Table of contents

Thinking of jumping into forex but feel like you're trying to read a map upside down? You’re not alone. Trader’s Guide: Your Key to Successful Trading was built for people like you—curious, motivated, and maybe just a bit overwhelmed. With countless platforms, flashy tools, and strategies that sound more like rocket science, it’s hard to know where to begin—or what really works.

As Warren Buffett once said, “Risk comes from not knowing what you're doing.” That’s why this guide breaks things down in plain English—no fluff, just the real stuff that helps you make smart, confident moves.

From picking the right platform to figuring out how much cash you actually need to start, this guide cuts through the noise. Let’s make forex trading feel less like a gamble and more like a plan.

1: What Is Forex Trading and How Does It Work?

Forex trading, or trading on the foreign exchange market, is the real-time act of exchanging one currency for another. This is not just a digital number game. It is a trillion-dollar marketplace where national economies, multinational corporations, and everyday retail traders converge. At its heart lies one thing: currency pairs — like EUR/USD or USD/JPY — whose values shift based on global supply and demand.

“I remember opening my first trade with USD/JPY at 5 a.m. Tokyo time,” says veteran trader Erik Ramos, who has spent more than a decade managing institutional forex portfolios. “I made five pips and thought I had conquered the market.” That memory, simple yet vivid, captures the universal beginning — every trader has been there.

Let us break it down:

The exchange rate is the price of one currency in terms of another.

Bid price is what a buyer is willing to pay.

Ask price is what a seller demands.

The spread? That is the broker’s cut.

One pip? Often the fourth decimal place. Traders count those like poker chips.

Leverage allows traders to control positions larger than their actual capital. High risk, yes. High potential reward, also yes.

Brokers act as your bridge to the forex market. Choose wisely — not all are created equal.

Forex.com, awarded “Best Overall Broker” in 2024 by Investopedia, notes in its public report that more than 70 percent of beginner accounts fail due to overuse of leverage and poor broker transparency.

Unlike stocks, forex never sleeps — and neither do its trading participants: banks, hedge funds, retail traders, even governments. They move billions while you sip your morning coffee.

If you have ever exchanged currency before a vacation, you have participated in the forex market. On a far bigger scale, traders try to profit from the movement of those same exchange rates — from Tokyo to London to New York.

“It is not just numbers. It is psychology, news, and global power dynamics,” Ramos says. “You are trading national confidence.”

And that is how forex works. Not theory. Real money. Real risk. Real traders.

2.Trader’s Guide to Forex Platforms

Web-Based vs Desktop Platforms

Web platforms are great for convenience—just log in via browser access, no installation required. But when it comes to performance and offline capability, a desktop platform often wins the race.

Web-Based Pros: Accessibility from anywhere, automatic updates, cross-device use.

Desktop Pros: Better performance, offline access, deeper customization.

Trade-Off: Web platforms win on ease; desktop platforms shine in speed and control.

"If speed is your edge, desktop wins every time," says Daniel Foster, FX technology strategist.

Features of Top Forex Apps

Whether you're trading from the couch or the coffee shop, mobile trading apps bring the action to your fingertips. But not all apps are created equal.

Look for these must-have features:

Charting tools with technical indicators

Real-time quotes and price alerts

Order execution speed and security features

Seamless account management, deposits, and withdrawals

Push notifications for market moves

These features can mean the difference between catching the trend—or missing it.

Platform Compatibility with Brokers

Not every broker gets along with every trading platform. Some play nice with MetaTrader 4 or cTrader, others push their own proprietary platforms.

| Platform Type | Broker Integration | API Access |

|---|---|---|

| MetaTrader 5 | Widely Supported | Yes |

| Proprietary Apps | Limited | Rare |

| cTrader | Moderate Support | Yes |

Key tip: Always check broker services and regulatory compliance. Compatibility affects execution model, liquidity provider access, and your overall trading flexibility.

3.Which Forex Tools Should Every Trader Use?

Forex Charting Software Options

Charting software is the beating heart of technical analysis. Whether you’re chasing candlestick patterns or watching RSI signals, the right platform matters.

Real-time charts and indicators keep you in sync with market shifts.

Top platforms like TradingView, MetaTrader 4, and cTrader offer user-friendly interfaces.

Great charting tools allow overlays, multi-timeframe views, and automated technical analysis.

Popular Software Comparison

| Software | Timeframes Supported | Indicator Count |

|---|---|---|

| MetaTrader 4 | 9 | 30+ |

| TradingView | Unlimited | 100+ |

| cTrader | 26 | 70+ |

Economic Calendar Use Cases

The economic calendar isn’t just for nerds—it’s a strategic edge.

Want to trade smart? Time your moves around news events, data releases, and high-impact announcements.

Identify high-volatility times (e.g., NFP Fridays).

Anticipate market reactions based on forecasts vs. actual data.

Build trades around scheduled economic indicators like CPI, GDP, or rate decisions.

"Trading without checking the calendar is like driving blind," says Forex analyst Jane Tolson. Always know what’s coming.

Benefits of Trade Journaling Tools

Want to stop making the same dumb mistakes? Start journaling your trades.

Trade journaling tools help you track every entry, exit, and emotional meltdown. They’re not just logs—they’re mirrors to your psychology and strategy discipline.

Review winning setups

Spot emotional patterns

Track improvements over time

Use tools like Edgewonk or TraderSync for automated stats and charts. Logging your trading behavior might be the most powerful (and underrated) move you can make.

How to Use Risk Calculators

Managing risk isn’t optional—it’s survival.

Risk calculators let you define position size, stop loss distance, and exposure before every trade.

Here’s how to use one:

Enter account capital and desired risk (usually 1–2%).

Set your stop loss in pips.

The calculator gives your lot size instantly.

Pro tip: Combine with leverage info for accurate sizing. Risk management tools keep your capital intact and your strategy on track.

4.Forex Account Types Explained

ECN vs Standard Accounts

Choosing between an ECN account and a Standard account boils down to trading style and cost tolerance.

ECN accounts connect traders directly to liquidity providers, ensuring faster execution speed and tighter spreads, but they usually charge a commission.

Standard accounts often involve Market Makers with wider spreads and no direct commissions.

STP accounts offer a hybrid experience—good for intermediate traders.

Table: Account Feature Comparison

| Broker Type | Spread (Pips) | Commission ($ per Lot) |

|---|---|---|

| ECN | 0.1 – 0.5 | 5 – 7 |

| Standard | 1.2 – 2.5 | 0 |

| STP | 0.7 – 1.4 | 3 – 5 |

“The best account type depends on your strategy and how much you value direct market access.” – Daniel Scott, FX Broker Analyst

Demo Accounts for New Traders

A demo account is your no-risk training ground—perfect for the new trader just dipping their toes into the market.

You get virtual funds to test trades in real-time market conditions.

It’s a trading simulation, so no profits—or losses—are real.

Helps build confidence with a learning platform before you ever go live.

Sounds good? It is. Think of it like taking the car for a spin before buying it. For beginner traders, there’s no better way to trial strategies, test platform features, and fine-tune account setup.

5.Is Forex Signal Trading Worth the Cost?

Free vs Paid Signal Services

Free signals might feel like a steal, but paid signals come with bells and whistles—think deeper market analysis, premium services, and expert strategy calls.

Cost comparison highlights:

| Type | Subscription Fees | Service Features |

|---|---|---|

| Free Signals | $0 | Basic alerts only |

| Paid Signals | $30–$150/month | Custom analysis, support |

Trial periods can help you test before you commit. Not every paid signal is gold, though—check the provider's credibility and review their track record.

Evaluating Signal Accuracy Rates

Before jumping in, ask: How often do these signals win?

Backtesting – Run trading signals through historical data to see their win/loss pattern.

Statistical analysis – Evaluate key performance metrics like drawdown, accuracy rate, and win/loss ratio.

Signal validation – Compare across multiple signal providers to cross-check reliability.

A high accuracy rate doesn’t guarantee success unless it fits your trading strategy. A 70% win rate with a poor risk-reward ratio could still hurt.

Risks of Following Signals Blindly

Look, blindly following signals is a one-way ticket to disappointment. Even top-tier signals can flop during market volatility.

Trading risks include:

Financial loss from over-reliance

Falling for fraudulent signals or scams

Ignoring due diligence and risk management

Like one Reddit trader put it: “I thought paid signals would do the work for me—until I blew half my account in two days.” Learn before you leap.

6.Forex Trading Strategies for Beginners

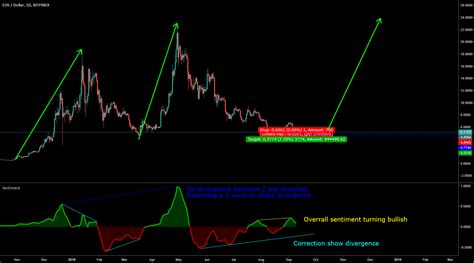

1: Trend Following for Starters

Trend following is a classic forex strategy where you trade in the direction of market momentum. The idea is simple: ride the wave, don’t swim against it.

How it works: Identify upward or downward movements using tools like moving averages.

Why it helps: It’s easier to make decisions when the direction is clear, especially when trading currency pairs like EUR/USD or GBP/JPY.

Pro tip: Start with a demo account before going live — no stress, no loss.

2: Using Support and Resistance

Support and resistance levels are the invisible barriers in the foreign exchange market. Support is where the price tends to stop falling, and resistance is where it often stops rising.

Spot the lines: Use historical price data to find areas where currency pairs repeatedly reversed.

Plan trades around these zones: Buy near support, sell near resistance.

Stay alert for breakouts: Sometimes prices smash through — that’s your next trade setup.

As one trader said:

“Support and resistance aren’t magic — they’re the footprints of trading participants reacting to price history.” — Marcus Lim, forex analyst at FXLab.

7.How Much Money Do You Need to Start Forex Trading?

Minimum Capital for Micro Accounts

You don’t need to be rich to start forex trading. A micro account usually requires a minimum deposit as low as $5 to $100, depending on the broker requirements. This makes it ideal for retail traders testing the waters with low capital. But watch out—starting with the bare minimum investment might limit your room for mistakes.

| Broker | Minimum Deposit (USD) | Micro Account Available |

|---|---|---|

| FXPro | 100 | Yes |

| XM | 5 | Yes |

| OANDA | 0 | No |

Starting with Leverage Explained

Leverage is like fuel for your trades—but don’t spill it. When you use borrowed funds, you’re multiplying both your trading power and your risk.

Leverage ratio of 1:100 means $100 turns into $10,000 in market exposure.

But you also face amplified losses if things go south.

Always understand your initial margin and prepare for a margin call if the market moves against you.

Pro tip: Start small with a 1:10 ratio while you learn to control the throttle.

Cost Breakdown per Trade

Every trade costs money—not just the money you win or lose. Let’s break it down:

Spread – the difference between the buy/sell price, which is often how brokers profit.

Commission – fixed or percentage-based fee charged per trade.

Slippage – when your trade executes at a different price than expected.

Smart traders always calculate their per-trade cost to manage trading expenses and reduce surprises.

Hidden Fees and Spreads

This stuff can sneak up on you! Even if a broker says “zero commission,” you might still be hit with:

Rollover fees (overnight positions)

Inactivity fees if you go MIA

Deposit/Withdrawal fees that eat your profits

Also, brokers may markup spreads instead of charging transparent fees.

“Low spreads can look great until hidden fees undo your gains,” says forex analyst Jordan Miles.

Always read the fine print. Pricing transparency is non-negotiable.

Conclusion

Trading’s a lot like learning to drive—at the start, everything feels overwhelming. But once you know what each button does, where the risks are, and how to steer, you stop guessing and start cruising. This guide just handed you the keys.

“Success in trading doesn’t come from predicting the future, but from managing the present.” — Paul Tudor Jones. Stick to the basics, use the right tools, and take action with confidence.

The best time to trade forex is typically during the overlap of major market sessions, when trading volume is highest. This is usually between the London and New York session overlap (8:00 AM – 12:00 PM EST). During this window:

Liquidity is highest

Spreads are typically tighter

Price movements are more predictable

Choosing a forex broker involves checking several important factors:

Always read reviews and try a demo account before committing.

Regulatory compliance (e.g., FCA, ASIC, NFA)

Trading fees and spreads

Platform usability and mobile support

Deposit/withdrawal options and limits

Yes, but it’s not easy. Turning forex into a full-time income requires:

Most traders start part-time and scale up only after demonstrating consistent profitability.

Consistent, proven strategy

Strong risk management skills

Adequate capital and emotional discipline

Forex trading is legal in most countries, but the regulations vary. For example:

Always check with your country’s financial authority or consult a legal advisor.

In the U.S., it’s legal but tightly regulated by the CFTC and NFA

In India, it’s legal but restricted to specific currency pairs

In the UK, forex is fully legal and regulated by the FCA

There are several order types used in forex trading:

Understanding these helps you manage trades more effectively.

Market order – Executes immediately at the current market price

Limit order – Executes at a specific price or better

Stop-loss order – Automatically closes a trade to limit losses

Take-profit order – Closes a trade when a set profit target is reached