The Forex market is the largest financial market in the world, with a daily trading volume ranging approximately between two-three trillion dollars! To become a successful Forex trader, one has to carefully study all the important aspects of the foreign exchange market. Among them are the different Forex trading sessions which exist around the world.

In this article, we will examine the various Forex market hours, look at the different sessions, analyse the best - and worst - times to trade and much more!

The Forex market is open 24 hours a day, five days a week and is made up of a vast array of participants, including central banks, hedge funds, investment management firms, retail Forex brokers and investors from all over the world.

During each Forex trading session, the city with the major financial hub in the relevant region is given the session title. If you are trying to analyse the best time to trade Forex currency pairs, it is paramount to understand the different trading sessions and which currencies or markets are most liquid during those hours.

The Forex Market Hours

The international currency market is not actually dominated by a single market exchange but, instead, entails a global network of exchanges and brokers throughout the world. Forex market hours are based on when trading is open in every participating country.

The four major Forex sessions are as follows:

Sydney

London

Tokyo

New York

The trading day actually begins each weekday in New Zealand, although it is the city of Sydney which lends its name to the first major session. The pattern then tends to follow that, as one major Forex market approaches its close, another one opens. Certain times of the day are more active than others and it is important to keep track of these.

In the coming sections, we will examine the three most important sessions and the best times at which to trade them in more detail. But first, let's look at the open and close times of each of the individual sessions which make up the Forex trading day.

Spring/Summer in the Northern Hemisphere

To confuse things ever so slightly, due to the observation of daylight saving hours, the Forex session times vary with the seasons. Out of the four major Forex trading sessions which we identified above, only Japan keeps things straightforward all year round and does not change their clocks.

Below is a table with the opening and closing times of each Forex session in both the local timezone and BST (British Summer Time).

Session | Local Time | BST (GMT + 1) |

|---|---|---|

Sydney | 07:00 - 16:00 | 22:00 - 07:00 |

Tokyo | 09:00 - 18:00 | 01:00 - 10:00 |

London | 08:00 - 16:00 | 08:00 - 16:00 |

New York | 08:00 - 17:00 | 13:00 - 22:00 |

Autumn/Winter in the Northern Hemisphere

The table below shows the major Forex market hours in local time and GMT.

Session | Local Time | GMT |

|---|---|---|

Sydney | 07:00 - 16:00 | 20:00 - 05:00 |

Tokyo | 09:00 - 18:00 | 00:00 - 09:00 |

London | 08:00 - 16:00 | 08:00 - 16:00 |

New York | 08:00 - 17:00 | 13:00 - 22:00 |

Trade With a Risk Free Demo Account

Traders who trade with Admirals have the ability to trade with a risk free demo account. Practice trading with virtual currency in real-market conditions before making the transition to the live markets! To open your FREE demo trading account, click the banner below!

The Main Forex Trading Sessions

One of the greatest characteristics of the Forex market, as mentioned earlier, is that it is open 24 hours a day, 5 days a week. This means that investors around the globe can trade whenever they want throughout the working week. However, not all times are created absolutely equal. There are times during the week when price action is consistently volatile and there are also periods when it is completely muted.

Although different currencies can be traded anytime you wish, a trader cannot personally monitor their positions for such long periods of time. There will be Forex market hours when opportunities are missed or when a jump in market volatility leads the spot to move against a set position while the trader is not nearby. To reduce such a risk, a trader has to be aware of when the market is most commonly volatile, and, therefore, decide what times are best for their individual trading strategy and style.

Typically, the market is separated into three main sessions - during which activity is at its peak: the Asian, European and North American sessions, or, more commonly known as, the Tokyo, London and New York sessions respectively.

Such names are used interchangeably amongst Forex traders simply because these three cities represent the key financial centres for each region. The markets are most active when those three financial powerhouses are conducting business - as the majority of banks and corporations make their daily transactions and there is a larger number of speculators online.

Let's take a look at each one of these Forex sessions in a bit more detail.

The Tokyo Trading Session

Following the weekend, action returns to the Forex market - on Sunday evening for us Europeans - in the form of the Asian trading session. Although not officially, activity from this part of the world is largely generated by the Tokyo capital markets, which is why the session bears its name.

Nonetheless, there are a lot of other locations with considerable pull that are present during this period - including Australia, China and Singapore.

Despite the large amount of transactions taking place, liquidity can sometimes be low during the session, especially in comparison with the London and New York sessions.

The London Trading Session

Later in the trading day, just before the Asian Forex market hours come to a close, the European session takes over in keeping the currency market active. This time zone is very dense and involves many key financial markets. However, it is London's name which takes the honour of identifying the boundaries of the European session.

Largely due to its favourable time zone - London is not only the centre of Forex trading in Europe, but also the world. The London session overlaps with the two other major Forex trading sessions (Tokyo and New York), meaning that a large proportion of daily Forex transactions take place during this period of time.

This increased Forex activity results in high liquidity throughout the session and, potentially, lower spreads. A further effect of the increased activity is also that the London session usually presents the most volatile Forex market hours. Volatility tends to dip in the middle of the session, before picking up again once New York opens.

The New York Trading Session

When the North American session comes online, the Asian markets have already been closed for several hours, but the day is only halfway through for European Forex traders. The session is mostly influenced by activity in the US, with contributions from Canada, Mexico and a few countries in South America.

The morning hours mark high periods of liquidity and volatility, which both tend to die down in the afternoon once the Europeans cease trading.

Trade With MetaTrader 5

Did you know that Admirals offers traders the number 1 multi-asset trading platform in the world - completely FREE!? MetaTrader 5 enables traders access to superior charting capabilities, free real-time market data & analysis, the best trading widgets available, and much more! To download MetaTrader 5 now, click the banner below:

Overlaps in the Forex Sessions

As you will no doubt notice from the opening and closing times of the different Forex sessions, there are periods of the day where two sessions are open at the same time.

These overlaps represent the busiest times of day in terms of Forex transactions, simply because there are more market participants active. Traders can expect both higher volatility and liquidity during these Forex market hours - making them among the best times of day to trade.

Currency pairs display varying levels of activity throughout the trading day, based on who is active in the market at any given time. Being aware of the different Forex sessions gives us an idea of what time of day Forex pairs are most active.

For example, during the London and New York session overlap - which represents the busiest time of day trading wise - you can expect the EURUSD and GBPUSD to be at their most active, with high volatility and liquidity. On the other hand, volatility and liquidity would be considerably lower in both of these pairs during the Sydney session.

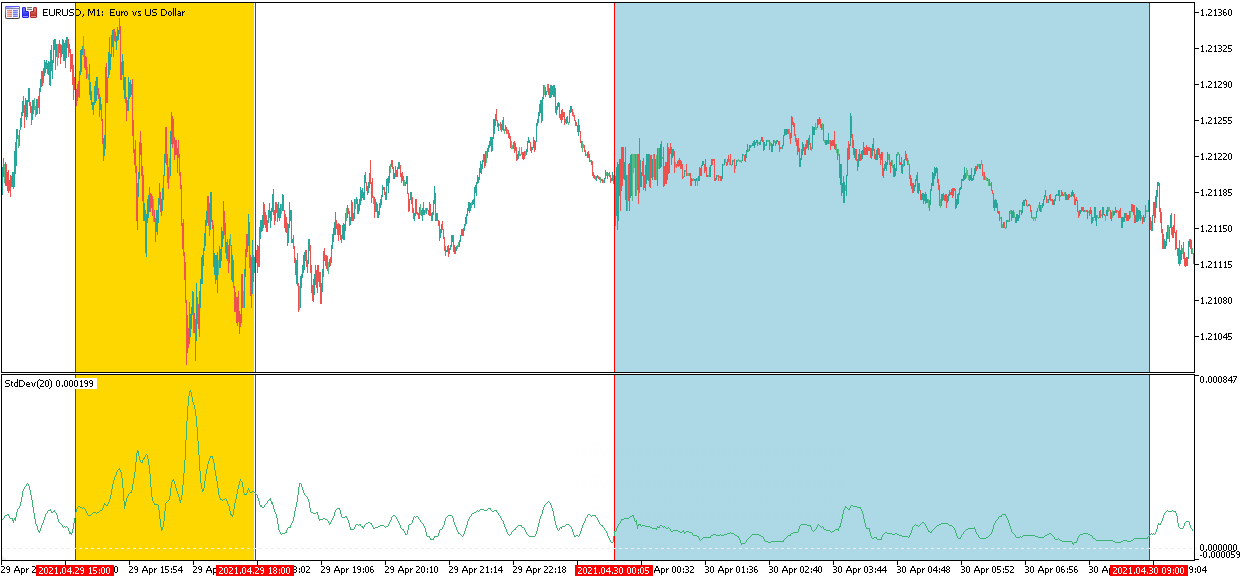

This is highlighted in the EURUSD chart below, where the section highlighted in yellow represents the overlap between the London and New York sessions and the section highlighted in blue shows the Sydney session. The Standard Deviation indicator along the bottom of the screen reflects the level of volatility in the market - which is noticeably higher during the market overlap.

Therefore, if you are a Forex trader who thrives off volatility, you can deduce from the different Forex market hours which times of day are best for trading which currency pairs. Similarly, if your trading style dictates that you avoid periods of high volatility, you can analyse which times of day you should probably stay away from the markets.

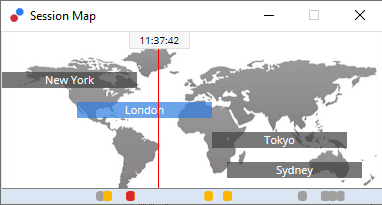

Finding it complicated to keep track of which sessions you are in? With all the different time zones, we don't blame you! That's why we included the 'Session Map' indicator as part of our MetaTrader Supreme Edition plugin. This handy tool allows you to see a chart with the current running Forex market hours in your trading terminal!

Source: Admirals MetaTrader 5 Supreme Edition - Session Map

The Best and Worst Times to Trade Forex

The best and worst times of day to trade Forex are mostly relative, depending on your preferred trading strategy or style and on the pairs you want to trade.

As we highlighted in the previous section, traders who require high volatility will want to trade relevant currency pairs during market overlaps and those who eschew these conditions should be wary of these times of day.

Another time of high market volatility to be aware of is in the build up, and directly after, important economic announcements, such as interest rate decisions or new GDP figures.

Times of low liquidity are not good for anyone, generally speaking, and there are certain times during the trading week where these conditions tend to be prevalent.

For example, during the week, there tends to be a slow down in activity at the end of the New York session and the start of the Sydney session - as North Americans stop trading for the day whilst Australians and New Zealanders are getting up and ready for work.

Similarly, most traders would agree that both the beginning and end of the week tend to be slower as people get back into trading after a few days' rest or wind down their positions in anticipation of the weekend.

Final Thoughts

When trading Forex, a market participant must, first of all, define whether high or low volatility will work best with their individual trading style. Those wanting high volatility may be better off only trading the session overlaps or perhaps just around economic release times might be the preferable option.

When considering the EURUSD pair, the London/New York session crossover will provide the most movement. There are usually alternatives and an FX trader should balance the necessity for favourable market conditions with physical well-being.

If a market participant from the United States prefers to trade the active Forex trading session for GBPJPY (i.e. the Tokyo/London overlap), for example, they will have to wake up very early in the morning to keep up with the market.

If this person also has a regular day job, this could lead to considerable exhaustion and, subsequently, mistakes in terms of judgment when trading. A much better alternative for this trader might be trading a different currency pair during the London/New York session overlap, where volatility is still high.

Either way, a good knowledge of the different Forex trading sessions, can provide you with an advantage in terms of trading currencies most effectively.