Table of contents

Ever placed a trade in Forex, left it overnight, and woke up to find your profit dipped—or surprisingly rose—without touching a thing? That’s the magic (or the mystery) behind what is swap in Forex. In simple terms, it’s a fee or bonus that kicks in when you hold a position past market close. But for many traders, especially beginners, it feels like a hidden charge no one warned them about.

Think of it like keeping a rental car an extra day—you’ll either pay more or get a discount depending on the terms. Forex swaps work the same way, only the “terms” are based on interest rate differences between currencies. As trading expert Kathy Lien puts it, “interest rates are the heartbeat of currency trading.”

If you're trying to cut costs, pick the right broker, or build a strategy that doesn’t quietly bleed money overnight, knowing how swaps work isn’t optional—it’s essential.

1. What Is Swap in Forex?

“Let me ask you this,” says Daniel Cho, a seasoned forex trader and financial analyst at PacificFX. “Have you ever left a forex position open overnight and noticed a small charge—or sometimes a credit—appear in your account the next morning? That is a swap.”

A swap in forex trading refers to the interest paid or earned for holding a currency pair position overnight. This subtle mechanism, tied directly to the interest rate differential between the two currencies in the pair, often surprises newcomers. Whether holding a long position or a short position, traders are either debited or credited based on the central bank rates of the respective countries.

Daniel recalls his early days:

“I once kept a position open over a weekend, thinking nothing of it. Come Monday, I saw a triple swap charge. That was the day I learned about rollover mechanics the hard way.”

Key facts to remember:

Swap charges vary by broker and are recalculated daily.

Rollover occurs automatically when positions cross into the next trading day.

A positive swap rewards you; a negative swap costs you.

The swap calculation depends on currency pair volatility, broker policy, and interest rate movement.

According to data from the Bank for International Settlements, interest rate policy changes directly affect swap values. Several brokers display transparent swap calculators on their platforms, such as IC Markets and Pepperstone, providing real-time insight into swap impacts.

Understanding the swap in forex is not merely technical. It is strategic. As Daniel puts it: “If you are holding trades overnight without knowing your swap exposure, you are trading half-blind.”

2.How Does a Swap Work in Forex?

Swap calculation in forex trading

In Forex trading, a Swap is the fee or credit applied to positions held overnight. It’s based on the interest rate differential between two currencies in a currency pair and calculated using the lot size, swap points, and whether you're holding a long or short position.

To figure out your Swap, brokers typically use this formula:

| Variable | Description | Example (EUR/USD) |

|---|---|---|

| Lot Size | Volume traded | 1 lot (100,000 units) |

| Interest Rate Diff | Central bank rates delta | 1.50% |

| Swap Points | Broker-set daily adjustment | 0.70 |

The final Profit/Loss calculation factors in the bid/ask price and whether you’re gaining or paying interest.

Interest rate role in swaps

Interest rate plays a starring role in the Swap game. When trading Forex, the interest rate differential between two currencies dictates whether you’ll earn or owe a swap.

Traders using the carry trade strategy aim to buy currencies with higher rates and sell those with lower ones. Think of it like earning interest on a savings account—just with way more risk.

“Interest rate decisions by central banks are like weather forecasts for traders—ignore them, and you're probably going to get soaked.” — Lena Walsh, FX Strategist

Overnight positions and swap impact

Hold a position past the rollover time (usually 5 PM EST)? You’re now into overnight position territory—aka Swap time.

The interest rate differential kicks in, either charging you or crediting your account.

Weekend trading? You’ll be charged 3x the swap on Wednesdays to cover Saturday and Sunday.

Even a small position size can impact your margin requirement and eventual profit/loss.

Plan ahead. Or better yet—set a reminder.

3.Types of Forex Swap

Positive swap meaning in forex

A positive swap occurs when traders earn a profit from holding a position overnight. It’s all about interest rate differentials between the two currencies in the pair.

If you hold a long position in a currency with a higher interest rate than the one you’re selling (the short), you might receive a rollover payment.

For example, buying a currency pair where the base currency yields more than the quote currency typically results in a positive swap.

This makes positive swaps an attractive tool in carry trade strategies, where traders aim to collect swap income while waiting for favorable price movement.

What is a negative swap?

A negative swap is when you get charged for holding a position overnight — yep, it's like a sneaky little fee.

Say you're in a trade where the short position earns more interest than your long position. That difference? It’s coming out of your pocket as a swap loss. Even a killer setup can lose shine when negative swaps eat away your profit.

So yeah, even if you’re thinking long-term, don’t forget to check the swap rate before going to bed.

Forex rollover swap explained

Rollover swaps happen when forex traders keep positions open past the trading day’s close (typically 5 p.m. EST). This process moves the trade to the next day — often called "tom-next" (tomorrow–next day).

<1> Interest rate differentials between currencies determine if the rollover results in a fee or a gain.

<2> Rollover is automatic on most platforms but varies in timing and cost.

<3> Spot forex traders experience rollover daily, with Wednesday often applying triple swaps to cover weekends.

Currency pair swap differences

Swap rates differ depending on the currency pair you trade — and it’s not random. The gap between the interest rates of the base currency and quote currency sets the tone.

| Currency Pair | Interest Differential | Swap Outcome |

|---|---|---|

| EUR/USD | -0.50% | Negative swap |

| AUD/JPY | +2.00% | Positive swap |

| USD/TRY | +4.50% | High positive swap |

Major pairs often have lower volatility in swap rates. But when trading exotic pairs, expect the swap to swing hard — either costing you more or paying you more.

4.Swap-Free Forex Accounts

Who needs swap-free accounts?

Swap-free accounts are specifically tailored for Muslim traders who follow Sharia law, which prohibits earning or paying interest (riba). Since regular forex accounts charge or credit overnight swaps, this violates Islamic finance principles.

But religious reasons aren't the only motivator. Some traders simply want to avoid rollover fees due to high swap costs on long-term trades. These accounts are available through many online brokers as Islamic accounts, offering interest-free trading while maintaining access to the global forex trading environment.

Here's a quick breakdown of common users:

| Trader Type | Motivation | Feature Focus |

|---|---|---|

| Muslim Traders | Religious restrictions | No interest charges |

| Long-term Holders | Cost-saving | Avoid rollover fees |

| Ethical Investors | Interest avoidance | Sharia-compliant terms |

Islamic forex trading rules

Islamic forex trading must comply with Sharia law, which means no gambling (maysir), no interest-based profits (riba), and avoiding uncertainty (gharar). This has led to a specific set of forex trading regulations under Islamic finance.

“Halal trading ensures that Muslims can engage in global markets without compromising their beliefs.” — Imran Siddiqui, Islamic finance consultant

That means swap-free accounts must be designed to remove interest completely while still allowing trading on major currency pairs. However, traders should always check for hidden administration fees, which some brokers sneak in to compensate. If it's halal, it must be transparent.

5.Forex Swap Fees Explained

How swap fees are charged

Swap fees are applied when a position is held overnight — this is called rolling over. Here's how they show up:

Based on Currency Pair Interest Differentials: Each pair has two interest rates. The swap fee reflects the difference.

Broker Involvement: The broker adds their commission to the raw swap, which varies across trading platforms.

Fee Timing: Charged automatically at a fixed hour, often around 5 PM New York time.

Also, don’t forget the bid-ask spread and transaction fees — they stack up with swap costs if you're not watching.

Factors affecting swap rates

Interest Rates: Higher interest from one currency means either a reward or a cost.

Central Bank Policy: Moves by the Fed, ECB, or others cause daily shifts.

Market Conditions: Volatility, news, and economic events shake up swap values.

Even the supply and demand in the interbank market can sneak in to tweak your fees unexpectedly.

Broker fee structures compared

| Broker Name | Swap Rate (USD/EUR) | Commission (USD/lot) | Platform Type |

|---|---|---|---|

| BrokerX | -$2.13 | $6.00 | MT4 |

| FXTradePro | +$0.75 | $4.50 | cTrader |

| SwiftMarkets | -$1.60 | $0.00 | Proprietary |

"A clear swap fee model can make or break a strategy," says Dana Roswell, senior analyst at Global FX Insights.

Different account types, minimum deposit, and access to trading tools also influence the financing rates you're dealing with. Choose wisely!

6.Low Swap Forex Brokers

Top brokers with low swap fees

Swap fees can eat into your Forex trading profits, especially if you hold positions overnight. But not all brokers charge the same — and some offer seriously low or even zero swap rates on specific CFD or currency pairs.

ECN Brokers often offer tighter spreads and lower swap fees than standard brokers.

Islamic Accounts or Swap-Free Accounts are excellent for those looking to avoid interest-related costs entirely.

Brokers like IC Markets, Pepperstone, and Exness are frequently praised for their competitive overnight fee policies.

"When you're trading long-term, low swap brokers aren’t just a luxury—they’re a necessity," says Daniel Martins, veteran FX strategist at FXAlpha.

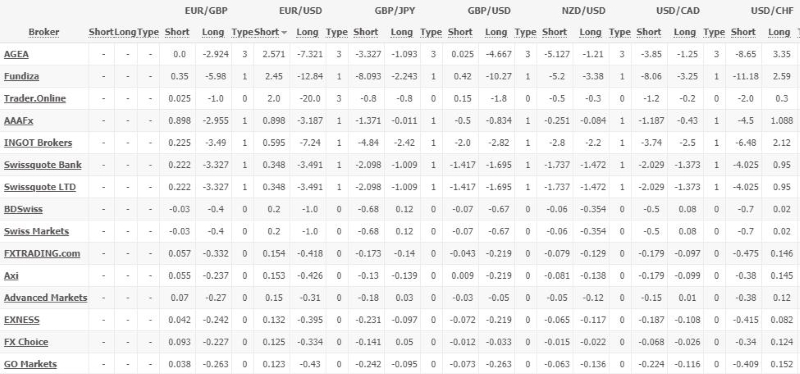

Compare swap costs by broker

Comparing swap costs across brokers is critical — fees vary based on the broker’s liquidity providers, the trading platform, and account type.

Here’s a quick comparison of average overnight swap rates (in USD) for the EUR/USD long position:

| Broker | Swap Rate | Account Type |

|---|---|---|

| Pepperstone | -1.25 | Razor Account |

| IC Markets | -1.10 | Standard ECN |

| Exness | -0.98 | Raw Spread |

Always check rollover fees in your trading platform before holding positions overnight. Even a small difference in swap costs can add up fast over time.

7.Is Forex Swap Profit or Loss?

Swap strategy for long-term trades

If you’re into long-term trades, swaps can make or break your results. Since trades held overnight accumulate swap points, traders targeting larger trends must account for interest rate differentials between currency pairs.

Central banks set interest rates, which impact whether you earn or pay a swap.

Low transaction costs and narrow bid-ask spreads can reduce the burden of swap charges.

Always check for market volatility, which can widen spreads and disrupt plans.

Tip: Pair strong risk management with currency pairs offering favorable swap conditions to maximize profits from carry trades.

When swap becomes a hidden cost

Financing charges sneak in as overnight swaps, especially on high-leverage trades.

Some trading platforms roll over positions with spread markups or hidden commissions.

Margin requirements and large lot sizes amplify the damage if you're unaware.

Think of it as a parking fee for your money — not obvious at first, but it adds up!

Carry trade and swap profit

A classic carry trade takes advantage of the interest rate differential between low-yielding and high-yielding currencies. If done right, the swap profit stacks up while you hold the position.

| Currency Pair | Rate Differential | Swap Profit (per lot/day) |

|---|---|---|

| AUD/JPY | 3.25% | $4.70 |

| NZD/CHF | 2.90% | $4.10 |

| USD/TRY | 4.50% | $5.60 |

Quote: “Carry trades are like renting money—cheap in one place, profitable in another,” — Erik Johansson, FX Strategist.

Avoiding losses from negative swaps

Don’t hold losing trades overnight — especially when interest rates are stacked against you.

Analyze swap points before entering short or long positions.

Apply currency hedging to offset unfavorable swap exposure.

Align your trading strategy with central bank trends to stay ahead.

A bit of smart planning saves a lot of pain. Negative swaps are like little termites — they gnaw at your account if you’re not looking.

Conclusion

Swap in Forex might sound like Wall Street jargon, but it's really just the behind-the-scenes fee—or reward—you get for holding trades overnight. Think of it like paying rent or earning interest while your trade "sleeps." If you're not checking those swap terms before jumping in, you're flying blind—and that’s where traders lose money without even realizing it.

As trading legend Paul Tudor Jones once said, "The most important rule of trading is to play great defense." Knowing how swaps work is a solid step toward protecting your account.

Forex swap refers specifically to the interest rate differential applied when holding a position overnight in forex trading. Currency exchange, on the other hand, is the act of converting one currency into another at the prevailing exchange rate, typically without considering interest implications.

Swap fees are charged to reflect the cost or gain of borrowing one currency and lending another when a position is held overnight. These fees are tied to the interest rate differential between the two currencies in a trading pair.

The interest rate differential between the two currencies

The direction of your trade (long or short)

The lot size and leverage

The broker's markup or adjustment to the swap rate

Yes, certain long-term strategies take advantage of positive swaps:

These strategies rely on holding positions over time to accumulate interest.

Carry Trade Strategy – Buying a high-interest currency against a low-interest one

Swap Arbitrage – Rare but possible with very small or positive swap spreads

Yes, there are ways to avoid swap charges:

Use a swap-free (Islamic) account offered by many brokers

Close trades before rollover time (usually 5 p.m. EST)

Choose brokers that offer zero swap promotions on specific pairs

Triple swap occurs when the broker applies three days’ worth of swap charges or credits in a single day. This typically happens on Wednesday, to account for the weekend when markets are closed but swap interest still accrues.

Most do, but the amount can vary greatly. Some brokers offer zero-swap trading on selected pairs, but generally:

Major pairs and exotics often have higher swap rates

Cross currency pairs may have lower or even positive swaps

Swap rates are updated daily based on interbank interest rates