In the dynamic world of forex trading, managing your investments effectively is crucial for success. One of the best ways to achieve this is through professional guidance, which is where the best forex account management Telegram channels come into play. These channels offer traders direct access to experienced account managers who provide timely insights, signals, and updates, ensuring that your account is managed efficiently. Whether you're new to forex trading or an experienced investor, the right Telegram channel can make all the difference in navigating the complexities of the market.

Overview of the Best Forex Account Management Telegram Channels

In the competitive forex market, selecting the right forex account management service is crucial. The best forex account management Telegram channels offer traders the opportunity to receive expert management and advice, helping them navigate complex trading decisions.

What is Forex Account Management?

Forex account management refers to the practice of managing a client's forex account by professional traders or account managers. These managers use their expertise in trading strategies, market analysis, and risk management to make informed decisions on behalf of the client. A key aspect of account management is understanding the client’s risk tolerance and financial goals to tailor strategies for optimal growth while minimizing losses. Account managers typically monitor the market for the client, execute trades, and provide reports on performance.

The Role of Telegram in Forex Account Management

Telegram has become an essential tool in forex account management due to its real-time communication capabilities. Forex account managers can create dedicated channels or groups where they share updates, market insights, and trade signals with their clients. Telegram’s ease of use and ability to send instant notifications make it an ideal platform for providing timely information, answering questions, and ensuring that traders are always in the loop. Through Telegram, traders can receive updates on account performance and market movements as they happen, making it an effective means of managing accounts in the fast-paced forex market.

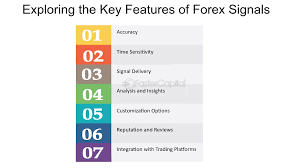

Key Features to Look for in Forex Account Management Channels

When choosing a forex account management Telegram channel, look for transparency, frequent updates, and risk management advice. Transparency in trade execution and the sharing of performance metrics is essential to trust. A reliable channel should update clients regularly on market conditions, trade status, and any changes in strategy. Moreover, risk management advice, such as setting stop-loss orders or adjusting trade sizes, is crucial for minimizing potential losses. An ideal channel should offer personalized recommendations based on individual goals and market conditions.

Best Forex Account Management Channels of 2024

| Channel Name | Features | Rating |

|---|---|---|

| ForexSignalPro | Real-time trade signals, market insights, risk management tips | 4.9/5 |

| TradeMasters | Expert analysis, personalized account management, frequent updates | 4.7/5 |

| FXManagementHub | Focus on long-term growth, regular performance reports | 4.6/5 |

| ExpertTraderGroup | Daily trading strategies, transparent performance, active community | 4.8/5 |

How to Choose the Right Forex Account Management Telegram Channel

When evaluating forex account management Telegram channels, start by assessing the expertise of the managers and the quality of their trade signals. Consider the transparency of performance reports and how often updates are shared. Additionally, check if the channel provides risk management guidance and personalized advice. A good forex account management service should align with your trading goals and risk tolerance. Ensure the channel has a supportive community where you can interact with other traders and get real-time assistance. Always opt for channels that have a proven track record of successful account management.

Forex Account Types and Management Methods

Understanding Forex account types is essential for traders seeking effective management through Telegram channels. Each account type comes with different features, influencing trading strategies and risk levels. Below, we explore the main account types and how they impact account management.

Understand Forex Account Types

There are various forex account types, each designed to suit different trading preferences and levels of experience. Common account types include:

Standard Account: Ideal for beginners, offering typical spreads and moderate leverage.

ECN Account: Best for professional traders, offering direct access to interbank liquidity and tighter spreads.

STP Account: Suited for traders who prefer low commissions and direct market access.

Micro Account: Offers lower minimum deposits, allowing small traders to enter the market.

Mini Account: A good option for those who want to trade with a smaller deposit compared to a standard account.

Islamic Account: A swap-free account, ideal for traders adhering to Islamic finance principles.

Choosing the Right Account Type for Managing an Account

The type of forex account you select plays a significant role in shaping the management strategy. Account types like ECN or STP accounts provide faster execution, which is crucial for day trading or scalping strategies, while Micro and Mini accounts are better suited for those with lower budgets or who prefer to trade with less risk. Understanding the leverage, spreads, and execution method of your account type is key to adjusting your trading strategy to match your risk tolerance and goals.

Pros and Cons of Each Account Type

| Account Type | Pros | Cons |

|---|---|---|

| Standard | Low initial deposit, easy to use for beginners | Higher spreads, lower leverage |

| ECN | Tight spreads, direct access to market liquidity | Requires larger deposit, high commission fees |

| STP | Low spreads, fast execution | May involve higher minimum deposit requirements |

| Micro | Low deposit requirement, reduced risk | Limited access to advanced tools, higher spreads |

| Mini | Lower deposit compared to Standard, flexible trading | Limited trading options, higher spreads |

How Telegram Channels Can Be Customized Based on Account Type

Forex Telegram channels can adapt to different account types by providing tailored advice and strategies. For example:

ECN account traders may receive real-time, high-frequency trade signals and market updates due to the need for fast execution.

Micro and Mini account traders might get more conservative trading strategies, with a focus on risk management and smaller position sizes to minimize exposure.

Islamic accounts can receive content related to swap-free trading and guidance on maintaining Sharia-compliant positions.

This customization ensures that traders receive the most relevant and effective advice for their specific account type.

Forex Trading Strategies for Account Management

Effective forex trading strategies are vital for successful account management. In this section, we explore various trading methods and how they can be tailored to meet client goals, ensuring that risk is minimized while maximizing potential returns.

Popular Forex Trading Strategies

Forex traders commonly utilize a variety of strategies to navigate the markets, including:

Scalping: A short-term strategy that involves making multiple trades in a day, aiming for small profits.

Day Trading: Involves opening and closing positions within the same trading day, ideal for those who prefer quick market turns.

Swing Trading: A medium-term strategy that focuses on taking advantage of market swings over several days or weeks.

Position Trading: A long-term approach where traders hold positions for weeks or months, focusing on larger trends.

Trend Following: Involves identifying and trading in the direction of the market's current trend.

Align Trading Strategies with Account Management Goals

A good account manager aligns trading strategies with the client’s goals. For instance:

Conservative Clients: For clients seeking minimal risk, a position trading strategy might be more suitable, with long-term market analysis and fewer trades.

Aggressive Clients: Scalping or day trading could align with clients seeking rapid returns, though this comes with higher risk. By understanding each client's risk tolerance, account managers can adjust strategies to ensure clients meet their investment goals while maintaining an acceptable level of risk.

Risk Management Strategies in Forex Trading

| Strategy | Purpose | Example |

|---|---|---|

| Stop-Loss Orders | Limits potential losses by automatically closing a trade at a set price. | Setting a stop-loss at 50 pips to limit a loss on a trade. |

| Take-Profit Orders | Secures profits by automatically closing a trade when a target is reached. | Closing a position when a profit of 100 pips is achieved. |

| Position Sizing | Determines the amount of capital allocated to a trade. | Allocating 1% of total capital per trade to manage exposure. |

Using Algorithmic Trading to Manage Accounts

Algorithmic trading, or the use of automated trading systems, can significantly enhance account management by executing trades based on predefined criteria. Account managers can use algorithms to manage large volumes of trades, ensuring efficiency and consistency in decision-making. These systems can be programmed for scalping, trend following, and even risk management features like stop-loss or take-profit execution.

Backtesting and Optimizing Trading Strategies

Before applying strategies to real managed accounts, account managers must backtest them on historical data to evaluate their effectiveness. This process helps to refine strategies, ensuring they perform well under various market conditions. Optimization techniques also ensure that the strategy remains adaptable to changing market dynamics, increasing its potential for success.

Managing Client Expectations: Risk vs. Reward

Account managers must clearly communicate to clients the potential risks and rewards associated with their trading strategies. For example, while high-frequency trading strategies like scalping offer quick profits, they also come with significant risks. It is essential for managers to set realistic expectations about potential outcomes, ensuring clients are comfortable with the level of risk involved. Regular updates and transparent communication are key to maintaining trust and aligning expectations.

Risk Management and Forex Account Protection

Forex risk management is essential to protect investments in the volatile world of forex trading. Implementing proper risk management strategies ensures that traders and account managers can mitigate losses while maximizing potential profits.

What is Forex Risk Management?

Forex risk management refers to the strategies and techniques used to minimize potential losses in forex trading. This includes understanding market conditions, applying protective orders, and managing capital wisely. By calculating potential risks, traders can safeguard their investments while pursuing profitable opportunities. The importance of risk management is heightened in managed accounts, where the goal is to balance the client's growth objectives with minimizing risk exposure.

Stop Loss and Take Profit Strategies

| Tool | Purpose | Example |

|---|---|---|

| Stop-Loss | Automatically closes a trade when the market moves against the trader, minimizing losses. | Setting a stop-loss at 50 pips to protect a trade from further decline. |

| Take-Profit | Automatically closes a trade when the market reaches a set profit level. | Setting a take-profit at 100 pips to secure profits before the market reverses. |

Stop-loss and take-profit strategies are fundamental in protecting managed accounts from significant losses while locking in gains. These tools help traders adhere to their risk management plan, ensuring that emotions don't drive trading decisions. Setting appropriate levels based on volatility and market conditions ensures that risk is kept within acceptable limits.

Position Sizing and Its Impact on Risk

Position sizing determines how much capital is allocated to each trade and plays a crucial role in managing risk exposure. By adjusting the position size, traders can control how much of their total capital is at risk in each trade. Larger positions increase the potential for both profits and losses, while smaller positions reduce risk. This strategy helps account managers tailor their approach to the client's risk tolerance, ensuring that even in volatile markets, the risk remains manageable.

Forex Risk Management Tools and Resources

Forex traders and account managers often rely on various tools to assess and manage risk effectively. Some common tools include:

Risk Calculator: Helps determine the appropriate position size based on account balance and desired risk level.

Forex Volatility Index (VIX): Provides an indicator of the market's volatility, allowing traders to adjust their strategies accordingly.

Risk Management Software: Various platforms offer automated tools for tracking risk, setting stop-losses, and managing trades.

These tools offer real-time analysis and calculations, enabling account managers to make informed decisions about their trades.

Establishing a Sustainable Risk-Reward Ratio for a Managed Account

A stable risk-reward ratio is key to sustainable forex trading. This ratio measures the potential reward for every unit of risk. For example, a 1:3 ratio means the trader expects to gain three times the amount they risk. Maintaining a balanced ratio ensures that profits over time outweigh losses. Account managers can use this strategy to tailor their approach based on the client’s goals, aligning with their risk tolerance and desired return. By consistently applying the risk-reward ratio, traders can develop long-term profitability while managing the risk inherent in forex trading.

Top Forex Trading Platforms for Managed Accounts

Choosing the right Forex trading platform is crucial for efficient account management. Platforms like MetaTrader 4, MetaTrader 5, TradingView, and cTrader each offer unique features that can help traders manage multiple accounts effectively.

MetaTrader 4 vs MetaTrader 5 for Managing Accounts

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Order Execution | Instant and Market execution | Instant, Market, and Exchange execution |

| Charting | Basic charting tools | Advanced charting with more indicators |

| Timeframes | 9 timeframes | 21 timeframes |

| Order Types | Limited order types | More advanced order types (e.g., buy stop limit) |

| Multi-Account Management | Available with third-party tools | Built-in multi-account management feature |

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most popular forex platforms for managed accounts. While MT4 remains a favorite for its simplicity and reliability, MT5 offers more advanced tools, such as greater charting options and more order types, making it more suited for professional account management. Traders managing multiple accounts may find MT5 more efficient due to its built-in multi-account support.

TradingView: Key Tools for Account Managers

TradingView is another essential tool for account managers, offering a powerful charting platform with a wide range of indicators and drawing tools. The ability to share charts and analysis instantly with clients via Telegram channels makes it an invaluable tool for real-time communication. Key tools in TradingView include:

Advanced charting and trend analysis

Customizable indicators and alerts

Collaboration features to share analysis with clients

Access to global markets and asset classes, not just Forex

cTrader: Advantages of Managing Forex Accounts

cTrader is known for its user-friendly interface and powerful order execution features. It provides account managers with advanced trading tools, including algorithmic trading support and a one-click trading feature for quicker responses. cTrader’s multi-account manager (MAM) feature allows for the efficient management of multiple accounts under one platform, enabling traders to execute trades across various accounts simultaneously, saving time and enhancing productivity.

Choosing the Right Trading Platform for Your Account Type

| Account Type | Recommended Platform | Reason |

|---|---|---|

| Standard Account | MetaTrader 4 | Simplicity and reliability, ideal for beginners |

| ECN Account | MetaTrader 5 | Advanced execution, lower latency, better for professional traders |

| Micro Account | cTrader | User-friendly interface, easy to manage small trades |

| Islamic Account | TradingView | Flexible charting tools, non-swap features for long-term strategies |

The choice of trading platform largely depends on the account type being managed. For ECN or STP accounts, MT5 is often preferred due to its advanced features. For micro accounts, cTrader is a great option, as it allows for more efficient management with smaller capital allocations. TradingView provides excellent tools for traders looking to implement long-term strategies, especially for Islamic accounts that require swap-free conditions.

Conclusion

In conclusion, selecting the best forex account management Telegram channels is key to achieving success in the highly competitive world of forex trading. By leveraging the right trading platforms such as MetaTrader 4, MetaTrader 5, TradingView, and cTrader, account managers can effectively manage client accounts while mitigating risk. A clear understanding of forex risk management, choosing the right account type, and aligning trading strategies with client goals are crucial steps in the journey. Ultimately, the integration of these tools with real-time communication on Telegram channels enhances the efficiency and transparency of account management services, enabling traders to achieve their financial goals with confidence.

The best platform depends on the trader's needs. **MetaTrader 4** is ideal for beginners, while **MetaTrader 5** offers more advanced tools and better multi-account management. **cTrader** and **TradingView** are also popular for their intuitive interfaces and enhanced charting features.

Forex risk management tools like **stop-loss orders** and **take-profit orders** help limit potential losses and secure profits by automatically closing trades at predetermined levels. These tools are essential for protecting **managed accounts** from significant market fluctuations.

Telegram facilitates real-time communication between **account managers** and clients. It allows traders to receive instant updates, market insights, and trading signals, making it easier to manage accounts and respond to market changes swiftly.

Yes, **MetaTrader 5** offers built-in tools for managing multiple accounts simultaneously, making it an excellent choice for professional **account managers** handling numerous client accounts.

Choosing the right **forex account type** is crucial because it impacts risk exposure, leverage, and overall account management strategy. Different accounts, such as **Standard**, **ECN**, or **Mini**, cater to different trading styles and budget levels.

TradingView is a powerful tool for **account managers**, offering advanced charting, real-time market analysis, and collaborative features that make it easy to share insights and strategies with clients. Its versatility across multiple asset classes makes it a top choice for traders managing diverse portfolios.

**cTrader** provides multiple features that aid in **account management**, such as one-click trading, advanced charting, and automated trading tools. It is known for its user-friendly interface and efficient management of multiple accounts.

The **risk-reward ratio** is a critical factor in **forex risk management**. It helps account managers evaluate the potential reward of a trade relative to the risk involved. A balanced ratio ensures that trades have a high potential for profit while minimizing risk exposure.