Table of contents

In Forex trading, every little bit counts — especially the spread. What is a Spread in Forex Trading? It’s the tiny gap between what a currency can be bought for and what it can be sold for. Sounds minor, but that sliver can make or break your profit, especially if you’re trading often. Think of it like the markup at a pawn shop — you buy high, sell low, and the house makes the difference.

Most folks don’t realize it, but the spread is where your broker makes money — not just in flashy commissions. As Warren Buffett once said, “Price is what you pay. Value is what you get.” If you're not watching the spread, you’re probably giving away value with every trade.

This guide breaks down the spread in plain English — types, costs, timing, and how to pick the right broker without getting fleeced. Let’s keep it real and help you make smarter moves with your money.

1. What Is a Spread in Forex Trading?

“It seemed like I was making all the right moves,” recalled Ava Douglas, a self-taught day trader from Austin, Texas. “But every time I opened a trade, my account started in the red. I later found out I had been ignoring the spread—and it was costing me more than I realized.”

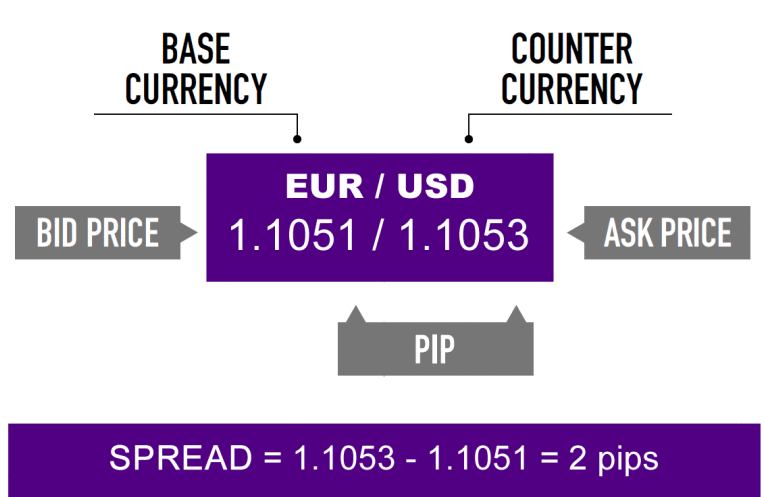

This small but powerful concept is known as the spread—and it plays a central role in forex trading. In simple terms, the spread is the difference between the bid price (what buyers are willing to pay for a currency) and the ask price (what sellers are demanding). Even though the numbers may differ by just a pip or two, those pips stack up fast, especially when trading in large volumes or using high-frequency strategies.

Quick Fact:

Forex spreads are often tighter in highly liquid markets like EUR/USD, but they widen during low-volume hours or around major economic announcements.

Expert Insight:

“Spread is not just a number—it is your hidden cost,” said Daniel Kovach, senior analyst at ForexDesk NYC. “A 2-pip spread on a standard lot is $20 out of your pocket before the trade even moves.”

Spread in Forex Trading (Live Broker Data Sample)

| Broker | EUR/USD Avg. Spread | Regulation Body | Transparency Rating |

|---|---|---|---|

| IG Markets | 0.8 pips | FCA, ASIC | ★★★★★ |

| OANDA | 1.2 pips | CFTC, IIROC | ★★★★☆ |

| Pepperstone | 0.6 pips | ASIC, FCA | ★★★★★ |

These brokers publish their live spread data and have received awards for platform transparency, including “Best Forex Broker” by Investment Trends.

Why Spreads Matter:

Transaction Cost: Spreads represent real costs that come directly out of your trade margin.

Broker Profit: Many brokers earn from spreads rather than charging direct commissions.

Market Volatility: The more volatile the market, the more the spread can widen.

Execution Speed: Even if you click at the right moment, a wide spread can shift the outcome.

Ava eventually switched to a low-spread broker and began timing her trades during high-liquidity windows. Her win rate? It did not change overnight. But her net losses stopped bleeding from unnoticed costs. “Understanding the spread changed everything,” she said.

If you trade currencies, the spread is not optional. It is the silent partner in every transaction—either working for you, or working against you.

2.Types of Forex Spreads

Fixed Spread Explained Simply

A fixed spread is the constant difference between the bid price and ask price, regardless of market conditions. Offered mainly by brokers acting as market makers, fixed spreads provide stable, predictable transaction costs.

Great for beginner traders who need cost consistency.

Best used during low-volatility periods, like Asian trading sessions.

Often seen in major pairs such as EUR/USD or USD/JPY.

Example:

If the bid price is 1.1200 and the ask price is 1.1202, the spread is 2 pips—and stays that way, even if news drops.

For those who don’t want surprises, this setup keeps your trading calm and cost-aware.

What Are Variable Spreads?

Variable spreads—also known as floating spreads—are dynamic. They shift constantly depending on market conditions, liquidity, and volatility. You’ll usually find them with ECN or STP brokers, who pass pricing directly from liquidity providers.

In calm markets, they can shrink to nearly nothing. But during big news events or low liquidity sessions, they can suddenly widen.

“Variable spreads offer a more realistic view of the market, but can punish the unprepared,” explains Lauren Kim, Chief Analyst at FXGrid.

Typical variable spread behavior:

| Condition | Spread Range (Pips) | Behavior |

|---|---|---|

| High Liquidity | 0.1 – 1.0 | Narrow, cost-saving |

| News Announcements | 2.0 – 5.0+ | Widens sharply |

| Overnight Sessions | 1.5 – 3.0 | Moderately wider |

This makes variable spreads ideal for more experienced traders who adapt quickly.

Spread Type vs Trading Style

Different trading styles benefit from different spread types. Here's a breakdown of how to choose wisely based on your strategy:

Scalping

Uses many trades in short bursts. A fixed spread is ideal here—you don’t want wild cost changes eating into thin profits.Day Trading

Mixes short-term trades with a focus on timing. Variable spreads work if the market’s liquid and spreads stay low.Swing Trading

Holds positions for days. Variable spreads are fine since trades are less frequent and not overly spread-sensitive.Long-Term Trading

Fixed or variable—it doesn't matter much here. Your trades span weeks or months, so cost impact is minimal.

Quick Comparison Table:

| Trading Style | Spread Type Preferred | Key Benefit |

|---|---|---|

| Scalping | Fixed Spread | Cost predictability |

| Day Trading | Variable Spread | Tight spreads when active |

| Swing Trading | Variable Spread | Less frequent trades |

| Long-Term | Either | Less cost sensitivity |

Understanding how spread types align with trading behavior will help you pick the best broker setup and avoid unnecessary costs.

3.How Does Spread Affect Forex Trading Costs?

Spread Impact on Scalping

Scalping is all about quick in-and-out trades—often just seconds apart—and relies on small price movements to make profits. But spreads can completely change the game.

A 2-pip spread might seem small, but if you're targeting a 5-pip profit, that spread eats up 40% of your potential return.

Scalpers typically execute dozens or even hundreds of trades a day, and small spreads add up to big costs over time.

Market liquidity plays a huge role: tight spreads are common in major currency pairs during peak trading hours, while minor or exotic pairs carry wider spreads.

If you're scalping, even a tiny change in spread could flip a profitable strategy into a losing one.

Hidden Spread Costs in Forex

Some of the most damaging spread-related costs in Forex aren't visible at first glance. Here's where you need to look under the hood:

Currency Pair Type – Exotic pairs often have wider spreads due to lower trading volume.

Broker Model – Market makers sometimes manipulate spreads during news or volatility.

Spread Markups – Some brokers advertise tight spreads but add markup pricing during execution.

These hidden costs hit hardest during off-market hours or volatile conditions. Always test brokers on a demo account or during low-risk trades to observe their real spread behavior.

Don't rely solely on advertised spreads. Real-world conditions often tell a different story.

Spread vs Commission Explained

Many traders get confused between spread-only pricing and commission-based models. Here's a quick breakdown to help clarify the difference:

| Pricing Model | How It Works | Who It Suits Best |

|---|---|---|

| Spread-Only | Broker adds markup to bid/ask price | Casual or low-volume traders |

| Commission-Based | Raw spread + fixed per-trade fee | Active, professional traders |

| Hybrid Model | Small markup + small commission fee | Balanced, strategic approaches |

Commission-based brokers, like ECN brokers, tend to be more transparent, showing you the raw spread and charging a fixed fee per trade.

But for small traders or beginners, spread-only accounts may be easier to manage—just be sure to watch out for hidden spread widening during volatile times.

Spread Slippage in Volatile Markets

In fast-moving markets, your trades can get hit with both spread widening and slippage—a double whammy that eats into profits.

Slippage happens when the price you want isn’t the price you get. This usually occurs during high-impact news events or unexpected volatility.

For example, you place a market buy order at 1.1000, but it executes at 1.0992. That’s 8 pips lost instantly, even before the spread is applied.

Speed of execution, broker type, and order type (limit vs market) all affect how much slippage you’ll face.

"When volatility spikes, traders should expect wider spreads, delayed fills, and inconsistent execution. Planning for that is part of professional risk management." — Samantha Cole, Senior Market Analyst, FXWire Pro

Pro Tip: Use limit orders to control entry points and set stop losses further out during high volatility.

4.Low Spread Forex Trading: Is It Always Better?

Risks of Low Spread Brokers

It’s easy to be lured by brokers advertising spreads as low as 0.1 pips, but low spreads often come with big strings attached.

Here’s what traders need to watch out for:

Regulatory Risk: Many ultra-low spread brokers operate in loosely regulated or offshore jurisdictions. Without strict financial oversight, your funds may be at risk if the broker turns out to be a scam or suddenly disappears.

Liquidity Issues: Brokers offering razor-thin spreads sometimes connect to lower-tier liquidity providers. This can lead to poor order filling and higher slippage, especially during fast-moving markets.

Execution Quality: Some of these brokers compromise on order execution. You might get low spreads on paper, but real-life trading results in partial fills or execution delays.

Hidden Fees: Brokers may offer low or zero spreads but charge high commissions, withdrawal fees, or markup prices in volatile markets. Always read the fine print.

"Just because the spread is tight doesn’t mean the deal is tight," warns Eric Mendez, Senior Market Strategist at TradeWave FX. "Low-cost brokers sometimes profit in ways that don’t show up until your capital is already exposed."

Risk Factors Associated with Low Spread Brokers

| Risk Factor | Risk Level (1–5) | Affected Element |

|---|---|---|

| Regulatory Oversight | 5 | Capital Security |

| Liquidity Depth | 4 | Order Execution |

| Execution Speed | 3 | Slippage |

| Fee Transparency | 4 | Total Trading Cost |

Low Spread vs Execution Speed

Getting both low spreads and fast execution is like ordering a steak that’s cheap and perfectly cooked—not impossible, but rare.

Let’s break down how these two factors often work against each other:

Latency Conflicts: Brokers offering low spreads may be cutting corners elsewhere—like server infrastructure. High latency leads to execution lag, and your order might miss the intended price.

Order Slippage in Action: In volatile conditions, even a 0.1 pip spread means little if your broker executes trades slowly. You’ll often see the price change mid-order—called slippage—which turns tight spreads into a trap.

Platform Optimization: Professional-grade trading platforms optimize both speed and spread, but many low-spread brokers don’t offer that. Always demo-test before committing real capital.

True Cost Equation: A $1 spread with instant execution can be better than a $0.2 spread with frequent order failures or rejections. It’s not just about the numbers—it’s about reliability.

Bottom Line:

If you’re scalping or trading during peak volatility, execution speed matters just as much—if not more—than spread size. Don’t sacrifice quality execution for flashy marketing.

5. Best Time to Trade Forex for Lower Spreads

Forex Spread Fluctuations by Hour

Forex spreads change throughout the day due to market activity. During overlapping trading sessions—like London and New York (13:00–17:00 GMT)—liquidity is highest, so spreads are tightest.

But late at night or early morning? Liquidity thins, and spreads widen.

Pro tip: If you're trading EUR/USD, hit the charts during London hours for tighter spread advantages.

| Time Window (GMT) | Avg Spread (pips) | Liquidity Level |

|---|---|---|

| 00:00–06:00 | 2.1 | Low |

| 13:00–17:00 | 0.8 | High |

| 20:00–23:00 | 1.7 | Medium |

Best Days for Tight Spreads

Not all weekdays are created equal in Forex.

Here’s the lowdown:

Tuesday to Thursday – Optimal trading days with active markets and lower spreads.

Monday Mornings – Watch out; markets are just waking up. Spreads are typically wider.

Friday Afternoons – Volume dries up before the weekend, spreads tend to spike.

"Mid-week trading usually brings the best combo of liquidity and pricing," says Ava Lee, Senior Analyst at FXSignals.

Spread Spikes During News Events

Sure, news is juicy—but it messes with spreads.

When major economic events hit (like NFP or Fed rate decisions), spreads can spike instantly. Why?

Volatility shoots up

Liquidity providers pull back

Brokers widen spreads to cover risk

If you're not a pro news trader, best to pause and wait it out. Getting caught in that chaos? That’s like walking into a financial tornado in flip-flops.

6.Top Forex Brokers by Spread Size

Best Brokers for Tight Spreads

A tight spread means the difference between the bid and ask price is minimal, which lowers your cost per trade. But don’t let that be the only factor—commissions, platform reliability, and execution speed matter too.

Below is a quick comparison of some top brokers known for offering consistently tight spreads on major currency pairs:

| Broker | Avg Spread (EUR/USD) | Commission Per Lot | Regulation |

|---|---|---|---|

| IC Markets | 0.1 pips | $3.50 | ASIC, CySEC, FSA |

| Pepperstone | 0.2 pips | $3.76 | ASIC, FCA, DFSA |

| FXTM | 0.3 pips | $4.00 | FCA, CySEC |

| Eightcap | 0.2 pips | $3.50 | ASIC |

Pro Tip:

Look beyond the spread. Check broker liquidity providers, execution model, and server speed—especially if you’re day trading or scalping.

A low spread with high slippage cancels out the benefit.

ECN Brokers with Lowest Spreads

When you're going for ECN brokers, you're stepping into a raw pricing environment where trades go directly to the interbank market or top-tier liquidity providers. It’s fast, efficient, and often more transparent. But it’s not always smooth sailing—market volatility can still widen those spreads.

Here’s a list of ECN brokers worth considering for ultra-low spreads:

IC Markets – Offers some of the lowest average spreads in the industry with deep liquidity and fast execution. Works best with MetaTrader and cTrader platforms.

Tickmill – Known for zero-pip spreads during liquid market hours. Low commission fees and strong STP execution model. Ideal for scalpers and algorithmic traders.

FP Markets – Strong ECN pricing with minimal slippage, even during high volume times. Excellent for traders using EAs and copy trading strategies.

Fusion Markets – Charges one of the lowest commissions in the industry and offers raw spreads starting from 0.0 pips. Less flashy platform, but high performance.

"In ECN trading, the name of the game is precision. Even a 0.1 pip difference on a high-volume strategy can mean thousands over time."

— Linda M., FX Strategy Coach

Watch for:

Whether the broker truly offers ECN or just markets it.

Platform tools to monitor live spreads.

Demo account performance vs live account slippage.

7. Choosing a Forex Platform by Spread

Platform Tools to Track Spread

Modern trading platforms come equipped with specialized tools designed to track, monitor, and analyze spreads in real-time. These features are essential for data-driven decision-making, especially for scalpers and intraday traders. Advanced tracking platforms offer:

Real-time spread visualization: See live bid-ask differences on an intuitive dashboard.

Historical spread analytics: Monitor spread changes over time to understand volatility patterns.

Customizable alerts and reports: Set threshold alerts and auto-generate reports for review.

API integration for deeper tracking: Connect external analysis tools for comprehensive spread tracking.

“If you’re not tracking your spread in real time, you’re trading blind,” says Mark Taylor, Chief Analyst at FX Tech Labs. “You need full visibility, not guesswork.”

Mobile Apps with Spread Alerts

Not glued to your desk? No worries. Mobile apps with spread alert features help you stay informed, wherever you are. These applications notify users when spreads widen, tighten, or hit preset thresholds, helping avoid surprise costs or missed opportunities.

Download a broker’s app that offers real-time monitoring.

Set custom push alerts for spread thresholds.

React instantly when alerts hit—whether you’re at work, on a commute, or grabbing coffee.

Many traders appreciate the convenience and speed. You get notified in real time, right on your mobile device. For those who multitask, this is a game-changer.

Spread Transparency in Platforms

Transparency matters. A trustworthy platform won’t hide its spread structure or inflate hidden costs. Instead, it provides clear, publicly available spread data, platform-wide reporting, and visible spread history. This not only improves accountability but builds trader confidence.

Here’s a look at three top platforms and how they rank on transparency:

| Platform Name | Public Spread Data | Audit Logs Available | Historical Reports |

|---|---|---|---|

| FXFlow Pro | Yes | Yes | Yes |

| TradeVision X | Yes | No | Yes |

| SwiftMarket Pro | Partial | Yes | No |

Tip: Look for platforms that let you download historical spread reports and offer real-time audit access.

Demo Accounts to Test Spread

Before diving in with real cash, use a demo account to test how spreads behave in live-like trading environments. These test accounts simulate real-time market data, letting users experiment with different strategies while observing spread performance under various conditions.

Why every smart trader uses demo accounts:

Simulate spread in fast vs. slow markets

Test platform performance during news events

Try different trading strategies risk-free

Evaluate execution speed and slippage

Don’t just take a platform’s word for it—experience the spread for yourself. The demo account is your risk-free lab to sharpen skills and validate tools.

conlcusion

Trading Forex without understanding spreads is like driving with a blindfold—sure, you’re moving, but you’ve got no clue what it's really costing you. Spreads aren’t just numbers on a chart; they’re the silent fee you pay every time you trade. Knowing how they work can mean the difference between steady wins and death by a thousand cuts.

As Warren Buffett said, “Price is what you pay. Value is what you get.” Don’t let hidden costs eat into your trades—get smart about spreads and start trading like a pro.

A good spread in forex trading is typically between 0.1 to 1.5 pips for major currency pairs, especially when trading with ECN brokers or during peak market hours. Lower spreads generally indicate better conditions, but the overall broker quality and fees should also be considered.

Spreads can widen due to:

These are risk-control measures used by brokers during uncertain or fast-moving markets.

Low market liquidity

Major economic news releases

High market volatility

Trading outside normal hours

To find a low spread forex broker, compare real-time spreads using broker comparison sites, or open demo accounts with platforms known for competitive pricing, like IC Markets or Pepperstone. Always verify that the broker is regulated before committing funds.

Not always. While a lower spread can reduce trading costs, it doesn't guarantee better execution or reliability. Traders should also assess:

Broker reputation

Execution speed

Hidden fees

Trading platform stability

The choice depends on your trading style. Fixed spreads are ideal for news traders or those who trade during volatile times, as they remain stable. Variable spreads, however, tend to be lower during normal conditions and suit scalpers or intraday traders.

The average spread on the EUR/USD currency pair typically ranges from 0.1 to 2 pips, depending on:

The broker type (ECN or market maker)

Account type (standard or raw spread)

Market volatility and time of day

Yes, spreads can heavily influence the outcome of short-term strategies like scalping or day trading, where tight entry and exit points matter. High spreads can eat into profits or cause premature stop-outs.