Margin and margin requirements are something that no forex trader can afford to ignore. Margin has often been labeled a “good faith deposit” to open a position.

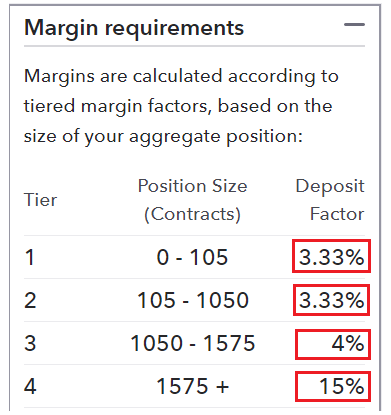

Margin is usually presented as a percentage amount of the full position, 0.25%, 0.5%, 1%, 2%, and so on. You can calculate the maximum leverage you can use with your trading account based on the margin required by your broker.

Why are margin calculations important?

Margin calculations in forex are a deposit that a trader puts up in order to secure a position. Think of it as collateral—it's not a fee or a cost, but it ensures that your account can handle whatever trades you are making. The margin that you have to put up entirely depends on the amount that you're trading. It's important not to put too much on margin because otherwise, you'll lose everything if your trades prove to be duds. Trading on margins is a big part of why stock dealers in the crash of 1929 lost so much. Make sure you keep that in mind while forex trading.

The formula for calculating the margin for a forex trade is simple. Just multiply the size of the trade by the margin percentage. Then, subtract the margin used for all trades from the remaining equity in your account. The resulting figure is the amount of margin that you have left.

How does a margin calculation work?

You might be staking a position for a currency pair, and neither the base nor the quote currency is the same as the currency used on your account. As a result, the margin requirement for these kinds of trades can be calculated in a currency that is different from what your own account deals with, which makes calculating margins a bit more difficult.

Let's say that you decided to trade with GBP and JPY. The currency you use in your account is USD. Suppose that you then decide to take a position with 10,000 units of currency. This means that you are buying 10,000 GBP against an equivalent number of JPY. You are paying in JPY and buying in GBP, but in reality, you are buying JPY with USD. As far as your broker is concerned, your margin requirement will be calculated solely in USD, or your main account currency.

Here’s the formula required for calculating the margin requirement in your main account currency:

Margin Requirement = ([{Base Currency} ÷ {Account Currency}] ✕ Units) / Leverage

In the example of trading GBP/JPY, the terms in the above formula are as follows:

Base Currency = GBP

Account Currency = USD

Quote Currency = JPY

Base Currency/Account Currency = Current exchange rate of GBP/USD units = 10,000

Base Currency/Account Currency = Exchange rate between the two traded currencies

For GBP/USD, this will, at the time of writing, be around 1.30.

For get more updates on Forex trading, visit forex forum.

The formula for calculating the margin for a forex trade is simple. Just multiply the size of the trade by the margin percentage. Then, subtract the margin used for all trades from the remaining equity in your account. The resulting figure is the amount of margin that you have left. If you are looking forward to gaining a good Forex Broker, my best bet would be on the HFM which is the best forex broker that will collect all important types of indicators analysis and provide you with good and accurate instruction.