Dải Bollinger là một trong những chỉ báo kỹ thuật phổ biến nhất trên bất kỳ thị trường tài chính nào, bao gồm cả thị trường Forex. Chúng được John Bollinger tạo ra vào đầu những năm 1980 dựa trên nhu cầu về các dải giao dịch thích ứng phản ánh chính xác biến động giá. Tìm hiểu Dải Bollinger là gì trong Forex, các chỉ báo được các nhà giao dịch chuyên nghiệp sử dụng và cách diễn giải các tín hiệu của nó trong bài viết đầy đủ này.

Mục lục

Giới thiệu về Dải Bollinger

Dải Bollinger Chiến lược số 1: Dải Bollinger bật lên

Các chỉ báo xác nhận bật lên của dải Bollinger: RSI và nến

Đảo ngược lên:

Sự phục hồi giảm giá

Lợi ích và rủi ro

Chiến lược dải Bollinger số 2: Dải Bollinger Đột phá Timberline

Đột phá tăng giá

Đột phá giảm giá

Lợi ích và rủi ro

Chúng được sử dụng phổ biến nhất để xác định mức quá mua và quá bán khi giá chạm mức Dải Bollinger Bán khi giá ở đường trên và mua khi giá bật trở lại từ đường dưới của Dải Bollinger. Kỹ thuật này hoạt động tốt trong các thị trường có giới hạn phạm vi và cho phép giao dịch bật lên theo hướng của xu hướng chính. Dải Bollinger cũng có thể được sử dụng để đột phá bên ngoài Dải Bollinger, đặc biệt là sau một khoảng thời gian Dải Bollinger tương đối hẹp. Chúng tôi sẽ kiểm tra hai phương pháp này vào thời điểm thích hợp: thoát và ngắt.

Giới thiệu về Dải Bollinger

Dải Bollinger bao gồm một bộ ba dải liên quan đến giá: đường trung bình động 20 kỳ ở giữa và dải trên và dải dưới hai dải lệch chuẩn ở trên và dưới. bên dưới đường trung bình chuyển động đơn giản. Độ lệch chuẩn là một chỉ báo thống kê đưa ra dấu hiệu tốt về biến động giá. Vì 68% dữ liệu nằm trong khoảng cộng hoặc trừ một độ lệch chuẩn của giá trị trung bình, nên độ lệch chuẩn bằng hai có nghĩa là giá sẽ được phân bổ 95,5% trong phạm vi hai độ lệch so với giá trị trung bình. Các dải giao dịch này, được vẽ bên trong và xung quanh cấu trúc giá, tạo thành một "đường bao" và hành động giá gần các cạnh của đường bao được đặc biệt quan tâm.

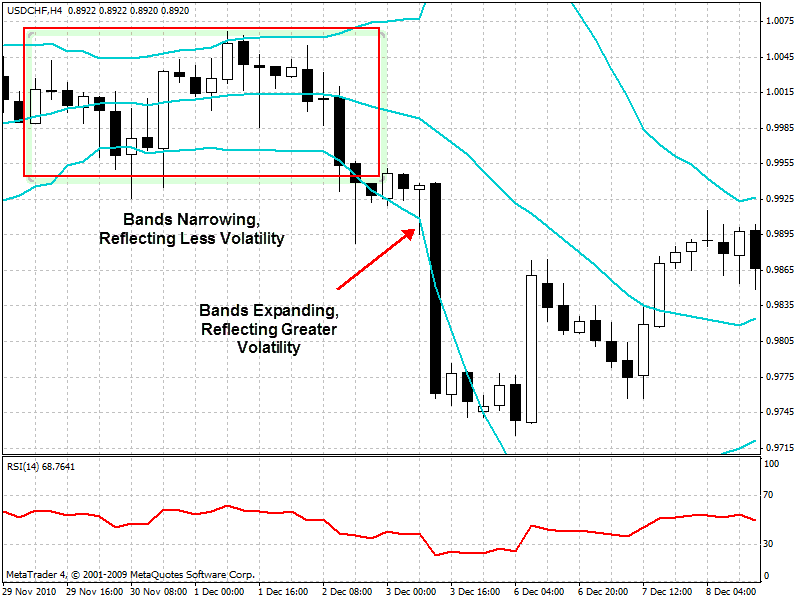

Khi giá thay đổi mạnh, các dải này mở rộng và mở rộng, phản ánh mức độ biến động lớn hơn, trong khi khi giá thay đổi vừa phải, các dải hẹp và co lại, phản ánh sự thiếu biến động.

Chúng ta không cần đi sâu vào toán học đằng sau Dải Bollinger hoặc lịch sử của chúng, vì vì tất cả các mục đích thực tế , thông tin này không liên quan.

Chiến lược dải Bollinger số 1: Sự phục hồi của dải Bollinger

Nghiên cứu cho thấy sự thâm nhập của Dải Bollinger chỉ xảy ra 15% thời gian. Thời gian còn lại giá di chuyển trong Dải Bollinger và thường giá sẽ quay trở lại giữa dải. Theo cách này, Dải Bollinger trông giống như những sợi dây cao su chỉ có thể bị kéo căng đến một mức độ nhất định trước khi trở về mức trung bình hoặc trung bình. Dải trên và dải dưới của Dải Bollinger được tạo bởi 2 đường lệch chuẩn tạo nên ranh giới giá.

Vì có nhiều khả năng giá sẽ nằm trong dải hơn là xuyên qua nó, một trong những cách phổ biến và đáng tin cậy nhất để giao dịch trong dải là mua khi giá tiến gần đến giới hạn dưới của dải. dải, tại thời điểm đó giá Bán khi đạt đến giới hạn trên của dải.

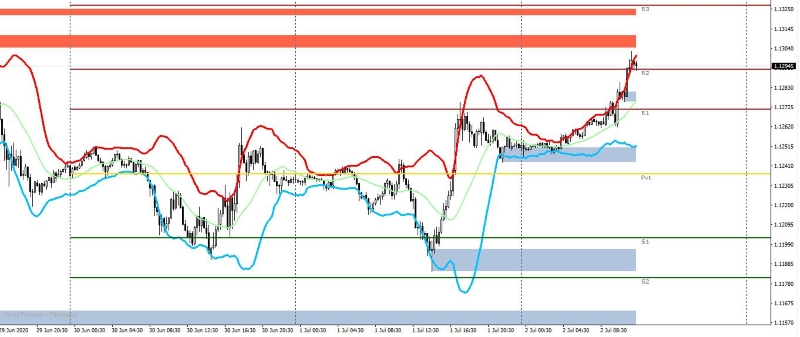

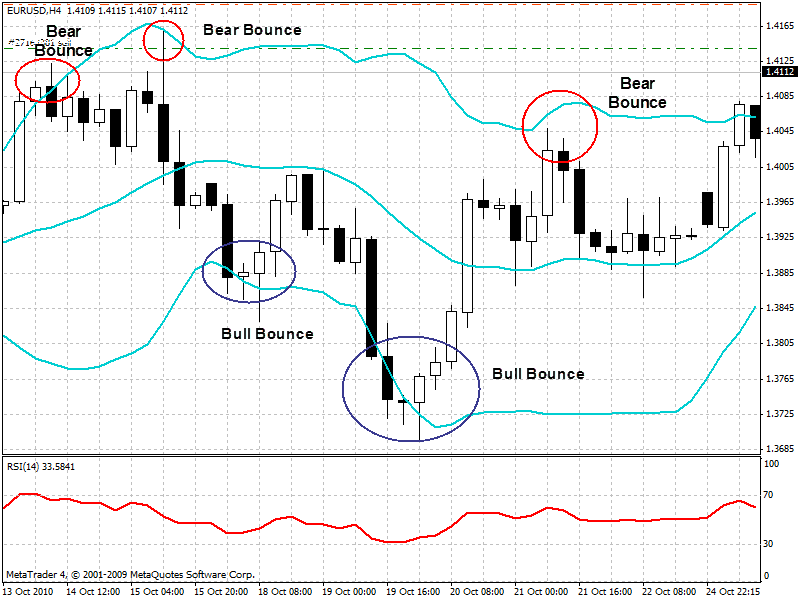

Bạn có thể thấy trong biểu đồ trên rằng đã có ít nhất 5 lần giá chạm vào dải bên ngoài chỉ để thoái lui về dải giữa hoặc ngược lại mang lại. Điều này không có nghĩa là nên thực hiện giao dịch phản hồi mỗi khi giá gặp phải mức giảm. Sẽ hợp lý hơn khi giao dịch các cú nảy ngược theo hướng của xu hướng chính trong khi sử dụng các chỉ báo xác nhận khác như nến và RSI.

Các chỉ báo xác nhận sự phục hồi của Dải Bollinger : RSI và Chân nến

Chỉ vì giá chạm Dải Bollinger trên hoặc dưới không nhất thiết có nghĩa đây là thời điểm tốt để bán hoặc mua. Một xu hướng mạnh sẽ "cưỡi" các dải này và loại bỏ bất kỳ nhà giao dịch nào cố gắng mua ở mức giá "thấp" trong xu hướng giảm hoặc bán ở mức giá "cao" trong xu hướng tăng. Trên thực tế, giá sẽ tạo ra các mức cao mới trong xu hướng tăng và mức thấp mới trong xu hướng giảm, chạm và vượt mức dao động, nhanh chóng loại bỏ điểm dừng giao dịch trực tiếp trên các dao động. Do đó, nên giao dịch các đợt tăng giá với các chỉ báo xác nhận khác như RSI và nến.

Nếu bạn đang cố gắng giao dịch khi dải Bollinger bật lên, tốt nhất bạn nên xem xét Chỉ số sức mạnh tương đối hoặc RSI. Chúng tôi không xem xét liệu chỉ số RSI đang ở trạng thái quá mua hay quá bán mà là nó đang mạnh lên hay yếu đi như thế nào. Nói chung, mọi người sẽ bán khống một loại tiền tệ nếu giới hạn trên của Dải bollinger bị phá vỡ khi chỉ số RSI cho thấy điểm yếu (lớn hơn 50-80 và đang giảm). Ngược lại, nếu Dải Bollinger thấp hơn xảy ra khi chỉ số RSI thể hiện sức mạnh (dưới 30-50 và đang tăng), mọi người sẽ mua tiền tệ. Bằng cách này, chúng tôi xem RSI như một chỉ báo xu hướng sớm, xác nhận kênh phá vỡ xu hướng ngược.

Ngoài ra, người ta có thể kiên nhẫn chờ đợi những nến xác nhận sự đảo chiều. Khi thanh xuyên qua dải trên, bạn có thể tìm kiếm các nến giảm giá và khi thanh xuyên qua dải dưới, bạn có thể tìm kiếm các nến tăng giá. Nếu nến tạo mức cao hoặc thấp mới bên ngoài dải thì đó không phải là thời điểm tốt để tham gia giao dịch. Nhưng nếu nến sau đột phá không tạo được mức cao hoặc mức thấp mới, hãy quan sát xem liệu mô hình giảm giá hay tăng giá hình thành: đường âm dài hoặc bóng trên dài là giảm và đường trắng dài hoặc bóng dưới dài là tăng. Xem bài viết của tôi về mô hình nến.

Khung thời gian bật lại của dải Bollinger tốt nhất: Khung thời gian càng dài thì cơ hội phục hồi càng ít nhưng các dải có xu hướng mạnh hơn. Đây là một sự đánh đổi. Bạn muốn có nhiều cơ hội, muốn có một ban nhạc mạnh nhưng thật khó để tìm được sự cân bằng giữa cả hai. Chúng tôi thấy H4 hoạt động tốt nhất. Bạn sẽ có nhiều cơ hội giao dịch và các khung thời gian phản ánh những biến động mạnh.

Sự phục hồi tăng giá:

Sự phục hồi tăng giá (hoặc sự đảo chiều tăng giá) là khi một loại tiền tệ đang trong xu hướng tăng và sau đó quay trở lại Dải Bollinger phía dưới. Điểm vào của bạn phải là một nến tăng đã đảo chiều theo xu hướng trước đó.

Điều kiện để tham gia:

Tiền tệ đang có xu hướng tăng

Tiền tệ chạm hoặc rất gần chạm tới Dải bollinger phía dưới

Tìm kiếm RSI dưới 30-50 và đang tăng

Tìm kiếm các mô hình và nến đảo chiều tăng giá

*Đảm bảo bạn chỉ thực hiện 1-2 giao dịch như vậy mỗi ngày. Nếu bạn bị dừng giao dịch trên cả hai giao dịch, điều đó cho thấy rằng thị trường đang trong giai đoạn điều chỉnh mạnh và không nên giao dịch với các đợt phục hồi tiếp theo bên ngoài dải.

Điều kiện thoát:

Dừng lỗ nằm ở mức 20 pip dưới giới hạn dưới thứ ba của độ lệch (bạn cần rút một mức) hoặc cách điểm vào 50-80 pip.

Điểm kích hoạt điểm hòa vốn nằm ở giữa ban nhạc.

Tăng lợi nhuận tại Dải Bollinger khác hoặc lợi nhuận 100-150 điểm .

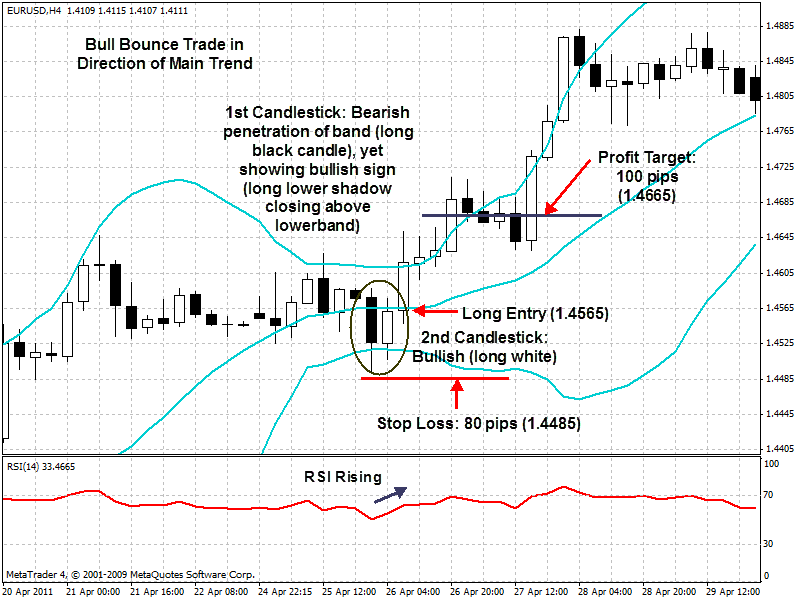

Trong hình trên, dải tần thu hẹp sau giai đoạn mở rộng, biểu thị sử dụng Thời điểm đã chín muồi cho một giao dịch tăng giá theo hướng xu hướng chính tăng giá. Một nến tăng xuyên qua dải phía dưới và sau đó ổn định trở lại phía trên cho thấy rằng bây giờ là lúc sẵn sàng bóp cò. Vì nến tiếp theo cho thấy thân nến tăng giá tốt và chỉ số RSI đã mạnh lên nên đã đến lúc mua vào khi đóng cửa thanh này (1.4565). Bốn chân nến sau đó, lợi nhuận 100 pip của tôi đã đạt được. Sử dụng nhiều điều kiện này để xác nhận sẽ đảm bảo khả năng thắng cao hơn.

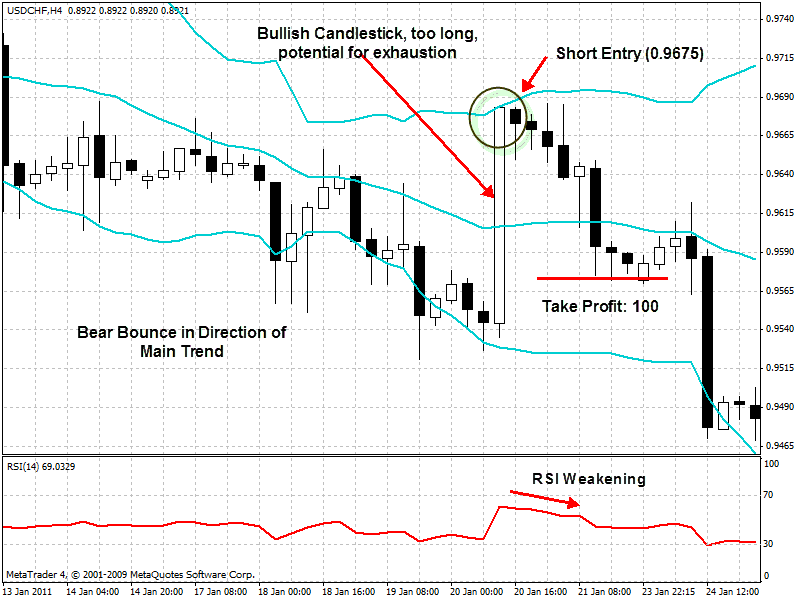

Phản ứng giảm giá

Một cú bật lên giảm giá (hoặc đảo chiều giảm giá) là khi một loại tiền tệ đang trong xu hướng giảm và sau đó kéo lên Dải Bollinger phía trên. Điểm vào của bạn phải là một nến giảm giá đã đảo ngược xu hướng trước đó.

Điều kiện để vào:

Tiền tệ đang trong xu hướng giảm

Tiền tệ đang chạm hoặc rất gần chạm tới Dải Bollinger trên

Hãy tìm RSI ở trên 50- 80 trở xuống

Tìm kiếm các nến đảo chiều giảm giá và các mẫu.

* Đảm bảo bạn chỉ thực hiện 1-2 giao dịch như vậy mỗi ngày. Nếu bạn bị dừng giao dịch trên cả hai giao dịch, điều đó cho thấy rằng thị trường đang trong giai đoạn điều chỉnh mạnh và không nên giao dịch với các đợt phục hồi tiếp theo bên ngoài dải.

Điều kiện thoát:

Dừng lỗ được đặt 20 pip trên giới hạn độ lệch trên thứ ba (bạn cần rút một mức), hoặc 50-80 pip tính từ điểm vào lệnh.

Điểm kích hoạt điểm hòa vốn nằm ở giữa ban nhạc.

Trong Dải Bollinger khác hoặc mục nhập 100-150 Lợi nhuận điểm .

Trong biểu đồ trên, thị trường đang dần di chuyển xuống thấp hơn, cho thấy xu hướng lớn hơn đã giảm thì bất ngờ, một nến tăng rất dài hình thành từ dải dưới và kết thúc ở dải trên. Những loại nến steroid này rất hiếm và có thể được kích hoạt bởi các sự kiện tin tức và khi chúng đi ngược lại xu hướng chính, bạn có thể đặt cược rằng vào thời điểm chúng vượt qua toàn bộ hành lang Dải Bollinger, chúng sẽ tự cạn kiệt. Thấy mô hình nến đó và chạm vào dải trên sẽ là tín hiệu báo động để bạn nạp súng và nhắm vào đầu kẻ đột nhập này. Việc thấy nến tiếp theo không tạo được mức cao mới và chuyển sang giảm giá là một dấu hiệu để bóp cò, ngoài ra còn thấy chỉ báo RSI suy yếu. Giá không bao giờ tiếp tục chuyển tiếp mà bắt đầu giảm từ điểm vào lệnh và trong vài nến tiếp theo, bạn có thể dễ dàng đạt được mức chốt lời 100 pip.

Lợi ích và rủi ro span>

Thiết lập thoát này rất linh hoạt, có nghĩa là nó hoạt động trên tất cả các khung thời gian. Các nhà giao dịch ngắn hạn có thể sử dụng nó trên biểu đồ hàng giờ, các nhà giao dịch trung hạn có thể sử dụng nó trên biểu đồ bốn giờ và các nhà giao dịch vị thế có thể sử dụng nó trên biểu đồ hàng ngày và hàng tuần. Hãy nhớ rằng khung thời gian càng ngắn thì tín hiệu càng kém tin cậy, mặc dù chúng ta vẫn cần khung thời gian mang lại cho chúng ta một số cơ hội giao dịch.

Nhiều nhà giao dịch đã phát triển hệ thống nảy của Dải bollinger rất thành công, tận dụng các điều kiện phạm vi hoặc tốt hơn là điều chỉnh xu hướng. Bây giờ, điều gì sẽ xảy ra khi thị trường có xu hướng vượt ra ngoài Dải Bollinger? Hy vọng rằng bộ lọc chiến lược thoát của bạn sẽ ngăn bạn tham gia giao dịch này nếu không bạn sẽ bị dừng giao dịch. Bạn cũng có thể tận dụng các cơ hội đột phá, như minh họa bên dưới.

Chiến lược dải Bollinger số 2: Đột phá dải Bollinger

Các đột phá của Dải Bollinger thường có thể được dự đoán bằng hiện tượng được gọi là sự siết chặt của dải. Khi các dải tập trung lại với nhau hoặc thu hẹp lại, thị trường đã bước vào giai đoạn kênh biến động thấp. Nó di chuyển trong các dải hẹp này càng lâu thì khả năng thị trường cuối cùng sẽ thâm nhập vào các dải này và tiếp tục đi theo hướng đột phá càng lớn, đặc biệt nếu sự kiện này xảy ra theo hướng của một xu hướng dài hạn đã được thiết lập trước đó. Tuy nhiên, thời gian là tất cả, chúng ta chỉ không biết đợt siết chặt sẽ kéo dài bao lâu.

Lưu ý: Dải Bollinger đóng vai trò là bộ lọc. Bạn chắc chắn không muốn giao dịch theo đột phá trong một thị trường có giới hạn phạm vi. Nếu bạn cố gắng thoát ra khỏi đỉnh của một kênh giá, nó sẽ trở thành một cái thòng lọng quanh bạn khi thị trường quay trở lại phía bên kia của kênh. Một cách để xác định xem thị trường có bị giới hạn trong phạm vi hay không là sử dụng Dải Bollinger làm bộ lọc. Điều bạn muốn làm là đo khoảng cách giữa dây đai trên và dưới. Bạn xác định thông qua việc kiểm tra lại rằng nếu khoảng cách nhỏ hơn điểm X (hãy gọi nó là BBRange), thì Dải Bollinger quá hẹp và bạn nên tránh giao dịch. Nếu thị trường vẫn nằm trong phạm vi BB hẹp này và sau đó mở rộng ra ngoài phạm vi đó thì đây sẽ trở thành điều kiện thứ hai và thứ ba để thiết lập mục nhập. Điều kiện đầu tiên là bạn chỉ nên giao dịch theo hướng của xu hướng chính.

Cách móc dây đeo: dây trên hướng lên trên và dây dưới úp xuống. Chìa khóa trực quan là quan sát cả dải trên và dải dưới khi giá tiếp cận. Nếu dây đai phẳng hoặc co lại, hoặc chỉ có một móc dây đeo còn cái kia thì không, bạn có dấu hiệu cho thấy không có gì nhiều xảy ra. Tuy nhiên, nếu dải trên tăng trong khi dải dưới giảm, điều đó cho thấy hành động giá có thể bùng nổ theo hướng của dải đẩy nến. Nó càng thẳng đứng thì chuyển động tiềm năng càng mạnh.

Các chỉ báo khác: Chân nến và RSI. Cũng giống như giao dịch tăng giá, bạn có thể sử dụng mô hình nến và RSI làm chỉ báo xác nhận để đặt giao dịch. Bạn muốn nến đột phá hoặc phá vỡ rộng hơn một chút so với bình thường. Bạn muốn chỉ số RSI mạnh hơn trong các giao dịch tăng giá và yếu hơn trong các giao dịch giảm giá.

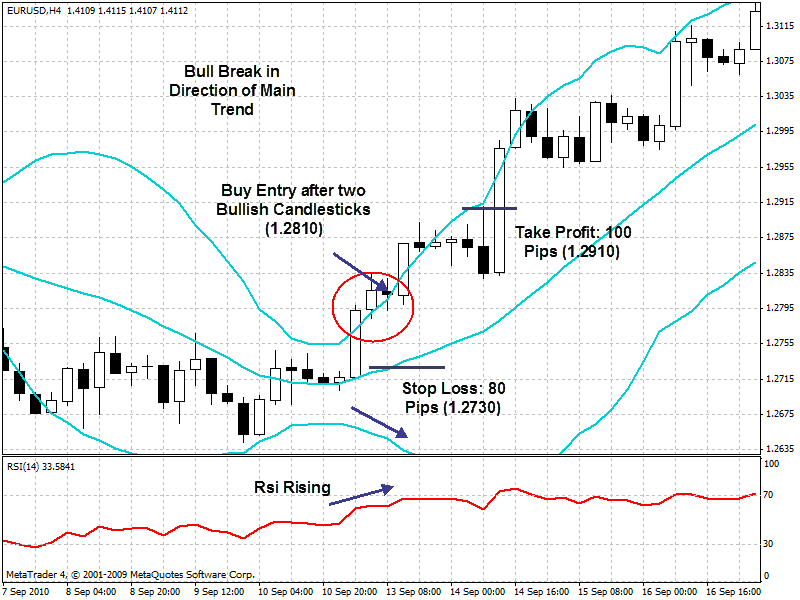

看涨突破

Một đột phá tăng giá xảy ra sau khi Dải Bollinger thu hẹp lại, sau đó giá bứt phá và kéo dải trên lên trên. Dây đai trên hướng lên trên và dây đai dưới hướng xuống dưới.

Điều kiện để vào:

Đồng tiền đang trong xu hướng tăng

Đồng tiền đang bị khóa trong phạm vi hẹp Trong phạm vi

Giá đạt tới đường trên và đường trên bị móc Và móc đường ray phía dưới

Phạm vi của nến đột phá rộng hơn trước. Nến lớn hơn

RSI ở mức 30-50 và đang tăng

Điều kiện thoát:

Dừng lỗ được đặt 20 pip bên dưới dải giữa hoặc 50-80 pip tính từ điểm vào lệnh.

Lợi nhuận 100-150 pip từ mục nhập.

Trong biểu đồ trên, thị trường đã bước vào giai đoạn thu hẹp (ép) ngắn gồm 5 thanh, điều này sẽ cảnh báo các nhà giao dịch về khả năng đột phá lên trên dải trên theo hướng của xu hướng chính . Khi một thanh tăng giá mạnh và lành mạnh di chuyển lên từ dải giữa và xuyên qua dải trên, đây sẽ là tín hiệu cần chú ý: sự đột phá vừa xảy ra và chúng ta cần một vài tín hiệu xác nhận. Dấu hiệu xác nhận là dấu hiệu trực quan cho thấy dải trên móc lên trên trong khi dải dưới móc xuống dưới. Một dấu hiệu xác nhận khác là thanh tiếp theo cũng tăng và tạo mức cao mới, cho thấy sự đột phá thành công, không có sự phục hồi trước mắt và điểm vào mua phải được thực hiện khi đóng nến.

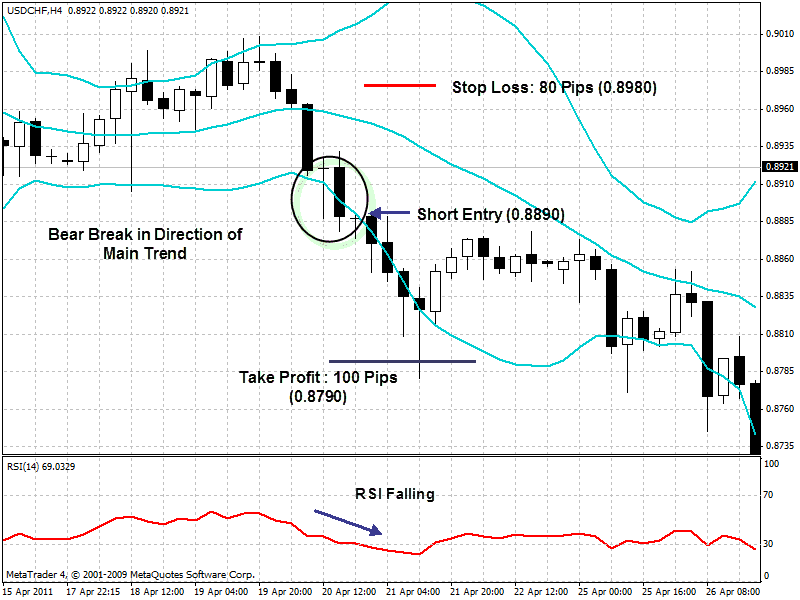

Đột phá giảm giá

Dải Bollinger thu hẹp theo sau là một đột phá giảm giá trước khi giá bứt phá và mở rộng dải dưới xuống phía dưới. Dây đai trên hướng lên trên và dây đai dưới hướng xuống dưới.

Điều kiện để vào:

Đồng tiền đang trong xu hướng giảm

Đồng tiền đang bị khóa trong phạm vi hẹp Trong phạm vi

Giá đạt tới đường trên và đường trên bị móc Và móc đường ray phía dưới

Tỷ lệ phạm vi của nến phân tích Cây nến trước đó lớn hơn

RSI ở mức 50-80 và đang giảm

Điều kiện thoát:

Dừng lỗ được đặt 20 pip phía trên dải giữa hoặc 50-80 pip tính từ điểm vào lệnh.

Lợi nhuận 100-150 pip từ mục nhập.

Biểu đồ trên bắt đầu với việc thị trường đang thu hẹp, với các nến cố gắng hết sức để đẩy thị trường và đạt mức trần cao hơn trước nhược điểm của xu hướng chính. Khi ba nến giảm giá mạnh sau đó giảm xuống các dải phía dưới, Goldilocks nhận thấy có khả năng đột phá về phía nam. Nến thứ tư xuyên qua dải dưới trở thành doji chân dài, điều này sẽ cản trở quyết tâm của phe gấu. Tuy nhiên, dấu hiệu trực quan sẽ giúp bạn tự tin hơn rằng dây đeo phía trên đang móc xuống trong khi dây đeo phía dưới được móc xuống. Ngoài ra, người ta có thể thấy rằng chỉ số RSI đang suy yếu. Khi nến thứ 5 trở nên giảm giá mạnh, bạn sẽ có xác nhận rõ ràng hơn rằng đột phá đã thành công và bạn sẽ bán khi đóng nến, dễ dàng thu được 100 pips ở bốn nến tiếp theo.

Lợi ích và rủi ro span>

Mặc dù giao dịch siết chặt đột phá xảy ra ít thường xuyên hơn giao dịch tăng điểm, nhưng đây vẫn là một chiến lược rất mạnh mẽ đáng xem xét. Nó có thể chỉ xuất hiện 15% thời gian, nhưng khi xuất hiện, nó có thể đại diện cho một động thái đột phá rất quan trọng.

Hãy nhớ rằng, nếu bạn cố gắng hành động trong mọi trường hợp có sự đột phá của dao động do giá điều khiển, tài khoản của bạn sẽ bị hủy rất nhanh. Bạn phải chú ý đến các chỉ số xác nhận khác. Sau khi dải đã thu hẹp trong một khoảng thời gian, bạn nên giao dịch theo hướng của xu hướng chính. Bạn muốn các dải cố định lên xuống theo chiều dọc, bạn muốn nến thâm nhập lớn và bạn muốn chỉ số RSI mạnh lên trong các giao dịch tăng giá và yếu đi trong các giao dịch giảm giá. Nếu tuân theo tất cả các điều kiện này, bạn vẫn có thể sai nên phải đặt một điểm dừng cố định cách lối vào không xa, ẩn sau dải giữa.