Scalp Trade Forex: Meaning, Risks, and Special Considerations

Scalp trading is a popular strategy in the forex market that involves making quick trades to take advantage of small price movements. Traders who engage in scalp trading aim to make multiple small profits throughout the day, rather than waiting for large price movements.

Meaning of Scalp Trade Forex

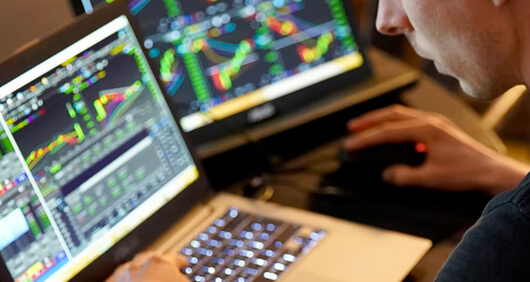

Scalp trading involves opening and closing positions within minutes or even seconds. Traders use technical analysis, such as charts and indicators, to identify short-term price trends and execute trades based on those trends. The goal is to capture small price fluctuations and profit from them.

Risks of Scalp Trade Forex

While scalp trading can be profitable, it also comes with its own set of risks:

- High transaction costs: Frequent trades can result in high transaction costs, especially if your broker charges a commission for each trade.

- Market noise: Intraday price movements can be volatile and unpredictable, making it challenging to identify profitable opportunities consistently.

- Emotional stress: The fast-paced nature of scalp trading can be mentally and emotionally demanding. Traders need to make quick decisions and handle the pressure of constant monitoring.

Special Considerations

1. Time commitment: Scalp trading requires a significant time commitment. Traders must be actively monitoring the market and executing trades throughout the day.

2. Risk management: Due to the frequency of trades, risk management is essential. Traders should set strict stop-loss and take-profit levels to limit potential losses.

3. Scalp trading tools: Utilizing charting software, indicators, and other technical analysis tools can help identify short-term trends and potential entry and exit points.

4. Practice and experience: It's crucial to practice scalp trading strategies in a demo account before risking real money. Experience and familiarity with the intricacies of scalp trading can help improve success rates.

In conclusion, scalp trading in the forex market can be a profitable strategy for traders who have the time, skill, and discipline to execute it successfully. However, it's important to be aware of the risks involved and to carefully manage those risks.