In forex trading, divergence refers to the discrepancy between the price action and the indicators used to analyze the market. It occurs when there is a disagreement between the direction of the price movement and the direction of the indicator. Divergence is a powerful technical analysis tool that can provide traders with potential trading opportunities.

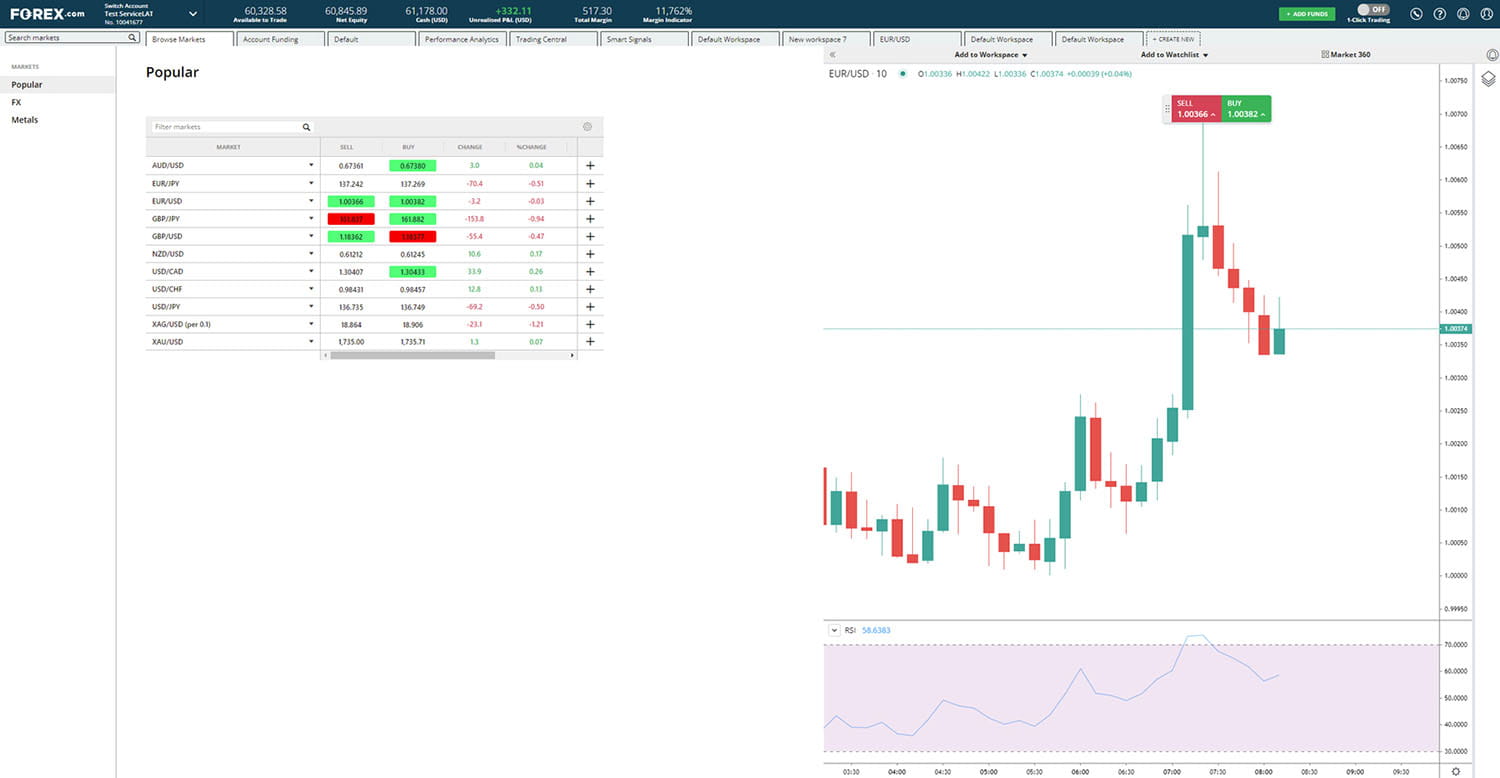

There are two types of divergence: bullish divergence and bearish divergence. Bullish divergence occurs when the price forms a lower low while the indicator forms a higher low. This suggests that the price may reverse and start an upward trend. On the other hand, bearish divergence occurs when the price forms a higher high while the indicator forms a lower high. This indicates that the price may reverse and start a downward trend.

To trade divergence, traders need to follow a systematic approach. First, identify potential divergence by comparing the price action with the indicator. Look for discrepancies in the highs and lows of both the price and the indicator. Once divergence is identified, wait for confirmation. This can be done by analyzing other technical indicators or using price patterns.

After confirmation, traders can enter a trade in the direction indicated by the divergence. For example, if bullish divergence is identified, traders can consider entering a long position. Conversely, if bearish divergence is identified, traders can consider entering a short position. It is important to set stop-loss orders to manage the risk and protect against potential losses.

When trading divergence, it is important to remember that it is not a foolproof strategy. It is necessary to conduct thorough analysis and use other technical indicators to confirm the divergence before making any trading decisions. Additionally, it is essential to practice proper risk management and adhere to a trading plan.

In conclusion, divergence is an important concept in forex trading that can provide traders with potential trading opportunities. By identifying and confirming divergence, traders can enter trades in the direction indicated by the divergence. However, it is crucial to conduct thorough analysis, use other technical indicators for confirmation, and practice proper risk management.