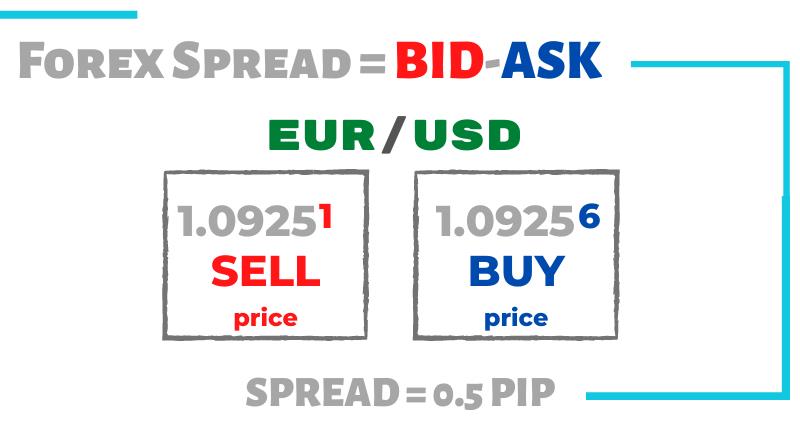

In Forex trading, or any other financial market, the spread refers to the price difference, quoted by a broker, between the sell (Bid) and the buy (Ask) prices of a currency pair.

KEY TAKEAWAYS

Spread is a type of transaction cost

Due to the spread, each trade will always start with a loss

Spread is the difference between the sell and buy prices

Investors buy an asset at ask price and sell at bid price

Table of Contents

Spread in Trading

Forex Spreads

Bid Ask Spread

Trading With Spreads

Fixed Spreads Forex Brokers

Variable Spreads Forex Brokers

ECN Brokers: Lower Spreads, But...

Spread in Trading

The spread in CFDs trading represents the difference between the Buy and Sell prices, or in technical terms, the Bid and Ask prices.

At the same time, the spread measures the fee charged by the CFDs brokers, which is applied to the trade when opening a position. The spread in trading can be very narrow, as an example the EUR/USD pair, is often quoted by several brokers with a 0-pip spread, or very wide, for example for the BTC/USD, due to its volatility.

We pointed out that the spread in trading also represents the broker's fee. In fact, while traditional brokers, or investment banks, charge commissions for buying and selling operations, online CFDs trading brokers charge the spread, measured in pips.

It is therefore a trading cost that the trader has to take into account, regardless if investing in stocks via the local bank, or trading CFDs with an online broker.

Needless to say, the lower the spread applied to an asset, the cheaper it is to trade it. In online Forex CFDs trading, the higher the spread, the higher the percentage that the broker retains on the trade when it is opened.

The spread in trading varies depending on the financial instrument category. Most brokers will price their spreads differently for commodities, stocks, indices, FX and crypto currencies.

Also, the spread in trading, varies according to an asset’s volatility. This applies both in general, depending on the type of instrument, and specifically, depending on the moment.

For example, at a time of more volatility in a particular asset, caused by high impact news announcements, the broker may decide to increase the spread for that instrument.

The reason behind this practise is because, since a trader's profit comes from the price variations, the greater and stronger these variations are, due to the volatility, theoretically, the greater the trader’s profits can be (also the losses).

Spreads in trading can also widen when the opposite happens, when liquidity and volatility are very low, especially at the beginning of a daily session. As the markets are not pulling any interest from investors, brokers widen the spreads, to cover their costs.

As far as the various asset classes are concerned, the lowest spreads in trading are generally applied to Forex CFDs, and in particular to the Euro-US Dollar currency pair, as it is the most liquid pair and competition amongst brokers is higher.

Forex Spreads

As we saw above, Forex spreads are a transaction cost applied by the broker, also part of their revenue. Forex spreads are measured in pips (percentage in point), the smallest price change a currency pair can make.

Depending on the currency pair, 1 pip is one basis point (0.0001) for all the currency pairs that do not include the Japanese Yen, such as the EUR/USD or the USD/CHF. A EUR/USD quote could look like 1.1994.

For the base currencies traded against the Japanese Yen, 1 pip is .01, such as the USD/JPY or the CHF/JPY. A USD/JPY quote could look like 105.26.

Several online CFDs brokers will display their quotes in a 5-digit format. With the 5-digit pricing, the EUR/USD quote would look like 1.19945 and the USD/JPY quote 105.265. These fractions of a pip are often referred to as “pipettes”.

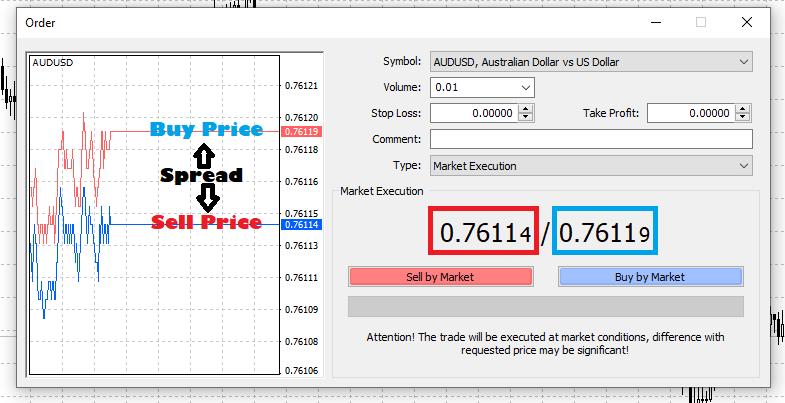

Forex brokers will quote two different prices for a currency pair, on their trading platforms. A price for buying and a price for selling.

For example, regarding the EUR/USD CFD contract, the prices displayed could be: Sell 1.19945 and Buy 1.19950, meaning that the EUR/USD spread would be 0.5 (half a pip).

In the rare case of a 4-digit FX broker, the prices quoted could be Sell 1.1994 and Buy 1.1995, meaning that the EUR/USD spread would be 1 pip.

Forex spreads is how the “no commission” brokers make their profits. Instead of charging an extra commission for doing the trade, these brokers add that cost into the quoted prices.

But not only the “no commission” brokers. The ECN trading style brokers, although charging a trade commission, also charge spreads, still, slightly lower that the other type of brokers.

Basically, Forex spreads is how brokers make money, in two similar ways:

By selling a quoted currency to traders for a higher price than what they bought it for.

By buying a base currency from traders for a lower price than what they will sell it for.

This difference is the Forex spread.

Bid Ask Spread

The bid-ask spread is the difference between the buy and sell prices of a security. The bid price is the price at which buyers are willing to buy a financial instrument. The ask price is the price at which sellers are willing to sell a financial instrument.

The ask price (also known as the offer price) is always higher than the bid price. Investors looking into buying a security, or a CFD product, will always buy at the lowest ask price. Investors looking into selling a security, or a CFD product, will always sell at the highest bid price. The best bid is the highest bid price available on the market. Similarly, the best ask is the lowest ask price on the market.

A market quotation can shows the best bid and best ask available on the market, known as a BBO (Best Bid and Offer). In this case, the bid-ask spread is the difference between the best ask and the best bid available on the market.

Regarding the dealer's operations, the bid-ask spread is the gross profit margin of that intermediary, if trading securities belonging to its own portfolio, also known as inventory, or if it's an intermediary dealer, requoting prices from a liquidity provider, and adding them to its margin. Just like an online Forex CFDs broker will do.

Concearning investors, the bid-ask spread represents an implicit transaction cost, which differs from the main explicit transaction cost, such as the commission paid to the dealer/broker for making the trade.

The concept of the bid-ask spread is also applicable to other markets, and is thus the difference between the best bid and the best offer in the market.

Trading With Spreads

There are advantages and drawbacks with both types of brokers.

There are dozens of fixed spread brokers out there, and a few with a fixed spread as low as 1 pip on EUR/USD. The advantage of this setup is obvious: traders feel that they can retain the fixed low spread all the time, even during times of market volatility such as during a high impact news event, where variable spread brokers might increase the spread to offset the volatility risk.

Fixed Spreads Forex Brokers

Traders may even get the fixed low spread during low liquidity periods such as the Asian session, where variable spread brokers typically increase the spread to offset the liquidity risk.

However, some fixed spread brokers will quote wider spreads during quiet periods such as during the Asian session (e.g., if they are 2 pips on EUR/CHF during the day, they are 4 or 5 pips during the night), and also during news announcements.

If fixed brokers change the spread during night or news, they will warn about it on their website. Every serious shakeout in the market: news, economic shifts or other global events will immediately cause fixed spreads to expand unless a broker promises to never widen a spread.

If you are interested in fixed spread brokers, check the broker's spread policy before you sign up for an account.

Variable Spreads Forex Brokers

Lately, there has been a rising number of variable broker spreads. Variable spreads can be costly. Variable spreads will vary depending on the market volatility and liquidity. Higher volatility — higher spread, lower volatility — lower spread.

Under the normal course of the day, a currency pair might have normal volatility and thus spread remains fixed, but when volatility increases due to news or geopolitical events, the spread can be increased, perhaps going from a 1-pip spread to 3-4 pip spread, or even 10 pip spread if the news event is powerful enough. At the same time: higher liquidity – lower spreads, lower liquidity – higher spreads.

The EUR/USD is a good example of a higher liquidity currency that also has lower spreads (sometimes around 0.5 spread), and the EUR/AUD is an example of a currency pair with lower liquidity and higher spread (often around 2 pip spread).

Be on guard against the spread bait of “as low as” spread (e.g., GBP/USD spread “as low as” 1 pip) to lure traders into such a bargain. Whilst these “as low as” spreads might be surprisingly low; you will probably never end up trading with these spreads because they will happen for a couple seconds in a 24-hour period.

Instead of looking at the “as low as” spread, focus instead on the “typical” spread reading, sometimes posted by the broker themselves. The “typical” spread reading should be good most of the time, but sometimes the definition of typical can be vague.

Better yet, try to get an average spread. It is much fairer because it takes into consideration every pip fluctuation throughout the trading day. Few brokers display average spread pricing, so it is a good idea to plot the average spread with the tools and websites posted above.

ECN Brokers: Lower Spreads, But...

Some brokers, called ECN brokers (Electronic Communication Network), collect the best price feeds from a few investment banks and attempt to show the very best bid or offer.

They also charge a commission instead of marking up the raw spread in order to let their clients trade on prices closer to the bank’s own price. Thus, the foremost advantage of trading with an ECN broker is the noticeable spread difference. But there is a catch (see note below).

Note: With ECN broker one must factor in the spread cost in addition to the commission, though the spread + commission might be lower than what is the spread of a typical Market Maker Broker or many Straight Through Processing (STP) Brokers.

Moreover, there is a second advantage. Throughout volatile times (or low liquidity periods) an ECN Forex broker will try to show the very best price obtainable, instead of marking up a spread to offset risk.

The disadvantage with ECN brokers is that you can be deceived into thinking that you have a low transaction cost when in fact you might have the same or higher than other brokers. Since we have all been trained to look at the spread, we may be tempted to go with the ECN broker with the lowest spread.

However, the commission cost added to each trade can make an ECN broker much less attractive than some of the more competitive STP Brokers that have low spread without commission.

For instance, you might see that an ECN broker has a spread of 0.5 on EUR/USD, but when it also adds a commission of $6 per 100,000 lot, then you are in effect trading with a broker that has a 1.1 pip transaction cost.

It is thus imperative if you are searching for a good ECN broker to investigate both the average spread and the commission cost, and add them up.

Sometimes the search can pay off: there are some good ECN Forex brokers out there that do in fact have the best transaction costs (spread + commission) in the forex business.