MetaTrader 4 (MT4) is a popular trading platform used by traders worldwide. One of the main reasons for its popularity is the ability to use various trading strategies to make informed trading decisions. In this article, we will discuss the top 20 MT4 strategies used by traders to maximize their trading performance.

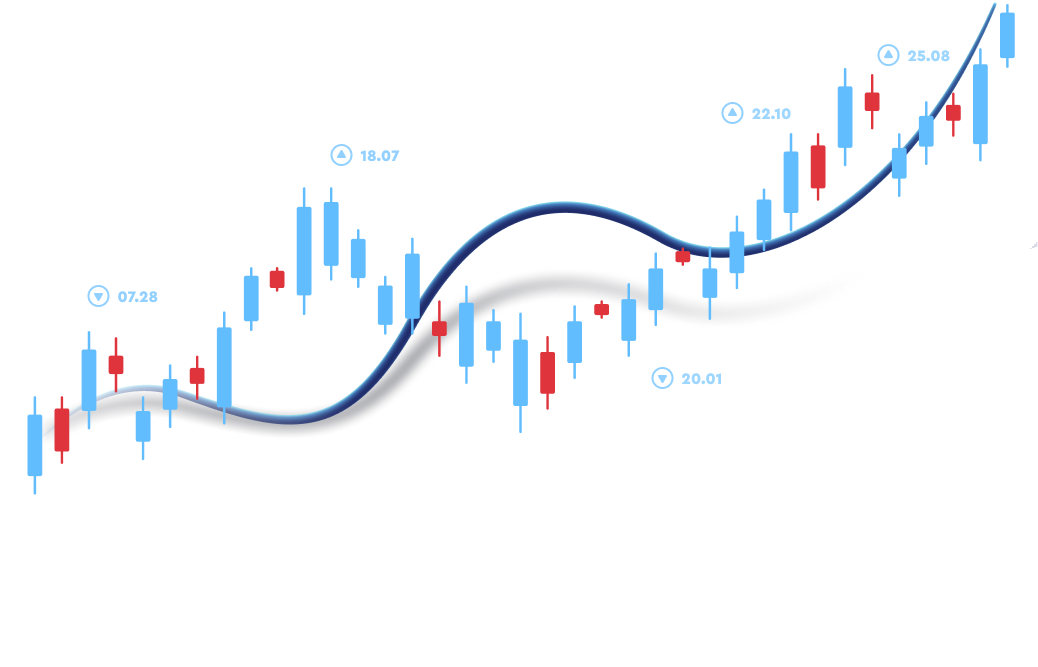

1. Moving Average Crossover

The Moving Average Crossover strategy is one of the most popular MT4 strategies. It involves the combination of two moving averages of different periods. When the shorter moving average crosses above the longer moving average, it generates a buy signal, and when the shorter moving average crosses below the longer moving average, it generates a sell signal.

2. Breakout Strategy

The Breakout strategy involves identifying key levels of support and resistance and entering trades when price breaks out of these levels. Traders can use various indicators such as Bollinger Bands or Donchian Channels to identify breakouts and set appropriate stop-loss and take-profit levels.

3. MACD Divergence

The MACD Divergence strategy involves identifying divergences between the MACD indicator and price. When there is a bullish divergence, it suggests a potential buying opportunity, and when there is a bearish divergence, it suggests a potential selling opportunity.

4. RSI Overbought/Oversold

The RSI Overbought/Oversold strategy involves using the Relative Strength Index (RSI) to identify overbought and oversold conditions. Traders can enter trades when the RSI crosses above the overbought level (70) or crosses below the oversold level (30).

5. Fibonacci Retracement

The Fibonacci Retracement strategy involves using Fibonacci levels to identify potential support and resistance levels. Traders can enter trades when price retraces to these levels and shows signs of reversal.

6. Candlestick Patterns

Candlestick patterns are a popular tool used by traders to identify potential trend reversals. Traders can use patterns such as engulfing patterns, doji patterns, or hammer patterns to enter trades.

7. Support and Resistance

The Support and Resistance strategy involves identifying key levels of support and resistance and entering trades when price bounces off these levels. Traders can use indicators such as pivot points or horizontal lines to identify these levels.

8. Trend Following

The Trend Following strategy involves identifying the direction of the trend and entering trades in the same direction. Traders can use indicators such as moving averages or trendlines to identify the trend.

9. Stochastic Oscillator

The Stochastic Oscillator strategy involves using the Stochastic indicator to identify overbought and oversold conditions. Traders can enter trades when the Stochastic crosses above the oversold level or crosses below the overbought level.

10. Parabolic SAR

The Parabolic SAR strategy involves using the Parabolic SAR indicator to identify potential trend reversals. Traders can enter trades when the dots of the Parabolic SAR change position from above the price to below the price or vice versa.

11. Moving Average Envelopes

The Moving Average Envelopes strategy involves plotting two moving averages above and below the price to identify potential overbought and oversold conditions. Traders can enter trades when the price reaches the upper or lower envelope.

12. Bollinger Bands

The Bollinger Bands strategy involves using Bollinger Bands to identify potential overbought and oversold conditions. Traders can enter trades when the price reaches the upper or lower band.

13. ADX Trend Strength

The ADX Trend Strength strategy involves using the Average Directional Index (ADX) to identify the strength of the trend. Traders can enter trades when the ADX is above a certain level, indicating a strong trend.

14. Ichimoku Cloud

The Ichimoku Cloud strategy involves using the Ichimoku Cloud indicator to identify potential support and resistance levels and trend direction. Traders can enter trades when price breaks above or below the cloud.

15. RSI + Moving Average

The RSI + Moving Average strategy involves combining the RSI and a moving average to generate trading signals. Traders can enter trades when the RSI crosses above or below the moving average.

16. Double Bottom/Double Top

The Double Bottom/Double Top strategy involves identifying double bottom or double top patterns, which indicate potential trend reversals. Traders can enter trades when price breaks above the neckline of the pattern.

17. Channel Trading

The Channel Trading strategy involves identifying channels or price ranges and entering trades when price reaches the upper or lower channel boundary. Traders can use indicators such as Donchian Channels or Keltner Channels to identify channels.

18. Elliott Wave

The Elliott Wave strategy involves using the Elliott Wave theory to identify potential wave counts and enter trades based on wave patterns and Fibonacci retracements.

19. Moving Average Ribbon

The Moving Average Ribbon strategy involves plotting multiple moving averages with different periods to identify potential trend reversals. Traders can enter trades when the moving averages converge or diverge.

20. Range Trading

The Range Trading strategy involves identifying a range-bound market and entering trades when price reaches the upper or lower boundary of the range. Traders can use indicators such as Bollinger Bands or ATR to identify range-bound markets.