Trading signals are indicators or triggers that help traders make informed decisions about buying or selling financial instruments such as stocks, currencies, commodities, or cryptocurrencies. These signals are generated by various methods and tools including technical indicators, fundamental analysis, news events, and social sentiment.

Traders use trading signals to identify potential profitable trading opportunities and take appropriate actions. These signals can be generated manually by experienced traders or automatically by computer algorithms.

There are different types of trading signals:

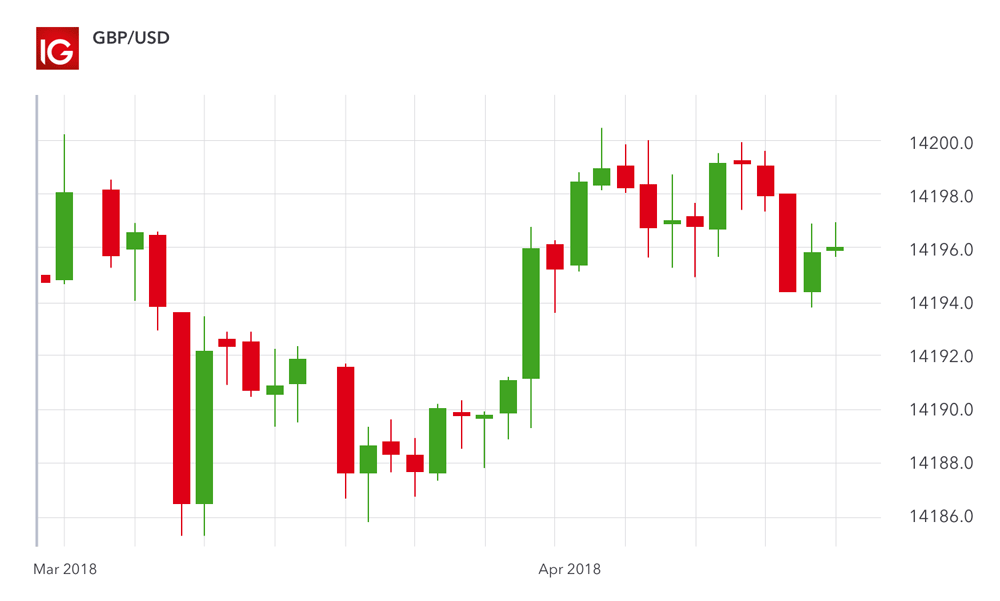

1. Technical Signals: These signals are generated by analyzing price charts, patterns, and technical indicators such as moving averages, MACD, RSI, and Bollinger Bands. Traders use these signals to identify trends, momentum, support and resistance levels, and to make entry and exit decisions.

2. Fundamental Signals: These signals are generated by analyzing fundamental factors that can impact the value of financial instruments. Traders look at economic data, earnings reports, news events, and geopolitical factors to identify trading opportunities. For example, a positive earnings report can be a signal to buy a stock.

3. News Signals: These signals are generated by analyzing news articles, press releases, and social media posts. Traders look for relevant news related to specific financial instruments and use this information to make trading decisions.

4. Social Signals: These signals are generated by analyzing social sentiment and market sentiment. Traders look at social media platforms, forums, and online communities to gauge the sentiment of other traders and investors. Positive sentiment can be a signal to buy, while negative sentiment can be a signal to sell.

Traders can receive trading signals through various channels:

1. Email: Traders can subscribe to signal providers who send out trading signals via email. These signals include the asset to trade, entry price, stop-loss level, and take-profit level.

2. SMS: Traders can receive trading signals as SMS messages on their mobile phones. This allows them to take immediate action on the signals.

3. Mobile Apps: Traders can download mobile apps that provide trading signals. These apps send out notifications when a signal is generated.

4. Trading Platforms: Some trading platforms offer built-in trading signals. Traders can access these signals directly from their trading accounts.

Trading signals can be valuable tools for traders, especially for those who are new to trading or do not have the time or expertise to analyze the markets themselves. However, it is important to note that trading signals are not foolproof and can sometimes generate false or misleading signals. Traders should use their own judgment and consider other factors when making trading decisions.