Forex, or foreign exchange, trading is the buying and selling of currencies on the global market. It offers traders the opportunity to make profits by predicting the future movements of currency pairs. However, trading forex successfully requires a well-thought-out strategy and a deep understanding of the market.

Here are three proven forex trading strategies that can help you trade forex successfully:

Trend Following Strategy

The trend following strategy is based on the principle that the trend is your friend. It involves identifying a trend in the market and riding it until it reverses. Traders using this strategy look for higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend.

To implement this strategy, traders can use technical analysis tools such as moving averages, trendlines, and support and resistance levels. These tools help identify the direction of the trend and provide entry and exit points for trades.

Range Trading Strategy

The range trading strategy is based on the idea that prices tend to trade within a specific range for a period of time. Traders using this strategy look for areas of support and resistance and trade the bounces within the range.

To implement this strategy, traders can use technical indicators such as oscillators and moving averages to identify overbought and oversold conditions. They can then enter trades when the price reaches the top or bottom of the range and exit when it reaches the opposite level.

Breakout Strategy

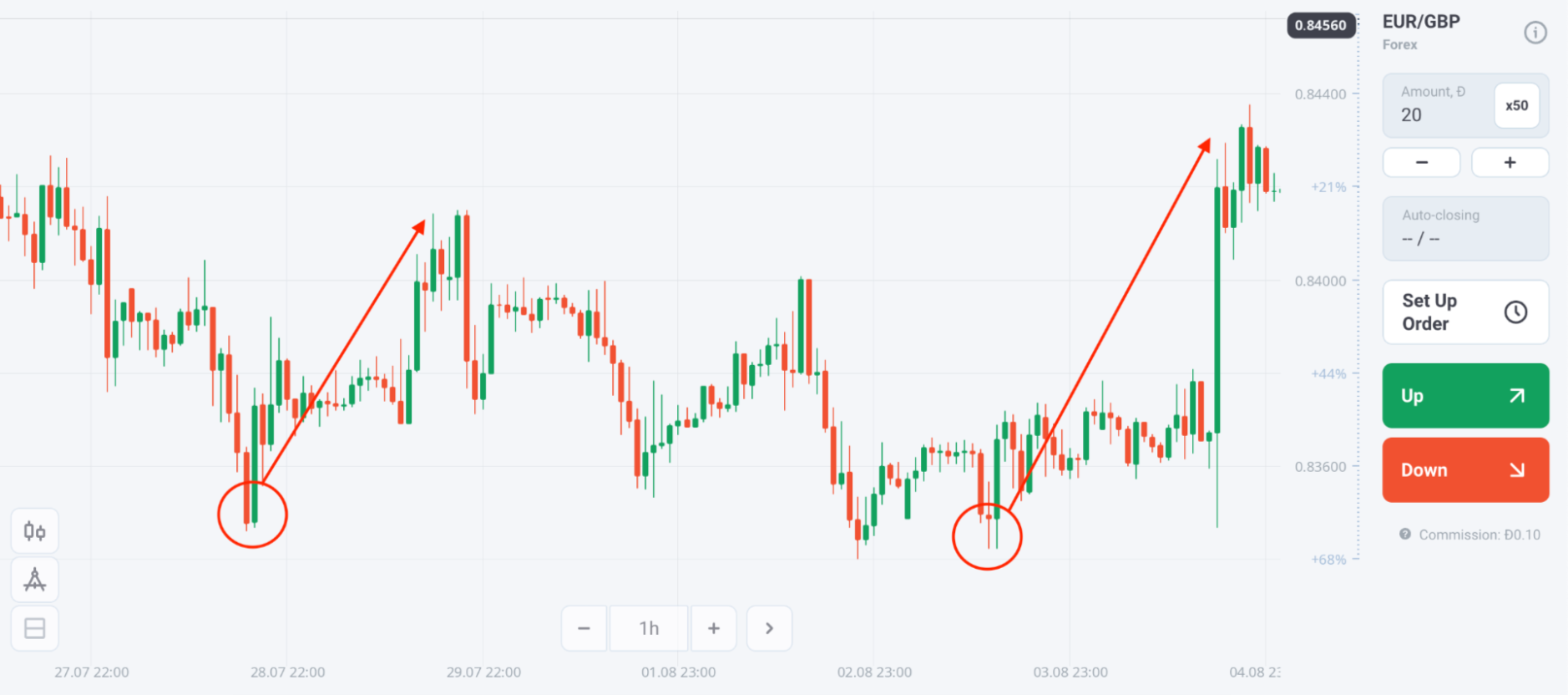

The breakout strategy involves trading the break of a key level of support or resistance. Traders using this strategy anticipate that when the price breaks out of a range, it will continue in the direction of the breakout.

To implement this strategy, traders can use technical analysis tools such as trendlines, support and resistance levels, and chart patterns. They can enter trades when the price breaks above a resistance level or below a support level and exit when the price shows signs of reversing.

Successful forex trading requires discipline, patience, and a deep understanding of market dynamics. It is important to backtest and refine your chosen trading strategies before applying them in real-time trading. Remember that no strategy is foolproof, and losses are a part of trading. Proper risk management and money management are crucial to long-term success in forex trading.