Financial leverage attracts a lot of traders to the Forex market. You might see many results on Google such as 'Best leverage to use in Forex'' which make it seem like this is the only option when trading with Forex. However, it is not the foolproof tool that some people make it out to be, nor is it the only option in terms of professional Forex trading. While leverage can be beneficial, it can also lead to some disastrous outcomes.

This is especially likely in the case of traders with no experience. It's also worth noting that many large financial companies are actually practicing currency trading without leverage. So what are the advantages of trading with and without leverage? And what are the pros and cons of Forex trading? You can find out the answers to these questions yourself with a free Demo account, if you want to jump ahead and start practicing now.

However, if you would like to possess a little more knowledge beforehand, we encourage you to read on.

Table of Contents

Leverage | Introduction

Leverage | A Financial Example

Forex Trading With Leverage

Forex Trading Without Leverage

Institutional Trading

To Leverage or Not to Leverage

Final Thoughts

Leverage | Introduction

Perhaps you already know what leverage is? If not, here's a brief summary:

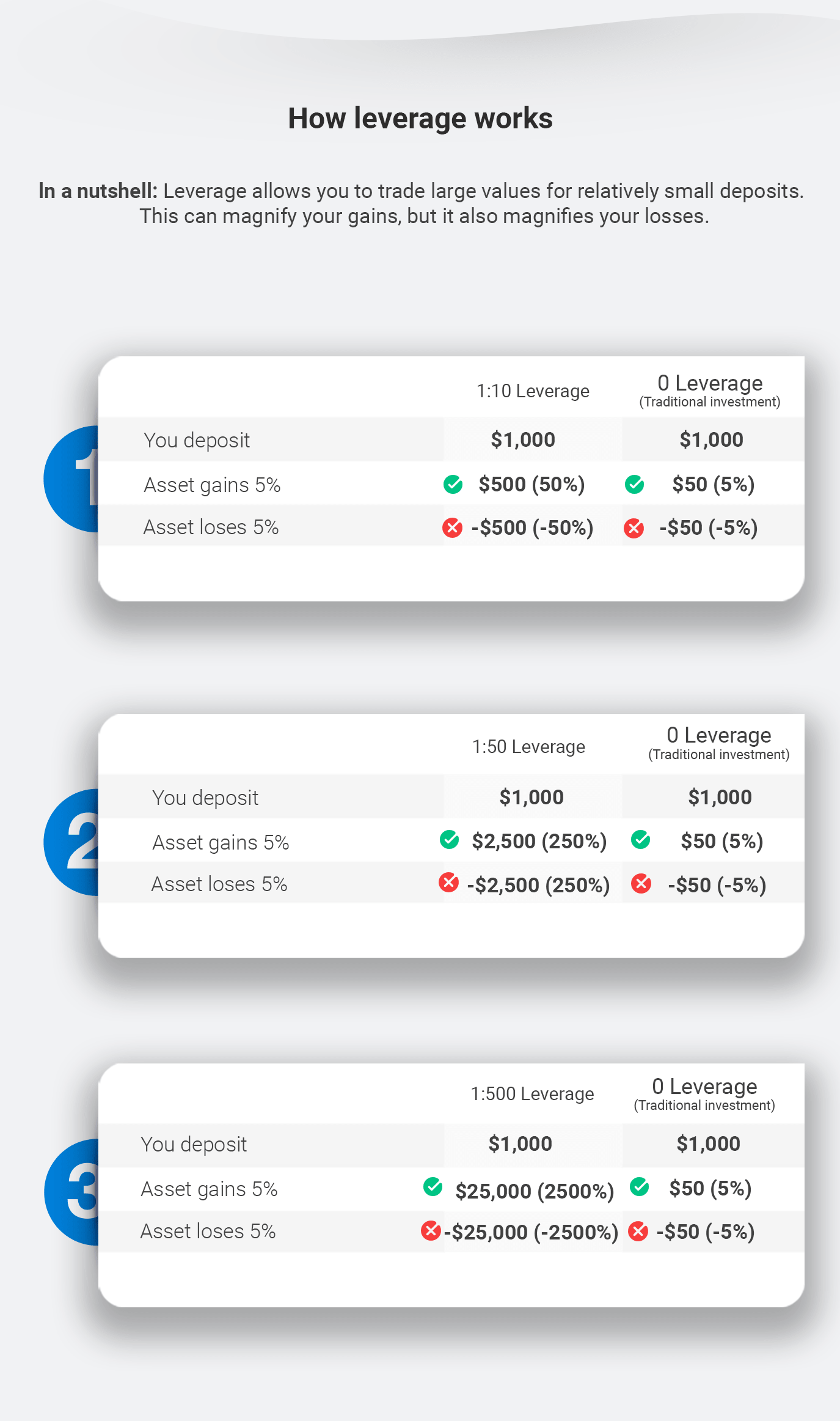

Financial leverage is a credit provided by a broker. Leverage allows traders to place orders that are significantly higher than their actual deposit. It is possible to use leverage to trade stocks and other financial instruments, but it is far more accessible when trading currencies. Leverage potentially helps traders to achieve higher profits in the market. Of course, the same also applies to losses. Traders risk losing their deposit faster when using leverage – so use it cautiously!

Leverage | A Financial Example

Image that a trader has a deposit of 10,000 EUR. The trader's broker offers a leverage of 1:100 for a deposit of this size. Knowing these two values, we can easily calculate the largest position available to this trader. We need to multiply the trader's balance by the first value in the leverage ratio (i.e. 10,000 multiplied by 100). Therefore, this trader can open a deal up to 1,000,000 EUR in volume.

Of course, this may sound too optimistic. The position size doesn't mean much if you are not aware of how you're trading. Before you begin trading, you should learn about the positives and negatives of trading, and then try it without leverage.

Forex Trading With Leverage

Ok, so now you know what leverage is, but what does leverage mean in Forex? Let's answer that question by looking at how leverage is used within Forex trading:

The biggest advantage of leverage is that it allows traders to boost their trade sizes, even when they don't have substantial capital. Traders usually consider 1,000 USD to be a decent starting sum. However, not all traders can afford this – especially when starting out. And this is where financial leverage comes into play. Even leverage as low as 1:10 allows traders with a 100 USD deposit to open a 0.01 lot position. But this is not a 100% beneficial condition, as you also expose yourself to risk.

But how does Forex leverage work exactly? Let's consider an example of trading with no leverage to answer that question:

Let's say you buy 1000 USD for 800 EUR, and then the price of USD drops by 50%. You would only lose half of your funds (in this particular example, you would lose 400 EUR). However, if you were using 100:1 leverage, and the price changed by less than 1%, you would then lose all of your funds. Always be aware of the risks leverages pose, and try to prepare yourself for them. Preparation can be as simple as practicing leveraged and unleveraged trades on a demo account.

If you can't create good returns with low leverage, expect potentially significant loses with over-leverage.

Interested in practicing your trading with virtual funds, before executing your tactics live? Register now for a free demo account and enjoy training under real and live market conditions! Click the banner below for more:

Forex Trading Without Leverage

The main downside of trading Forex without leverage is that it is simply not accessible for most traders. Forex trading without leverage means that changes in the price of an asset directly influence the trader's bottom line. The average monthly return a trader can generate is 10%. But in reality, the return is around 3 to 5% a month.

However, this figure already includes marginal trading. With no leverage Forex trading you would probably only make between 0.3 to 0.5% a month. It may be enough for some Forex traders – but perhaps not for the majority. The need for substantial trading capital is the biggest drawback of trading without leverage. On the other hand, currency trading without leverage gives you less risk exposure.

However, this doesn't mean that there are no risks involved in trading without leverage. Let's proceed with an example of 'No-leverage trading'. Let's say you deposit 10,000 USD and make a monthly return of 5%. You would only get 500 USD each month, and that's before any taxation. You could probably make the same money with a 9-to-5 job, without risking your own capital in the process.

Institutional Trading

What is institutional trading? As we've already mentioned, a lot of institutions choose Forex trading without leverage. Yet these organizations are still able to achieve large profits. How is this possible? Large banks have access to billions in capital. They can afford to trade large amounts on attractive entry signals. Institutions also often trade long term, so unlike the average trader, institutions can have their position open for months or even years.

Since they don't use leverage, the swap expense tends to be quite low too. In fact, in many cases there is no swap at all. Institutions directly benefit, or suffer from the differences in interest rates. Many of the largest Forex market trades have been made by institutions without leverage. These deals have a speculative motivation, and typically use extensive capital in the billions.

Are you looking to further boost your trading knowledge? Why not register for one of our free webinars, hosted by our in house trading experts! Click the link below to start:

To Leverage or Not to Leverage

That is the question.

But unfortunately, there's no definitive answer to it – it depends on the situation. You have to consider your trading strategy, your financial targets, the capital at your disposal, and how much you are willing to lose. Like any financial market, the Forex market is generally risky. The higher your leverage is, the riskier your trading gets.

So consider trading with as little leverage as possible, to ultimately get the profit you want. And conversely, keep in mind that the more leverage you use in Forex trading, the more profit you can potentially make. In most cases, a beginner trader should consider using leverage between 1:5 to 1:100. The table below illustrates the importance of trading with the right leverage. It displays 10 consecutive losing trades in a row when using high vs low leverage.

Final Thoughts

Hopefully, we've answered some of your questions about Forex trading without leverage.

By now, you should understand why leverage is risky, and that high leverage means a higher risk, with the possibility of a higher return and vice versa. So again, practicing with leverage on a Demo account is a smart initial move. It is important to ensure your trading strategy considers your deposit amount, how much you are willing to lose, and the minimum you are willing to make - before you start leveraged trading. Keep learning, keep educating yourself, and most importantly, keep trying out new things.