EUR/USD Trading Signals Live:

The EUR/USD is one of the most commonly traded currency pairs in the foreign exchange market. Traders and investors closely monitor its movements to take advantage of potential trading opportunities. Today, we will look at some live trading signals for the EUR/USD pair.

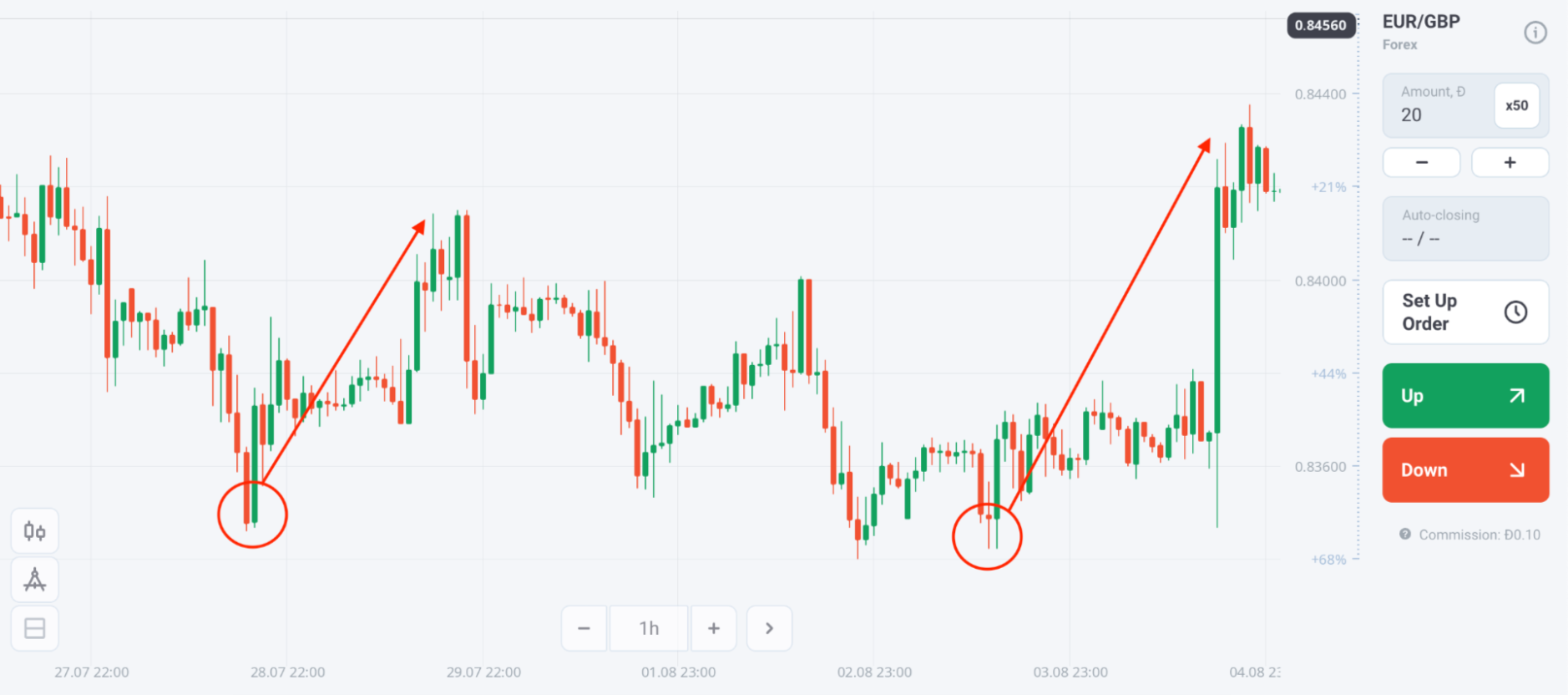

1. Bullish Engulfing Pattern:

A bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle. This pattern indicates a potential reversal in the market. Traders may consider buying the EUR/USD when they spot a bullish engulfing pattern.

2. Moving Average Crossover:

A moving average crossover strategy involves the intersection of two moving averages. When the shorter-term moving average crosses above the longer-term moving average, it may signal a buy opportunity. Conversely, when the shorter-term moving average crosses below the longer-term moving average, it may indicate a sell opportunity.

3. Fibonacci Retracement Levels:

Fibonacci retracement levels are used to identify potential support and resistance levels in a market. Traders may look for buying opportunities when the price of the EUR/USD retraces to a fibonacci support level. Conversely, they may look for selloffs when the price of the pair retraces to a fibonacci resistance level.

4. RSI Divergence:

The Relative Strength Index (RSI) is a popular momentum indicator used by traders to identify overbought and oversold conditions. When the RSI diverges from the price action, it may indicate a potential reversal in the market. Traders can look for bullish divergence to buy the EUR/USD and bearish divergence to sell the pair.

These are just a few examples of live trading signals that traders use to make informed decisions when trading the EUR/USD currency pair. It is important to note that these signals should be used in conjunction with other technical analysis tools and risk management strategies to increase the likelihood of success.