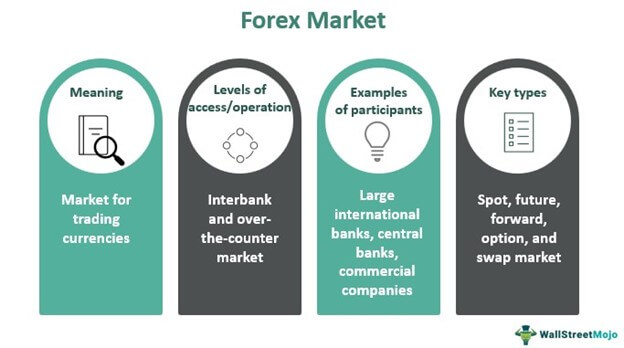

Foreign exchange, or forex, is a decentralized global market where currencies are traded. It is the largest and most liquid market in the world, with trillions of dollars worth of transactions happening on a daily basis. One way to participate in the forex market is by opening a forex account.

What is a forex account?

A forex account is an investment account that allows individuals and businesses to buy and sell currencies. It is provided by a forex broker, who acts as the intermediary between the trader and the market. Opening a forex account gives you access to the forex market and allows you to trade different currency pairs.

Why open a forex account?

There are several reasons why someone may choose to open a forex account:

- Profit potential: Forex trading offers the potential for higher returns compared to other investment options.

- 24/5 market: The forex market is open 24 hours a day, 5 days a week, allowing traders to participate at their convenience.

- Leverage: Forex trading allows traders to utilize leverage, which can amplify their trading capital and potential profits.

- Diversification: Forex trading allows traders to diversify their investment portfolio by trading different currency pairs.

- Hedging: Forex trading allows traders to hedge against currency risk, particularly for businesses involved in international trade.

How to open a forex account?

Opening a forex account is a relatively straightforward process:

- Do your research: Research and choose a reputable forex broker that suits your trading needs.

- Complete the application: Fill out the online application form, providing your personal and financial information.

- Submit required documents: Upload or email the required identification documents, such as a passport or driver's license, as well as proof of address.

- Fund your account: Deposit the initial funds into your forex account. The minimum required deposit varies depending on the broker.

- Download trading platform: Once your account is funded, you can download the trading platform provided by your broker.

- Start trading: With your account funded and the trading platform installed, you can now start trading currencies in the forex market.

Choosing the right forex broker

It is essential to choose the right forex broker when opening an account. Consider the following factors:

- Regulation: Make sure the broker is properly regulated by a reputable financial authority.

- Trading platforms: Check if the broker offers a user-friendly and reliable trading platform.

- Account types: Look for a broker that offers account types suitable for your trading needs.

- Customer support: Consider the level of customer support provided by the broker.

- Trading conditions: Compare the spreads, leverage, and other trading conditions offered by different brokers.

Opening a forex account can be the gateway to participating in the exciting world of forex trading. It is important to do thorough research and choose a reputable forex broker that meets your trading requirements. So, get started and explore the opportunities available in the forex market!