Purchasing Power Parity (PPP) is a fundamental concept in economics that helps explain the relationship between exchange rates and the relative price levels of different countries. It's a principle that suggests that in the absence of transportation costs and other frictions, identical goods should have the same price across different markets when expressed in a common currency. This concept plays a pivotal role in international economics and finance, serving as a bridge to understanding how currencies adjust in the global market.

The significance of PPP extends beyond theoretical discussions; it has practical applications in real-world economic analysis, policy formulation, and investment strategies. Whether you're an economist tracking the health of national economies, an investor considering cross-border investments, or simply a curious global citizen wondering how price levels differ across countries, PPP is a key concept to grasp.

In this article, we will explore the ins and outs of Purchasing Power Parity, from its theoretical foundations to its real-world applications. We will also address its limitations and the criticisms it faces. By the end, you’ll have a comprehensive understanding of how PPP influences exchange rates and the broader economic landscape.

Table of Contents

What is Purchasing Power Parity?

The Theory Behind PPP: A Closer Look

PPP and Exchange Rates: A Direct Connection

Real-World Examples of PPP in Action

The Big Mac Index: A Fun Way to Understand PPP

Limitations of Purchasing Power Parity

How Governments and Central Banks Use PPP

PPP and Economic Indicators: How They Interact

Future Implications of PPP in a Globalized World

1. What is Purchasing Power Parity?

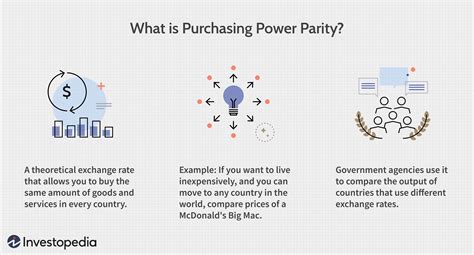

At its core, Purchasing Power Parity is a theory that compares the relative value of currencies based on the price of a specific basket of goods in different countries. In simpler terms, PPP suggests that exchange rates should adjust so that an identical item costs the same in different countries, when prices are converted into a common currency.

For example, if a loaf of bread costs $2 in the United States and the equivalent of $2 should buy the same loaf in France, then the exchange rate between the U.S. dollar and the Euro should be 1:1 for this particular product. Of course, in reality, it’s not always that straightforward, but PPP offers a useful framework for understanding how prices and exchange rates should theoretically align.

The concept has significant implications for global trade, investment decisions, and economic policy. Economists use PPP as a tool to compare the cost of living between countries and to gauge whether currencies are overvalued or undervalued.

2. The Theory Behind PPP: A Closer Look

The idea of PPP originates from the "law of one price," which states that in a perfectly competitive market, identical goods should sell for the same price, when expressed in a common currency. However, this theory assumes no transportation costs, no tariffs, and no market imperfections, conditions that are rarely met in the real world. Despite this, PPP offers valuable insights into long-term trends in exchange rates and international price levels.

The theory suggests that if a currency is undervalued, it will eventually appreciate to reflect the true value of the goods it buys. Conversely, an overvalued currency will depreciate over time. This is why PPP is often used by economists to predict long-term exchange rate movements, even though it doesn't always hold in the short term.

Interestingly, PPP can also help explain discrepancies in the cost of living between different countries. For instance, a worker in India may earn significantly less than a worker in the U.S. but may be able to buy equivalent goods and services in India at a much lower cost, thanks to PPP.

3. PPP and Exchange Rates: A Direct Connection

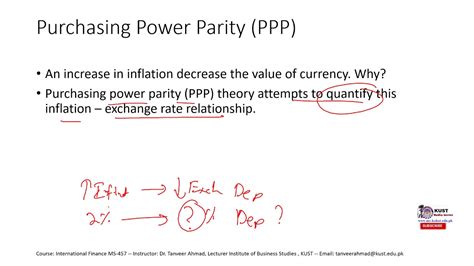

At the heart of PPP lies its connection to exchange rates. If PPP holds true, then the exchange rate between two currencies should reflect the relative price levels of the two countries involved. This means that if a country experiences a rise in inflation, its currency should depreciate in the long term to maintain parity in the prices of goods.

To understand this better, let’s consider an example: Suppose that in the U.S., inflation rises by 5%, while in Canada, inflation remains stable. According to the theory of PPP, the U.S. dollar should depreciate by about 5% against the Canadian dollar to maintain the same purchasing power.

However, in practice, PPP doesn’t always align with market exchange rates due to factors like capital flows, speculative activities, and government interventions. Still, it remains a crucial model for understanding long-term trends in currency valuation.

4. Real-World Examples of PPP in Action

Despite its theoretical nature, PPP provides valuable insights when applied to real-world scenarios. Take the example of the Eurozone and the United States. Over the years, economists have used PPP to compare price levels between the two regions and estimate the fair exchange rate between the Euro and the U.S. dollar. Historically, the exchange rate fluctuates due to different inflation rates, but the long-term trend follows PPP closely.

Another interesting example can be seen in emerging markets. For instance, countries like India, Brazil, and China often have lower price levels for goods and services compared to developed nations. This discrepancy can be explained by PPP, which reflects the purchasing power of local currencies and provides a more accurate measure of their relative value than nominal exchange rates.

These real-world applications of PPP show how the theory can offer valuable insights into international price disparities and guide investment decisions across borders.

5. The Big Mac Index: A Fun Way to Understand PPP

One of the most famous and lighthearted applications of Purchasing Power Parity is the Big Mac Index, created by The Economist magazine. This index uses the price of a McDonald’s Big Mac as a benchmark to compare the purchasing power of different currencies around the world.

The concept behind the Big Mac Index is simple: McDonald’s sells a similar product in nearly every country, so the price of a Big Mac can serve as a proxy for the cost of living in different nations. If the price of a Big Mac is lower in one country than in another, it may indicate that the local currency is undervalued relative to the other currency. Conversely, if the price is higher, it could suggest that the currency is overvalued.

While the Big Mac Index is far from a perfect measure of PPP, it’s a fun and easily understandable tool that illustrates the disparities in purchasing power across the globe.

6. Limitations of Purchasing Power Parity

Despite its widespread use, Purchasing Power Parity has its limitations. The first major limitation is that it assumes no transportation costs, tariffs, or trade barriers, all of which are common in the real world. In addition, PPP assumes that markets are perfectly competitive, which is often not the case.

Moreover, PPP tends to perform poorly in the short run, as exchange rates are often influenced by speculative activities, interest rate differentials, and geopolitical events. The theory is more reliable when used for long-term analysis, but it should be used cautiously when predicting short-term movements in currency markets.

Another limitation is the variation in consumption patterns across countries. The basket of goods used in PPP calculations may not accurately reflect the actual consumption habits of people in different nations, leading to discrepancies in price comparisons.

7. How Governments and Central Banks Use PPP

Governments and central banks use PPP as a tool to assess the relative value of their currencies and make informed decisions about economic policy. Central banks, for example, may rely on PPP data to gauge whether their currency is overvalued or undervalued and to determine whether interventions in the foreign exchange market are necessary.

Furthermore, PPP can play a role in the measurement of GDP. The World Bank and International Monetary Fund often use PPP-adjusted GDP figures to compare the economic output of different countries more accurately, as this adjusts for differences in price levels between nations.

8. PPP and Economic Indicators: How They Interact

PPP is closely related to a variety of economic indicators, including inflation rates, interest rates, and GDP. These indicators, in turn, influence exchange rates, as they impact the relative purchasing power of a country's currency.

For instance, a rise in inflation in one country can lead to a depreciation of its currency in the long run, in line with the PPP theory. Similarly, interest rates affect capital flows and can influence the strength of a currency, which in turn can alter PPP-adjusted price comparisons.

Understanding the interplay between PPP and these indicators is essential for policymakers, economists, and investors as they navigate the complexities of the global economy.

9. Future Implications of PPP in a Globalized World

As the world becomes more interconnected, the relevance of PPP may evolve. Globalization has led to increased trade, cross-border investment, and the movement of labor, all of which can impact exchange rates and price levels. While PPP remains a valuable tool for understanding long-term trends, the dynamic nature of the global economy may lead to new challenges and adjustments in how PPP is applied.

Technological advancements, such as digital currencies and blockchain, could also influence how PPP is calculated and utilized in the future. As these innovations reshape the financial landscape, economists will need to adapt and refine PPP models to account for new economic realities.

Conclusion

Purchasing Power Parity is a powerful economic tool that provides valuable insights into the relationship between exchange rates, price levels, and the cost of living across countries. Although it has its limitations and doesn’t always hold in the short term, PPP remains a cornerstone of international economics, offering a framework to understand global price disparities.

As we move forward in a rapidly changing global economy, PPP will continue to play a critical role in shaping our understanding of currency markets and international trade. Whether you're a policy maker, an investor, or just a curious global citizen, grasping the basics of PPP will help you navigate the complexities of today's interconnected world.

References:

The Economist - Big Mac Index.

International Monetary Fund (IMF).

World Bank - PPP GDP Estimates.

Krugman, P., Obstfeld, M., & Melitz, M. (2018). International Economics: Theory and Policy.

Purchasing Power Parity (PPP) is an economic theory that suggests that in the absence of transportation costs and other trade barriers, identical goods should have the same price when expressed in a common currency. PPP helps to compare the relative value of currencies and the cost of living across different countries. It's essential because it provides insights into how exchange rates should adjust based on price differences, offering a more accurate way to compare economic outputs and living standards between nations.

PPP influences exchange rates by suggesting that they should reflect the price differences between two countries for a similar basket of goods. If one country experiences higher inflation than another, its currency should depreciate to maintain parity in purchasing power. For instance, if the U.S. experiences a higher inflation rate than the Eurozone, the U.S. dollar is expected to depreciate against the euro in the long term to adjust for this price difference.

The Big Mac Index is a fun and simplified version of PPP, created by The Economist magazine. It uses the price of a McDonald’s Big Mac in different countries as a measure to compare the purchasing power of currencies. By looking at the price of a Big Mac in various nations, we can get a sense of whether a currency is undervalued or overvalued relative to others, offering a light-hearted yet insightful look at the global economy.

PPP has several limitations. It assumes there are no transportation costs, tariffs, or market imperfections, which isn't realistic in the real world. Additionally, PPP doesn't always hold in the short run due to speculative activities, interest rate differentials, or geopolitical factors. The theory works better for long-term analysis but is less reliable for predicting short-term fluctuations in exchange rates. Furthermore, consumption patterns vary across countries, so a standard "basket of goods" might not reflect actual living expenses accurately.

Yes, governments and central banks use PPP as a tool to assess the relative value of their currencies and make economic decisions. It is particularly useful in comparing the economic output of countries using PPP-adjusted GDP figures. By understanding PPP, policymakers can evaluate whether a currency is overvalued or undervalued, which may influence monetary policies, trade agreements, and foreign exchange interventions.