This article explores the topic of Forex currency volatility as a whole, discussing what is volatility? What are the highest volatility currency pairs? how volatility affects trading in general, how to measure volatility with indicators such as the Average True Range (ATR), currency fluctuations, and more!

Table of Contents

Volatility: An Introduction

Volatility Index & Forex ATR Indicator

Highest Volatility Currency Pairs

Currency Volatility: What's so Important?

Other Ways Volatility Affects Trading

A Final Word On Volatility

The uncertainty that sprung from the surprise result of the Brexit vote back in 2016 sent shockwaves through the global financial markets. Consequently, The summer of 2016 was a volatile time for the Forex market. The most notable moves were in Forex (FX) pairs containing sterling (GBP). The immediate aftershocks of the Brexit referendum have faded somewhat now (although currency pairs that include GBP are still affected greatly by news developments, and announcements regarding the Brexit negotiations).

There are many other factors that also affect the FX markets. Speculation on the timing of further FED (Federal Reserve Bank) rate hikes and long-term fears of economic weakness have grown more in more recent years, which has fuelled uncertainty. And more often than not - uncertainty is a close companion to volatility. But before we start, we need to be clear on what volatility is, how we will classify volatile currency pairs, and how to adjust volatility protection settings.

Volatility: An Introduction

When we discuss volatility, we are discussing how much a price moves over a certain period of time. In short, a more volatile market will move more frequently over a given time-frame, compared with a less volatile one. Now when we say that, we are talking about price movements, and that can be one of two things:

Proportional

Absolute

Both have their uses, namely: The proportionate measure is more useful for comparative purposes generally, and when we are specifically looking at currencies, it can be useful to talk in absolute terms. After all, traders may simply want to know typical pip movement for a certain period. And for the purposes of the following comparison, let's use this route. We'll simply look at how many pips each currency moves.

Are you interested in practicing your trading under real and live market conditions? Register now for a free demo account and hone your skills before testing them on the live markets! Click below for more:

Volatility Index & Forex ATR Indicator

There are different ways to measure volatility, but one of the best-known indicators for this purpose is the Average True Range (ATR). The ATR indicator was developed by J. Welles Wilder (along with a collection of other well-known methods), in his book New concepts in technical trading. Wilder was a commodity trader and ATR was originally designed for commodity markets.

In the commodity market, there is normally a stretch of time between the market closing and reopening. It is not unusual to see commodity prices 'gapping' upon opening. Gapping refers to opening at a different level to the close of the previous day. This is less of an issue with the FX market, because currencies trade 24 hours a day during the week.

Nevertheless, it may be applicable when the FX market re-opens after closing for the weekend. A gapping market poses a problem to the most simplistic way of gauging volatility: which is looking at the range between the high and low for a certain period.

So what is the problem if the previous close was outside that range?

Well, if we focus purely on the high-low range, we are ignoring a certain amount of movement when the market gaps upon opening. True range is a measure that accounts for this circumstance, and is the largest of the following:

High of current period minus low of current period

High of current period minus close of previous period

Low of current period minus close of previous period.

Note that true range is always a positive value. We ignore the minus sign if we get a negative value from the calculations (see above). But why do we do this? Where volatility is concerned, we are only interested in the magnitude of change - not its direction. Once we have our values for true range, we use them to derive ATR.

ATR is an Exponential Moving Average (EMA) of true range. The good news is: ATR comes as a standard indicator with MetaTrader 4. Traders may also benefit from using the MetaTrader 4 Supreme Edition plugin, which provides the ability to list highly volatile currency pairs, and also comes with several other handy indicators that complement ATR.

Highest Volatility Currency Pairs

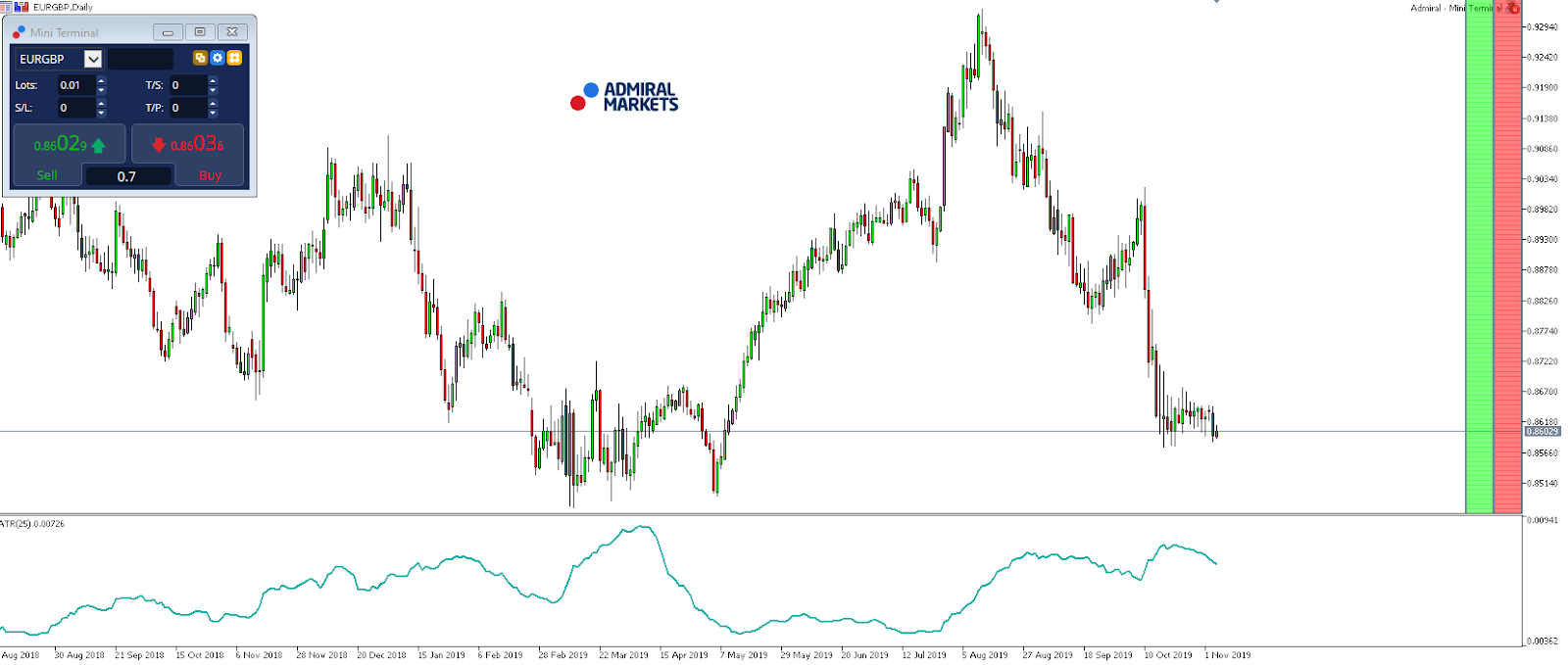

One way of measuring the volatility of a currency pair is to use the ATR trading indicator, or Average True Range. For example, here is a daily price chart of EUR/GBP, with the ATR (25) plotted beneath it:

This currency has gone through periods of high volatility and low volatility. During the high volatility periods - when the ATR indicator is at its highest - the average daily trading range of the past twenty-five daily bars was 89 pips. Whereas, during the low volatility periods - when the ATR indicators is at its lowest level - the average daily trading range of the past twenty-five days was just 41 pips.

Let's compare it with the EUR/NZD currency pair:

During the first few months of 2019, the ATR reading was quite high, peaking at 152 pips. The lowest reading up until June 2019 has been 81 pips. Both are significantly higher than EUR/GBP.

So from the examples provided, it is clear to see that EUR/NZD moved a lot more than EUR/GBP during the specified timeframe. It's important to note that volatility changes over time and what was once a high volatility market could turn into a low volatility market.

Looking to always stay up to date when it comes to your trading? Why not tune in to one of our free webinars hosted by our trading experts and learn new insights and strategies for your trading? Click below to get started:

Currency Volatility: What's so Important?

Like many technical measures, ATR is measures something that occurred in the past. It is performed in order to make an educated guess about what may be likely for the market in future. Such probabilistic thinking is usually at the heart of good trading.

It is advisable that traders:

Do not try to make specific predictions about the future

Attempt to gauge the overall probabilities of success for strategies in the long run

Naturally, you are probably now wondering if there is a way to forewarn yourself about likely times of higher volatility. Yes, there is. One tool that traders use, is the Forex Calendar. By watching how volatility rises when certain reports come out, traders can get a feel for what kind of data releases tend to be market movers. For example, the US Bureau of Labor Statistics usually releases employment data on the first Friday of each month.

The data is extremely timely and historically well correlated with economic growth. As a result, it has often sparked sharp movements for a variety of markets like FX. But that's just part of the story: because there may be patterns of volatility throughout the trading week. You may want to study this yourself to see how volatility ebbs and flows. If so, why not read our guide on the best days per week to trade Forex? and learn more!

Other Ways Volatility Affects Trading

There's varied ways that you can use volatility to guide your trading decisions. For example, you can use your volatility measure to try and normalise the level of risk you take with each trade. This involves adjusting your trading size, so that it's appropriate in relation to the market's volatility.

In other words:

The more volatile a pair, the smaller your contract size

The less volatile a pair, the larger your contract size.

This move attempts to reduce the impact of volatility on your trading. But why would you want to do this?

Well, imagine you are using the same strategy across multiple FX pairs. It stands to reason that your chance of winning or losing, is the same for each position you have, right? After all, a winning strategy should provide you with overall profit over the long term.

Such a result, will generate a sequence of losing and winning trades. But here's the thing: the balance of these results is everything. It's vital that no losing trades dwarf your winning trades. This could happen if a loss occurs on a more volatile currency pair, when you haven't adjusted your size accordingly. The usefulness of volatility doesn't stop there - it can also help you to choose a market that best suits your trading style.

If you are a long-term trend follower, you are probably going to want to trade a less volatile currency. Why? Because volatile markets make it hard to hold on to a long-term trend. Whipsawing prices will ensure that there are times when at least some of your profit will evaporate.

And let's face it, that can be hard on a trader's psychology. On the other hand, if you are a swing trader then you probably want more volatile pairs. Let's take a look at a quick example of increasing volatility. We mentioned Brexit earlier, because it was an example of extreme market volatility. Let's consider trading over that period:

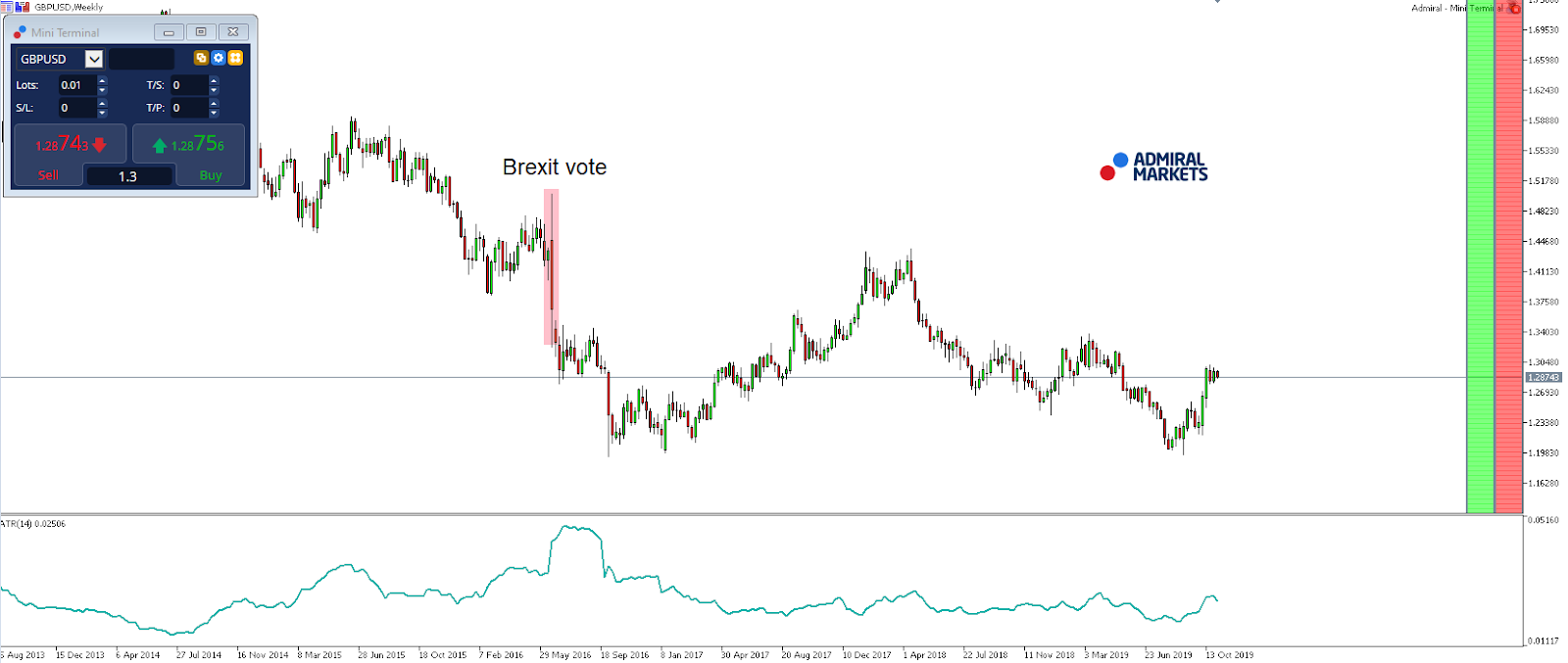

The image above shows a weekly chart of the GBP/USD currency pair, which includes the 14-period ATR plotted beneath it. You can see how volatile the FX pair was before, during and after the Brexit vote, as the ATR reached the highest levels in the time period shown. The long red candle in the middle is for 24 June 2016, when the market reacted to the outcome of the Brexit vote.

Now obviously such a sharp move pushed the ATR up to very high levels, and because the ATR is an average, this kept the ATR high for some time after. However, notice how the ATR was rising even before the Brexit vote? The volatility actually started rising a year earlier in 2015.

In January 2016 the weekly average range was above 200 pips. After the Brexit vote the range was above 480 pips.