During the COVID-19 pandemic, options trading soared in popularity as investors flocked to participate in the financial markets. According to data from the Chicago Board Options Exchange (CBOE), options trading by individual investors has roughly quadrupled over the past five years. Options trading offers a variety of benefits compared with trading stocks, such as access to leverage, higher potential returns and alternative trading strategies. In this article we’ll explore the foundations of trading options.

What is Options Trading?

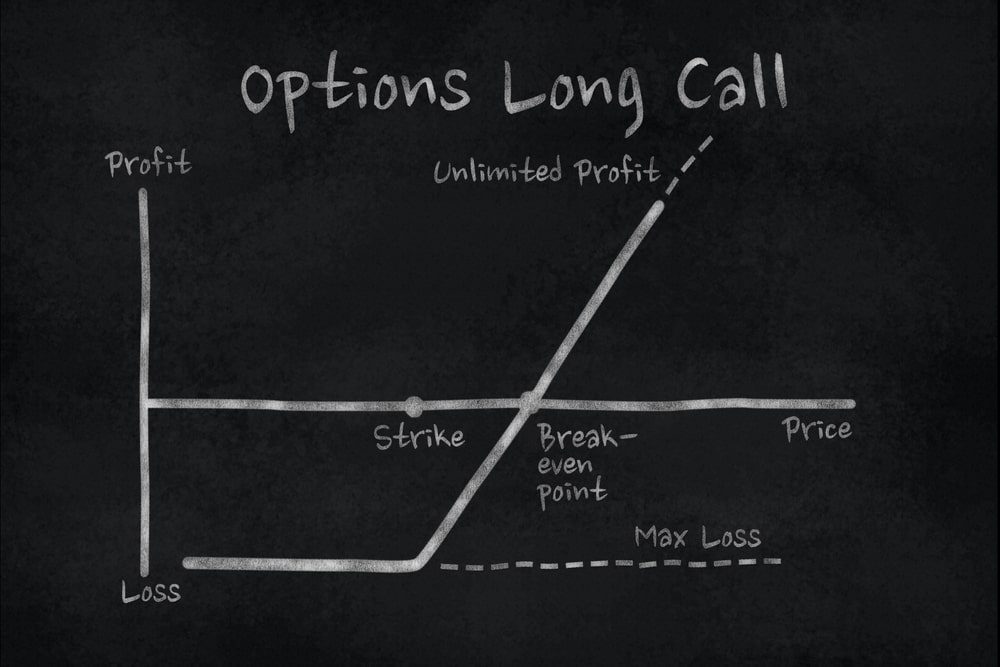

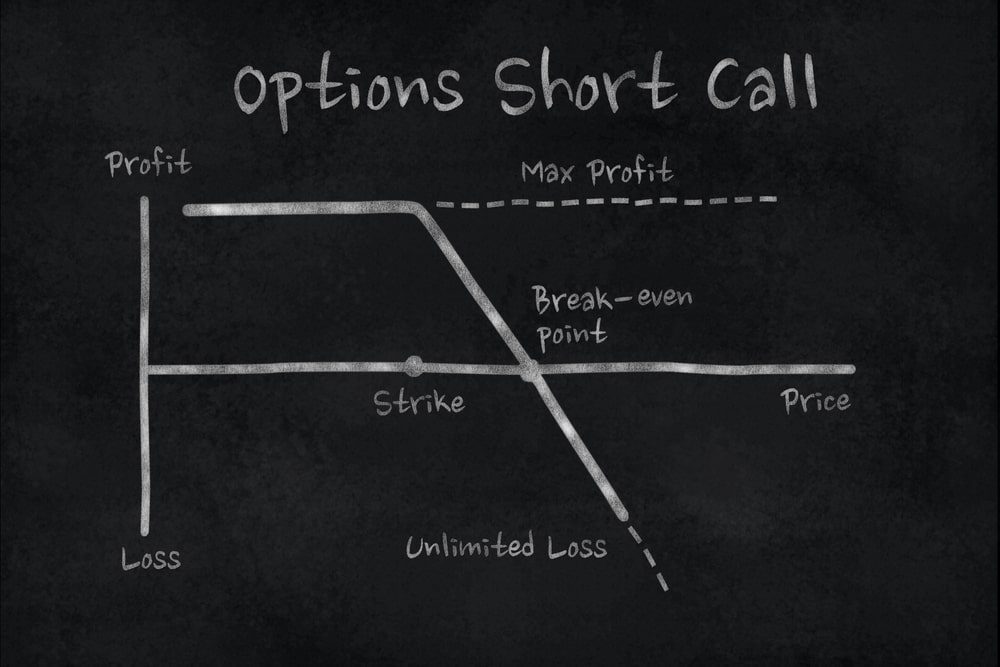

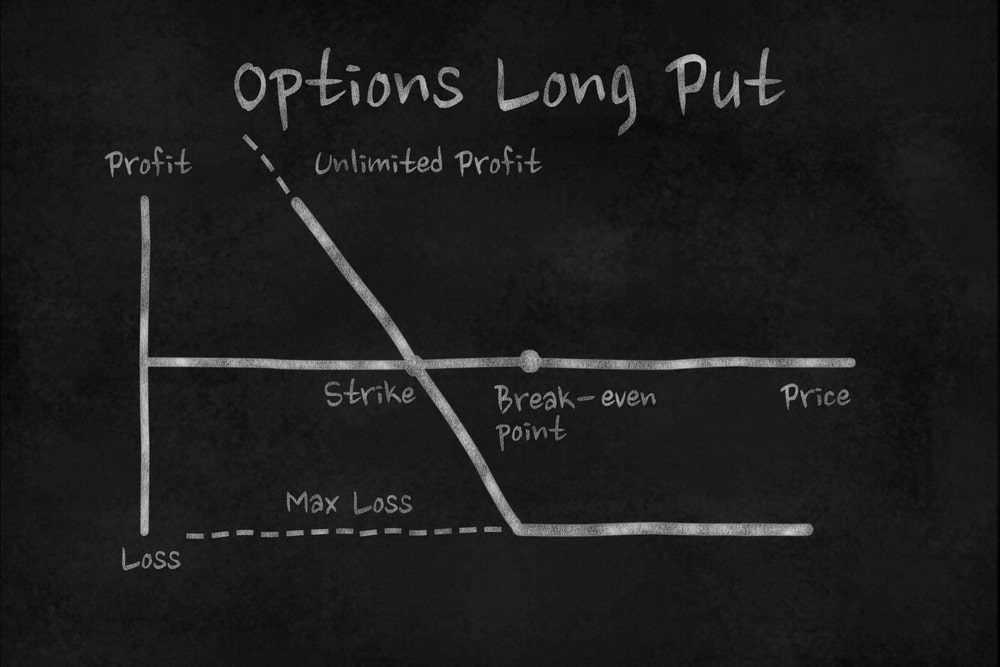

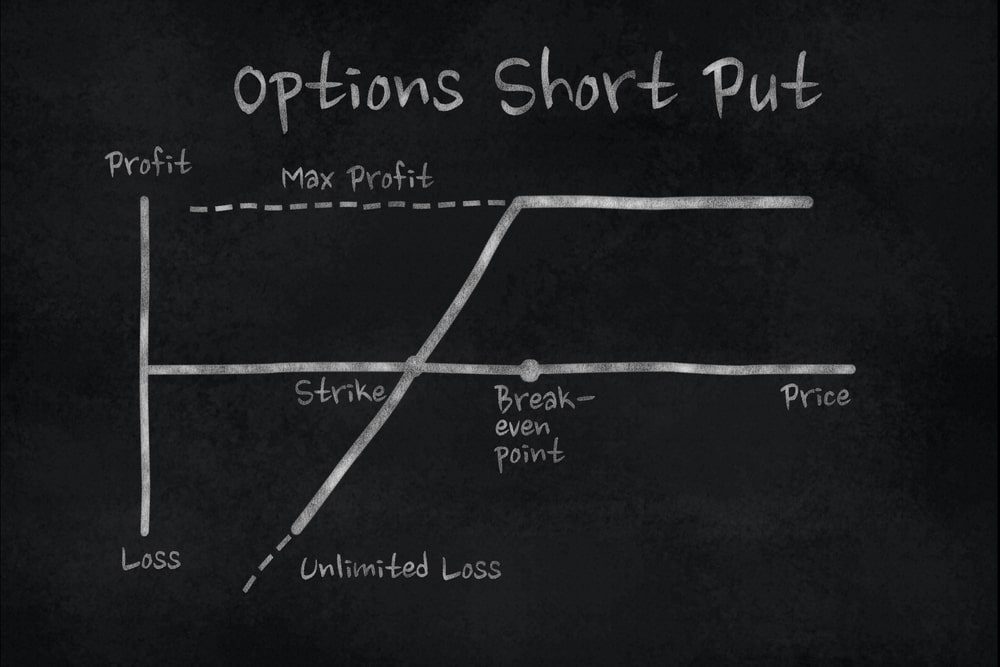

An option is a contract which gives the holder the right to buy or sell an asset at a set price within a specific timeframe. Options can be traded on a variety of assets, including stocks, currencies and commodities. A stock option contract typically represents 100 shares of the underlying stock. A call is an option to buy an asset at a set price on or before a particular date. A put is an option to sell an asset at a set price on or before a particular date. The price at which a put or call option can be exercised is called the strike price. The price that is paid to buy the option is called the premium. For example, imagine that a trader expects the price of gold to rise from $1,750 to $1,800 an ounce in the coming weeks. They decide to buy a call option giving them the right to buy gold at $1,760 (the strike price) at any time within the next month. If gold rises above the strike price of $1,760 before the option expires, they will be able to buy gold at a discount. If gold remains below $1,760, the trader doesn’t need to exercise the option and can simply let it expire. In this scenario, the trader would lose the premium paid to buy the call option. Options on individual stocks and on stock indices are actively traded on exchanges such as the Chicago Board Options Exchange (CBOE), which is the largest US options exchange. Options are also traded on the American Stock Exchange (AMEX) and Pacific Stock Exchange (PSE). Major options exchanges outside the US include the Eurex Exchange and the Montreal Stock Exchange. An OTC (over-the-counter) options market also exists, where traders from large institutions trade non-standard option derivatives. OTC means that the options are traded directly between two parties and without a central exchange or broker. To begin trading options you will need to open a brokerage account. Most leading stock brokers offer trading in both stocks and stock options. Due to the higher level of risk and complexity when trading options, a larger account balance may be required and clients are screened for suitability. Once you have enabled options permissions, you can start to trade. If you expect a stock’s price to appreciate, you could buy a call option or sell a put option. If you expect a stock’s price to move sideways you could sell a call option or sell a put option. If you think a stock’s price will fall, you could sell a call option or buy a put option. (See also: Call and Put Stock Options) To enter the trade you will need to pick the strike price. For example, if Tesla (TSLA) is trading at $770 and you believe it will go to $900, you could buy a call option with a strike price of less than $900. If TSLA rises above the strike price, it means that your call option is in the money – meaning that you have the opportunity to buy TSLA below its current market price. Conversely, imagine that you think the price of Amazon (AMZN) will fall from $3,400 to $3,000. You could buy a put option with a strike price of $3,200. If AMZN falls below the strike price of $3,200, your put option is in the money – meaning that you have the opportunity to sell AMZN above its current market price. There are also two styles of options, American and European. European-style options can only be exercised at expiration. American-style options offer more flexibility because they can be exercised at any time prior to expiration. To find the options that are available for a certain stock, you will need to refer to an option chain. An option chain, also known as an option matrix , shows all listed puts, calls, their expiration, strike prices, and volume and pricing information. Amazon.com Options Chain In the example above, we can see the option expiration date is September 2nd and both calls and puts are shown. Under the drop down menu at the top right, the strike price has been selected to show options that are ‘near the money’. Other possible choices to select are ‘in the money’ and ‘out of the money’. Near the money means an options contract whose strike price is close to the current market price of the underlying stock. In the money means an option that represents a profit opportunity due to the relationship between the strike price and the current market price of the underlying stock. Out of the money describes an option that lacks intrinsic value. An out of the money call or put option is worthless because it represents the opportunity to buy a stock for more than the current market price or sell for less than the current market price. The Strike column shows the price at which a call buyer can purchase the security if the option is exercised. In the case of a put option, it is the price at which the option buyer can sell the underlying stock if the option is exercised. Meanwhile, the option writer will be assigned to provide the underlying stock at the strike price if an option they sell (write) is exercised. Options on stocks have the same trading hours as regular stocks. For US exchanges such as the New York Stock Exchange (NYSE) and the Nasdaq Stock Market (Nasdaq), regular hours are 9:30 a.m. to 4 p.m. On both the NYSE and Nasdaq exchange, after-hours options trading takes place between 4:00 pm and 6:00 pm EST via electronic communications networks (ECNs). While most US brokers now offer commission-free trading in stocks and ETFs, options trading still usually involves fees or commissions. There may be a fee for each trade along with a commission charged per contract. The most common fee is $0.65 per contract, although this can vary depending on the stock options broker. For example, based on the typical fee of $0.65, to buy 5 contracts a trader would pay $3.25 to make the trade ($0.65 × 5 = $3.25). Ameritrade, Charles Schwab and Fidelity all charge a $0.65 fee per options contract at the time of this writing. Now let’s go over the four foundational options strategies for beginners to understand. Long Call: In this strategy, the trader is buying a call option. They are bullish and hope that the price of the underlying stock will rise above the strike price before the option expires, allowing them to buy below the market price. Example: Karen believes that the share price of Acme Corporation, currently trading at $50, will rally higher in the coming months. She purchases a long call option contract for 100 shares, set to expire in three months, at a strike price of $50 per share. The premium (fee) for purchasing the option is $2 per share. The share price of Acme Corporation does indeed surge higher in price and in three months shares are trading for $90. Karen exercises her option, buying 100 shares at $50 each, and then sells them for $90 each. In this case her profit is $3,800. This figure reflects the gross profit of $4,000 (100 x 40) minus the cost of the premium $200 (2 x 100). If the price of Acme Corporation had instead fallen in price, the option would expire worthless and Karen would have lost the premium she paid ($200). Short Call: Here, the trader sells (writes) a call option. This trader is typically bearish, expecting the price of the underlying stock to fall or move sideways. The trader receives a fee (premium) for selling the call option. If the stock price falls or moves sideways, the trader keeps the premium. However, the call seller is liable to the buyer to sell shares at the strike price if the underlying stock rises above that price, up until the options contract expires. Example: Steve believes that the share price of Virtucon, currently trading at $75, will drop in price in the coming months. Steve decides to write (sell) a call option for 100 shares, set to expire in three months, at a strike price of $75 per share. The premium is $3, so Steve earns an upfront sum of $300 (3 x 100). The share price of Virtucon does fall in price as expected, and in three months shares are trading for $50. In this case the option expires worthless and Steve has earned $300 from the premium. If the price of Virtucon had instead rallied to $100, then the holder would exercise the option and Steve would have lost $2,200. This figure reflects the gross loss of $2,500 (25 x 100) minus the premium earned of $300. Long Put: In this strategy, the trader buys a put option in anticipation of a decline in the underlying stock. The put option gives the right to sell the stock at the strike price before expiration. The trader wants stock prices to fall so that they can profit by selling above the market price. A long put could also be used to hedge a long position in the underlying stock. Example: George believes that shares of Wonka Industries, currently trading at $200, are going to slide lower in the months ahead. He buys a long put option contract for 100 shares, set to expire in three months, with a strike price of $200 per share. The premium is $3 per share. Wonka Industries posts a disappointing earnings report, and in three months the share price falls to $175. George buys 100 shares at $175 and exercises his option to sell the shares at $200. This results in a profit of $2,200. This figure represents the gross profit of $2,500 (25 x 100) minus the premium of $300 (3 x 100). If the price of Wonka Industries shares had instead risen to $225 after three months, George’s option would have expired worthless and he would have lost the $300 premium. Short Put: In this strategy the trader sells (writes) a put option and hopes that the stock price rises or stays flat until the option expires. In this scenario, the trader keeps the premium. However, the put seller is liable to the put buyer to buy shares at the strike price if the underlying stock falls below that price, until the contract expiration date. Example: Olivia is bullish on Cyberdyne Systems, currently trading at $50 a share. She expects the company’s shares will rise in the coming months. She decides to write (sell) a put option for 100 shares, set to expire in three months, at a strike price of $50 per share. The premium is $2, so Olivia earns an upfront sum of $200 (2 x 100). The share price of Cyberdyne Systems does rise in price as expected and in three months shares are trading for $60. In this case the option expires worthless and Olivia has earned $200 from the premium. If the price of Cyberdyne Systems had instead fallen to $40, then the holder would exercise the option and Olivia would have lost $800. This figure reflects the gross loss of $1,000 (10 x 100) minus the premium earned of $200. Covered Call: This strategy involves selling call options while owning an equivalent amount of the underlying stock or asset. When using covered calls, the trader earns the premium and might be required to deliver the shares if the buyer of the call chooses to exercise the options. It is suitable for investors who think that the price of the stock will move roughly sideways for the life of the options contract. Example: Martina buys 100 shares of Parker Industries for $200 per share. She believes that the stock market will not experience significant volatility in the near future. She expects that the price of Parker Industries will rise to roughly $215 in the next three months. She sells 1 call option contract with the strike price of $215 which expires in 3 months. The premium on this call option is $2 per share. Martina is correct in her forecast and the price of Parker Industries rises to $212 after three months. The buyer of the call option does not exercise it because it is ‘out of the money’ since the strike price is higher than the market price. Martina keeps the $200 in premium earnings and the value of the shares of Parker Industries that she owns have increased modestly. In the case where Parker Industries shares soar to $300 after 3 months, the buyer of the call option will exercise it. Martina receives $215 per share (strike price of the option) and can keep the $200 in earnings from the premium, but she misses out on the large gains in the stock. If the share price of Parker Industries falls to $190 after 3 months, the buyer of the call option does not exercise it because it is ‘out of the money’. In this scenario the value of Martina’s holdings in shares of Parker Industries has decreased, but this loss is offset by the earnings from the premium of the call option that she sold. Cash Secured Put: This is an income generating options strategy that involves selling (writing) a put option on a stock while having the cash in your account to buy the stock if the option is exercised. Remember, when selling a put option, you are selling the right to sell and thereby you are guaranteeing that you will be a buyer of a stock at a set price (the strike price) if the option is exercised. Example: Ronald is bullish on Alchemax Corporation and is confident that shares will either remain steady or rise in the next month. Alchemax shares are trading at $80 and Ronald sells a cash secured put with a strike price of $60 that expires in 30 days. He receives $200 ($2 per share) in premium. Ronald needs to have $6,000 in his account, in case the option is exercised and he must purchase the shares. The price of Alchemax stays above $60 during the next 30 days, and Ronald simply earns the $200 premium. If the price had fallen below $60, Ronald would have needed to be ready to purchase the 100 shares of Alchemax at $60 with the cash available in his account. Married Put. This strategy involves an investor who buys a stock and also buys a put option in the same stock to hedge against a fall in price. When using married puts, an investor can benefit from an upside price movement in a stock while also being protected from the price falling below the put’s strike price for the lifetime of the option. Example: Susan purchased 100 shares of Lexcorp at $50 a share and wants to protect herself against downside risk in the stock over the next month. As a form of insurance, she buys 1 put with a strike price of $45 which expires in 30 days. The premium for the option is $2 per share. The following week, Lexcorp posts disappointing earnings and the stock price tanks to $20. Susan exercises her put option and sells her stock in Lexcorp at $45, restricting her loss to $700. This figure reflects a $500 loss from selling the shares and the $200 premium. If the price of Lexcorp had instead rallied to $80, Susan would have a potential profit of $2,800 ($3,000 from the price appreciation of the stock, minus the $200 premium). We can see in this example that by using a married put, Susan was able to both limit her losses and leave herself open to upside gains in the share price of Lexcorp, during the 30 day lifetime of the option. Stocks represent ownership in a company. When investors buy stocks they can profit if the share price appreciates. Stocks also have the benefit of sometimes paying dividends. A dividend is a sum of money paid to shareholders, typically on a quarterly basis. When trading stock options, there is no ownership of the underlying company and there is no opportunity to receive dividends. Options offer the advantage of being cost-efficient. An options trader can take on a similar position in the market to a stock trader but with far less capital. Options offer higher potential returns in percentage terms, due to the lower level of capital required. Options also give traders access to flexible and complex strategies. These include strategies that can be profitable under any market conditions, for example when the market moves sideways. Options can compliment an existing stock portfolio by providing a reliable hedge against adverse moves in the market. Options trading can carry greater risk than trading stocks. For an options buyer (holder), the risk is contained to the amount of the premium paid. However, an options seller (writer), assumes far greater risk. For example, when selling an uncovered call option, the potential loss is infinite, because there is no limit on how high a stock price can rise. Brokers use trading approval levels to control the risk exposure of the customer and of the company itself. Options trading approval levels range from 1 to 4; with 1 being the lowest and 4 being the highest. Level 1 allows individuals to sell options that are collateralized or secured. For example, with level 1 approval, traders can sell covered calls. The call option is ‘covered’ when they own 100 shares of the same stock associated with the call option. The sale of cash secured puts is also permitted. In this case the trader has sufficient cash in their account to buy 100 shares of the underlying stock associated with the put. Level 2 options trading provides access to buying options. Here, the most a trader can lose is the premium paid to buy the option. If they buy a call or a put for $100, and the option expires ‘out of the money’, the most they can lose is $100. Level 3 options trading allows traders to hold spreads. A spread is when you open two or more options positions against the same underlying stock. Level 4 options trading allows the highest risk forms of options trading. These include the selling of naked (uncovered) calls and naked (uncovered) puts. When a trader sells a naked call, it means they do not own the shares to cover the call they sold, which means that the risk is potentially infinite. Options have some important pros and cons to consider: Advantages Cost efficiency and leverage. Options trading offers greater leverage than trading stocks. Less capital is needed to buy options than to buy shares outright and the percentage gains on your investment have the potential to be higher. For example, in order to buy 100 shares of an $800 stock would require $80,000 (or $40,000 with 50% margin). When buying options the upfront capital requirement is much lower to take on the same level of market exposure. Options allow investors to take on substantial positions in the market with a relatively small amount of capital. Limited Risk. While in some cases, options trading can have unlimited risk, in other instances the risk is limited and clearly defined. When buying puts and calls, a trader is risking less than when trading the stock directly. The most that an investor can lose is the premium (and the fee to initiate the trade). Most retail options traders are buyers of calls and puts and are exposed to a relatively low level of risk. Flexibility. Options allow you to create unique strategies to take advantage of different characteristics of the market. For example, options allow traders to make money when the market moves sideways. Traders can use options to profit within short or medium timeframes without the need for a stock’s price to move upwards or downwards. Options can be used for speculation and to produce income from premiums. Buying put options can hedge an existing portfolio and offset market risk. Disadvantages Low liquidity. Individual stock options typically have low volume, unless it is a highly popular stock or stock index. High risk for option sellers. When a trader writes (sells) a call or a put option, they can end up losing far more money than they earned from the contract’s premium. In the case of selling calls, the risk is theoretically unlimited. Selling options can result in losses greater than the value of your account. Limited availability. Options are not available for all stocks. Stocks with low prices, low trading volumes and low market caps are more likely to not have options. Strict approval levels. To trade options, approval must be granted by your broker. Traders must meet certain requirements and based on your background and experience your broker will assign you a trading level that governs which options trades you can execute. Conclusion The apparent complexity and technical jargon associated with options trading can be off-putting to some investors. Nevertheless, the basic concepts can be grasped fairly easily and options trading can open up a broad new range of opportunities in the financial markets. While some strategies are high risk, with others the risk is limited and clearly defined. Once the domain of professionals, the risks and rewards of options trading now are more accessible than ever to retail traders.Where do Options Trade?

How to Trade Options

Reading Options Tables

When Do Options Trade During the Day?

Can You Trade Options for Free?

Options Trading Strategies

Trading Options vs. Trading Stocks

What Are the Levels of Options Trading?

Level 1: Covered Level 2: Standard Cash Level 3: Standard Margin Level 4: Advanced Covered callsCash secured putsMarried Puts Buying calls and putsAll of level 1 Covered putsSpreadsAll of levels 1 and 2 Uncovered calls and putsAll of levels 1, 2 and 3 Advantages and Disadvantages of Trading Options