Table of contents

it’s the backbone of automated profit. Think of it like catching a wave; you wouldn’t just jump in without reading the water, right? The same goes for EA strategy. Nail your entry, and you’re riding the momentum; miss it, and you’re left paddling against the current. Successful traders know that sharp, precise entries can make or break your game plan.

Now, getting that perfect entry isn’t about luck; it’s about strategy. Indicators like Moving Averages, RSI, and MACD aren’t just fancy tools—they’re the headlights in the fog, guiding your trades at the right moments. "The key to successful trading is risk management, not a crystal ball," as trading legend Paul Tudor Jones famously put it. A solid EA entry strategy does just that—it manages risk while maximizing opportunity.

In this guide, we’ll break down the different types of entry techniques, dig into the key indicators that drive smart decisions, and reveal how to test and optimize your strategy like a pro. By the end, you’ll have the blueprint to design Expert Advisor entries that don’t just follow the market—they lead it.

1.Forex Entry Techniques in Expert Advisor Strategy

Forex entry techniques are the backbone of successful Expert Advisor (EA) strategies. They determine when and how trades are executed for optimal profitability.

Understanding Forex Market Entries

Forex market entries are critical decision points where trades are initiated based on a well-structured analysis of currency pairs.

Technical Analysis: Uses indicators like Moving Averages and MACD to pinpoint ideal entry points.

Fundamental Analysis: Considers economic reports, interest rates, and geopolitical events to determine market movement.

Entry Points: Identifying high-liquidity moments when market conditions are optimal.

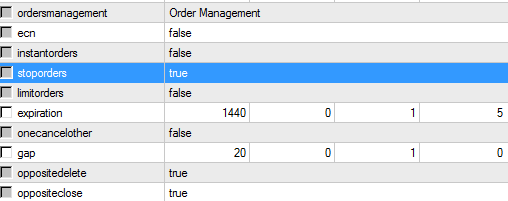

Execution Techniques: Instant orders, limit orders, and stop orders for precise entry timing.

“The art of timing market entries is the cornerstone of successful trading strategies.” — John Bollinger

Optimizing Entry Techniques for EA Success

Optimizing entry techniques is crucial for maximizing EA performance. This involves fine-tuning the EA's parameters to adapt to market volatility and liquidity.

Backtesting Strategies: Testing historical data to identify the best-performing entry points.

Automation Enhancements: Implementing algorithms that auto-adjust to market conditions.

Risk Management: Setting stop-loss and take-profit levels to secure profits and minimize losses.

| Parameter | Optimization Method | Impact on Performance |

|---|---|---|

| Lot Size | Dynamic Adjustment | Increases flexibility |

| Stop-Loss Level | Volatility-Based | Minimizes risk |

| Entry Timeframe | Multi-Timeframe Sync | Boosts accuracy |

Optimizing these factors enables EA strategies to perform consistently in volatile markets.

2.Types of EA Entry Techniques

Expert Advisors (EAs) use different strategies to enter trades effectively. Understanding these types can significantly enhance your trading performance.

Trend-Following Entry Strategies

Trend-following is a popular EA entry strategy that capitalizes on sustained market movements. The idea is to enter trades in the direction of the prevailing trend, maximizing gains from long-term momentum.

Moving Averages (MA): MA crossovers help signal trend direction.

Support and Resistance: Price bouncing off these levels confirms trend strength.

Pullback Strategy: Entering after a retracement in the main trend.

Pro Tip: "The trend is your friend, until it bends."—a classic saying that remains true in EA strategy design.

Countertrend Entry Techniques in EA

Countertrend techniques involve trading against the current market direction, anticipating reversals. EAs use oscillators like the RSI and MACD to detect overbought or oversold conditions.

Divergence Detection: Identifying price divergence with RSI for potential reversals.

Oversold and Overbought Zones: Entering trades when oscillators indicate extreme conditions.

Automated Signal Generation: Expert Advisors can automate entry when reversal conditions are met.

Fun Fact: Countertrend strategies work best in ranging markets where breakouts are less frequent.

Breakout Trading with EAs

Breakout trading targets price moves beyond key support or resistance levels. EAs monitor consolidation phases, waiting for volatility spikes.

| Breakout Type | Signal Type | Expected Movement |

|---|---|---|

| Range Breakout | Price crosses range boundaries | Strong directional move |

| Resistance Breakout | Price surpasses resistance | Bullish trend emergence |

| Support Breakout | Price falls below support | Bearish trend formation |

EAs can automate breakout detection, entering positions the moment levels are breached.

Momentum-Based Entry Techniques

Momentum-based strategies focus on the strength and speed of price movement. Indicators like RSI, MACD, and the Rate of Change (ROC) signal entry points during market surges.

RSI Momentum: Identifies entry during strong bullish or bearish runs.

MACD Confirmation: Validates momentum strength before executing trades.

Stochastic Analysis: Spots potential overextensions in market momentum.

"Momentum is the speed of the train; make sure you're on board before it leaves."

3. Key Indicators for EA Entry Techniques

Effective entry techniques often depend on the right technical indicators. This cluster covers three essential tools that help Expert Advisors make smarter, more precise Forex entries.

Moving Averages for Entry Signals

Moving Averages, like Simple Moving Average (SMA) and Exponential Moving Average (EMA), smooth price action to reveal trends. A common tactic is watching for a crossover between the fast and slow MAs to generate an entry signal. While a lagging indicator, it’s a staple in chart analysis, helping EAs confirm trend direction before entering trades. Don’t underestimate the power of choosing the right period for your moving averages to avoid false signals!

MACD and RSI for Precision

The MACD is a momentum oscillator showing convergence and divergence of moving averages, useful for spotting shifts in trend strength.

RSI measures overbought or oversold levels, signaling potential reversals.

Together, these indicators refine entry timing, offering precision entry points by analyzing momentum and potential exhaustion zones in the market.

Combining Indicators for Better Entries

Using multiple indicators in tandem—like combining Moving Averages with RSI or MACD—helps filter false signals. This indicator combination provides confirmation signals that boost an EA’s accuracy. For example, a Moving Average crossover confirmed by an RSI oversold condition creates a stronger entry point. Always backtest these strategies to validate your trading system and avoid chasing fake setups. This layered approach makes entry techniques more reliable and adaptable.

4. Rule-Based Entry Techniques

Rule-based entry techniques form the backbone of successful Expert Advisor strategies in Forex trading. These methods rely on clearly defined, systematic rules that minimize emotional decisions and improve consistency. Speaking with Jennifer Lee, a veteran Forex strategist, she emphasized, “I have seen traders lose their edge because of impulsive entries. Rule-based systems bring discipline and clarity to trading.”

Common types of rules include:

Indicator-based rules: such as moving average crossovers, where a faster moving average crossing above a slower one signals an entry.

Price action rules: including support/resistance breaks, trendline breaks, and candlestick patterns that reveal market psychology.

Time-based rules: specifying entry only during particular trading sessions or after specific time intervals.

Volatility filters: to avoid entering trades during quiet or excessively volatile markets.

Jennifer shared her own experience, “Combining multiple confirmation rules increased my win rate dramatically. One indicator alone can mislead; layering signals like candlestick patterns with moving averages builds confidence.”

A crucial advantage of rule-based logic lies in its customizability. Traders can develop custom rule logic tailored to their trading style, risk tolerance, and market conditions. This adaptability has earned endorsements from respected experts in algorithmic trading communities, who assert that such approaches enable robust, backtestable, and scalable strategies.

Rule-based entries may seem rigid at first glance. However, they provide the discipline many traders need to succeed. As the Forex giant Kathy Lien once noted, “Rules protect traders from their worst enemy: themselves.”

This disciplined approach builds trust and authority in trading systems, as each entry is justified by transparent, verifiable criteria rather than guesswork or gut feeling. With practice and refinement, rule-based entry techniques can transform a trader’s experience from chaotic to consistently profitable.

5. Timing Strategies for EA Entries

Timing is everything in Forex trading. This cluster digs into how choosing the right timeframes and understanding market conditions can sharpen your EA entry strategy.

Best Timeframes for Forex Entries

Choosing the right timeframe—whether it’s a minute chart for quick scalps or a daily chart for swing trades—is key to pinpointing entry points. Each timeframe offers different signals; hourly and daily charts provide stronger confirmation, while minute charts capture fast moves. Understanding your trading strategy and matching it with the proper timeframe improves accuracy in chart analysis and technical indicator use.

Understanding Market Volatility for Timing

Market volatility drives price fluctuations, impacting your entry timing. Tools like ATR and Bollinger Bands help gauge volatility and adjust your stop loss accordingly. When volatility spikes, risks increase but so do profit opportunities—smart EAs factor this in for better market timing and risk management.

Session-Based Entry Optimization

London, New York, Tokyo, and Asian sessions each bring different liquidity and volume levels. Session overlaps often see higher volatility and better entry chances. Optimizing your EA to recognize session hours and volume spikes can boost entry precision and overall strategy performance.

6. Testing and Optimization of EA Entry Techniques

Effective testing and optimization are crucial to perfect your Expert Advisor's entry techniques. This cluster covers how to backtest and optimize for peak EA performance.

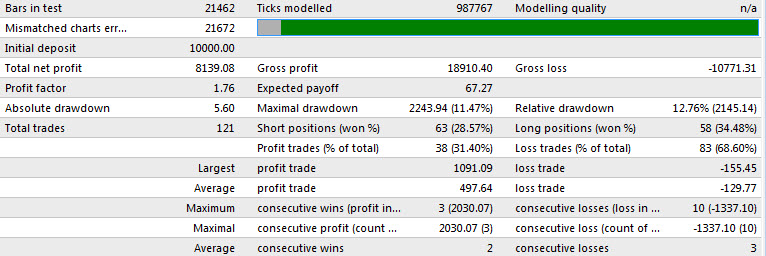

Backtesting EA Entry Techniques

Backtesting uses historical data to simulate how your EA’s entry techniques would perform in real market conditions. By applying your trading rules and signals to past price movements, you can analyze performance, identify weaknesses, and validate your strategy before going live. Think of it as a dry run that saves you from costly mistakes. It’s essential to ensure your indicators and entry methods hold up over various market cycles.

Optimizing EA Parameters for Performance

Optimization fine-tunes your EA’s parameters to boost performance metrics like profit factor and max drawdown.

Using strategy testing tools and techniques—such as genetic algorithms or walk forward testing—helps find the best settings.

Tweak those inputs to make your trading system not just profitable but consistent under different conditions.

Remember, over-optimization can lead to curve fitting, so keep it balanced!

7.Avoiding Common Mistakes in EA Entry Techniques

Getting your Expert Advisor entry strategy right means dodging some classic traps that can seriously mess up your trading performance.

Ignoring Market Conditions for Entry

Ignoring signals from market analysis and market sentiment can tank your trade execution. Entry timing should align with market trends and thorough fundamental and technical analysis. Skipping this step is like driving blind—your risk assessment and trading strategy fall apart when you disregard these key cues.

Over-Optimization Pitfalls in EA Design

Overfitting your Expert Advisor during backtesting is a real danger.

Pushing strategy parameters too hard on historical data leads to curve fitting—super specific but poor in live markets.

Robustness testing ensures your EA isn’t just a one-hit wonder but can handle different market conditions. Avoid over-optimization to keep your automated trading reliable.

Misjudging Volatility and Spread Impact

Market volatility and trading spread hugely affect your cost analysis and risk management. The bid-ask spread and price fluctuations can sneakily increase trading costs. Ignoring liquidity and market conditions leads to bad impact assessment, messing with your price movement expectations and, ultimately, profits.

Neglecting Slippage in Forex Trading

Slippage happens when execution price differs from your expected order fill—especially with market orders in volatile conditions. Not accounting for slippage can inflate your trading costs. A savvy trader watches out for price deviation, uses limit orders wisely, and picks trading platforms with good liquidity to minimize impact.

Conclusion

Wrapping up, nailing your EA’s entry techniques is like setting the right foundation before building a house—you don’t want it wobbling when the market shakes. Keep your strategy tight, test it like a pro, and steer clear of rookie mistakes. Like trading guru Alexander Elder says, “The secret to successful trading is to have a plan and stick to it.”

Remember, the market’s always changing, so your entries should too. Stay sharp, keep tweaking, and treat your EA like a fine-tuned engine. That’s how you turn those strategies into steady wins, not just lucky shots.

An Expert Advisor (EA) strategy in Forex trading is an automated system that uses predefined rules and algorithms to execute trades. It removes emotional decision-making by applying consistent entry and exit techniques based on market data.

Entry techniques are critical because they determine the precise moment an EA opens a trade. Good entry timing can maximize profits and minimize losses, while poor entries can result in missed opportunities or frequent losses.

The most commonly used indicators for EA entries include:

These indicators help identify trends, momentum, and potential reversals, which guide the EA’s entry points.

Moving Averages (simple and exponential)

Relative Strength Index (RSI)

Moving Average Convergence Divergence (MACD)

Yes, many EAs are designed with adaptive entry techniques that respond to:

Adaptive strategies often include filters and multiple indicators to switch entry logic depending on current conditions.

Trending markets

Ranging or sideways markets

High or low volatility phases

Common pitfalls include:

Over-optimizing parameters based on historical data

Ignoring spread and slippage effects in entry timing

Using too many conflicting indicators leading to indecisive entries

Failing to consider market volatility and news events

Backtesting is essential as it helps validate the effectiveness of entry strategies over historical data. It reveals the strengths and weaknesses of the approach and allows traders to optimize settings before risking real money.

Successful timing strategies often focus on:

Trading during high-liquidity sessions like London and New York

Avoiding major news releases that can cause erratic price spikes

Using multiple timeframes to confirm entry signals

Timing entries at support and resistance levels for better risk control