What are Lots in Forex and How do you Calculate Lot Sizes?

In the world of Forex trading, a lot refers to the size of a trade. It is a standardized unit used to quantify the volume of a particular trade. Lot sizes can vary depending on the broker, the type of account, and the currency pair traded. Understanding and calculating lot sizes is important for successful trading.

Types of Lots:

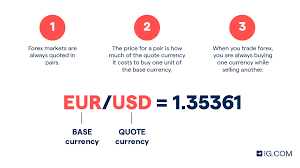

There are three main types of lots in Forex trading: standard lots, mini lots, and micro lots. A standard lot is the equivalent of 100,000 units of the base currency in a currency pair. For example, if you are trading the EUR/USD pair, one standard lot would be equal to €100,000.

A mini lot is equal to 10,000 units of the base currency, and a micro lot is equal to 1,000 units. Mini and micro lots are used by retail traders who have smaller account sizes and want to trade in smaller increments.

Calculating Lot Sizes:

To calculate the position size for a trade, you need to know the pip value and the account currency. The pip value represents the monetary value of a single pip movement in the currency pair. It varies depending on the currency pair and the lot size.

The formula to calculate the position size is as follows:

Position size = (Account Size x Risk Percentage) / (Stop Loss x Pip Value)

Example:

Let's say you have a trading account with a balance of $10,000 and you are risking 2% of your account per trade. You want to buy the EUR/USD pair at 1.2000 with a stop loss at 1.1900. The pip value for the EUR/USD pair is $10 for a standard lot.

Position size = ($10,000 x 0.02) / (0.0100 x $10) = $2,000 / $100 = 20 mini lots

Therefore, in this example, you would trade 20 mini lots in order to risk 2% of your account on this trade.

Conclusion:

Lots are an important concept in Forex trading as they determine the size of a trade. Understanding how to calculate lot sizes is crucial for risk management and determining proper position sizing. By using the pip value and account size, traders can accurately calculate the number of lots to trade in order to manage their risk effectively.