Cho rằng các cặp tiền tệ mà chúng ta giao dịch thể hiện sức mạnh tương đối của một loại tiền tệ so với một loại tiền tệ khác, chúng ta phải tìm cách so sánh các lực lượng kinh tế đằng sau mỗi loại tiền tệ trong cặp đó. Ví dụ, nếu đang nghiên cứu lãi suất, chúng ta phải nghiên cứu sự khác biệt về lãi suất giữa hai nhóm, gọi là chênh lệch lãi suất chứ không chỉ nghiên cứu lãi suất của một nhóm.

Hơn nữa, mọi so sánh sức mạnh cơ bản đều phải xem xét các điều kiện hiện tại và quá khứ cũng như suy đoán về triển vọng ngắn hạn và dài hạn trong tương lai. Tìm hiểu cách đọc phân tích cơ bản về Forex và khám phá 10 lực lượng thị trường hàng đầu thúc đẩy thị trường tiền tệ và ảnh hưởng đến giá cả trong bài viết này.

Sau đây là mười động lực cơ bản thúc đẩy thị trường tiền tệ.

Mục lục

Lãi suất

Về ngoại hối và tác động kinh tế

So sánh lãi suất hiện tại và lịch sử:

Lịch kinh tế: Các quyết định và bài phát biểu về lãi suất của Ngân hàng Trung ương

Tỷ lệ lạm phát

Tác động đến ngoại hối và nền kinh tế

So sánh tỷ lệ lạm phát hiện tại và lịch sử

Các sự kiện lịch kinh tế

Cán cân thương mại và tài khoản vãng lai

Tác động đến ngoại hối và nền kinh tế

Sự kiện kinh tế

Nợ chính phủ

Sự kiện kinh tế

Việc làm/Thất nghiệp

p>Tác động đến ngoại hối và nền kinh tế.

Các sự kiện trong Lịch kinh tế

Tổng sản phẩm quốc nội

Tác động đến ngoại hối và nền kinh tế

Các sự kiện trong lịch kinh tế

Thống kê liên quan đến sản xuất

Ý nghĩa đối với ngoại hối và nền kinh tế

Các sự kiện trong lịch kinh tế

Chi tiêu của người tiêu dùng và niềm tin

Ý nghĩa đối với ngoại hối và nền kinh tế Tác động kinh tế

Sự kiện kinh tế

Khởi công nhà ở mới và bán nhà mới và nhà hiện có

Tác động đến ngoại hối và nền kinh tế

< p>Sự kiện kinh tếRủi ro địa chính trị

Thiên tai:

Các cuộc tấn công khủng bố:

Chiến tranh:

Chính phủ Bầu cử hoặc thay đổi lãnh đạo:

Tình trạng bất ổn ở các quốc gia khác:

Bất ổn tài chính và chuyến bay an toàn:

Lãi suất

Ngân hàng trung ương thiết lập chính sách tiền tệ bằng cách kiểm soát lãi suất qua đêm hoặc ngắn hạn. Họ sử dụng các mức lãi suất này để cho các ngân hàng thương mại vay tiền nhằm tác động đến lãi suất thế chấp và các loại khoản vay khác. Chính sách tiền tệ của ngân hàng trung ương được thiết kế để kiểm soát lạm phát và/hoặc thúc đẩy tăng trưởng kinh tế. Ví dụ, Ngân hàng Trung ương Châu Âu (ECB) đặt mục tiêu kiểm soát lạm phát dưới 2%, trong khi Cục Dự trữ Liên bang có sứ mệnh kép là thúc đẩy tăng trưởng kinh tế và duy trì ổn định giá cả.

Dành cho ngoại hối và kinh tế Ảnh hưởng

Lãi suất và các chính sách tiền tệ đặt ra chúng có tác động sâu sắc đến giá trị tương đối của tiền tệ và hoạt động kinh tế trong nước. Lãi suất tác động trực tiếp đến đồng tiền, thu hút nhà đầu tư vào các đồng tiền và trái phiếu lãi suất cao, khiến các đồng tiền lãi suất cao tăng giá, hoặc khiến các nhà đầu tư vào các đồng tiền và trái phiếu lãi suất thấp sợ hãi, khiến các đồng tiền lãi suất thấp giảm giá. lãi suất ảnh hưởng đến hoạt động kinh tế tổng thể, hơn thế nữa. Lãi suất thấp nói chung (đôi khi chỉ trên lý thuyết) kích thích vay mượn, đầu tư và tiêu dùng, trong khi lãi suất cao hơn có xu hướng giảm vay mượn và tăng tiết kiệm hơn là tiêu dùng. Ngoài ra, do lãi suất thấp hơn làm giảm giá tiền tệ, điều này làm cho hàng xuất khẩu trở nên rẻ hơn đối với người tiêu dùng nước ngoài, từ đó giúp cân bằng thương mại.

Đối với nhà giao dịch, nguyên tắc chung là:

| Lãi suất | Hiệu lực tiền tệ | Hiệu ứng lạm phát | Hiệu ứng tăng trưởng |

|---|---|---|---|

| Tỷ lệ cao hơn | Tăng cường Tiền tệ | < td>Ổn định lạm phátLàm chậm tăng trưởng | |

| Tỷ lệ thấp hơn | Làm suy yếu tiền tệ | Làm tăng lạm phát | Kích thích tăng trưởng |

Sự khác biệt về lãi suất giữa nước này và nước khác được gọi là chênh lệch lãi suất, các nhà đầu tư Đó là thường bị thu hút bởi các cặp tiền tệ có chênh lệch lãi suất dương. Để biết thêm thông tin, hãy xem bài viết của chúng tôi về giao dịch chênh lệch giá.

So sánh lãi suất hiện tại và lịch sử:

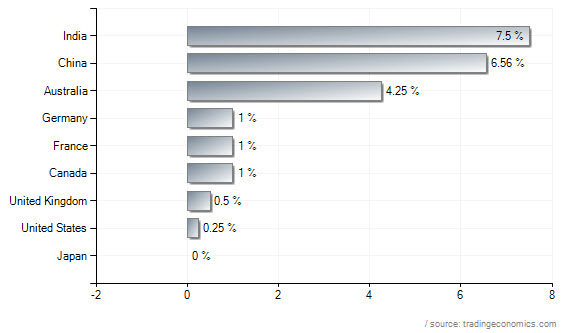

Trước tiên, người ta nên cố gắng quan sát sự khác biệt về lãi suất hiện tại ở mỗi cặp tiền tệ, trả đặc biệt chú ý đến hiệu suất Cặp tiền tệ có chênh lệch lãi suất dương lớn nhất. Ví dụ: đây là xếp hạng lãi suất của các quốc gia lớn, được cung cấp bởi Tradingkinh tế.com:

< br/>

< br/>

Bạn có thể thấy ngay từ biểu đồ trên rằng có một khoảng cách lớn giữa chênh lệch lãi suất dương 4% giữa mức 4,25% của Úc và 0,25% của Hoa Kỳ, điều này gợi ý mua AUD Vị thế /USD (và tăng trở lại 4% mỗi năm) sẽ là giao dịch chênh lệch giá tốt nhất.

Phần tiếp theo nên đi sâu vào lịch sử lãi suất, tốt nhất là ở định dạng biểu đồ lớp phủ, để hiểu bối cảnh thay đổi tương đối của lãi suất theo thời gian ở cả hai nước. Tương tự, Tradingkinh tế.com hiển thị biểu đồ lớp phủ về lãi suất của đồng đô la Úc so với tỷ giá của đô la Mỹ, với tỷ giá hối đoái AUD/USD ở nền:

Có thể thấy từ biểu đồ trên, lãi suất ở hai nước đã giảm mạnh trong năm 2008, với đồng đô la Mỹ giảm từ 5% xuống gần 0 và đồng đô la Úc giảm từ 7,25 xuống 3. Mãi cho đến tháng 10 năm 2009, đồng đô la Úc mới được phục hồi từ mức đáy của chính nó, trong khi đồng đô la Mỹ vẫn ở mức đáy, sau đó báo hiệu cho các nhà đầu tư rằng đã đến lúc phải tham gia giao dịch mua bán dài hạn đối với AUDUSD.

Lịch kinh tế: Các quyết định và bài phát biểu về lãi suất của Ngân hàng Trung ương

Các quyết định về lãi suất

Tác động: Cao

p>Quốc gia: Tất cả

Tần suất: Thay đổi

Sự kiện quan trọng nhất trong lịch kinh tế liên quan đến lãi suất là sự kiện trung tâm quyết định lãi suất của ngân hàng. Tại đây, các nhà hoạch định chính sách của ngân hàng trung ương đồng ý về việc ấn định lãi suất ở đâu. Các nhà giao dịch theo dõi chặt chẽ sự khác biệt giữa tỷ giá dự báo và tỷ giá thực tế, đẩy đồng nội tệ lên cao hơn khi tỷ giá cao hơn dự kiến và giảm xuống khi tỷ giá thấp hơn dự kiến.

| Sự khác biệt giữa dự báo và thực tế | Tác động tiền tệ | Lý do |

|---|---|---|

| Tỷ lệ cao hơn dự báo | Tích cực/tăng giá đối với tiền tệ | Các nhà đầu tư nước ngoài hiện muốn sở hữu một loại tiền tệ (và trái phiếu) có lãi suất cao hơn |

| Thấp hơn tỷ lệ dự báo | Tiêu cực/giảm giá đối với tiền tệ | Các nhà đầu tư nước ngoài hiện ít có xu hướng đầu tư vào loại tiền tệ (và trái phiếu) có lãi suất thấp hơn |

Bài phát biểu của Thống đốc Ngân hàng Trung ương

Tác động: Cao

Quốc gia: Tất cả

Tần suất: Thay đổi< /p>

Thống đốc hoặc thống đốc ngân hàng trung ương đôi khi có thể đưa ra những bài phát biểu trước công chúng gợi ý về chính sách tiền tệ trong tương lai. Ông có thể bày tỏ lo ngại về lạm phát gia tăng, làm dấy lên suy đoán rằng ông có thể tăng lãi suất để kiềm chế lạm phát, hoặc ông có thể bày tỏ lo ngại về điều kiện kinh tế và tỷ lệ thất nghiệp gia tăng, làm dấy lên suy đoán rằng ông có thể hạ lãi suất để kích thích vay mượn và đầu tư vào nền kinh tế. Do đó, các đánh giá có thể xác định xu hướng tích cực hoặc tiêu cực ngắn hạn. Tuy nhiên, hãy cẩn thận vì sự biến động do việc giải thích các tuyên bố gây ra có thể gây nguy hiểm cho các nhà giao dịch theo xu hướng ngắn hạn.

Các yếu tố khác ảnh hưởng đến quyết định lãi suất:

Lạm phát – tỷ lệ phần trăm thay đổi cao hơn khiến ngân hàng trung ương phải tăng lãi suất để kiềm chế lạm phát Mở rộng

Tài khoản vãng lai và cán cân thương mại - những con số thấp hơn có thể khiến một số ngân hàng trung ương hạ lãi suất để thu hẹp tiền tệ và tăng xuất khẩu

Thất nghiệp - Tỷ lệ thất nghiệp cao hơn sẽ thúc đẩy các ngân hàng trung ương hạ lãi suất để kích thích đầu tư và việc làm.

Tỷ lệ lạm phát

Sức mua của đồng tiền giảm được gọi là lạm phát. Với sự ra đời của tiền giấy và sức mạnh của các ngân hàng trung ương trong việc hạ lãi suất và in theo ý muốn để tăng nguồn cung tiền, tiền giấy như một dạng tiền tệ luôn bị đốt cháy hoặc mất giá trị. Kết quả là lạm phát dài hạn bất kể lực cung và cầu ngắn hạn đối với các hàng hóa và dịch vụ khác nhau trong Chỉ số giá tiêu dùng (CPI) của một quốc gia, một thước đo lạm phát phổ biến.

Tuy nhiên, các loại tiền tệ khác nhau được đốt với tỷ giá khác nhau, tùy thuộc vào mức độ thao túng lãi suất của mỗi quốc gia (hoặc ngân hàng trung ương) và trình độ của báo in, chúng tôi Là một nhà giao dịch, bạn quan tâm đến các tỷ lệ đốt khác nhau. Chúng tôi đặc biệt quan tâm đến tốc độ xói mòn sức mua của một cặp tiền tệ so với các loại tiền tệ khác tạo nên cặp tiền đó.

Tác động đến ngoại hối và nền kinh tế

Tỷ lệ lạm phát cao hơn trong nền kinh tế làm giảm đầu tư (và giá trị của đồng tiền trong đó) tiền tệ) vì mức độ lạm phát có thể loại bỏ toàn bộ hoặc một phần lợi nhuận kỳ vọng từ tài sản. Ví dụ, sẽ thật ngu ngốc nếu một nhà đầu tư đầu tư vào trái phiếu có lãi suất 5% mỗi năm ở một quốc gia có lạm phát 6%, vì anh ta sẽ mất 1% mỗi năm. Các ngân hàng trung ương theo dõi chặt chẽ chỉ số giá tiêu dùng để xem liệu lạm phát có còn ở mức chấp nhận được hay đang tăng quá cao. Nếu họ lo ngại lạm phát đã vượt quá mức chấp nhận được, họ có thể tăng lãi suất. Khi họ thấy mức độ lạm phát vừa phải và nền kinh tế trì trệ, họ thường hạ lãi suất (hoặc in tiền). Ngoài ra, chính phủ sử dụng CPI để thực hiện các khoản thanh toán được điều chỉnh theo lạm phát cho người nhận An sinh xã hội, nhân viên chính phủ và người về hưu cũng như người nhận phiếu thực phẩm.

Đối với nhà giao dịch, nguyên tắc chung là:

| Tỷ lệ lạm phát | Ảnh hưởng tiền tệ (Dài hạn ) | Ảnh hưởng của tiền tệ (ngắn hạn) | Lý do ngắn hạn |

|---|---|---|---|

| Tỷ giá cao hơn | < td >Làm suy yếu tiền tệCủng cố tiền tệ | Các nhà giao dịch có thể sử dụng dữ liệu lạm phát gia tăng này từ quan điểm của một giám đốc ngân hàng trung ương lo lắng đến mức ông ta cần phải tăng lãi suất để kiểm soát nó. ;Tăng lãi suất, đến lượt nó, củng cố đồng tiền. | |

| Lãi suất thấp hơn | Củng cố tiền tệ | ;Làm suy yếu tiền tệ | Các nhà giao dịch có thể nhìn nhận điều này từ quan điểm của một giám đốc ngân hàng trung ương, người hiện cảm thấy tự do hơn trong việc hạ lãi suất hoặc bắt đầu các vòng nới lỏng định lượng mới (in tiền) trong bối cảnh dữ liệu lạm phát lành tính và tình trạng suy thoái Hạ lãi suất hoặc in tiền sẽ củng cố đồng tiền. |

Cuối cùng, về lâu dài, tỷ lệ lạm phát cao hơn sẽ làm giảm phát tiền tệ nhanh hơn. Điều này là hiển nhiên. Điều ít rõ ràng hơn là những thay đổi về tỷ lệ lạm phát cao hơn có thể có tác động tích cực đối với đồng tiền trong ngắn hạn (thậm chí có thể vào ngày diễn ra sự kiện). Nguyên nhân là do các nhà giao dịch sẽ suy đoán rằng ngân hàng trung ương có thể tăng lãi suất để kiểm soát lạm phát. Tất nhiên, họ có thể sai, và trong cuộc khủng hoảng kinh tế toàn cầu ngày nay, các ngân hàng trung ương coi GDP yếu và thất nghiệp là những vấn đề cấp bách hơn lạm phát. Điều có nhiều khả năng xảy ra là nếu lạm phát thấp hơn dự kiến thì điều đó có thể giúp các ngân hàng trung ương có nhiều quyền tự do hơn trong việc giảm lãi suất hoặc nếu lãi suất đã ở mức thấp, hãy in thêm tiền để tài trợ cho nền kinh tế đang gặp khó khăn. .

So sánh tỷ lệ lạm phát hiện tại và lịch sử

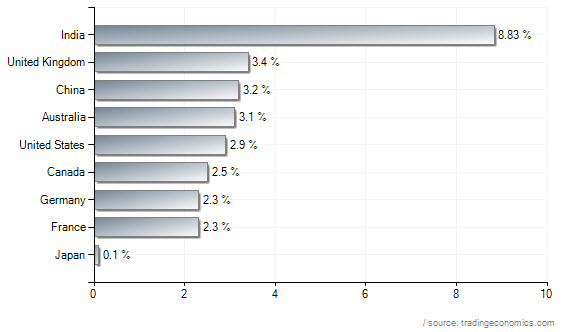

Trước tiên, người ta nên cố gắng xem xét sự khác biệt về tỷ lệ lạm phát hiện tại ở mỗi cặp, Trả tiền đặc biệt chú ý đến những cặp tiền tệ có sự khác biệt lớn nhất về tỷ lệ lạm phát. Ví dụ: đây là bảng xếp hạng tỷ lệ lạm phát ở các quốc gia lớn do Tradingkinh tế.com cung cấp:

Có thể thấy rõ từ biểu đồ xếp hạng trên, Vương quốc Anh có tỷ lệ lạm phát cao nhất trong các loại tiền tệ chính ở mức 3,4%, trong khi Nhật Bản có tỷ lệ lạm phát thấp nhất ở mức 0,1%, với tỷ lệ lạm phát chênh lệch 3,3%. Điều này có nghĩa là rất khó để biện minh cho giao dịch chênh lệch giá trên GBPJPY khi chênh lệch lãi suất dương chỉ +0,5% bị xóa sổ hoàn toàn bởi chênh lệch tỷ lệ lạm phát âm -3,3%.

Sự kiện lịch kinh tế

Chỉ số giá tiêu dùng (CPI)

Tác động: Trung bình đến cao

Quốc gia: Hoa Kỳ, Vương quốc Anh, Nhật Bản, Thụy Sĩ, Khu vực đồng Euro, các nước lớn ở Châu Âu

Tần suất: Hàng tháng

Giới thiệu tại Lịch kinh tế Sự kiện quan trọng nhất ảnh hưởng đến tỷ lệ lạm phát là Chỉ số giá tiêu dùng (CPI). CPI là chỉ số giá theo dõi giá của một nhóm hàng hóa và dịch vụ tiêu dùng cụ thể, cung cấp thước đo lạm phát. Các quốc gia khác nhau công bố những thay đổi về chỉ số CPI của riêng họ và các nhà giao dịch chú ý đến sự khác biệt giữa tỷ giá hối đoái dự báo và thực tế để có cơ hội giao dịch ngắn hạn, đẩy đồng tiền của họ lên cao hơn khi tỷ giá hối đoái cao hơn dự kiến và thấp hơn khi tỷ giá hối đoái thấp hơn mức dự kiến.

CPI cốt lõi

Tác động: Trung bình đến cao

Các quốc gia: Hoa Kỳ, Canada, Khu vực đồng Euro< /p>< p>Tần suất: Hàng tháng

Báo cáo đo lường những thay đổi về giá hàng hóa và dịch vụ mà người tiêu dùng mua, không bao gồm thực phẩm, năng lượng, rượu và thuốc lá. Vì các ngân hàng trung ương của Hoa Kỳ và Canada sẽ xem xét CPI cơ bản (CPI trừ đi giá thực phẩm và năng lượng) thay vì CPI, nên các nhà giao dịch sẽ theo dõi CPI cơ bản chặt chẽ hơn để biết những thay đổi về lạm phát ở đồng đô la Mỹ hoặc Canada.

Chỉ số giá sản xuất (PPI)

Tác động: Trung bình

Các quốc gia: Hoa Kỳ, Vương quốc Anh, Canada , Úc, Khu vực đồng Euro, các nước lớn ở Châu Âu

Tần suất: Hàng tháng

PPI đo lường sự thay đổi về giá hàng hóa bán ra của nhà sản xuất (đầu ra PPI) , được coi là có tầm quan trọng thấp và giá hàng hóa và nguyên liệu thô được nhà sản xuất mua (đầu vào PPI), được coi là có tầm quan trọng trung bình. Nó có thể là một chỉ báo sớm có giá trị về lạm phát khi các nhà sản xuất chuyển chi phí cao hơn sang người tiêu dùng, do đó, nó có cách diễn giải ngắn hạn và dài hạn giống như CPI.

| Difference between forecast and actual | Currency Effect | Possible Trigger Level | Potential Pip Range | Reason |

|---|---|---|---|---|

| CPI or PPI Higher than forecast rate | Positive/bullish for currency | +0.20% | 50 pips | Central bankers might see the higher inflation rate as a threat that needs to be subdued by a higher interest rate |

| CPI or PPI Lower than forecast rate | Negative/bearish for currency | -0.20% | 50 pips | Central bankers might see the lower inflation rate as a non-threat and so they can focus instead on keeping interest rates the same or lower. |

Lưu ý rằng sự gia tăng lạm phát có tác động tiêu cực đến bất kỳ loại tiền tệ nào. Do đó, thật trớ trêu khi các nhà giao dịch lại tham gia giao dịch vì tỷ giá hối đoái của một loại tiền tệ cao hơn dự kiến. Họ làm điều này đơn giản vì họ thấy những thay đổi về lãi suất từ góc độ của một thống đốc ngân hàng trung ương, người có thể bị đe dọa bởi lạm phát cao hơn nên phải tăng lãi suất nhằm kiềm chế lạm phát, và việc tăng lãi suất này, nếu xảy ra, sẽ lần lượt làm tăng nhu cầu về tiền bạc.

Gần đây, cũng như trong thập kỷ vừa qua, các ngân hàng trung ương quan tâm nhiều hơn đến việc hạ lãi suất để kích thích nền kinh tế ốm yếu của họ hơn là với việc lãi suất tăng đều đặn (và dưới mức báo cáo) tỷ lệ lạm phát trong nội bộ làm xói mòn sức mua của hầu hết các loại tiền giấy. Đủ để nói rằng, xét trên tổng thể, chỉ số CPI và PPI cao hơn sẽ gây nguy hiểm cho đồng tiền. Các nhà đầu tư thông minh không muốn đầu tư vào một loại tiền tệ mất giá nhanh hơn (từ CPI) và các nhà sản xuất không muốn xây dựng nhà máy ở những quốc gia có chi phí sản xuất cao hơn (từ PPI). Một trong những lý do khiến đồng Yên Nhật mạnh lên trong vài năm qua (cùng với vàng) là do "môi trường không có lạm phát" tương đối của nó được các nhà đầu tư lo lắng về tỷ lệ lạm phát của hầu hết các loại tiền giấy khác coi là nơi trú ẩn an toàn.

Cán cân thương mại và tài khoản vãng lai

Thương mại đã phát triển thành một trong những động lực quan trọng nhất định hình nền kinh tế thế giới, với các sản phẩm được mua bán ở thị trường nước ngoài Doanh nghiệp chiếm một phần lớn GDP của bất kỳ nền kinh tế lớn nào. Ví dụ, tại Hoa Kỳ, hơn 12 triệu việc làm liên quan đến lĩnh vực xuất khẩu và khoảng 25% hoạt động kinh doanh của Hoa Kỳ có liên quan đến thương mại quốc tế theo cách nào đó. Thông thường, thương nhân quan tâm đến số liệu “xuất khẩu ròng”. Xuất khẩu thể hiện khả năng cạnh tranh của một quốc gia trên thị trường thế giới, khả năng tạo việc làm và tăng lợi nhuận doanh nghiệp. Để đáp ứng nhu cầu trong và ngoài nước, các doanh nghiệp phải sản xuất nhiều hơn và sản lượng cao hơn đồng nghĩa với tăng trưởng GDP nhanh hơn. Tác động tiêu cực của việc tăng nhập khẩu là làm suy yếu tăng trưởng GDP do các công ty nước ngoài sản xuất các sản phẩm này.

Ba lực lượng chính ảnh hưởng đến cán cân thương mại của một quốc gia: 1) sự khác biệt tương đối về tốc độ tăng trưởng giữa nước sở tại và các nước khác; 2) người tiêu dùng trong nước mua hàng xu hướng hàng hóa nước ngoài; 3) thay đổi giá trị của đồng nội tệ so với các đồng tiền khác. Nếu nước sở tại tăng trưởng nhanh hơn hầu hết các nước khác, nhập khẩu sẽ tăng nhanh hơn xuất khẩu, dẫn đến thâm hụt. Tuy nhiên, một số quốc gia, chẳng hạn như Hoa Kỳ, có người mua sắm có xu hướng nhập khẩu hàng hóa nước ngoài hơn các quốc gia khác, tạo thêm nhiều vấn đề cho Hoa Kỳ, quốc gia luôn thâm hụt thương mại hàng năm kể từ năm 1976. Những thay đổi về giá trị tiền tệ có thể làm thay đổi giá xuất nhập khẩu và do đó làm thay đổi nhu cầu. Đồng tiền mạnh hơn sẽ làm xấu đi cán cân thương mại vì nó làm giảm giá hàng nhập khẩu, khiến chúng trở nên phổ biến hơn với người tiêu dùng, đồng thời làm tăng chi phí bán hàng trên thị trường quốc tế, khuyến khích người mua nước ngoài tìm kiếm sản phẩm rẻ hơn ở nơi khác.

Tác động đến ngoại hối và nền kinh tế

Thương mại hàng hóa và dịch vụ quốc tế là một cách hữu hình để một quốc gia kiếm được ngoại hối. Một đồng tiền mạnh dựa trên xuất khẩu vượt quá nhập khẩu. Xuất khẩu ròng tạo ra thu nhập nhiều hơn thu nhập được giữ lại trong nước thay vì mua để nhập khẩu. Xuất khẩu nhiều hơn nhập khẩu sẽ tạo ra cán cân thương mại lành mạnh (và tài khoản vãng lai lành mạnh) và dẫn đến đồng tiền và nền kinh tế ổn định hơn. Người nước ngoài càng mua nhiều hàng hóa và dịch vụ từ một quốc gia thì họ càng phải trả nhiều tiền hơn cho những sản phẩm đó.

Ngược lại, thâm hụt thương mại ngày càng trầm trọng sẽ làm suy yếu đồng tiền. Để mua hàng hóa và dịch vụ nước ngoài, công dân nước này phải bán tiền của mình để thanh toán cho sản phẩm nước ngoài bằng nội tệ. Nhập khẩu ròng (Nhập khẩu > Xuất khẩu) có nghĩa là nhiều tiền rời khỏi đất nước hơn là chảy vào, khiến tỷ giá hối đoái suy yếu. Nó cũng có thể có nghĩa là sự sụt giảm trong sản xuất hàng xuất khẩu địa phương và đất nước đã trở thành thị trường cho các nước khác bán sản phẩm của họ với chi phí cho ngành công nghiệp địa phương của chúng ta, một tình huống cuối cùng ảnh hưởng đến tỷ lệ thất nghiệp, tiền lương và GDP. Hơn nữa, đôi khi nhu cầu tiêu dùng khổng lồ phải được thúc đẩy bởi tín dụng. Để đáp ứng nhu cầu tiêu dùng khổng lồ, trung bình mỗi ngày Mỹ vay nước ngoài hơn 2 tỷ USD, điều này cũng dẫn đến đồng đô la Mỹ mất giá.

Sự kiện kinh tế

Thương mại hàng hóa và dịch vụ quốc tế (hoặc Cán cân thương mại):

Tác động: Cao< /p> p>

Các quốc gia: Hầu hết

Tần suất: Hàng tháng

Báo cáo này đo lường hoạt động xuất nhập khẩu hàng hóa và dịch vụ trong thời gian chênh lệch giá trị kỳ báo cáo. Số dương cho biết hàng hóa và dịch vụ được xuất khẩu nhiều hơn nhập khẩu (doanh thu kiếm được nhiều hơn chi tiêu), trong khi số âm cho biết hàng hóa và dịch vụ được nhập khẩu nhiều hơn xuất khẩu (doanh thu chi nhiều hơn số thu).

Số dư tài khoản vãng lai:

Tác động: Trung bình

Các quốc gia: Hoa Kỳ, Canada, Úc, Nhật Bản, Khu vực đồng Euro

Tần suất: Hàng quý

Đây là bản báo cáo rộng nhất về mối quan hệ thương mại và đầu tư của một quốc gia với phần còn lại của thế giới. Một khía cạnh của báo cáo này liên quan đến việc trao đổi hàng hóa và dịch vụ giữa nước sở tại và các nước khác (xem cán cân thương mại ở trên). Nhưng nó còn rộng hơn thế. Ngoài việc mua bán hàng hóa, dịch vụ ở thị trường nước ngoài còn có hoạt động xuất nhập khẩu vốn đầu tư. Người nước ngoài mua và bán cổ phiếu, trái phiếu và các loại tài sản khác của một quốc gia hàng ngày và lợi nhuận từ đầu tư ra nước ngoài (cổ tức và tiền lãi) là thu nhập chảy về nước. Do đó, báo cáo hàng quý này cố gắng theo dõi sự di chuyển xuyên biên giới của tất cả các hàng hóa và dịch vụ này, dòng thu nhập đầu tư và hoạt động mua bán tài sản. Các tài khoản tài chính phản ánh dòng vốn đầu tư và các khoản vay trong và ngoài nước, bao gồm ngoại tệ và chứng khoán thuộc sở hữu của Chính phủ và đồng nội tệ thuộc sở hữu của Chính phủ khác.

Hệ thống vốn quốc tế Kho bạc:

Tác động: Trung bình

Quốc gia: Hoa Kỳ

Tần suất: Hàng tháng

Báo cáo theo dõi dòng tiền đầu tư vào và ra khỏi Hoa Kỳ Bởi vì người Mỹ thích sống vượt quá khả năng của họ và chính phủ liên bang chính phủ chi tiêu nhiều hơn số tiền thu vào, nó chi tiêu Khoảng cách lớn về thu nhập có nghĩa là các hộ gia đình và chính phủ liên bang phải vay tiền để lấp đầy khoảng cách. Người lao động ở Châu Âu, Nhật Bản và Trung Quốc được biết là tiết kiệm từ 5% đến 40% thu nhập của họ, cuối cùng họ cho Hoa Kỳ vay số tiền tiết kiệm dư thừa để mua cổ phiếu, trái phiếu và các tài sản bằng đồng đô la khác của Hoa Kỳ. Những khoản vay nước ngoài này đã trở thành nguồn vốn mà Hoa Kỳ cần để giữ lãi suất trong nước ở mức thấp và tiếp tục tăng trưởng kinh tế. Thật không may, sẽ đến lúc các chủ nợ nước ngoài nhận thấy rằng danh mục đầu tư của họ phụ thuộc nhiều vào đồng đô la Mỹ và họ sẽ bắt đầu thu hẹp quy mô và đa dạng hóa sang các loại tiền tệ khác. Trong báo cáo Lịch kinh tế, chúng ta sẽ thấy một con số gọi là Giao dịch dài hạn ròng TIC, đo lường sự khác biệt về giá trị giữa chứng khoán nước ngoài dài hạn được mua bởi công dân Hoa Kỳ và chứng khoán dài hạn của Hoa Kỳ được nhà đầu tư nước ngoài mua, được biểu thị bằng 10 Tỷ đô la Cầu về chứng khoán trong nước và cầu về tiền tệ có liên quan trực tiếp vì người nước ngoài phải mua nội tệ để mua chứng khoán của nước đó.

Đối với nhà giao dịch, nguyên tắc chung là:

Sự khác biệt được dự đoán và chênh lệch thực tế : Tài khoản vãng lai# hoặc Số dư thương mại# Lý do tác động đến tiền tệ

Cán cân thương mại cao hơn dự kiến, số dư tài khoản vãng lai và giao dịch dài hạn ròng TIC làm cho tiền tệ mạnh hơn với nhiều tiền chảy vào hơn là tiền ra (tăng tiền tệ), Ngành xuất khẩu địa phương có vẻ lành mạnh hơn (có lợi cho GDP). Bất kỳ dấu hiệu nào cho thấy cán cân thương mại âm đang đảo chiều và bắt đầu tiến tới thặng dư thương mại đều rất lạc quan.

Cán cân thương mại, tài khoản vãng lai và giao dịch dài hạn ròng TIC thấp hơn dự kiến làm suy yếu đồng tiền do tiền ra đi nhiều hơn ở lại (đồng tiền mất giá) và ngành xuất khẩu địa phương có vẻ kém lành mạnh hơn (có hại cho GDP ) . Bất kỳ dấu hiệu nào cho thấy cán cân thương mại âm dần xấu đi hoặc cán cân thương mại dương đảo chiều đều là dấu hiệu giảm giá.

Lưu ý: Việc đảo ngược hoặc thu hẹp thâm hụt thương mại chỉ có thể cải thiện đồng tiền khi nhu cầu quốc tế đối với hàng hóa và dịch vụ của một quốc gia tăng lên. Nếu sự đảo chiều hoặc thu hẹp là do suy thoái sâu làm giảm nhu cầu nhập khẩu, các nhà đầu tư vẫn sẽ né tránh đồng tiền.

Nhìn chung, thặng dư thương mại được gọi là thặng dư thương mại và bao gồm việc xuất khẩu nhiều hơn một mặt hàng nhập khẩu (có nghĩa là nó nhận được nhiều tiền hơn là tiêu tiền), trong khi đó một giao dịch thâm hụt được gọi là thâm hụt thương mại và liên quan đến việc nhập khẩu nhiều hơn một sản phẩm xuất khẩu (chi nhiều hơn nhận). Cả hai đều không nguy hiểm đối với các nền kinh tế lớn, nhưng thâm hụt thương mại lớn có thể là dấu hiệu của các vấn đề kinh tế khác. Ví dụ, Hoa Kỳ từ lâu đã có thâm hụt thương mại lớn, đặc biệt là với Trung Quốc, nước đã thu được một lượng lớn thặng dư thương mại bằng đồng đô la và tái đầu tư chúng vào trái phiếu Mỹ. Chiến lược thương mại của Trung Quốc là giành được càng nhiều thị phần sản xuất toàn cầu càng tốt, và như một tác dụng phụ của chiến lược này, nước này đã tích lũy được nguồn dự trữ ngoại hối lớn. Để đạt được chiến lược này, Trung Quốc cố tình thao túng tiền tệ của mình, gắn nó với đồng đô la Mỹ gần như luôn suy yếu, và do sự cố định này cũng như chi phí lao động và sản xuất thấp, họ giữ cho hàng xuất khẩu rẻ trên toàn thế giới. Ngược lại, những mặt hàng xuất khẩu rẻ hơn này lại làm suy yếu việc làm trong lĩnh vực sản xuất của Hoa Kỳ. Các nhà xuất khẩu dây thừng của Liên minh châu Âu thậm chí còn chịu thiệt hại lớn hơn. Khi đồng đô la suy yếu, hàng hóa Mỹ trở nên rẻ hơn ở châu Âu, nhưng hàng hóa châu Âu không rẻ hơn ở Mỹ hoặc Trung Quốc. Với việc Hoa Kỳ và Châu Âu vẫn đang trong tình trạng suy thoái kinh tế toàn cầu, Trung Quốc sẽ giành được nhiều thị phần hơn bằng cách duy trì tỷ giá đồng nội tệ và tăng trưởng nhiều hơn thông qua xuất khẩu.