In the fast-paced world of forex and CFD trading, having a reliable risk management strategy is essential for protecting profits and minimizing losses. One powerful tool in a trader’s arsenal is the MQL4 trailing stop code, which allows you to automate the process of adjusting stop-loss levels as the market moves in your favor. This technique, built into the MetaTrader 4 platform, can significantly enhance your trading strategy by locking in profits while still allowing the trade to run if the market continues in a favorable direction. Whether you're a novice coder or an experienced trader, understanding how to implement and optimize trailing stop functionality in MetaTrader 4 can make a meaningful difference in your trading results.

Understanding MQL4 Trailing Stop Basics

What is a Trailing Stop in Trading?

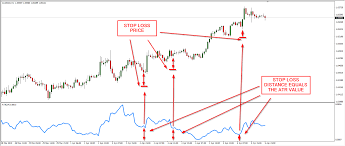

A trailing stop is a dynamic stop-loss order that moves with the market price to lock in profits while protecting against market reversals. In contrast to a fixed stop order, which remains at a set price once placed, a trailing stop adjusts itself based on price movements. As the price moves in your favor, the trailing stop "trails" the market, maintaining a fixed distance between the market price and your stop-loss level. The main benefit of a trailing stop is its ability to lock in profits as the market moves in your favor, without requiring manual intervention.

How a Trailing Stop Works in MQL4

In MetaTrader 4 (MT4), implementing a trailing stop involves adjusting the stop-loss dynamically based on the current market price. Unlike manual trading, where traders adjust their stop-loss orders manually, an MQL4 trailing stop automates this process. The language offers several functions, such as OrderModify, to modify the stop-loss when certain conditions are met. These conditions might include a price moving a set distance in your favor, at which point the stop-loss is adjusted upwards (in a buy trade) or downwards (in a sell trade) to secure profits.

Setting Up a Trailing Stop Code in MQL4

To implement a trailing stop in MQL4, you need to modify the stop-loss level dynamically. Here's an example of the basic syntax you can use:

// Example MQL4 trailing stop code snippet

double trailingStop = 50; // Trailing stop distance in points

double stopLoss = OrderOpenPrice() - trailingStop * Point;

if (Bid - OrderOpenPrice() >= trailingStop * Point) {

OrderModify(OrderTicket(), OrderOpenPrice(), stopLoss, OrderTakeProfit(), 0, clrNONE);

}This code snippet checks if the market has moved 50 points in favor of the position. If so, it adjusts the stop-loss using OrderModify to lock in the profits.

Common Pitfalls When Writing Trailing Stop Code

When coding trailing stops in MQL4, a few common issues may arise. One of the most frequent problems is missed stops — when the trailing stop doesn't adjust when the price moves past the predefined level. This can happen if the execution delays in the system prevent the code from triggering in real time. Additionally, incorrect use of OrderSelect or OrderModify can cause improper stop-loss adjustments. Debugging and ensuring your trailing stop logic is correctly implemented can save you from unexpected losses.

Optimizing Trailing Stop Performance in MT4

To make trailing stops more responsive, you can employ various techniques to improve their execution. For example, using time filters or adding price buffers can help to prevent the stop-loss from being adjusted too frequently. This reduces the possibility of “whipsaw” movements, where the market fluctuates within a small range, potentially triggering a stop without a real trend. Dynamically adjusting trailing stops can also improve performance by adapting to market volatility.

MQL4 Trailing Stop Coding Techniques

Core Functions for Implementing a Trailing Stop

To implement a trailing stop effectively in MQL4, understanding the core functions is crucial. These functions enable you to select orders, modify them, and close them when necessary. The key functions include:

OrderSelect(): This function is used to select a specific order from the order pool, allowing you to retrieve order details for modification.

OrderModify(): This is the primary function used to adjust the stop-loss of an open order, which is essential for implementing a trailing stop.

OrderClose(): Used to close an open position when the trailing stop triggers the stop-loss condition.

Here's a breakdown of how these functions interact in a trailing stop strategy:

| Function | Purpose | Example Use |

|---|---|---|

| OrderSelect() | Selects an order for modification or closing. | OrderSelect(ticket, SELECT_BY_TICKET) |

| OrderModify() | Modifies the stop-loss of an open order. | OrderModify(ticket, openPrice, newStopLoss, takeProfit) |

| OrderClose() | Closes an open order when conditions are met. | OrderClose(ticket, lotSize, Bid, slippage) |

These functions form the foundation for trailing stop logic in MetaTrader 4.

Using Conditional Statements (if Statements) in Trailing Stop Code

Conditional statements, particularly if statements, play a vital role in controlling when and how the trailing stop should adjust. For example, in MQL4, you can use an if statement to check if the market price has moved a specific distance in your favor before modifying the stop-loss.

if (Bid - OrderOpenPrice() >= trailingStop * Point) {

OrderModify(OrderTicket(), OrderOpenPrice(), stopLoss, OrderTakeProfit(), 0, clrNONE);

}Here, the if statement checks if the price has moved enough (greater than or equal to the trailing stop distance). If the condition is met, the stop-loss is adjusted. This is a simple but powerful way to automate trailing stop logic.

Using Bid and Ask Prices to Set a Trailing Stop

To adjust the trailing stop, it's important to base your stop-loss on market prices—specifically the Bid for sell orders and Ask for buy orders. By using these prices, you can dynamically adjust the stop-loss as the market moves. Here's an example of using the Bid and Ask prices in trailing stop logic:

| Order Type | Price to Use | Trailing Stop Direction |

|---|---|---|

| Buy Order | Ask | Adjust stop-loss upwards as price rises. |

| Sell Order | Bid | Adjust stop-loss downwards as price falls. |

In this way, the trailing stop continuously follows the market, adjusting the stop-loss level based on current market conditions.

Handling Multiple Open Trades and Trailing Stops

When dealing with multiple open trades, especially in the same direction, it's important to manage the trailing stop for each order individually. The strategy should ensure that each open position has its own trailing stop logic without interfering with other trades.

Here’s a simple approach:

Use a loop to check all open positions.

Apply the trailing stop logic to each trade based on its individual open price and market price.

for (int i = 0; i < OrdersTotal(); i++) {

if (OrderSelect(i, SELECT_BY_POS)) {

if (OrderType() == OP_BUY) {

// Apply trailing stop logic for buy orders

}

if (OrderType() == OP_SELL) {

// Apply trailing stop logic for sell orders

}

}

}By managing trailing stops for multiple trades, you can ensure each position is protected independently, allowing for optimal risk management across all trades.

Integrating Trailing Stops into Trading Strategies

Using Trailing Stops with Trend Following Strategies

Trailing stops are particularly effective when used in conjunction with trend following strategies, such as those based on moving averages or price action. These strategies aim to capture the longer-term market direction, and trailing stops ensure that profits are locked in as the trend progresses. For example, when the price rises above a moving average, a trailing stop can be set below the average to follow the trend upward while securing profits if the trend reverses.

The benefit of integrating a trailing stop in a trend-following strategy is that it allows traders to ride out the trend while minimizing the risk of losing profits during minor pullbacks. The stop will only be adjusted upward, not downward, helping traders stay in the trend longer.

Integrating Trailing Stops with Breakout Strategies

One of the most powerful ways to use trailing stops is within breakout strategies. During a breakout, prices can move rapidly through key levels of support or resistance, and trailing stops can help lock in profits as the price surges. For instance, when the price breaks above a significant resistance level, you can set a trailing stop to follow the price as it accelerates, ensuring that if the breakout fails, you're not left with a loss.

| Breakout Event | Action | Trailing Stop Application |

|---|---|---|

| Price Breaks Resistance | Set trailing stop just below resistance. | Trailing stop follows upward movement. |

| Price Breaks Support | Set trailing stop just above support. | Trailing stop follows downward movement. |

| False Breakout | Exit if the price fails to sustain breakout. | Trailing stop locks in gains quickly. |

Risk Management and Trailing Stops

Trailing stops are an excellent tool for risk management. By automatically adjusting the stop-loss as the market moves in favor of the trade, trailing stops minimize the need for manual intervention. They help lock in profits and ensure that losses are limited if the market reverses unexpectedly. This becomes particularly crucial during periods of market volatility, where price swings are more pronounced. Using a trailing stop can prevent a profitable trade from turning into a loss, even in uncertain market conditions.

Customizing Trailing Stops for Different Market Conditions

In different market conditions, such as high volatility or in reaction to major economic news, customizing your trailing stops can significantly improve performance. For instance, in a volatile market, you might want to widen the trailing stop to avoid being stopped out during minor price fluctuations. Conversely, in a stable market, tightening the trailing stop can help capture profits more quickly.

| Market Condition | Recommended Trailing Stop Adjustment | Rationale |

|---|---|---|

| High Volatility | Use a wider trailing stop. | To avoid premature stop-outs during swings. |

| Low Volatility | Use a tighter trailing stop. | To lock in profits more quickly. |

| Pre-News Release | Adjust trailing stops dynamically. | To account for potential price spikes. |

Advanced MQL4 Techniques for Trailing Stop Optimization

Trailing Stop Using Multiple Timeframes

Using multiple timeframes for trailing stop strategies allows traders to align their stops with higher timeframe trends. For example, you can use a longer timeframe such as the 1-hour or 4-hour chart to define the primary trend and adjust the trailing stop accordingly, while using a shorter timeframe (e.g., 15-minute or 30-minute) to capture more granular price movements.

By analyzing multiple timeframes, you can ensure that the trailing stop is aligned with the broader market direction, reducing the chances of the stop being prematurely hit by minor price fluctuations. In this way, MQL4 can be leveraged to automate the adjustment of stop-loss orders as the market shifts between timeframes.

Incorporate News Events into Trailing Stop Logic

Economic calendar data plays an essential role in adjusting trailing stop logic, especially during high-impact news events. With MQL4, you can program the trailing stop to adjust dynamically based on the time of key announcements, such as interest rate decisions or GDP releases. For example, you can widen the trailing stop before a major news event to allow for larger price swings, and tighten it afterward to secure profits once the market stabilizes.

| Event | Action | Trailing Stop Logic Adjustment |

|---|---|---|

| High-Impact News | Wait for news release, widen trailing stop. | Allow larger price swings during volatility. |

| Post-News Stabilization | Tighten trailing stop to secure profits. | Lock in profits once the price stabilizes. |

This allows for more adaptive and risk-managed trading in response to changing market conditions.

Combining Trailing Stop with Automated Risk Management Tools

Integrating position sizing, stop loss, and trailing stop into a unified strategy is key to effective automated risk management. MQL4 allows you to combine these elements programmatically, optimizing risk per trade and ensuring that your trailing stop doesn't violate your overall risk parameters. For instance, you can define the lot size based on the trailing stop distance, adjusting the risk dynamically according to the stop level.

By combining these tools, traders can create a fully automated risk management system that works seamlessly with the market, adjusting stops and position sizes without manual intervention.

Advanced Coding Techniques: Optimizing Trailing Stop Performance

To optimize the performance of trailing stops, you can use advanced looping techniques and optimization functions in MQL4. These techniques involve fine-tuning parameters like stop distance, execution speed, and slippage. For example, you can loop through open trades, adjust stop-loss levels dynamically, and ensure that the trailing stop is applied only when specific conditions are met (such as a minimum price movement).

Advanced coding techniques allow you to refine the trailing stop logic, minimizing execution delays and improving efficiency.

Backtesting Trailing Stop Strategies in MT4

Backtesting is essential for ensuring that your trailing stop strategy works under different market conditions. In MT4, backtesting allows you to simulate past trades to assess the effectiveness of your trailing stop settings. By adjusting parameters like the stop distance and time frames, you can analyze how your strategy would have performed historically, making necessary adjustments before going live.

| Parameter | Adjustable Factor | Impact on Strategy Performance |

|---|---|---|

| Stop Loss Distance | Adjust distance between market price and stop. | Controls how far the stop is from the entry price. |

| Timeframes | Test across multiple timeframes. | Helps assess performance under different trend conditions. |

| Risk-Reward Ratio | Adjust stop and take profit for optimal ratio. | Ensures the strategy is properly risk-managed. |

This allows for data-driven adjustments to your trailing stop strategy, ensuring it works effectively in live market conditions.

Evaluating the Effectiveness of a Trailing Stop Strategy

Evaluating the effectiveness of a trailing stop strategy is essential for refining its performance and ensuring that it aligns with your trading goals. By tracking performance metrics, optimizing for trade duration, and fine-tuning stops, you can continually improve how well the trailing stop serves its purpose of locking in profits while managing risk. This final cluster delves into methods for assessing and optimizing trailing stop setups in various market conditions.

Tracking Performance with a Trailing Stop

To measure the effectiveness of a trailing stop, key performance metrics must be tracked. The primary focus should be on how well the trailing stop protects profits during favorable market movements and reduces losses during reversals. Metrics such as maximum drawdown, average trade duration, and profit-to-risk ratio can be insightful.

| Metric | Purpose | How to Measure |

|---|---|---|

| Maximum Drawdown | Measures the largest peak-to-trough loss. | Track the largest loss during a trade sequence. |

| Profit-to-Risk Ratio | Evaluates profitability against the risk taken. | Compare total profits with total risk levels. |

| Average Trade Duration | Assesses how long a trade lasts before exiting. | Measure the time between order execution and exit. |

By examining these metrics, traders can gauge whether their trailing stop settings are helping to maintain profitability and manage losses.

Optimizing a Trailing Stop Based on Trade Duration

The performance of a trailing stop strategy can vary depending on the duration of a trade. For short-term trades, where market volatility plays a significant role, a tighter trailing stop might be beneficial to lock in profits quickly. In contrast, long-term trades may require a looser trailing stop to allow for larger market fluctuations.

As a trade progresses, adjusting the trailing stop in response to how long it has been open can improve results. Shorter holding periods might favor more aggressive stops, while longer trades benefit from allowing the market more room to move.

Fine-Tuning Stops Using a Trailing Stop

Fine-tuning your trailing stop involves adjusting stop levels based on market behavior and trade objectives. This customization works hand-in-hand with trailing stop logic to maximize profits. For instance, setting dynamic stop levels based on recent price action, volatility, or key support/resistance zones can help ensure that stops remain relevant and effective throughout the trade's lifecycle.

Fine-tuning can also involve adjusting the trailing stop in response to major news events, changes in market volatility, or as a reaction to key technical indicators.

| Adjustment Factor | Purpose | Action |

|---|---|---|

| Price Action | Customizes stops based on market trends. | Adjust stops based on recent highs/lows. |

| Volatility | Adapts to changes in market volatility. | Widen stops during volatile periods. |

| Support/Resistance Levels | Fine-tunes stops near key price levels. | Adjust stop to trail support or resistance. |

This approach allows for a more personalized and adaptive trailing stop strategy, increasing its overall effectiveness.

Conclusion

Incorporating a trailing stop strategy into your trading approach can greatly enhance your risk management by locking in profits while allowing trades to run with favorable market movements. Through MQL4 coding techniques, traders can automate trailing stops effectively and fine-tune their performance across various trading strategies, such as trend following and breakout systems. By understanding the core principles behind trailing stops, optimizing them using advanced techniques like multi-timeframe analysis, and continually evaluating their performance, traders can improve their trading outcomes. The integration of trailing stops ensures that positions are protected against reversals while maximizing potential gains over time.

A trailing stop in MQL4 is an automated stop-loss order that moves with the market price to lock in profits as the market moves in a favorable direction. Unlike a fixed stop-loss, the trailing stop adjusts itself to follow the market, securing profits while protecting against reversals. - It can be implemented using the OrderModify function in MetaTrader 4 (MT4). - Traders can set the trailing stop distance in points or pips.

In MT4, you can set a trailing stop manually through the terminal or programmatically using MQL4. - MQL4 code: Use OrderModify() to adjust the stop-loss based on the market's movement. - For automatic trailing stops, you can enable the trailing stop feature in the MT4 terminal settings.

The main benefits of using a trailing stop strategy are: - Risk management: Limits potential losses by automatically adjusting the stop-loss. - Profit protection: Locks in profits as the market moves in your favor, ensuring you don’t lose gains during reversals.

A **trailing stop** dynamically adjusts as the market price moves, following the trend and locking in profits. A **fixed stop-loss**, on the other hand, is set at a specific price and does not move once it's placed. This means trailing stops offer flexibility, while fixed stop-losses provide a static level of protection.

Yes, trailing stops can be used effectively with various trading strategies such as: - **Trend following** strategies, where stops are adjusted to follow the market's trend. - **Breakout** strategies, where trailing stops can lock in profits as the price moves past key levels of support or resistance.

MQL4 provides the necessary functions, such as **OrderModify**, to automate the trailing stop process. Traders can write custom scripts to dynamically adjust the stop-loss based on predefined conditions, allowing for seamless execution of the strategy within **MetaTrader 4**.

To track the performance of a trailing stop, you should evaluate metrics such as: - **Maximum drawdown** to measure potential losses. - **Profit-to-risk ratio** to ensure that the strategy is yielding favorable returns. - **Average trade duration** to see how long trades are held with the trailing stop in place.

Yes, you can program **MQL4** to adjust trailing stops dynamically based on economic calendar data. For example, widen the stop before a major news event to account for increased volatility and then tighten it afterward to secure profits once the market stabilizes.