Many of the current broker website has their own pips calculator that allow you to calculate the requirement for pips and other forex sources.

it is possible for someone who doesn't know what a PIP means in Forex trading to learn and start trading Forex. However, it is important to have a solid understanding of the basics of Forex trading, including the concepts of PIPs, before starting to trade.

A PIP, or "Percentage in Point," is a unit of measurement for the change in value between two currencies. In Forex trading, PIPs are used to determine the profit or loss on a trade. Understanding PIPs is an important part of Forex trading, as it helps traders to determine the potential profitability of a trade and to make informed decisions.

USD/1.0200 CAD)

(The value change in counter currency) times the exchange rate ratio = pip value (in terms of the base currency)

[.0001 CAD] x [1 USD/1.0200 CAD]

Or Simply

[(.0001 CAD) / (1.0200 CAD)] x 1 USD = 0.00009804 USD per unit traded

Using this example, if we traded 10,000 units of USD/CAD, then a one pip change to the exchange rate would be approximately a 0.98 USD change in the position value (10,000 units x 0.0000984 USD/unit). (We use “approximately” because as the exchange rate changes, so does the value of each pip move)

Here’s another example using a currency pair with the Japanese Yen as the counter currency.

GBP/JPY at 123.00

Notice that this currency pair only goes to two decimal places to measure a 1 pip change in value (most of the other currencies have four decimal places). In this case, a one pip move would be .01 JPY.

(The value change in counter currency) times the exchange rate ratio = pip value (in terms of the base currency)[.01 JPY] x [1 GBP/123.00 JPY]

Or Simply

[(.01 JPY) / (123.00 JPY)] x 1 GBP = 0.0000813 GBP

So, when trading 10,000 units of GBP/JPY, each pip change in value is worth approximately 0.813 GBP.

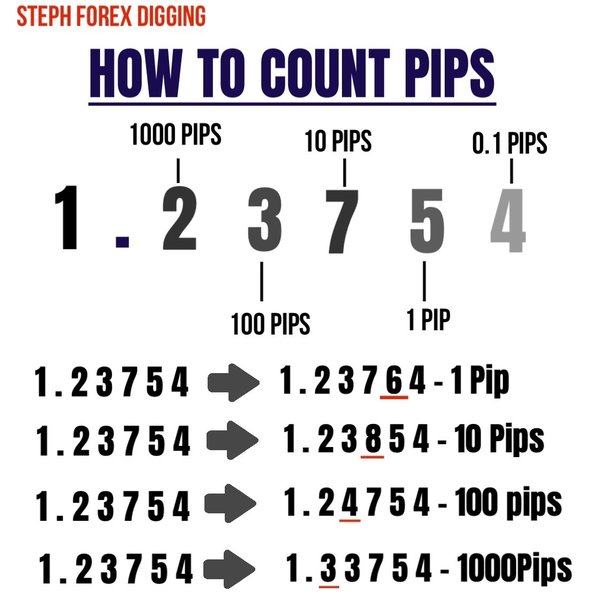

Here's a pictorial illustration on how to calculate pips in forex.

Note this doesn't apply to JPY pairs