In the fast-paced world of forex trading, having the right tools at your disposal is crucial for making informed decisions. One such essential tool is the forex trading calculator, which helps traders manage their risk and calculate key metrics like pip value, margin requirements, and profit potential. By using an accurate trading calculator, you can ensure that your trades are well-planned and based on solid data, ultimately leading to more successful trades. Whether you're a beginner or an experienced trader, mastering how to use a forex trading calculator is vital for optimizing your trading strategy and improving overall profitability.

Forex Trading Calculator Basics

This cluster will introduce the foundational aspects of using a forex trading calculator, ideal for beginners looking to understand its primary functions and how to make the most of it for successful forex trading.

What is a forex trading calculator?

A forex trading calculator is a tool used by traders to perform important calculations, aiding in risk management and ensuring more precise trading decisions. It simplifies the process of evaluating essential metrics such as margin requirements, stop loss, and pip value.

Definition of forex trading calculator

A forex trading calculator is a digital tool designed to help traders calculate different parameters that impact their trades. It provides quick and accurate solutions for determining the amount of risk and the potential reward of each position.

The role of trading calculators in forex trading

Trading calculators help forex traders make informed decisions by providing real-time calculations for various trade parameters. They streamline complex calculations, enabling traders to focus on analyzing market trends and making strategic decisions.

Why does every forex trader need a trading calculator?

A trading calculator allows traders to manage their risk more effectively, ensuring they don't overexpose their capital. It helps in evaluating stop-loss levels, determining proper lot sizes, and calculating margins, which are all essential for maintaining profitability.

Key functions of forex trading calculators

Forex trading calculators come with several key functions that are indispensable for traders, ranging from risk assessment to managing profit and loss scenarios.

Calculate stop loss and take profit

Using a forex trading calculator allows traders to set realistic stop loss and take profit levels based on their desired risk-reward ratio. This ensures that trades are automatically adjusted according to the pre-determined levels.

| Stop Loss & Take Profit Calculation | Description |

|---|---|

| Stop Loss Level | Helps determine the price level at which a trader should exit a losing position. |

| Take Profit Level | Sets a price point where the trader locks in profits when a trade reaches a target. |

| Risk-Reward Ratio | Assesses the risk versus potential reward to ensure favorable trading conditions. |

Calculate margin requirements

Forex trading calculators are used to calculate the margin needed to open a position. This ensures traders can manage their capital effectively and avoid margin calls due to underfunded accounts.

Calculate risk-reward ratio

By calculating the risk-reward ratio, traders can assess the potential return of their trades relative to the risk they are willing to take. This helps them determine whether a trade aligns with their risk management strategy.

How to calculate account balance and required margin

A forex calculator also helps determine the available account balance and the margin required for specific trades, enabling traders to make smarter decisions regarding their leverage and position sizes.

How to use forex trading calculators for basic calculations?

Now that we've covered the essential functions, it’s time to look at how traders can practically apply them when using a forex trading calculator.

Enter trading parameters

Entering the correct parameters, such as lot size, leverage, and the currency pair, is essential for obtaining accurate calculations. The more accurate the input, the more reliable the results.

View output results

Once the parameters are entered, the forex trading calculator will output key metrics like pip value, stop loss, and margin requirements. This allows traders to make immediate decisions based on calculated data.

Adjust parameters to optimize calculations

To maximize the benefits of the calculator, traders should continuously adjust parameters to reflect changing market conditions. Fine-tuning the inputs based on real-time data helps ensure the accuracy of risk and profit assessments.

Forex Calculation Types and Application Scenarios

This cluster will explore various forex calculation types, helping users understand how to apply them in practical trading scenarios with the help of forex trading calculators.

Calculating Margin Requirements

Margin requirements are crucial for any forex trade as they define the amount of capital a trader needs to open and maintain a position. These calculations help ensure that traders are not overexposed to risk.

What are margin requirements?

Margin requirements refer to the amount of money a trader must deposit to open a position in the forex market. The required margin is typically calculated based on the leverage, position size, and the value of the currency pair being traded.

How to calculate initial margin

To calculate the initial margin, multiply the position size by the market price of the currency pair, and then divide by the leverage ratio. This ensures that you have enough capital to open the position and hold it until the trade is completed.

How to calculate maintenance margin

Maintenance margin is the minimum amount of equity a trader must maintain in their margin account to avoid a margin call. It is usually a percentage of the total position size and can be calculated using the same method as the initial margin, but considering the current market value.

How to adjust margin based on leverage

Adjusting margin based on leverage means that traders can control larger positions with less capital. The formula for this adjustment is simple: divide the position size by the leverage factor to determine the required margin.

Profit and Loss Calculations in Forex Trading

Profit and loss calculations help traders assess the effectiveness of their trades and ensure they are making profitable decisions in real time.

How to calculate profit

Profit is calculated by subtracting the entry price from the exit price, multiplying it by the position size, and adjusting for the pip value. This helps determine how much a trader will earn based on their trade size and price movement.

How to calculate loss

To calculate loss, simply subtract the exit price from the entry price, multiply by the position size, and adjust based on the pip value. The result will indicate the monetary amount lost if the trade goes against you.

The impact of exchange rate fluctuations on profit

Exchange rate fluctuations directly impact profit by altering the value of the traded currency pair. Small fluctuations in the exchange rate can lead to significant gains or losses, especially for trades with high leverage.

Using trading calculators to predict profit

Forex trading calculators help traders predict their potential profit by considering factors like position size, leverage, and market movement. This enables traders to plan and adjust their strategies before executing a trade.

Risk-Reward Ratio and Stop Loss Calculations

Understanding the risk-reward ratio and setting stop loss levels are vital to managing risk and maximizing returns in forex trading.

What is risk-reward ratio?

The risk-reward ratio helps traders assess the potential reward of a trade in relation to the risk taken. For example, a 1:3 risk-reward ratio means that for every unit of risk, the trader expects to earn three units of reward.

How to set stop loss and take profit

Setting a stop loss involves determining the maximum amount you’re willing to lose on a trade. Take profit is set at the price where you wish to lock in your profits. These levels can be calculated using the risk-reward ratio to ensure that potential rewards outweigh the risks.

How to adjust stop loss points based on risk-reward ratio

Adjusting stop loss points based on the risk-reward ratio involves calculating the distance between the entry point and the stop loss level to match the desired ratio. For instance, if you're aiming for a 1:2 risk-reward ratio, set the stop loss point at a distance where the expected reward is twice the risk.

| Risk-Reward Ratio Calculation | Description |

|---|---|

| Risk Amount | Amount of money you're willing to lose per trade |

| Reward Amount | Expected profit from the trade |

| Entry Price | The price at which the trade is executed |

| Stop Loss Level | Price point at which the trade will be automatically closed to limit losses |

| Take Profit Level | Price point at which profits will be automatically realized |

Advanced Features and Optimization of Forex Trading Calculators

This cluster dives into advanced features of forex trading calculators, showing how to use these tools to refine trading strategies and enhance trading efficiency.

How to Adjust Trading Strategies According to Market Volatility

Market volatility significantly impacts the success of forex trades. Understanding how to incorporate volatility into your trading strategy can help you make better, more informed decisions.

Using calculators to predict market volatility

Forex trading calculators can help predict potential volatility by analyzing historical data and market trends. These tools use statistical models to project price fluctuations, allowing traders to anticipate sudden market changes and adjust their positions accordingly.

Adjusting stop loss points according to volatility

When market volatility increases, the risk of sharp price movements rises. Calculators can be used to adjust stop loss points, widening them to avoid premature closures of positions due to natural market fluctuations.

The relationship between volatility and trading leverage

High volatility increases the risk of large price swings, making it necessary to adjust leverage. Using a calculator, traders can determine the optimal leverage ratio to mitigate risk while maximizing potential profit during volatile conditions.

How to use calculators to adjust leverage ratios

Traders can use forex trading calculators to optimize leverage ratios by inputting current market volatility and desired risk levels. The calculator will then suggest an appropriate leverage ratio that balances risk and reward for each trade.

Calculating Transaction Costs for Different Currency Pairs

Transaction costs, including spreads and commissions, can significantly affect a trader's profitability. Calculators can help estimate these costs for different currency pairs, enabling traders to account for them in their strategy.

How to calculate transaction fees (spreads, commissions, etc.)

To calculate transaction fees, traders can use calculators to determine the spread and commission based on the currency pair being traded. The total cost is the sum of these factors and helps traders assess the true cost of executing a trade.

| Transaction Cost Breakdown | USD/JPY | EUR/USD |

|---|---|---|

| Spread | 0.3 pips | 0.2 pips |

| Commission | $2 per trade | $1.5 per trade |

| Total Transaction Cost | $3.3 per trade | $1.7 per trade |

Factors affecting transaction costs

Factors like market liquidity, trade volume, and broker fees influence transaction costs. Forex calculators can account for these variables and provide a clear understanding of total costs.

How to optimize transaction costs through calculators

Using a forex calculator, traders can compare transaction costs across different currency pairs and broker services. This helps in choosing the most cost-effective options, ultimately improving profitability.

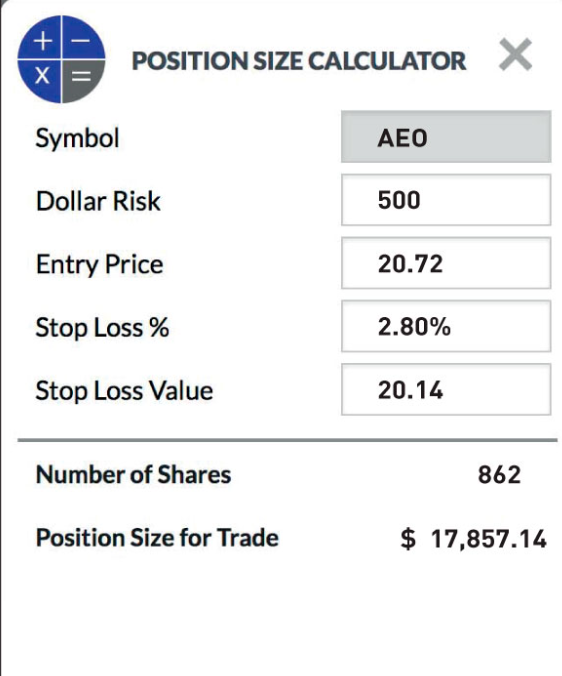

How to Use Forex Calculators for Position Size Calculations

Position size calculation is a critical aspect of forex trading, as it determines how much of a currency pair to trade based on risk tolerance.

Calculating the appropriate position size

To calculate position size, a forex calculator uses the trader’s risk percentage, stop loss distance, and account balance. This ensures that the trader doesn't risk more than a set percentage of their account balance per trade.

How to adjust positions according to risk level

By adjusting the risk level, traders can modify their position sizes using a calculator. For example, if the trader’s risk tolerance is lower, the calculator will suggest a smaller position size to minimize potential losses.

How to use calculators to calculate required margin

A forex calculator can calculate the required margin for a trade based on the position size, leverage, and the currency pair being traded. This helps traders ensure they have sufficient margin to open and maintain positions.

The relationship between position size and trading leverage

Forex calculators can show how changing position size impacts the required margin, depending on the leverage ratio. Understanding this relationship helps traders avoid over-leveraging, which can increase the risk of significant losses.

Common Problems and Solutions for Forex Calculators

In this cluster, we’ll address common issues forex traders encounter when using forex trading calculators, providing practical solutions to ensure smooth and efficient usage.

Common Forex Calculator Errors and Fixes

Errors in calculations can happen when using forex trading calculators, and it's essential to recognize and fix them to avoid costly mistakes.

Common calculation errors (such as profit calculation errors)

One of the most frequent errors in forex calculators is incorrect profit calculations, often caused by inputting the wrong position size or exchange rates. Traders must double-check their inputs and ensure that they’re using the correct currency pair and pip values.

How to avoid input errors

To avoid input errors, always double-check all parameters before hitting "calculate." Additionally, make sure you are using accurate, up-to-date market data. Many calculators also allow you to reset inputs before starting a new calculation, which can help reduce mistakes.

How to ensure that the calculator outputs the correct results

Ensuring accurate results involves setting the correct trading parameters (such as position size and leverage) and verifying that the calculator you are using is up-to-date. Most calculators also offer validation tips that can alert you to common errors before they impact your results.

Comparison of Forex Calculators with Other Tools

While forex trading calculators are powerful, it’s important to understand how they compare to other tools and methods.

Comparison with traditional manual calculation methods

Manual calculations can be time-consuming and prone to human error, especially when calculating things like pip values and margin requirements. Forex calculators automate these tasks, ensuring faster and more accurate results, which can be especially helpful during volatile market conditions.

Comparison of calculators with other online calculation tools

Unlike generic online calculators, forex trading calculators are specifically designed for the forex market. They include features tailored to currency pairs, leverage, and margin, providing a more accurate and relevant calculation compared to general tools.

Analysis of advantages and limitations

Forex calculators offer speed and accuracy but are only as good as the data entered. While they can handle complex calculations, they may not account for market nuances like slippage or sudden price movements. Traders should use calculators as a tool, not the sole decision-making method.

When to use a calculator and when to do manual calculations

Forex calculators are ideal for quick, routine calculations and minimizing errors. However, in certain situations, like adjusting strategies based on deep market analysis, manual calculations might be more suitable, particularly when interpreting more complex market signals.

How to Improve Calculation Accuracy

Improving the accuracy of your forex calculations is crucial for developing an effective trading strategy.

Set the right trading parameters

Ensure that you input accurate values, such as current exchange rates, your account balance, and desired risk levels. Adjusting these parameters correctly will provide the most reliable calculations for position sizes, margin requirements, and stop-loss levels.

Keep updated with market data

Market conditions change rapidly in forex trading. Ensure that you’re using real-time data when entering into a trade. Many forex calculators now have integration with live data sources, helping you stay updated on fluctuations that could affect your calculations.

| Factors Affecting Calculation Accuracy | Best Practices |

|---|---|

| Market Fluctuations | Always use real-time data from trusted sources. |

| Leverage Adjustments | Recalculate position size when leverage changes. |

| Trading Parameters | Double-check parameters before calculating. |

Conclusion:

In conclusion, forex trading calculators are indispensable tools for both novice and experienced traders. By understanding the various functions and features of these calculators, you can enhance your trading strategy, optimize risk management, and ensure more precise execution of trades. Whether you're calculating margin requirements, stop loss points, or transaction costs, these calculators allow you to make informed decisions that are crucial in the fast-paced forex market. Armed with the right knowledge and tools, you can refine your strategies and significantly improve your trading outcomes.

A forex trading calculator is a digital tool that helps forex traders perform essential calculations, such as determining margin requirements, calculating potential profit or loss, and setting stop loss and take profit levels. This tool simplifies the process of calculating key parameters that are crucial for executing successful trades.

Margin requirements in forex are determined by the leverage ratio and the position size. The formula typically involves multiplying the position size by the market price and dividing by the leverage. This ensures that you have enough capital to hold the position.

Manual calculations can be prone to errors, especially when calculating complex values like pip movement or leverage adjustments. In contrast, a forex trading calculator automates these calculations, reducing the risk of mistakes and ensuring faster, more accurate results.

To calculate profit with a forex trading calculator, you need to enter the entry price, exit price, and position size. The calculator will compute the difference in pips between the two prices, convert it into monetary value based on the currency pair, and display your total profit.

A forex trading calculator helps determine the optimal stop loss level based on your desired risk-reward ratio. By entering your position size and the pip difference between your entry and stop loss points, the calculator can automatically adjust the stop loss to fit your risk parameters.

When selecting a forex trading calculator, consider factors such as ease of use, accuracy, and whether it includes all the essential features (e.g., margin calculations, profit/loss, stop loss). You should also ensure the calculator can handle the specific currency pairs you are trading.

A forex trading calculator helps adjust leverage by allowing you to input your desired risk level and trade size. The calculator then suggests the appropriate leverage ratio, helping you manage your risk while optimizing potential returns.

A forex trading calculator plays a critical role in risk management by helping you determine position sizes, set stop loss points, calculate margins, and assess potential profit or loss. This ensures that your trades are aligned with your risk tolerance and capital availability.