When diving into the world of Forex trading, many traders rely on external sources to guide their decisions. One of the most prominent tools used by traders is Forex signals. But what exactly are Forex signals, and are they legal in the UK? In this article, we’ll explore the ins and outs of Forex signals, their legality, and how traders can ensure they are operating within the bounds of the law in the UK. Whether you're an experienced trader or just starting out, understanding the legal landscape surrounding Forex signals is crucial for success in this fast-paced market.

Table of Contents:

What Are Forex Signals?

How Do Forex Signals Work in the Trading World?

Understanding the UK’s Regulatory Environment for Forex Trading

The Legality of Forex Signals: A Deep Dive

"Charms on Crocs": Is There a Legal Twist to Forex Signal Providers in the UK?

Key Players in the Forex Signal Industry: Who to Trust and Why

Common Misconceptions About Forex Signals in the UK

How to Stay Safe While Using Forex Signals in the UK

Conclusion: Navigating Forex Signals and Legal Boundaries

1. What Are Forex Signals?

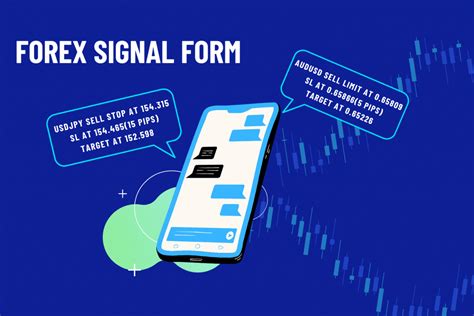

Forex signals are essentially recommendations or alerts that traders use to inform their decisions on buying or selling currency pairs. These signals can be generated either by experienced traders, automated systems, or a combination of both. Traders receive them through various platforms, such as emails, SMS, or trading apps.

Forex signals often include essential details such as the currency pair, the entry price, the stop loss, and take profit levels. In simpler terms, they provide guidance to make specific trades based on analysis, which can range from technical indicators to fundamental analysis. The idea is that these signals help traders maximize their chances of success in the volatile world of Forex.

2. How Do Forex Signals Work in the Trading World?

The effectiveness of Forex signals depends on the quality of the analysis behind them. For instance, some signal providers rely on sophisticated algorithms that analyze vast amounts of market data, while others may use manual methods like chart reading or news interpretation. Regardless of the method, Forex signals serve to highlight potential trading opportunities.

Consider this scenario: A trader might be following a signal for the GBP/USD pair that suggests entering a buy position at 1.3000 with a stop loss of 1.2950 and a take profit at 1.3100. The signal itself is rooted in a combination of past market data, price patterns, and a trader's insights into future market movements.

One key point that traders need to understand is that Forex signals are not foolproof. Even the most seasoned traders can make wrong calls, so it’s essential to approach signals with caution and sound risk management strategies.

3. Understanding the UK’s Regulatory Environment for Forex Trading

The UK has one of the most well-regulated financial markets in the world. The Financial Conduct Authority (FCA) is the main body overseeing Forex trading in the UK. It ensures that brokers and firms offering Forex trading services are operating in a transparent and legal manner. This includes monitoring the conduct of Forex signal providers.

For UK traders, it is critical to deal with regulated brokers and firms. The FCA’s role is not only to provide oversight on Forex brokers but also to safeguard traders against scams, fraud, and any illegal practices that might compromise their financial well-being.

In the UK, Forex trading is legal, but it’s governed by strict guidelines. This includes ensuring that any firm offering trading signals adheres to the rules regarding financial promotions, risk warnings, and customer protection.

4. The Legality of Forex Signals: A Deep Dive

Now, let’s get to the heart of the matter – are Forex signals illegal in the UK? Generally, Forex signals themselves are not illegal. However, the legality of Forex signal services depends on several factors, including how the signals are provided and the regulatory status of the service offering them.

Forex signal providers who are operating legally must comply with specific financial regulations. If the signal provider offers advice or investment services, they may need to be authorized by the FCA or another relevant authority. Unauthorized providers, especially those offering signals without proper credentials or in ways that could mislead traders, could be operating illegally.

Additionally, using Forex signals from an unregulated or fraudulent provider could expose you to risks like market manipulation or misleading information. For instance, signal providers who claim to guarantee profits or those who hide key information about the risks involved should be treated with caution.

5. "Charms on Crocs": Is There a Legal Twist to Forex Signal Providers in the UK?

The term "Charms on Crocs" might seem like a quirky fashion statement, but in the context of Forex signals, it serves as an analogy for the sometimes perplexing and controversial nature of the Forex signal industry. Just as charms on Crocs may look fun but raise questions about practicality and style, Forex signal providers can be enticing but require careful scrutiny.

There are certain "charms" in the Forex signal industry, such as flashy promises of guaranteed profits and success, which can lure in unsuspecting traders. These signals, while looking attractive, might not offer the transparency or legitimacy that traders need. It’s essential to be cautious and ensure that any signal provider adheres to the FCA’s regulations.

In short, while Forex signals themselves aren't illegal, the companies behind them might be, depending on their approach and adherence to the law. Be sure to check whether they are regulated, and whether they provide clear information on how their signals are generated.

6. Key Players in the Forex Signal Industry: Who to Trust and Why

There are many Forex signal providers out there, but not all are created equal. The key to using Forex signals responsibly lies in knowing whom to trust. Established signal providers often have a proven track record, customer reviews, and regulatory compliance, which can offer some peace of mind.

Many of the trusted providers are either brokers who offer signals as part of their service or independent signal services that adhere to FCA guidelines. Traders should always look for certifications, transparency about the signal generation process, and customer testimonials.

Before diving in, do some research to ensure that the Forex signal service you're considering has a history of reliability, provides clear risk disclosures, and is fully compliant with the UK's regulatory standards.

7. Common Misconceptions About Forex Signals in the UK

One common misconception is that Forex signals are foolproof and will always result in profitable trades. In reality, no signal system is flawless. The Forex market is volatile, and predictions are often subject to change.

Another myth is that Forex signals are only for experienced traders. In fact, even beginners can use Forex signals as long as they understand the risks involved and approach them with a sensible trading strategy.

Finally, some traders believe that Forex signal providers can guarantee profits, but no provider can. The market’s unpredictable nature means that there are always risks involved, and it’s important to exercise caution.

8. How to Stay Safe While Using Forex Signals in the UK

The best way to stay safe when using Forex signals in the UK is to ensure that the service you use is regulated. The FCA and other financial watchdogs offer a list of approved providers and have set up systems to warn traders about fraudulent services.

Additionally, keep a healthy skepticism when it comes to unrealistic promises. If a signal provider promises high returns with little risk, it’s time to pause and reconsider. Focus on services that provide transparent and honest assessments of the risks involved, and always read the fine print.

Risk management is another key aspect. Even if you are using trusted signals, always apply stop-losses and practice sound trading discipline. No signal is ever a guaranteed win.

9. Conclusion: Navigating Forex Signals and Legal Boundaries

In conclusion, Forex signals are legal in the UK as long as they are provided by regulated and compliant services. However, there are several pitfalls traders must avoid to ensure they are operating within the law. By choosing regulated providers, exercising caution, and understanding the risks, traders can safely use Forex signals to guide their trades without fear of legal repercussions.

Remember, the Forex market is a high-risk environment, and even with the best signals, losses are always a possibility. Always trade responsibly, stay informed, and choose services that operate transparently and legally. Whether you are using signals or trading independently, success comes from knowledge, strategy, and adherence to the rules.

References:

Financial Conduct Authority (FCA). "Forex Trading Regulation in the UK."

FCA. "Guidance on Financial Promotions and Risk Warnings for Forex Signal Providers."

International Journal of Financial Markets, "Legalities in the Forex Trading World."

Yes, Forex signals are legal in the UK, as long as the providers adhere to the Financial Conduct Authority (FCA) regulations. However, unregulated or fraudulent providers may operate illegally, so it's important to ensure that any signal service you use is properly regulated and transparent about its methods.

To determine whether a Forex signal provider is legitimate, check if they are authorized by the FCA or another regulatory body. Look for customer reviews, detailed risk disclosures, and transparency about how signals are generated. A reputable provider will also have clear information on the potential risks involved in using their signals.

No, even beginners can use Forex signals. However, it’s crucial to understand that signals should be used as part of a broader strategy and that risks are always involved. It's also recommended that beginners educate themselves on the basics of Forex trading to make informed decisions based on the signals they receive.

No, Forex signals do not guarantee profits. The Forex market is highly volatile and unpredictable, and while signals can help identify potential opportunities, there is always a risk of loss. It's important to use proper risk management techniques, such as setting stop-loss orders, when trading.

To avoid scams, only use Forex signal providers that are regulated by the FCA or a reputable regulatory authority. Be cautious of providers promising guaranteed profits or those who lack transparency in their methods. Always check reviews and conduct thorough research before committing to any service.

Yes, using Forex signals in the UK carries risks, such as following inaccurate signals, over-reliance on external advice, and potential scams. While Forex signals can offer helpful insights, it's essential to understand the risks and incorporate them into a broader, well-informed trading strategy. Additionally, using unregulated providers could expose you to legal and financial risks.