Calculating the right lot size is one of the most crucial skills every trader must master, particularly when managing a smaller account. For those with a $5,000 account, knowing how to calculate lot size for a 5k account can make the difference between sustainable growth and unnecessary risk. Lot size determines how much of a currency pair or other financial instrument you're trading, and it directly impacts both potential profits and losses. By understanding this concept and incorporating it into your overall risk management strategy, you can trade more effectively while keeping your exposure within manageable limits.

Understanding Lot Size and Account Management

1.1 What is Lot Size in Forex?

In Forex trading, "lot size" refers to the number of units of a currency pair that are being traded. The three common lot types are micro lot (0.01 lot), mini lot (0.1 lot), and standard lot (1.0 lot). The lot size directly influences your position size and, consequently, the risk and reward of each trade. For example, trading a micro lot exposes you to smaller price fluctuations, making it a safer option for smaller accounts, while a standard lot offers higher potential profits but also increases exposure to risk.

1.2 Lot Types and Their Impact on a 5K Account

When trading with a $5,000 account, your choice of lot size is critical in determining how much of your balance is exposed per trade. Here's how different lot sizes relate to a $5,000 account balance:

| Lot Type | Size (in units) | Approximate Value per Pip | Impact on $5,000 Account |

|---|---|---|---|

| Micro Lot | 1,000 units | $0.10 | Lower exposure, smaller risk |

| Mini Lot | 10,000 units | $1.00 | Moderate risk, moderate reward |

| Standard Lot | 100,000 units | $10.00 | Higher exposure, greater risk and reward |

Choosing the right lot size ensures that you're not risking too much of your capital while still participating in the market. For a $5,000 account, it’s common to start with micro or mini lots to minimize risk.

1.3 How Leverage Affects Lot Calculations

Leverage allows you to control larger positions with a smaller amount of capital. For example, if you have 50:1 leverage, you can control a $50,000 position with just $1,000 in margin. Leverage affects the amount of margin required to open a trade and, in turn, influences the lot size. Higher leverage can let you trade larger lot sizes, but it also increases potential risks. With leverage, it's crucial to calculate lot size carefully to avoid overexposing your account.

1.4 Understanding Account Balance and Equity

In Forex, your balance is the amount of money in your account without considering open positions, while equity is the balance plus or minus any floating profits or losses. Understanding the difference between the two is crucial when calculating lot size. Your equity plays a vital role in determining how much you can afford to risk per trade, affecting how many lots you can open safely without overleveraging.

1.5 Margin Calls and Position Sizing

A margin call occurs when your equity falls below the required margin, usually due to adverse price movements. To avoid this, it’s essential to maintain an appropriate position size. With a $5,000 account, position sizing is critical. If your lot size is too large, the market may move against you and trigger a margin call. Managing your position size effectively can help mitigate this risk and prevent the forced closure of trades.

Risk Management and Calculating Lot Size

2.1 Risk per Trade and Determining the Lot Size

In Forex trading, risk per trade refers to the percentage of your account balance you're willing to risk on a single trade. Typically, traders risk between 1% to 2% of their account balance per trade to prevent significant losses. To determine the appropriate lot size, you need to calculate the amount of money you are willing to lose in a trade based on the stop loss level and your account balance. The lot size is then adjusted to ensure that your potential loss doesn’t exceed the risk threshold.

Example:

If you have a $5,000 account and decide to risk 2% per trade, your maximum risk is $100. If your stop loss is 50 pips, you can calculate the lot size based on the amount you're willing to lose per pip. This calculation will help ensure that you manage your risk effectively without jeopardizing too much capital.

2.2 Calculating Stop Loss and Take Profit Levels

Setting appropriate stop loss and take profit levels is critical to managing risk and reward. These levels directly relate to lot size, as they determine how much capital is at risk. A narrow stop loss may require smaller lot sizes to stay within your risk tolerance, while a wider stop loss may justify larger lot sizes if you are willing to take on more risk.

| Stop Loss Level | Lot Size (for $5K Account) | Risk per Trade |

|---|---|---|

| 30 pips | 0.10 lot | $30 |

| 50 pips | 0.05 lot | $50 |

| 100 pips | 0.02 lot | $50 |

By calculating your stop loss and take profit, you can determine an appropriate lot size that ensures your potential losses stay within your desired risk parameters.

2.3 Maximum Loss and Lot Size Adjustment

It's crucial to track your losses and adjust lot sizes accordingly to protect your capital. If you've already reached your maximum allowable loss for the day or week, it may be wise to reduce your lot size or stop trading altogether. Continually monitoring your losses ensures that you're not overexposing your account, which is essential in maintaining a sustainable trading strategy.

Tip:

If your account balance drops by a certain percentage, consider reducing your lot size to minimize future risks. Adjusting your lot size based on your account balance keeps you within a safer range of exposure.

2.4 Risk-Reward Ratio and Its Role in Lot Size

The risk-reward ratio is a critical tool in determining your lot size. It compares the amount you are willing to risk (e.g., your stop loss) to the potential reward (e.g., your take profit). A 3:1 risk-reward ratio, for instance, means you're aiming for three times the reward compared to the risk you're taking. This ratio directly impacts the lot size you choose.

Maintaining a positive risk-reward ratio is crucial in ensuring that even if you have several losing trades, your profits from winning trades will compensate for the losses. For a $5,000 account, using a proper risk-reward ratio helps prevent large losses while allowing you to leverage smaller trades to secure bigger wins.

Trading Strategies and the Impact of Lot Sizing

Understanding how your trading strategy influences lot sizing is essential to maintaining proper risk management. Different strategies require unique approaches to position sizing, which directly impacts both potential gains and losses. In this cluster, we'll explore how lot size varies based on different trading methods, from scalping to position trading.

3.1 Scalping and Lot Sizing Considerations

Scalping is a strategy that involves executing many high-frequency trades with small profit margins. Since scalping typically involves holding positions for just a few seconds or minutes, lot size must be adjusted to ensure quick, low-risk trades. When using a small account, such as a $5,000 account, it’s crucial to trade smaller lot sizes to minimize exposure to the market. Small lots, like micro lots (0.01), are ideal for scalping, as they reduce the risk of large losses from rapid price fluctuations.

| Lot Size | Recommended for Scalping | Risk per Trade |

|---|---|---|

| Micro Lot | 0.01 lot | Low risk |

| Mini Lot | 0.1 lot | Moderate risk |

| Standard Lot | 1.0 lot | High risk |

Scalping requires tight stop losses and fast decision-making, making smaller lot sizes crucial for preserving capital while targeting small profits.

3.2 Swing Trading and Lot Calculations

Swing trading is characterized by holding positions for several days or weeks, capturing medium-term price movements. Unlike scalping, swing traders have more time to adjust their positions, but they still need to carefully manage their lot size to avoid excessive exposure. A balanced approach is key; you’ll often use mini lots (0.1 lot) or micro lots (0.01 lot) for swing trading with a $5,000 account, ensuring that the risk is kept within acceptable limits.

When setting your lot size for swing trading, consider factors like stop loss, take profit levels, and account size. Swing trading is generally less risky than scalping, but it still requires careful lot sizing to prevent larger-than-expected losses during overnight market shifts.

3.3 Day Trading vs. Position Trading: Lot Sizing

The difference between day trading and position trading lies in the duration of trades and the strategy’s risk tolerance. Day trading typically involves holding positions for a few minutes to hours, while position trading may last weeks or even months. Lot size varies significantly between these two styles because the risk exposure differs greatly.

| Strategy | Lot Size (Recommended) | Trade Duration | Risk Level |

|---|---|---|---|

| Day Trading | Mini Lot (0.1 lot) | Hours | Moderate |

| Position Trading | Standard Lot (1.0 lot) | Weeks to Months | Higher |

For day trading, smaller lots are more appropriate due to the need for quick entries and exits, whereas position trading requires larger lots to accommodate longer-term trends and bigger market moves.

Practical Steps to Calculating Lot Size for a 5K Account

Calculating the right lot size for a $5,000 account requires applying risk management strategies, using tools like lot calculators, and adjusting based on market conditions. This cluster provides practical steps and real-world examples to help traders make informed decisions about lot sizing.

4.1 Consider Risk Management When Calculating Lots

The first step in calculating lot size is to determine how much of your account you’re willing to risk per trade. Let’s say you decide to risk 2% of your $5,000 account on each trade, which equals $100. With a 50-pip stop loss, you can then calculate your lot size. To do this, you divide your risk per trade ($100) by the pip value (e.g., $1 per pip for a mini lot) and the stop loss distance (50 pips). This method ensures you’re managing your capital in a sustainable way.

| Account Size | Risk Percentage | Risk per Trade | Stop Loss | Lot Size Calculation |

|---|---|---|---|---|

| $5,000 | 2% | $100 | 50 pips | 0.2 lot |

By calculating lot size this way, you ensure that each trade stays within your predefined risk tolerance.

4.2 Using the Lot Calculator for a 5K Account

For many traders, especially beginners, using an online lot calculator can simplify the process of calculating lot size. These calculators automatically factor in your account size, risk percentage, stop loss, and leverage to give you an exact lot size. Tools like this save time and reduce the potential for human error. When using a $5,000 account, simply input the required details into the calculator, and it will provide the ideal lot size for your trade.

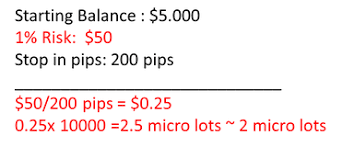

4.3 Case Study: Calculating Trading Lots for a $5,000 Account

Let’s look at an example of how to calculate the lot size for a $5,000 account using different risk tolerances and leverage.

If you want to risk 1% per trade on a mini lot and your stop loss is 30 pips, you can use the following formula:

Lot Size = (Account Balance x Risk Percentage) / (Stop Loss x Pip Value)

For a $5,000 account, risking 1% per trade with a 30-pip stop loss:

| Account Balance | Risk | Stop Loss | Pip Value | Lot Size |

|---|---|---|---|---|

| $5,000 | 1% | 30 pips | $1.00 | 0.17 lot |

This example shows how a trader can calculate lot size based on personal risk preferences and market conditions.

4.4 Adjusting Lot Size Based on Market Conditions

Market conditions, such as volatility or changes in your account balance, may require adjustments to your lot size. In volatile markets, it’s wise to reduce your lot size to protect your capital, as price swings can quickly erode profits. Conversely, in stable market conditions, you may choose to increase your lot size if your account has grown. Adjusting your lot size helps maintain a balanced risk profile, ensuring your exposure aligns with the market's current environment.

| Market Condition | Lot Size Adjustment | Reason |

|---|---|---|

| High Volatility | Decrease lot size | To reduce risk from price swings |

| Low Volatility | Increase lot size | To capitalize on stable movements |

By carefully monitoring market conditions and adjusting your lot size, you maintain control over your risk exposure.

Common Mistakes and Best Practices

Understanding common mistakes and applying best practices is crucial for traders managing a $5,000 account. In this section, we will highlight the errors traders often make when calculating lot size and provide strategies to avoid these pitfalls, ensuring better long-term success.

5.1 Overleverage and Its Consequences

One of the biggest mistakes traders can make is overleveraging, which occurs when traders use excessive leverage in an attempt to increase their profits. While leverage can amplify gains, it also magnifies losses. Overleveraging distorts the calculation of lot size because traders may be risking more than their account can afford. For instance, using 50:1 leverage with a $5,000 account to trade large standard lots (1.0 lot) can lead to quick margin calls if the market moves against you. To avoid overleveraging, traders should stay within safe leverage limits and adjust their lot size to match their risk tolerance.

| Account Size | Leverage | Lot Size | Potential Risk |

|---|---|---|---|

| $5,000 | 50:1 | 1.0 lot | High risk of margin call |

| $5,000 | 10:1 | 0.2 lot | Lower risk |

| $5,000 | 5:1 | 0.1 lot | Minimal risk |

By keeping leverage at a manageable level, you can protect your capital from significant drawdowns.

5.2 Ignoring the Risk-Reward Ratio

A common mistake among traders is ignoring the risk-reward ratio when calculating lot size. The risk-reward ratio helps you assess whether the potential reward justifies the amount of risk you're taking on. For example, if your stop loss is set at 30 pips and your target profit is 90 pips, you’re looking at a 1:3 risk-reward ratio. When setting lot size, ensure that your potential reward is always in proportion to your risk. Ignoring this ratio can lead to overexposing your account to risk, making it harder to recover from losing trades.

5.3 Not Adjusting Lot Size as Account Balance Changes

As your account balance grows or shrinks, adjusting your lot size accordingly is crucial. A common mistake is keeping the same lot size even when your account balance changes. For example, if your $5,000 account grows to $7,000, continuing to trade the same lot size as before could expose you to more risk than necessary. To align lot size with your account equity, use a consistent risk-per-trade percentage to guide your position sizing decisions.

| Account Balance | Lot Size | Risk per Trade | Recommended Adjusted Lot Size |

|---|---|---|---|

| $5,000 | 0.1 lot | $50 | 0.1 lot |

| $7,000 | 0.1 lot | $70 | 0.14 lot |

| $10,000 | 0.1 lot | $100 | 0.2 lot |

Adjusting lot size based on account balance ensures that your risk is proportional to your current equity, helping to avoid overexposure.

Conclusion

Calculating the ideal lot size for a 5k account is a fundamental skill that every trader should master. By understanding how to adjust lot size based on factors such as risk management, account balance, and trading strategies like scalping, swing trading, and position trading, you can effectively control your exposure to the market while protecting your capital. It’s essential to constantly monitor your account balance, leverage, and the risk-reward ratio to ensure that your trading decisions align with your financial goals. The key is maintaining balance—managing your lot size according to your trading strategy and risk tolerance to safeguard your account from unnecessary losses.

To calculate the correct lot size for a $5,000 account, you first need to decide how much you are willing to risk per trade (typically 1% to 2% of your account balance). Then, use the formula: Risk per trade ÷ (Stop Loss in pips × Pip value) = Lot size. For example, if you risk 2% of $5,000 ($100), with a 50-pip stop loss, you would trade around 0.2 lot size.

Leverage increases your potential exposure to the market, enabling you to control larger positions with a smaller capital investment. For instance, using 50:1 leverage allows you to control 50 times your account balance, but it also increases the risk. The higher the leverage, the smaller the lot size you should use to maintain manageable risk levels.

You should adjust your lot size according to changes in market volatility and the performance of your account. For example, during high volatility, consider reducing your lot size to lower the risk of large price swings. On the other hand, during stable market conditions, you may increase the lot size to take advantage of more predictable price movements.

Common mistakes include overleveraging, ignoring the risk-reward ratio, and failing to adjust lot size as your account balance changes. Overleveraging can lead to significant losses, while ignoring the risk-reward ratio can cause poor risk management decisions. Not adjusting lot size as your balance fluctuates can also expose you to unnecessary risks.

The risk-reward ratio helps you balance potential rewards against the risk you're taking. By calculating lot size in relation to the risk-reward ratio, you can ensure that your trading strategy remains consistent with your risk tolerance, helping you avoid large losses and maximize potential profits.

Overleveraging occurs when you use excessive leverage, which increases the risk of large losses. It can distort your lot size calculations, as you may trade too large a position relative to your account balance, increasing the chances of a margin call or significant drawdown.

The **stop loss** is a critical factor when calculating lot size, as it determines how much you are willing to lose on a trade. The wider the stop loss, the smaller the lot size needed to maintain the same level of risk. A tight stop loss, on the other hand, may allow you to trade larger lot sizes while still keeping risk manageable.

You should adjust your lot size regularly, especially when your **account balance** changes or when there are significant changes in market conditions. Regular adjustments ensure that your lot size remains aligned with your current risk tolerance and trading strategy.