Bạn có thể đã nhìn thấy hoặc nghe nói về chỉ báo Ichimoku Kinko Hyo tuyệt đẹp ((Ichimoku Kinkō Hyō, hay đơn giản là Ichimoku)), có các đường trung bình động bắt mắt và các đám mây mở rộng linh hoạt.

Cái tên này dịch từ tiếng Nhật là "biểu đồ cân bằng nhanh chóng", mô tả một cách khéo léo cách năm thành phần riêng biệt của nó khớp với nhau để tạo thành một bức tranh "tổng thể" về hành động giá "trong nháy mắt". ." Người ta nói rằng chỉ cần nhìn vào biểu đồ Ichimoku, những người thực hành nó có thể hiểu ngay được tâm lý, động lượng và sức mạnh của xu hướng. Tìm hiểu cách sử dụng nó trong bài viết đầy đủ này.

Cốt truyện rất hấp dẫn. Mặc dù chỉ báo thường được phát triển bởi một nhà thống kê hoặc nhà toán học trong lĩnh vực này, nhưng điều kỳ lạ là chỉ báo này lại được phát triển trước Thế chiến thứ hai bởi một nhà báo ở Tokyo tên là Goichi Hosoda và một số trợ lý thực hiện nhiều phép tính.

Sau 20 năm thử nghiệm, ông Hosoda cuối cùng đã công bố hệ thống này ra công chúng trong một cuốn sách xuất bản năm 1968. Chỉ báo này đã được sử dụng rộng rãi trong các phòng giao dịch châu Á kể từ khi ông Hosoda xuất bản cuốn sách của mình, mặc dù nó chưa xuất hiện ở phương Tây cho đến tận những năm 1990.

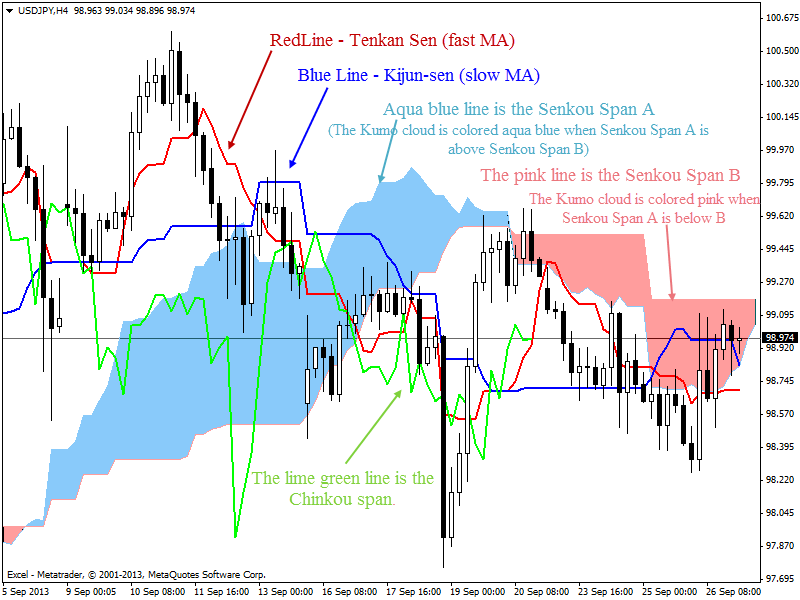

Chỉ báo Ichimoku Kinko Hyo bao gồm năm yếu tố chính:

Tenkan-sen ("đường chuyển hướng"): đường trung bình động nhanh 9 kỳ dựa trên chênh lệch cao-thấp thay vì giá đóng cửa truyền thống,

< li>Kijun-sen ("đường tiêu chuẩn"): di chuyển chậm 26 kỳ dựa trên chênh lệch cao-thấp thay vì giá đóng cửa truyền thống Đường trung bình,

Senkou Span A ("Dòng dẫn đầu tiên"): mức trung bình của Tenkan-sen và Kijun-sen, sẽ có một số thay đổi trong tương lai,

Senkou Span B ("Dòng dẫn đầu thứ hai"); Trung bình của giá cao nhất và thấp nhất trong một khoảng thời gian nhất định, có cùng thay đổi trong tương lai,< /span>

Chinkou Span ("đường trễ"): Giá đóng cửa được vẽ với cùng một sự thay đổi, Nhưng trong quá khứ.

Senkou Span A và B cùng nhau tạo thành cái được gọi là Đám mây Kumo.

Hình ảnh bên dưới hiển thị năm yếu tố trong thiết lập hoàn chỉnh:

Rõ ràng, có nhiều cách khác nhau để giao dịch đường giao nhau Ichimoku Kinko Hyo: người ta có thể giao dịch đường giao nhau Tenkan/Kijun như MACD, hoặc giao dịch đường giao nhau Kumo, hoặc giao dịch đường giao nhau giá với năm đường Ichimoku chặn bất kỳ dòng nào.

Trong nhiều thập kỷ, Hệ thống Ichimoku Kinko Hyo là một hệ thống thủ công được thiết kế để cho phép các nhà giao dịch xem nhanh sự tương tác và cân bằng của từng đường trong số năm đường chỉ báo chính để nắm bắt các xu hướng trung hạn.

Nhưng vấn đề với các hệ thống thủ công là chúng rất khó định lượng: người ta không thể chắc chắn chúng hoạt động như thế nào trong quá khứ hoặc chúng sẽ hoạt động như thế nào trong tương lai. Ngoài ra, có nhiều biến thể về cách giao dịch hệ thống Ichimuku, với các dấu chéo hoặc xác nhận từ bất kỳ hoặc tất cả năm yếu tố đường, khiến việc xác định biến thể nào hoạt động tốt nhất trở nên khó khăn.