Navigating the world of forex trading starts with understanding how to read price movements effectively. Forex charts offer a visual representation of currency pair fluctuations, allowing traders to analyze market behavior and make informed decisions. By learning to interpret these charts, beginners can identify trends, spot potential entry and exit points, and build a solid foundation for successful trading. Whether focusing on candlestick patterns, chart features like support and resistance levels, or technical indicators layered onto the chart, mastering forex charts transforms scattered price data into actionable insight. Grasping these essential tools is the first step toward developing confidence in the fast-moving forex market.

Understanding Forex Chart Basics

Forex trading starts with recognizing how to decode price behavior, and forex charts are the essential tool for this task. Every trader’s journey begins by learning how to read forex charts and understand market movement.

What Are Forex Charts?

Forex charts are visual tools used to display currency pair price fluctuations over various time frames. They reflect how pairs like EUR/USD, GBP/JPY, and USD/JPY behave across specific intervals. Each point on the chart represents crucial data: the opening price, closing price, highs, and lows during a selected period.

These charts simplify price data, allowing traders to spot patterns, identify trends, and make data-driven decisions. They bridge raw market information with actionable insights, transforming seemingly random movements into structured analysis. Without forex charts, recognizing an uptrend, a breakout, or a reversal becomes almost impossible.

Major Forex Chart Types Explained: Line, Bar, Candlestick

Different chart types serve distinct trading purposes:

Line Chart

Plots a continuous line connecting closing prices over a selected time frame.

Best for identifying the overall trend direction in pairs like EUR/JPY or GBP/USD.

Bar Chart

Displays the open, high, low, and close prices for each period.

Offers more detail compared to a line chart, making it ideal for spotting market conditions such as volatility or consolidation.

Candlestick Chart

Provides the same information as bar charts but visualized through filled or hollow candles.

Widely used for patterns like Head and Shoulders, Double Top, or Pennant.

| Chart Type | Information Displayed | Common Use Case | Popular Currency Pairs Example |

|---|---|---|---|

| Line Chart | Close price only | Spotting long-term trends | EUR/USD, GBP/JPY |

| Bar Chart | Open, High, Low, Close | Detailed price movement analysis | USD/CAD, EUR/GBP |

| Candlestick Chart | Open, High, Low, Close + Visual patterns | Identifying chart patterns | USD/JPY, AUD/USD |

Key Forex Chart Features: High, Low, Open, Close, Volume

To understand forex charts, one must grasp these key elements:

Open Price: The first price at which a currency pair is traded during a specific period.

Close Price: The last traded price within the time frame.

High & Low Prices: The maximum and minimum prices during that period.

Volume: Reflects the number of transactions, helping gauge the strength behind price moves.

Volume surges during market volatility, often indicating strong momentum, while the interaction between highs and lows signals possible support and resistance levels. For instance, noticing the volume spike alongside a breakout in the USD/CHF pair can suggest sustained price movement.

Time Frames in Forex Charts: From 1-Minute to Monthly

Time frames dictate the granularity of information forex charts provide. Different strategies depend on analyzing various time intervals:

1-minute & 5-minute charts: Suitable for scalpers needing fast, short-term data.

15-minute, 30-minute, and 1-hour charts: Common among day traders focusing on intraday price movements.

4-hour, Daily, Weekly, Monthly charts: Preferred by swing traders and position traders for long-term trend analysis.

For example, a trader might study the Daily chart of NZD/USD for broader trend direction, then zoom into the 15-minute chart to pinpoint entry points. Analyzing multiple time frames ensures the alignment of short-term trades with larger trends, increasing the chances of success.

Technical Indicators and Tools for Forex Charts

Decoding forex charts requires not only recognizing price points but also interpreting the tools layered across them. Technical indicators enhance reading precision, guiding traders through market complexity.

Moving Averages and Trend Lines in Forex Charts

Moving averages and trend lines serve as visual guides on forex charts, smoothing price data and revealing directional bias.

Simple Moving Average (SMA) calculates the average closing price over a set period, ideal for identifying uptrends or downtrends in pairs like EUR/USD or USD/JPY.

Exponential Moving Average (EMA) places more weight on recent prices, giving faster signals for currency pairs like GBP/USD or AUD/USD.

Trend Lines connect pivot highs or lows, acting as dynamic support and resistance levels across time frames such as 1-hour or 4-hour charts.

When combined, these elements highlight market momentum, filter noise, and set clearer entry or exit strategies.

Reading MACD and RSI on Forex Charts

Momentum and strength indicators like MACD and RSI simplify the decision-making process:

MACD (Moving Average Convergence Divergence)

Compares short-term and long-term moving averages.

Crossovers between the MACD line and signal line can indicate bullish or bearish shifts in EUR/GBP, USD/CHF, and other currency pairs.

RSI (Relative Strength Index)

Measures recent price changes to identify overbought or oversold conditions.

RSI values above 70 signal overbought markets, while values below 30 suggest oversold opportunities.

These tools are essential for recognizing reversal zones, especially when price patterns such as Double Tops or Wedges align with indicator signals.

Bollinger Bands: Spotting Volatility in Forex Charts

Bollinger Bands visually frame price volatility. Positioned around a moving average, the upper and lower bands expand during high volatility and contract during quiet periods. When trading pairs like NZD/USD or EUR/JPY:

Widening bands suggest potential breakout scenarios.

Narrow bands indicate periods of consolidation.

Price touching the upper band might reflect overbought conditions, while the lower band suggests oversold conditions.

Here’s a breakdown of key Bollinger Band metrics:

| Component | Description | Application Example |

|---|---|---|

| Middle Band | 20-period Simple Moving Average | Trend direction on GBP/JPY |

| Upper Band | 2 standard deviations above SMA | Identify resistance in USD/CAD |

| Lower Band | 2 standard deviations below SMA | Spot support in EUR/USD |

| Band Width | Difference between upper and lower bands | Measure volatility levels |

| Squeeze | Bands contract tightly | Signal upcoming breakout |

Fibonacci Retracement Levels on Forex Charts

Fibonacci retracement provides reliable support and resistance zones derived from mathematical ratios. Applied to currency pairs like USD/JPY or AUD/USD, traders:

Identify recent high and low points on candlestick charts.

Overlay retracement levels: 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

Anticipate price pullbacks aligning with these levels before continuing the trend.

For instance, during an uptrend, price retracing to the 38.2% level on a Daily chart often signals strong continuation potential, especially when coupled with indicators like MACD or Stochastic Oscillator.

Support and Resistance Levels: Identifying Key Zones

Price tends to react predictably at certain levels, forming natural barriers across forex charts:

Support Levels: Areas where price historically finds buying interest. For instance, the USD/CAD pair might repeatedly bounce from the same pivot point.

Resistance Levels: Zones where selling pressure halts price advances, such as observed in GBP/USD during strong uptrends.

Dynamic Levels: Moving averages, trend lines, and Fibonacci retracements frequently act as flexible support or resistance based on market conditions like breakouts or reversals.

Understanding these levels gives traders clearer risk management parameters, ensuring strategic entries aligned with chart signals.

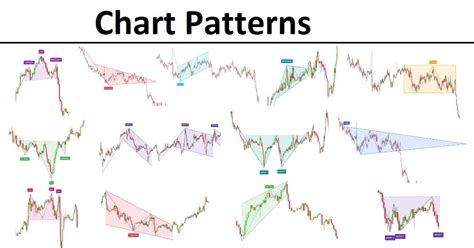

Chart Patterns Every Trader Should Know

Forex charts not only display price data but also reveal patterns traders use to predict future movements. Recognizing these patterns transforms random price action into strategic insights.

Head and Shoulders: Recognizing Reversals on Forex Charts

The Head and Shoulders pattern signals market reversals. It consists of three peaks: the left shoulder, the head (highest peak), and the right shoulder. Observing this formation on pairs like EUR/USD or GBP/USD often indicates a shift from an uptrend to a downtrend.

Key characteristics include:

Left Shoulder: Forms during an uptrend, reaching a moderate high.

Head: Price surges to a higher peak, followed by a decline.

Right Shoulder: A lower peak forms, followed by a price breakdown below the neckline (support level).

Reversal confirmation strengthens when combined with technical indicators such as RSI or Moving Average.

Double Top and Double Bottom Patterns Explained

Double Top

Appears after a sustained uptrend.

Two peaks form at similar highs, separated by a slight decline.

Breaks below support level signal bearish reversals, often seen on USD/JPY or GBP/JPY charts.

Double Bottom

Develops post downtrend.

Two troughs form at similar lows.

Breakouts above resistance level point to bullish reversals, especially effective on EUR/GBP or NZD/USD charts.

Triangles and Wedges: Continuation and Reversal Patterns

Triangles and wedges shape how price compresses before breakout moves:

Ascending Triangle: Flat resistance line, rising support—bullish signal.

Descending Triangle: Flat support line, falling resistance—bearish sign.

Symmetrical Triangle: Converging support and resistance, neutral until breakout.

Falling & Rising Wedges: Can indicate reversals depending on the breakout direction, frequently occurring in pairs like USD/CAD.

Flags and Pennants: Trading Breakouts on Forex Charts

Flags and pennants reflect short pauses before price continuation:

Flags: Rectangular channels slanting against the trend, forming after strong moves.

Pennants: Small symmetrical triangles after sharp price shifts.

Common features:

| Pattern Type | Shape on Forex Charts | Signal Type | Common Currency Pairs |

|---|---|---|---|

| Flag | Sloping rectangle opposite trend | Continuation | EUR/USD, USD/CHF |

| Pennant | Small symmetrical triangle | Continuation | AUD/USD, GBP/USD |

| Breakout | Price moves beyond pattern boundaries | Entry opportunity | NZD/USD, EUR/JPY |

Volume typically contracts within the pattern and expands during breakout, signaling strong momentum.

Cup and Handle Pattern: Spotting Bullish Setups

The Cup and Handle pattern reflects accumulation before bullish continuation:

The cup resembles a rounded bottom formed over weeks on Daily or Weekly charts, seen on pairs like GBP/JPY or USD/CHF. After the cup’s completion, a slight downward drift—the handle—develops. A breakout above the handle signals renewed uptrend momentum.

This setup is stronger when accompanied by increasing volume and confirmed by technical indicators such as MACD or Stochastic Oscillator.

Understanding Gaps and Volume in Chart Patterns

Gaps and volume provide context for chart patterns:

Gaps: Sharp price movements creating empty spaces on candlestick charts.

Breakaway Gap: Signals start of a new trend.

Continuation Gap: Confirms ongoing trend.

Exhaustion Gap: Suggests trend reversal.

Volume: Acts as a confirming indicator.

Rising volume during breakouts validates patterns like Head and Shoulders or Triangle.

Declining volume in consolidation phases signals potential pattern formation.

Monitoring gaps and volume on forex charts, particularly across time frames like 1-hour or Daily, sharpens pattern reliability.

Applying Forex Charts to Different Market Conditions

Price action does not occur in isolation. Understanding forex charts requires aligning patterns and indicators with real-time market conditions such as uptrends, downtrends, and consolidation phases.

Using Forex Charts in Uptrend and Downtrend Markets

Markets often swing between clear directional movements, and forex charts reveal these dynamics through price behavior:

Uptrend Market

Price forms higher highs and higher lows.

Trend lines slope upwards.

Moving Averages (SMA, EMA) point northward.

Currency pairs like EUR/USD or AUD/USD show strong bullish momentum.

Downtrend Market

Price sets lower highs and lower lows.

Trend lines slope downward.

Candlestick charts highlight frequent bearish engulfing patterns.

Pairs such as GBP/JPY or USD/CAD often exhibit these characteristics.

Recognizing these conditions helps traders position themselves appropriately, aligning trades with the prevailing trend.

Analyzing Consolidation and Breakouts on Forex Charts

Consolidation phases occur when price action moves sideways, confined within support and resistance zones. Forex charts often display this in narrow candlestick ranges, minimal volume spikes, and flattened Moving Averages.

Breakouts follow consolidation, where price decisively breaches key levels:

| Market Condition | Chart Pattern Appearance | Indicators to Watch | Common Currency Pairs |

|---|---|---|---|

| Consolidation | Horizontal price movement | RSI below 50, Narrow Bollinger Bands | USD/CHF, EUR/GBP |

| Breakout | Strong price candle breaking range | Volume surge, MACD crossover | GBP/USD, NZD/USD |

| False Breakout | Price reverses after breakout | Low volume, quick RSI reversal | USD/JPY, EUR/JPY |

Monitoring forex charts for consolidation and breakout patterns sharpens timing and risk management.

Recognizing Overbought and Oversold Signals

Certain technical indicators highlight overbought and oversold market conditions, crucial for traders using forex charts:

RSI (Relative Strength Index):

Above 70 signals overbought conditions; pairs like USD/CHF often reverse after reaching these levels.

Below 30 suggests oversold markets, signaling potential bullish reversals in AUD/USD or EUR/USD.

Stochastic Oscillator:

Confirms RSI signals; overbought above 80, oversold below 20.

Volume Analysis:

Sharp volume increases in overbought zones can precede price reversals, especially on candlestick charts.

Applying these signals prevents traders from chasing prices at extremes, ensuring decisions remain data-driven across different time frames.

Advanced Forex Chart Strategies for Beginners

Reading forex charts becomes more powerful when various elements—time frames, indicators, currency pairs—are combined into actionable strategies tailored to the trader’s style.

Multi-Time Frame Analysis: Reading Forex Charts Across Time Frames

Analyzing forex charts across multiple time frames enhances clarity and minimizes false signals. For instance:

Step 1: Identify the long-term trend on a Daily or Weekly chart (e.g., EUR/USD, USD/JPY).

Step 2: Confirm medium-term trend direction on a 4-hour or 1-hour chart.

Step 3: Pinpoint precise entry and exit points using 15-minute or 5-minute charts.

This layered approach ensures alignment with broader market conditions while capturing timely trade opportunities. It is especially effective when combined with Moving Averages, MACD, or Bollinger Bands.

Combining Technical Indicators with Chart Patterns

Pairing technical indicators with chart patterns refines decision-making.

Example strategy:

Identify a pattern: Spot a Double Bottom or Head and Shoulders pattern on a candlestick chart.

Confirm with indicators: Use RSI or MACD to validate trend reversals.

Check volume: Ensure increasing volume supports the breakout or breakdown.

Align time frames: Verify the setup across multiple periods (e.g., 1-hour, Daily charts).

This method reduces false signals, making trades more reliable.

Building a Trading Plan Based on Forex Charts

A structured trading plan rooted in forex charts includes:

Entry Criteria: Specific chart patterns like Triangle, combined with Moving Average crossover confirmation.

Stop-Loss Placement: Below support levels or recent lows on GBP/JPY, AUD/USD charts.

Take Profit Targets: Based on Fibonacci retracement levels or prior resistance zones.

Risk Management: Define risk-to-reward ratio, typically 1:2 or 1:3.

Each component keeps emotions in check, ensuring consistency.

Avoiding Common Mistakes When Reading Forex Charts

Many beginners fall into predictable traps:

Ignoring Volume: Trading without analyzing volume leads to false breakouts.

Overloading Indicators: Too many tools clutter the chart and confuse decisions.

Chasing the Market: Entering trades impulsively during volatile moves without confirmation.

Neglecting Time Frames: Focusing solely on 1-minute or 5-minute charts ignores broader trends.

Recognizing these mistakes early builds discipline and sharpens analytical skills.

Adapting Forex Chart Strategies for Different Currency Pairs

Each currency pair behaves differently due to volatility, liquidity, and economic influences. For instance:

| Currency Pair | Typical Volatility | Preferred Chart Types | Recommended Indicators | Optimal Time Frames |

|---|---|---|---|---|

| EUR/USD | Moderate | Candlestick, Line | Moving Average, RSI | 1-hour, Daily |

| GBP/JPY | High | Bar, Heikin-Ashi | Bollinger Bands, Fibonacci Retracement | 15-minute, 4-hour |

| USD/CHF | Low to Moderate | Candlestick, Area | MACD, Stochastic Oscillator | 30-minute, Daily |

| AUD/USD | Moderate | Candlestick, Renko | Trend line, ATR | 1-hour, Weekly |

| EUR/GBP | Low | Bar, Kagi | Ichimoku Cloud, ADX | Daily, Monthly |

Tailoring chart strategies based on the characteristics of each pair sharpens precision and increases profitability.

Conclusion

Understanding how to read forex charts marks a turning point for anyone stepping into currency trading. Each price movement, trend line, and chart pattern carries valuable information about the forces shaping the market. By becoming familiar with various chart types, from candlestick to bar charts, and learning to apply technical indicators like RSI or Moving Averages, traders can transform raw data into clear strategies. Recognizing common chart patterns such as Head and Shoulders or Double Tops and adjusting techniques to suit different market conditions further sharpens trading skills. The ability to interpret forex charts not only improves decision-making but also builds a framework for long-term success in the forex market.

The most popular forex charts used by traders include:

Each chart type offers a different way to visualize price data, with candlestick charts being the most favored due to their detail and clarity.

Candlestick charts

Line charts

Bar charts

Heikin-Ashi charts

Technical indicators are tools layered onto forex charts to help identify market trends, momentum, and potential reversal points. Common indicators like Moving Average, RSI, and MACD analyze past price movements to forecast future behavior, giving traders an edge in decision-making.

Several chart patterns are widely recognized as indicators of possible trend reversals:

These patterns often suggest a weakening of the current trend and the start of a new direction.

Head and Shoulders

Double Top and Double Bottom

Wedge patterns

Cup and Handle

The time frame selected directly influences how price movements appear on forex charts. Shorter time frames like 1-minute or 5-minute charts are ideal for scalping and intraday strategies, while longer time frames such as Daily or Weekly charts are better suited for swing trading and long-term analysis.

Different currency pairs exhibit unique behaviors and volatility patterns. For instance, EUR/USD typically shows smoother price movements, whereas GBP/JPY is known for higher volatility. Understanding the nature of specific currency pairs allows traders to adjust their chart analysis and strategies accordingly.

Recognizing whether the market is in an uptrend, downtrend, consolidation phase, or experiencing a breakout helps traders apply appropriate strategies. Forex charts combined with knowledge of market conditions reveal clearer opportunities and potential risks.

Beginners should pay close attention to several fundamental chart features:

Focusing on these elements simplifies chart reading and provides essential insights into price behavior.

Support and resistance levels

Trend lines

Highs and lows

Volume indicators