funds, which may have indirect cost implications.

Comparison of OQtima’s Funding Methods

| Funding Method | Processing Time | Fees | Notes |

|---|---|---|---|

| Bank Transfer | 1-3 business days | No fees | Can be slower than other methods |

| Credit/Debit Card | Instant | 1-3% processing fee | Fast but can incur higher fees |

| E-wallets | Instant | Up to 1% | Faster transfers, low fees |

| Cryptocurrency | Instant | Low or no fees | Only available for certain accounts |

In conclusion, managing your OQtima trading account efficiently, from funding to account security, is vital for minimizing costs and maximizing trading opportunities. By understanding the tools at your disposal, you can optimize your trading and achieve a smoother experience overall.

Advanced Trading Features and Fee Management

Understanding and leveraging advanced trading features on OQtima can significantly optimize your trading experience and minimize unnecessary fees.

1. Using Charting Tools and Technical Indicators for Fee Optimization

Advanced charting tools and technical indicators are essential for traders who want to optimize their strategies and avoid unnecessary costs. By using these tools effectively, you can minimize mistakes that lead to excessive fees and slippage.

Candlestick Patterns: These patterns can provide early signals for market trends, helping traders avoid costly decisions.

Moving Averages: Identifying potential entry and exit points can help reduce overtrading, which often leads to higher commission fees.

RSI and MACD: Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) help identify overbought or oversold conditions, assisting traders in timing their entries and exits more effectively.

2. Exploring OQtima’s API Trading for Professional Users

API trading allows professional traders to automate their strategies, and while this feature is robust, it may come with additional fees. Here’s how to manage those costs:

API Subscription Fees: Some trading APIs charge monthly or per-use fees, depending on the level of service.

Execution Fees: While automated trading can reduce human error and optimize trading, frequent or high-volume trades can incur additional execution fees.

Data Fees: Real-time market data used by APIs may incur extra costs. Professional traders need to factor this into their trading strategy to ensure profitability.

3. Optimizing Your Trading Strategy to Offset Fees

A well-crafted trading strategy not only helps maximize profits but also minimizes fees. By using targeted strategies, you can offset the cost of trading, such as high spreads or commission fees.

Limit Orders: Use limit orders to ensure that you are not paying higher spreads by executing trades at your preferred price points.

Scalping Strategy: This strategy involves making many small trades, which can take advantage of tight spreads, reducing commission costs over time.

Swing Trading: Holding positions for longer periods can minimize the need for frequent trades, which often attract extra fees.

4. Accessing OQtima’s Market News and Economic Calendar for Better Decision-Making

Incorporating market news and an economic calendar into your trading plan can provide valuable insights to help reduce trading mistakes that might lead to higher fees.

Market News: By staying informed about global events, you can avoid unnecessary trades based on market uncertainty.

Economic Calendar: Upcoming economic releases can provide essential information for planning trades and preventing last-minute decisions that lead to higher slippage and transaction fees.

Trade on High-Impact Events: Focusing on major economic events can help you time your trades better, potentially reducing the risk of unexpected volatility that can result in costly trades.

5. How OQtima’s Mobile App Can Help with Fee Management

The mobile app is an efficient tool for managing your trades and fees while on the go. The app offers several features that can help you stay on top of your fee management strategy.

Real-Time Notifications: Receive alerts on your trades and any fee-related changes to avoid surprise costs.

Instant Trade Execution: The mobile app allows for fast trade executions, reducing the chances of slippage and preventing the accumulation of additional spread fees.

Easy Account Access: Manage your account balance and monitor your trading fees directly from the app, ensuring you’re always in control of your fees.

6. Understanding OQtima’s Trading Platforms and Fee Impact

OQtima offers various trading platforms—web, mobile, and desktop—and each comes with its own fee structure. Understanding these differences can help you choose the best platform based on your fee management preferences.

Web Platform: Access to full features, but may incur higher fees for frequent traders due to potential slippage.

Mobile App: Optimized for convenience, but certain fee structures may apply depending on mobile usage.

Desktop Platform: Ideal for professional traders, the desktop platform often offers better execution speeds, which may reduce slippage fees.

Fee Comparison Across OQtima Platforms

| Platform | Features | Fee Impact |

|---|---|---|

| Web Platform | Full functionality, advanced charting | Higher slippage fees for frequent trades |

| Mobile App | Convenient, real-time notifications | Potential mobile transaction fees |

| Desktop Platform | Optimized for professionals, fast execution | Reduced slippage, lower execution costs |

In conclusion, mastering advanced tools, such as charting tools, API trading, and economic calendars, while understanding the specific fee structures of each platform, can significantly reduce trading costs. By making informed decisions and utilizing the right features, you can better manage fees and improve your overall trading performance.

Educational Resources for Traders

Learning to trade efficiently and managing trading fees are essential skills for every investor. OQtima offers a variety of educational resources to help traders navigate the complexities of the market and minimize unnecessary trading costs.

1. Understanding OQtima’s Trading Guides

OQtima provides a comprehensive range of trading guides that are designed to help traders improve their skills, understand complex market dynamics, and avoid mistakes that could lead to unnecessary fees.

Navigating Fee Structures: The guides explain how different fee types, such as commission fees and spreads, impact trading costs.

Choosing Trading Instruments: Learn how to select instruments like stocks, options, and ETFs, and understand how each affects trading costs.

Advanced Strategies: Guides cover advanced techniques like swing trading or scalping, which can help optimize your trade executions and minimize fees.

2. Webinars and Tutorials on Minimizing Trading Fees

OQtima’s webinars and tutorials focus on educating traders about fee management and how to avoid common pitfalls that lead to high costs. These sessions are essential for anyone who wants to trade efficiently.

Fee Awareness: Learn how to identify and understand different fees such as swap rates and inactivity fees.

Cost-Effective Strategies: Webinars teach how to utilize strategies that reduce overall fees, such as using limit orders to avoid high spreads.

Practical Examples: Case studies and real-life scenarios are discussed, showing how traders can avoid high costs by implementing the right tools and strategies.

3. OQtima Glossary: Key Terms Related to Trading Fees

For those new to trading, understanding fee-related terminology is crucial. The OQtima glossary provides clear definitions for complex terms to help traders make informed decisions.

Commission Fees: Charges applied to every trade, typically based on a percentage or flat fee.

Spreads: The difference between the buy and sell price of an asset, impacting traders when executing market orders.

Swap Rates: Fees incurred for holding positions overnight in forex or CFDs.

Key Fee Terms Explained

| Term | Description | Example |

|---|---|---|

| Commission Fees | A fee charged per trade, either fixed or percentage-based. | 0.1% commission on stock trades |

| Spreads | The difference between the ask and bid price in a trade. | A spread of 3 pips on a forex currency pair |

| Swap Rates | Overnight fees applied for holding positions on margin in forex or CFDs. | 2.5% overnight fee on a CFD trade |

Customer Support and Resolving Fee-Related Issues

When dealing with trading fees, misunderstandings or disputes can arise. Fortunately, OQtima offers a robust customer support system to help traders resolve issues and get the most out of their trading experience.

1. How OQtima’s Customer Support Helps with Fee Disputes

OQtima’s customer support team is equipped to assist with fee disputes and help clarify any misunderstandings related to commission fees, spreads, or swap rates. If you encounter unexpected charges, follow these steps to get help:

Contact Support: Reach out through available channels like email support, live chat, or phone support to report fee-related issues.

Provide Account Information: Ensure that you have your account number and transaction details handy for quicker assistance.

Clarify the Dispute: Clearly explain the fee in question and any related transactions to help the support team investigate thoroughly.

Follow Up: If the issue isn’t resolved on the first contact, escalate the case to a supervisor for further assistance.

Resolving fee disputes quickly ensures your trading costs remain transparent and manageable.

2. Getting the Most Out of OQtima’s Live Chat Support

Live chat is one of the most efficient ways to resolve fee-related issues. Here’s how to make the most of this support option:

Be Clear and Concise: Clearly describe the issue, mentioning the specific fee or charge you are questioning.

Provide Context: Share relevant details such as trade history, the date of the fee in question, and the account involved.

Ask for Clarification: If a fee seems unclear or was applied unexpectedly, ask for a breakdown of how it was calculated.

By preparing ahead of time, you can ensure a smoother conversation with customer support.

3. Exploring OQtima’s FAQ for Common Fee Questions

Before reaching out to customer support, you may find that OQtima’s FAQ section can resolve your fee-related queries quickly. Here’s a look at the most frequently asked questions related to fees and charges:

What are the different types of trading fees?

Commission fees, spreads, swap rates, and inactivity fees are commonly encountered.

How are swap rates calculated?

Swap rates are usually determined based on the type of instrument and the length of time a position is held overnight.

How can I avoid inactivity fees?

Simply ensure that your account remains active by executing trades or maintaining a sufficient balance.

By using the FAQ section effectively, traders can avoid unnecessary delays and resolve fee-related concerns without the need to contact support.

4. Escalating Fee Issues: When and How to Seek Resolution

If you believe a fee is unfair or has been applied incorrectly, it’s essential to know when and how to escalate the issue. Here are the steps to follow:

Step 1: Check the Fee Explanation: Review all related documentation, including account statements and fee schedules, to ensure that the fee was applied according to the terms.

Step 2: Contact Customer Support: Initially, reach out via live chat or email support for an explanation.

Step 3: Request a Review: If the explanation is unsatisfactory, request a supervisor or manager to review the issue.

Step 4: Formal Complaint: If the issue remains unresolved, submit a formal complaint through the OQtima support portal, outlining the nature of the fee dispute.

Escalating the issue through the correct channels will help ensure that the matter is addressed promptly and fairly.

Fee-Related Support Channels

| Support Channel | When to Use | Response Time |

|---|---|---|

| Live Chat | For quick responses and clarifications on common fees like spreads and swaps. | Instant to 1-2 minutes |

| Email Support | For non-urgent fee queries or detailed disputes. | 24-48 hours |

| Phone Support | When immediate assistance is required for urgent fee issues. | 5-10 minutes |

| FAQ Section | For general questions regarding fees and fee structures. | Instant |

Trading Orders and Fee Implications

Understanding how different order types affect trading fees is crucial for managing costs effectively.

1. Understanding Market Orders and Their Impact on Fees

Market orders are executed immediately at the current market price. While they ensure quick execution, they can have higher associated costs, especially in volatile markets. Here’s why:

Higher Slippage: When placing a market order, there’s a chance that the order will be filled at a price slightly different from the expected price due to market volatility, potentially resulting in higher costs.

Wider Spreads: Market orders may trigger larger spreads during times of low liquidity, adding to the overall transaction costs.

Instant Execution: While market orders execute quickly, they often come with higher commission fees compared to other order types that are more controlled.

In conclusion, while market orders offer convenience, they can lead to unexpected trading fees and higher costs due to slippage and wider spreads.

2. How Limit Orders Help Minimize Fees in Volatile Markets

In volatile markets, using limit orders can help minimize costs by allowing traders to control the price at which they buy or sell an asset. This strategy can be highly effective in reducing trading costs:

Price Control: Limit orders allow traders to set a specific price for the trade, which helps avoid paying higher spreads or slippage that often occur with market orders.

Reduced Commission Fees: Since limit orders don’t execute immediately, brokers may charge lower commission fees than for market orders, which often involve immediate execution.

Strategic Entry and Exit: Traders can use limit orders to buy low and sell high, capitalizing on market fluctuations without overpaying due to rapid price changes.

Example: In volatile markets, a trader might use a limit order to buy stock at a certain price, avoiding slippage and controlling the fee impact.

3. Stop-Loss and Take-Profit Orders: A Strategy to Manage Costs

Stop-loss and take-profit orders are valuable tools for managing both risk and fees in your trades. These orders help minimize unnecessary fees and avoid undesirable outcomes.

Stop-Loss Orders: A stop-loss order automatically sells an asset when its price falls below a certain threshold. This helps traders limit losses without having to monitor the market constantly.

Fee Implications: While stop-loss orders are helpful for reducing trading risks, they may incur additional commission fees if triggered unexpectedly.

Take-Profit Orders: Similarly, take-profit orders automatically close a position once it reaches a predetermined profit target, locking in gains without waiting for market conditions to worsen.

Fee Implications: These orders are often triggered without the trader needing to intervene, and they generally come with lower fees compared to manual trading.

Together, these orders help traders avoid paying additional fees due to emotional decision-making and unpredictable market movements.

4. The Role of Order Types in Fee Structures

Different order types come with varying fee structures. Understanding these differences can significantly impact the total costs of trading. Here's a breakdown of the most common order types and their related costs:

| Order Type | Fee Impact | When to Use |

|---|---|---|

| Market Order | Potential for high slippage and wider spreads | When immediate execution is necessary and acceptable fees are acceptable. |

| Limit Order | Generally lower fees and more control over price | In stable or volatile markets, when price control is crucial. |

| Stop-Loss Order | May incur higher costs if triggered unexpectedly, but limits loss | To automatically close positions and limit downside risk. |

| Take-Profit Order | Lower fees due to pre-set execution; used to lock in profits | When aiming to exit a position at a specific price for gains. |

Understanding which order to use based on your trading strategy can help you optimize fee structures.

5. Best Practices for Order Timing to Reduce Fees

Order timing can have a significant impact on the costs associated with trading. Here are some best practices to minimize fees based on when you place your orders:

Avoid Placing Orders During Market Open and Close: Market volatility is typically higher during the open and close of trading sessions, which can lead to wider spreads and slippage.

Place Orders During Peak Liquidity: Try placing orders during times of higher market activity, such as midday, to reduce the chances of incurring higher costs from slippage.

Use Limit Orders During Quiet Times: When the market is less volatile, using a limit order can help avoid unnecessary costs.

By timing your orders strategically, you can avoid unnecessary fees caused by market fluctuations and liquidity changes.

By understanding the different order types and their respective fee structures, traders can better control their costs and optimize their trading strategies. Whether using market orders for quick execution or limit orders to reduce slippage, the choice of order can significantly influence the overall trading costs.

Conclusion

In conclusion, understanding OQtima trading account fees is crucial for anyone looking to trade efficiently and avoid unexpected costs. By familiarizing yourself with the full range of fees—including commission charges, spreads, and inactivity fees—you can better tailor your trading strategies to suit your financial goals. The diversity of trading instruments, the tools available to optimize trades, and the support systems in place all influence how fees will affect your trading experience. Whether you're just starting or you're already experienced, being aware of these factors will empower you to make well-informed decisions. Armed with this knowledge, you can make the most of OQtima’s trading platforms, ensuring a more profitable and less stressful trading experience.

The typical fees for an OQtima trading account include commission fees, spreads, and inactivity fees. It's important to understand these costs as they can vary depending on your trading volume and the types of instruments you trade.

OQtima’s commission fees are generally competitive, especially when compared to other platforms in the same category. While fees vary based on the type of account and the trading instruments, OQtima strives to offer transparent and fair pricing.

To avoid inactivity fees, ensure that your account remains active by making at least one trade or funding your account regularly.

You can also contact customer support if you have any concerns about inactivity.

The OQtima trading platforms offer a range of tools, including automated trading and real-time charting, to help traders manage their costs.

Additionally, OQtima’s mobile app allows for quick decisions on the go, reducing the chance of unnecessary fees from delayed actions.

The spread is the difference between the buying and selling price of an asset. This cost is usually factored into the price you pay to enter and exit trades. A wider spread can increase your trading costs, while a narrower spread helps reduce them.

Start by familiarizing yourself with the fee structure and understanding how fees impact different types of trades (stocks, forex, etc.).

Consider using educational resources like tutorials to gain knowledge of how to reduce fees by optimizing your trading strategy.

OQtima’s trading tools such as advanced charting, market news, and economic calendars do not directly influence the fees but can help you make more informed decisions, potentially reducing trading costs by avoiding unnecessary trades or mistakes.

OQtima’s customer support is available via live chat, email, and phone support to help you with any fee-related inquiries or issues.

If you notice any discrepancies or unclear charges, reaching out to OQtima’s support team is a quick way to resolve issues.