Một chỉ báo dễ hiểu và rất hữu ích khác được phân loại là chỉ báo dao động động lượng được gọi là Chỉ số sức mạnh tương đối (RSI). Tìm hiểu RSI (chỉ số sức mạnh tương đối) là gì trong Forex, chỉ báo được các nhà giao dịch chuyên nghiệp sử dụng và cách diễn giải các tín hiệu của nó trong bài viết đầy đủ này.

Thư mục

RSI được tính bằng cách lấy mức trung bình đóng cửa của các thanh tăng (khoảng tần số tăng) và chia cho mức trung bình đóng cửa của thanh giảm. RSI đo lường tỷ lệ giữa xu hướng tăng và xu hướng giảm và phép tính được chuẩn hóa để chỉ số được biểu thị trên thang điểm từ 0-100. Các loại tiền tệ đang tăng giá đáng kể có chỉ số RSI cao hơn các loại tiền tệ đang giảm giá đáng kể. Việc tính toán thường được thực hiện vào cuối 14 khoảng thời gian cuối cùng của bất kỳ khung thời gian nào.

RSI dao động từ 0 đến 100 và các mức khác nhau trong phạm vi này sẽ ghi lại các tín hiệu giao dịch khác nhau:

| Mức RSI | Hành động giao dịch |

|---|---|

| Trên 50 | Tăng giá |

| 70-100 | Cực kỳ tăng và quá mua |

| Previously above 70, now below | Tín hiệu ngắn |

| Dưới 50 | Giảm |

| 0-30 | Cực kỳ giảm giá và bán quá mức |

| Trước đây dưới 30, bây giờ trên | Tín hiệu dài |

Chúng tôi sẽ xem xét từng tín hiệu này bên dưới.

Xu hướng giao dịch: RSI vượt qua đường 50

Cách đơn giản nhất để sử dụng RSI là vượt qua đường 50 như một tín hiệu theo hướng của xu hướng. Nếu chỉ số RSI vượt quá 50, nó được coi là tăng giá. Nếu nó phá vỡ dưới đây, nó được coi là giảm giá. Đây không phải là cách tốt nhất để giao dịch RSI, nhưng nó có thể đóng vai trò xác nhận xu hướng cùng với các tín hiệu khác.

Nếu đường 50 quá đơn giản đối với bạn, bạn có thể áp dụng ý tưởng của Andrew Caldwell về việc xác định phạm vi thị trường tăng giá khi RSI ở mức 40-80 di chuyển lên trên giữa, xác định phạm vi thị trường giá xuống khi chỉ số RSI di chuyển xuống trong khoảng 60-20. Biểu đồ luôn giao dịch trong các khu vực này, vì vậy tôi có thể dễ dàng chỉ cho bạn một ví dụ đơn giản:

Bạn có thể vượt qua Hộp màu đỏ cho biết chỉ số RSI trên biểu đồ hàng ngày của USDCHF di chuyển như thế nào từ 60 lên 20, cho thấy xu hướng giảm. Xu hướng này càng trở nên quan trọng hơn vì chỉ số RSI không thể duy trì trên 70 lâu và thị trường đang trong tình trạng quá mua nghiêm trọng.

Các mục nhập RSI phổ biến hơn Hệ thống là sự đảo ngược xu hướng giao dịch sau khi cạn kiệt vùng quá mua/quá bán 70/30.

Xu hướng giao dịch đảo ngược: Mua quá mức/Bán quá mức ở Đường 70/30< /span>

Mặc dù việc thử giao dịch ở những khu vực này rất hấp dẫn nhưng bạn nên coi chúng như những cơ hội đảo chiều đang chờ xử lý. Không giao dịch đảo chiều ở những khu vực này. Nguyên nhân: Sự không chắc chắn về việc giá sẽ tiếp tục tăng/giảm bao xa khiến bất kỳ giao dịch ngược xu hướng nào trong vùng quá mua/quá bán đều rất nguy hiểm. Ngược lại, bạn chỉ nên tìm cơ hội giao dịch ngược xu hướng khi chỉ số RSI vượt qua 70 từ trên xuống để đưa ra tín hiệu ngắn hoặc 30 từ bên dưới để đưa ra tín hiệu mua. Ví dụ: nếu chỉ số RSI vượt qua vùng quá mua 70 trong giai đoạn tăng giá và đạt đỉnh trong thời gian ngắn ở mức 80, nhưng không thể tiếp tục tăng và giảm xuống dưới 70, thì tín hiệu bán sẽ được tạo ra.

| Tín hiệu | Điều kiện |

|---|---|

| Tín hiệu ngắn | RSI trước đó > 70 RSI hiện tại < 70 (Truyền từ trên dưới 70) |

| Tín hiệu dài | RSI trước < 30 RSI hiện tại > 30 (chéo 30 từ dưới lên) |

Khoảng thời gian RSI là 14 thường là phù hợp, nhưng có thể khám phá các vùng quá mua/quá bán khác nhau, chẳng hạn như 75/25 hoặc 80/20.

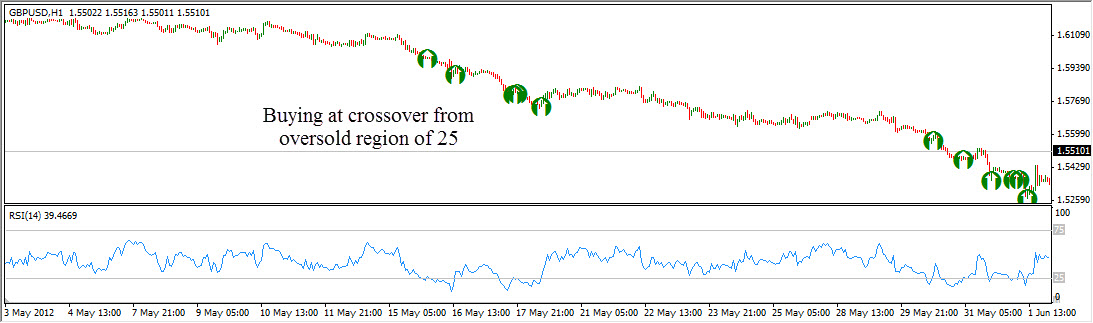

Những tháng mùa hè thường có phạm vi giới hạn vì các nhà giao dịch tiền sâu đang tận hưởng kỳ nghỉ của họ, chiến lược ngược xu hướng RSI có thể là một lựa chọn an toàn trong những tháng này. Ngoại trừ một số trường hợp ngoại lệ, các tín hiệu dường như bắt kịp thị trường ngay trước khi nó đảo chiều, ít nhất là một vài điểm và đôi khi nhiều hơn. Việc biết khi nào nên thoát khỏi chiến lược RSI hơi phức tạp và bạn nên kiểm tra lại mức dừng lỗ hiếm khi đạt được và mức chốt lời thường đạt được.

Đây là lần cuối cùng trong Tháng 5 Một ví dụ từ tháng trước, khi GBPUSD đã giảm liên tục, trong và ngoài vùng quá bán 25, điều này đã kích hoạt một số giao dịch mua lẽ ra phải dừng lại:

Giao dịch cắt xuống dưới/trên đường 75/25 có thể hoạt động tốt trong các thị trường biến động hoặc đi ngang, nhưng khi xu hướng thị trường mạnh, nó có thể Giảm tài khoản của bạn.

Vẽ đường giao nhau của RSI dưới/trên 75/25 cho các chỉ báo MT4:

| Chỉ báo | Bộ mô tả |

|---|---|

| Tín hiệu RSI-1 | Phát cảnh báo bằng hình ảnh và âm thanh khi RSI giảm xuống dưới 70 từ trên xuống hoặc vượt quá 30 từ dưới lên . |

RSI Chế độ biểu đồ

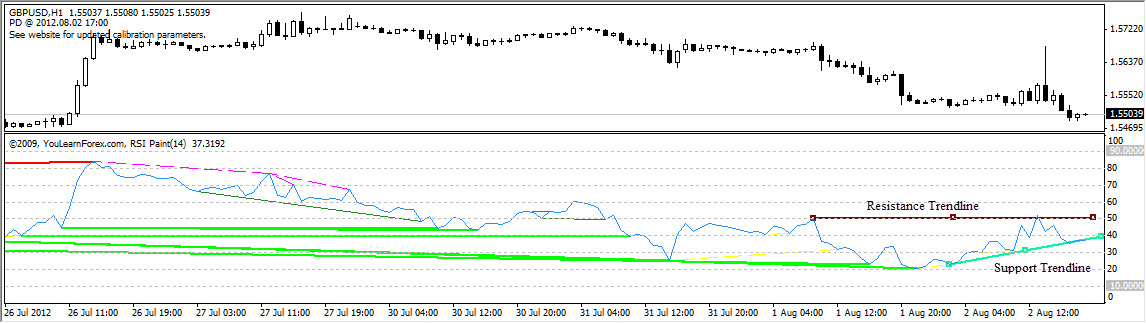

RSI thường hình thành các mẫu biểu đồ, chẳng hạn như đỉnh đầu và vai hoặc hình tam giác, có thể xuất hiện trên biểu đồ giá Hiển thị hoặc vô hình. Ngoài ra, RSI đôi khi hiển thị các mức hỗ trợ và kháng cự rõ ràng hơn chính giá cả. RSI là một trong số ít các chỉ báo dao động có thể sử dụng hiệu quả các đường xu hướng, đường hỗ trợ và đường kháng cự. Chúng được sử dụng làm tín hiệu để xác nhận xu hướng hiển thị trên biểu đồ giá. Khi các mẫu biểu đồ khác gợi ý hành động, đường xu hướng RSI cũng có thể xác nhận điều này. Đây là chỉ số RSI 14 kỳ trên biểu đồ hàng giờ của GBP/USD từ tháng 6 năm 2012 và tháng 7 năm 2012, chỉ lần này có một số đường xu hướng được hiển thị để hỗ trợ hành động trong tương lai:

GBP/USD đã có xu hướng giảm vào cuối tháng 7 và vào ngày 2 tháng 8 năm 2012, hình thành đường kháng cự ngang ở mức RSI 50 và đường xu hướng hỗ trợ đi lên ở mức RSI 35. Nó có thể được tìm thấy tại R

Phân kỳ RSI

Wilder còn tin rằng sự phân kỳ giữa RSI và hành động giá là một dấu hiệu rất mạnh cho thấy thị trường đang chuyển hướng điểm sắp đến. Những người khác theo sau ông đã cải tiến ý tưởng của ông.

Sự phân kỳ tăng xảy ra khi chỉ số RSI bắt đầu tăng, tạo ra các mức đáy cao hơn, nhưng đồng tiền cơ bản đang được phân tích vẫn đang tạo ra các mức thấp mới. Sự phân kỳ tăng này cũng có thể xảy ra nếu chỉ báo RSI tạo ra các đáy thấp hơn nhưng giá lại tạo ra các đáy cao hơn. Tín hiệu bán xảy ra khi điều ngược lại xảy ra

Dưới đây là một bảng đơn giản xác định những khác biệt khác nhau:

| Tên | Chỉ báo / Giá | Vị trí |

|---|---|---|

| Đảo ngược phân kỳ tăng | RSI đang hình thành các mức thấp cao hơn/ < span jsaction="click:E6Tfl, GFf3ac,tMZCfe; contextmenu:Nqw7Te,QP7LD; mouseout:Nqw7Te; mouseover:E6Tfl,c2aHje" jsname="W297wb">Giá đang giảm< /td> | RSI Thung lũng |

| Đảo ngược phân kỳ giảm | < span jsaction="mouseup:Sxi9L ,BR6jm; mousedown:qjlr0e" jsname="jqKxS">RSI đang hạ thấp các mức đỉnh/ Giá đang đạt mức cao mới< /td> | Đỉnh RSI |

| Phân kỳ tăng Tiếp tục | RSI đang hình thành các mức thấp thấp hơn/ < khoảng thời gian hoạt động ="click:E6Tfl,GFf3ac,tMZCfe; contextmenu:Nqw7Te,QP7LD; mouseout:Nqw7Te; mouseover:E6Tfl,c2aHje" jsname="W297wb">Giá đang tăng cao | RSI Valleys |

| Bearish Divergence Continuation | RSI đang tạo các đỉnh cao hơn/ Giá đang tăng cao hơn. | Đỉnh RSI |

Những đáy này đáng tin cậy nhất khi chúng hình thành dưới vùng 30% của chỉ báo RSI, hình thành tín hiệu mua có thể có hoặc khi chúng đạt đỉnh trên mức 70%, tạo thành tín hiệu bán có thể có. Tín hiệu phân kỳ mang lại lợi thế cho nhà giao dịch bằng cách xác nhận việc gia nhập xu hướng giảm trước khi xu hướng đó yếu đi và chuyển sang xu hướng tăng. Nó cũng được sử dụng để thoát khỏi xu hướng tăng khi nó yếu đi và trước khi rơi vào xu hướng giảm. Tín hiệu phân kỳ sẽ không xuất hiện khi xu hướng thay đổi, nhưng khi xuất hiện, nó sẽ gửi tín hiệu xác nhận mạnh mẽ rằng xu hướng có thể bùng phát.

Dưới đây là một ví dụ về Tiêu cực (Giảm giá) Sự khác biệt:

Khi giá hàng ngày của USDCHF đạt mức cao mới vào ngày 1 tháng 6 năm 2010 và đạt 1,173, phân kỳ giảm đã được nhìn thấy khi chỉ báo RSI tạo các mức cao thấp hơn. Đỉnh thấp hơn này cũng tương ứng với việc không duy trì được trên mức quá mua 70. Như bạn có thể thấy, sự phân kỳ mang lại cơ hội tuyệt vời để tận dụng sự đảo chiều sắp xảy ra.

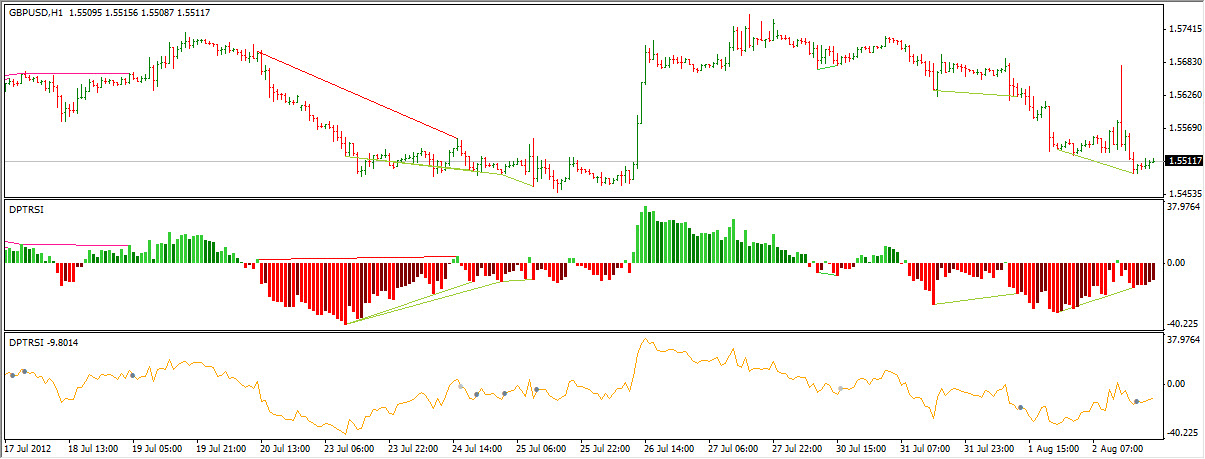

Giúp vẽ biểu đồ Chỉ báo MT4 cho các mẫu:

| Chỉ báo | Bộ mô tả |

|---|---|

| ind_RSIColored_v1 ind_DivPeakTroughRSI_SW_v1 | Đính kèm ind_RSIColored_v1, sau đó Kéo và thả ind_DivPeakTroughRSI_SW_v1 vào cùng một cửa sổ. |

Ảnh chụp màn hình của hai chỉ báo miễn phí cuối cùng trên biểu đồ GBPUSD:

Kết luận

Như chúng ta đã thấy, RSI có thể được sử dụng theo nhiều cách khác nhau. Nếu chỉ số RSI di chuyển lên trên và nằm trong khoảng từ 40 đến 80, đó có thể là dấu hiệu của một xu hướng tăng. Nếu nó phá lên trên 70 nhưng không thể giữ vững và thay vào đó giảm xuống dưới 70, điều này có thể cho thấy thị trường đang bị mua quá mức và có xu hướng giảm, ít nhất là trong ngắn hạn. Ngược lại, nếu chỉ số RSI di chuyển xuống và nằm trong khoảng từ 60 đến 20, điều đó có thể cho thấy một xu hướng giảm. Nếu nó phá vỡ dưới 30 và không giữ được mức dưới, đó có thể là dấu hiệu cho thấy thị trường đang bị bán quá mức và chuẩn bị cho một động thái tăng giá, ít nhất là trong ngắn hạn. Điều quan trọng cần nhớ là đây không phải là những quy tắc cứng nhắc và nhanh chóng. RSI có thể lừa đảo. Con số 70 không có nghĩa là sắp có sự đảo chiều, nó chỉ có nghĩa là thị trường đã mạnh mẽ. Thỉnh thoảng, thị trường sẽ phục hồi sau tình trạng mua quá mức hoặc bán quá mức bằng cách tự điều chỉnh theo hướng giao dịch trước đó. Trong các trường hợp khác, thị trường đã khắc phục được tình trạng mua quá mức chỉ bằng cách đi ngang. Trong trường hợp này, tình trạng mua quá mức sẽ tự giải quyết theo thời gian ở cùng mức giá. Theo thời gian, một số ngày thị trường tăng mạnh sẽ bị loại khỏi chu kỳ tính toán, điều này có thể dẫn đến mức giá tương tự nhưng chỉ số RSI thấp hơn. Điều này tạo ra sự phân kỳ mà một số nhà giao dịch sử dụng như một cơ hội để bắt đầu các giao dịch ngược xu hướng.