Table of contents

Part 1 - What is an Expert Advisor (EA) in Forex Trading?

Part 2 - Key Components of a Successful EA Strategy

Part 3 - How to Optimize an EA Setup for Maximum Profitability?

Part 4 - Backtesting and Forward Testing of EA Strategies

Part 5 - Risk Management Techniques for Expert Advisors

In the world of Forex trading, having a reliable strategy can make or break your game. That's where an Expert Advisor (EA) comes into play. In this guide, Expert Advisor Strategy Design: How to Optimize an EA Setup, we’ll cut through the noise and get straight to what really matters—building and fine-tuning an EA that actually works. Think of your EA as your trading sidekick—smart, quick, and always on the lookout for the best moves, but only if it’s set up right.

To make your EA strategy rock-solid, you need more than just a basic setup. We're talking key components, smart optimization techniques, and efficient risk management. You’ll also learn how to backtest your setup to see how it would have fared in the past. As trading pro Jack Schwager once said, “The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money.” The same rule applies to EAs—it's all about a disciplined and methodical approach.

By the end of this guide, you’ll know how to create an EA strategy that doesn’t just look good on paper but also performs well in the real world. No more guessing—just straightforward methods that keep your trading smooth, efficient, and profitable. Let’s get started.

1.What is an Expert Advisor (EA) in Forex Trading?

When traders discuss automating their strategies in the Forex market, the term Expert Advisor (EA) often takes center stage. An EA is a form of automated trading software specifically designed to perform trading actions based on predefined algorithms. These programs are typically developed for the MetaTrader platform, which is one of the most widely used trading platforms in the world. With EAs, traders can execute trades without manual intervention, allowing for faster decision-making and elimination of emotional bias.

To understand the full impact of EAs in Forex trading, it is crucial to explore the core components that make them powerful. An EA is coded to follow specific rules that determine entry and exit points in the market. These rules are based on technical indicators, price movement analysis, and sometimes complex mathematical formulas. This automation is what makes EAs incredibly effective in executing strategies with precision and consistency.

The Advantages of Expert Advisors

24/7 Market Monitoring: Unlike human traders, EAs can monitor the Forex market continuously without fatigue.

Emotion-Free Trading: Decisions are made strictly based on data and logic, not human emotions.

Backtesting Capabilities: Traders can backtest strategies on historical data to understand potential performance.

Instant Execution: Orders are executed at lightning speed, minimizing slippage.

Famed trading expert Alexander Elder once remarked, “The best trader is not a human—it is a well-coded algorithm. It does not get tired, does not get greedy, and does not get scared.” This perspective is precisely why EAs are highly regarded in the Forex community.

How Expert Advisors Operate in MetaTrader

The EA is attached to a trading chart on the MetaTrader platform.

It automatically scans for trading opportunities based on its programmed strategy.

Once the conditions are met, the EA places orders and manages them without human intervention.

Traders can customize the EA to handle risk management, including stop-loss and take-profit orders.

The flexibility of EAs allows traders to pursue strategies that would be impossible through manual trading. Whether executing complex scalping strategies or managing long-term positions, an EA acts with the precision of a machine, driven by data and devoid of hesitation.

As a Forex robot, an EA is the embodiment of algorithmic logic translated into trading action. With the right setup, it can be a powerful ally for traders seeking consistent performance in volatile markets.

2.Key Components of a Successful EA Strategy

Building a successful EA strategy requires understanding key components that enhance trading efficiency and profitability. Let’s dive into the essentials.

Forex Trading Indicators Explained

Forex trading indicators are the backbone of any Expert Advisor (EA) strategy. They analyze past and present price data to forecast market movements. Here are some must-know indicators:

Moving Average (MA): Smooths price data to identify trends.

RSI (Relative Strength Index): Measures market overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): Detects changes in strength, direction, and duration of trends.

Bollinger Bands: Tracks volatility and possible price breakouts.

Ichimoku Cloud: Shows support, resistance, and trend direction.

Fibonacci Retracement: Pinpoints potential reversal levels.

Chart Patterns: Recognize common formations like head and shoulders.

Pro Tip: Combine multiple indicators for a more comprehensive analysis.

Strategy Logic for EA Performance

An Expert Advisor (EA) strategy relies on logic to make trading decisions. Defining clear and effective logic is crucial for EA performance.

Trading Strategy Design: Outline the primary logic—trend-following, scalping, or breakout.

Algorithm Development: Translate strategy logic into executable code.

Backtesting Accuracy: Validate the logic using historical data to ensure reliability.

Performance Metrics: Use metrics like drawdown, profit factor, and win rate to evaluate efficiency.

Risk Management Rules: Set stop-loss and take-profit parameters to minimize loss.

Expert Insight: "An EA without clear logic is like sailing without a compass." - Tom Broker, EA Developer

Market Conditions and EA Adaptation

Adapting an EA to fluctuating market conditions ensures consistent performance. Market conditions can shift from trending to ranging, requiring flexible EA setups.

Key Market Conditions:

Trend: Prices move in a single direction—bullish or bearish.

Range: Prices fluctuate between support and resistance.

Sideways Market: Minimal price movement, low volatility.

High Volatility: Sudden, sharp price movements.

Economic Events: News or data releases impacting the market.

EA Adaptation Techniques:

Dynamic Parameters: Adjust lot size and stop-loss based on volatility.

Market Regime Detection: Use trend indicators to identify prevailing conditions.

Robustness Testing: Simulate different scenarios to ensure EA adaptability.

EA Parameter Adjustments by Market Condition

| Market Condition | Key Indicator | EA Adaptation Approach |

|---|---|---|

| Trending | Moving Average (MA) | Increase trade duration |

| Ranging | Bollinger Bands | Tighten stop-loss range |

| High Volatility | ATR (Average True Range) | Reduce lot size |

| Sideways | RSI (Relative Strength) | Limit trade frequency |

Quick Tip: Keep EAs flexible to switch strategies based on real-time conditions.

Incorporating well-chosen Forex indicators, structured strategy logic, and adaptive features will significantly enhance EA performance, making it resilient in various market conditions.

3.How to Optimize an EA Setup for Maximum Profitability

Optimizing an EA setup can significantly boost trading profitability. The key lies in selecting the right parameters, using effective techniques, balancing risk and reward, and avoiding overfitting.

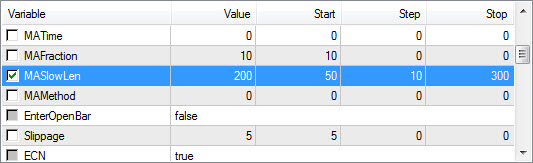

Choosing the Right EA Parameters

Picking the correct parameters is crucial for effective EA performance. Tuning variables like lot size, stop loss, and take profit can significantly affect results. Parameters should align with the chosen strategy and market conditions.

Start with broad parameter ranges during backtesting.

Use historical data to fine-tune settings for optimal results.

Regularly update parameters based on market changes.

Pro Tip: Prioritize simplicity in your configuration – overly complex setups often lead to inconsistent results.

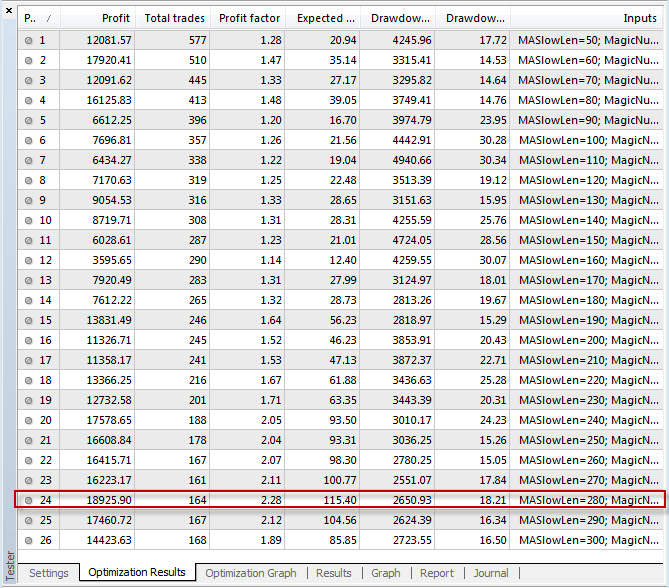

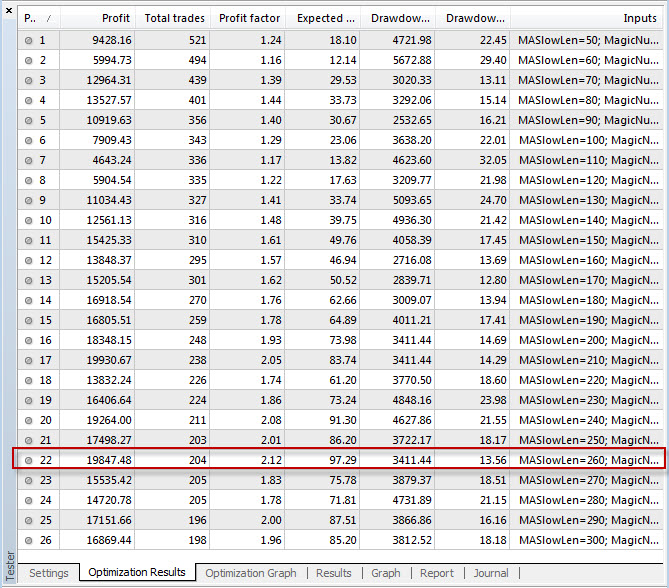

Optimization Techniques for EA Profitability

There are several techniques to maximize profitability, including parameter optimization, walk forward analysis, and drawdown minimization.

Parameter Optimization: Test various combinations to find the most effective setup.

Walk Forward Analysis: Validate the strategy by splitting data into in-sample and out-of-sample sets.

Equity Curve Smoothing: Minimize fluctuations for consistent growth.

Drawdown Control: Identify and eliminate high-risk configurations.

Expert Insight: "Optimization isn't just about finding profitable setups – it’s about ensuring stability over time." – Alex Moore, Forex EA Developer

Balancing Risk and Reward in EA

Balancing risk and reward ensures sustainable trading. Over-leveraging or poor risk management can wipe out profits in no time.

Set realistic stop loss and take profit ratios.

Adjust position sizing based on market volatility.

Monitor equity drawdowns and make adjustments when necessary.

Incorporate volatility-based risk metrics to manage uncertainty.

Example Risk-Reward Settings

| Setting | Risk Level | Potential Reward |

|---|---|---|

| Low Volatility | 1% | 2% |

| Medium Volatility | 2% | 4% |

| High Volatility | 3% | 6% |

Avoiding Overfitting in EA Strategies

Overfitting is a common pitfall in EA design. It occurs when the strategy is too tailored to historical data, lacking robustness.

Use Forward Testing: Avoid relying solely on backtesting.

Data Segmentation: Test on multiple data sets to check consistency.

Simplicity Matters: Too many variables increase overfitting risk.

Generalization Techniques: Ensure the EA adapts to changing market conditions.

Remember, it's not just about winning historically – it's about performing well in real-time!

Mastering EA optimization requires a balance between precision and adaptability. By carefully selecting parameters, using robust optimization techniques, balancing risk and reward, and avoiding overfitting, traders can enhance EA profitability while minimizing risks.

4.Backtesting and Forward Testing of EA Strategies

Backtesting and forward testing are essential for validating the effectiveness of an EA strategy. Here’s how to make the most of each method.

Effective Backtesting Methods for EAs

Backtesting is like giving your Expert Advisor (EA) a practice run using historical data. It’s essential to ensure your trading strategy performs well before going live.

Data Quality Matters:

Use high-quality, tick-by-tick data to minimize inaccuracies.

Poor data can lead to skewed results and overfitting.

Simulation Techniques:

Utilize both simple and advanced simulation methods.

Consider walk-forward analysis to test adaptability.

Performance Metrics:

Key metrics include profit factor, drawdown, and Sharpe ratio.

Avoid over-optimizing for one metric; balance is key.

Quote:

"Backtesting is not about predicting the future; it's about testing your strategy under controlled conditions." – John Carter, Forex Analyst

Forward Testing for Real-World Accuracy

Unlike backtesting, forward testing uses live data to evaluate the EA’s performance in real trading environments. This is where the strategy meets reality.

Demo vs. Real Account:

Start with a demo account to observe behavior without risking capital.

Transition to a real account when confident.

Monitor Key Factors:

Keep an eye on slippage and latency, especially with volatile pairs.

Broker differences can significantly affect performance.

Validate Consistency:

Regularly compare forward test results with backtest outcomes.

Adapt the strategy if discrepancies arise due to changing market conditions.

Comparing Backtesting and Forward Testing

| Testing Type | Data Source | Environment | Accuracy Level | Key Challenge |

|---|---|---|---|---|

| Backtesting | Historical Data | Simulated | Moderate | Overfitting |

| Forward Testing | Live/Real Data | Real Trading | High | Market Volatility |

By combining backtesting and forward testing, traders gain confidence in their EA’s ability to adapt to both historical and live trading conditions. Balancing both methods is key to maintaining a robust trading strategy.

5.Risk Management Techniques for Expert Advisors

Managing risks effectively is crucial for successful EA trading. This chapter covers strategies to control losses, manage leverage, and recover from drawdowns.

Setting Stop Loss and Take Profit

Stop loss and take profit are vital for controlling risks in EA trading. Setting them at appropriate price levels ensures that trading orders execute automatically to minimize losses or secure gains.

Stop Loss: Sets a predefined loss limit.

Take Profit: Locks in profits when the market price hits the target.

Trailing Stop: Adjusts as the market price moves favorably.

Tip: Combine trailing stops with limit orders for dynamic risk management.

Leverage Management in EA Trading

Leverage can amplify both gains and losses in automated trading. Managing leverage in EA trading requires careful consideration of risk exposure and account balance.

Position Sizing: Calculate risk per trade to maintain balanced leverage.

Margin Management: Monitor account balance to avoid margin calls.

EA Settings: Configure leverage settings according to trading capital.

Risk Per Trade: Keep it below 2% to maintain stability.

| Risk Level | Leverage Ratio | Capital Preservation |

|---|---|---|

| Conservative | 1:10 | High |

| Moderate | 1:50 | Medium |

| Aggressive | 1:100 | Low |

Drawdown Control and Recovery Plans

Drawdown management ensures capital preservation during trading slumps. An effective recovery plan helps stabilize the equity curve and mitigate risks.

Drawdown Metrics: Track maximum drawdown to assess strategy efficiency.

Risk Mitigation: Adjust position sizes to reduce equity curve dips.

Recovery Factor: Calculate the ratio of net profit to maximum drawdown.

Capital Preservation: Use conservative risk metrics to maintain stability.

Recovery Plan Steps:

Analyze the cause of drawdown.

Reduce position sizes temporarily.

Adjust the trading strategy for lower risk.

Gradually increase exposure as performance improves.

By implementing these risk management techniques, Expert Advisors can maintain a sustainable trading approach, reducing potential losses while optimizing profitability.

6.Monitoring and Adjusting Your EA Strategy

Monitoring and adjusting your EA strategy is crucial to maintaining consistent performance. Regular checks ensure that your strategy adapts to changing market conditions.

When to Adjust Your EA Setup

Knowing when to tweak your EA setup can make or break your trading strategy. Generally, adjustments are needed when performance metrics indicate a decline. Here are key situations to consider:

Significant Drawdown: If the drawdown exceeds your risk tolerance, it’s time to revisit parameters and optimization.

Market Volatility Spikes: Unusual volatility can skew EA performance, prompting a reassessment of settings.

Slippage Issues: High slippage rates often mean your EA is not optimized for current market conditions.

Performance Drops: A sudden decline in profitability indicates the need for backtesting to identify problem areas.

Expert Insight:

"An EA setup that doesn’t adapt to evolving market conditions will inevitably fall short. Regular optimization is key."

– John Millard, Forex Algorithmic Trader

Monitoring Performance and Trade Analysis

Keeping an eye on performance metrics helps detect issues early. Analyzing trade history can reveal patterns that might affect profitability. Here’s a quick breakdown:

| Metric | Typical Range | Ideal Value |

|---|---|---|

| Drawdown (%) | 0 - 20 | < 10 |

| Profit Factor | 1.2 - 3 | > 2 |

| Win Rate (%) | 50 - 70 | > 60 |

| Average Gain/Loss | 1.5 - 2.5 | > 2 |

Equity Curve Analysis: A downward trend could mean the EA configuration is outdated.

Trade History Evaluation: Identify losses linked to specific market conditions.

Reporting and Journaling: Maintain detailed logs for statistical analysis and strategy evaluation.

Sometimes, tweaking the settings or revisiting the strategy logic is enough to restore performance. Don’t just guess; use data-driven adjustments.

Monitoring and adjusting your EA strategy is not just about fixing problems but also about anticipating market shifts. Stay proactive and keep optimizing!

7.Advanced Techniques for EA Strategy Enhancement

Enhancing your EA strategy with advanced techniques can significantly boost performance and profitability. Integrating AI, machine learning, and hybrid systems offers a smarter approach to Forex trading.

Integrating Artificial Intelligence in EAs

Artificial Intelligence (AI) is transforming EA setups by automating complex decision-making processes. Integrating AI with Expert Advisors (EAs) enables trading systems to analyze large data sets and execute strategies with precision.

Key Benefits:

Automation of routine trading tasks.

Real-time data analysis for quick decision-making.

Enhanced strategy execution using neural networks.

Example:

An AI-driven EA uses neural networks to detect subtle market shifts, enabling faster response times compared to traditional algorithms.

"Artificial Intelligence allows EAs to evolve with changing market conditions, significantly reducing human error." - John McKee, Forex Strategist

Machine Learning for Strategy Optimization

Machine learning takes EA optimization to the next level by identifying patterns and optimizing trading strategies. It uses data analysis and predictive modeling to fine-tune algorithms.

Data Analysis: Analyzes historical price movements.

Predictive Modeling: Forecasts potential market trends.

Algorithm Tuning: Adjusts strategy parameters dynamically.

Performance Metrics: Measures the effectiveness of strategy changes.

| Technique | Benefit | Use Case |

|---|---|---|

| Data Analysis | Identifies trading patterns | Analyzing historical price data |

| Predictive Modeling | Forecasts future market movements | Generating buy/sell signals |

| Algorithm Tuning | Optimizes EA performance | Adjusting parameters in real-time |

| Feature Engineering | Enhances model accuracy | Selecting relevant trading variables |

Machine learning models can continually adapt, ensuring your EA stays relevant despite market shifts.

Algorithmic Pattern Recognition in Forex

Algorithmic trading in Forex benefits significantly from pattern recognition techniques. Identifying consistent patterns in market data can inform profitable strategy execution.

Common Techniques:

Data Mining for extracting significant trading patterns.

Statistical Models to analyze chart patterns.

Time Series Data analysis for spotting trend reversals.

Example:

An EA uses pattern recognition to identify head-and-shoulders formations, issuing sell signals at the peak.

Incorporating signal generation and trading signals based on these patterns reduces the risk of false entries.

Hybrid EA Systems for Better Results

Hybrid EA systems combine multiple trading strategies into one framework. This system architecture leverages the strengths of various algorithms for more robust performance.

Why Go Hybrid?

Balances risk by diversifying strategies.

Enhances performance with integrated approaches.

Reduces drawdowns through adaptive combinations.

Example:

A hybrid EA might blend a trend-following algorithm with a mean-reversion strategy, balancing short-term and long-term goals.

Steps to Implement:

Select Compatible Strategies: Identify algorithms that complement each other.

System Integration: Combine them into a unified EA framework.

Backtesting: Validate combined performance under various market conditions.

Optimization: Fine-tune each component for stability.

By leveraging hybrid systems, traders can capitalize on diverse market conditions, reducing volatility and enhancing overall success.

Conclusion

When it comes to building a rock-solid EA strategy, it's all about nailing down the essentials and keeping things sharp. From crafting a smart design to running tight optimization, each step matters if you want to stay ahead of the curve. And let’s face it, markets change faster than the weather, so keeping your EA tuned up isn't just smart—it's necessary. Like Warren Buffett says, "Risk comes from not knowing what you're doing." In Forex, your EA is your edge; make sure it's a sharp one.

So, take the time to test, adjust, and explore new tech like AI to supercharge your results. The right setup can mean the difference between just trading and truly thriving. Get your EA right, and you’re not just playing the game—you’re mastering it.

An Expert Advisor (EA) is a software program designed to automate trading activities on MetaTrader platforms. It executes trades based on pre-set trading strategies without human intervention.

Optimization fine-tunes the EA settings to maximize profitability and minimize risk. It evaluates different parameter configurations to find the best performing setup for specific market conditions.

Benefits of EA Optimization:Enhances profit potential

Reduces drawdowns

Adapts to changing market conditions

A successful EA strategy includes:

Trading Indicators: Essential for entry and exit signals.

Risk Management: Defines stop-loss, take-profit, and lot sizes.

Execution Logic: Determines how and when trades are placed.

Backtesting is crucial as it allows you to test the EA's performance using historical data before applying it to live trading. This helps to identify flaws and optimize the strategy without risking real capital.

While backtesting is important, forward testing is critical for validating the EA's performance in live markets. It exposes the EA to real-time volatility and slippage, which are not always captured in historical data.

Backtesting uses historical data to simulate trading results, while forward testing runs the EA in a demo environment to observe its performance in real-time market conditions.

Key Differences:Backtesting: Simulated on past data

Forward Testing: Real-time market exposure

Accuracy: Forward testing often exposes more realistic results

Artificial Intelligence (AI) can enhance EA strategies by:

Pattern Recognition: Detects complex market patterns for better predictions

Adaptive Learning: Adjusts strategies based on real-time performance

Data Analysis: Processes large datasets to optimize decision-making