Trong giao dịch Forex hoặc bất kỳ thị trường tài chính nào khác, chênh lệch giá là chênh lệch giữa giá chào bán (mua) và giá chào mua (chào bán) được nhà môi giới niêm yết cho một cặp tiền tệ.

Những điểm chính

Chênh lệch là một loại chi phí giao dịch< /p>

Mọi giao dịch luôn bắt đầu với khoản lỗ do chênh lệch giá

Chênh lệch giá là chênh lệch giữa giá bán và giá mua Chênh lệch giá

Nhà đầu tư mua tài sản ở giá chào bán và bán nó với giá chào mua

Chênh lệch giao dịch

Chênh lệch trong giao dịch CFD thể hiện sự chênh lệch giữa giá mua và giá bán giá cả, hoặc theo thuật ngữ kỹ thuật, giá chào mua và giá chào bán.

Trong khi đó, mức chênh lệch đo lường mức phí do nhà môi giới CFD tính, được áp dụng cho giao dịch khi một vị thế được mở. Biên độ giao dịch có thể rất hẹp, chẳng hạn như cặp EUR/USD, thường được một số nhà môi giới báo giá với 0 pip, hoặc rất rộng, chẳng hạn như BTC/USD do tính biến động của nó.

Chúng tôi chỉ ra rằng chênh lệch trong giao dịch cũng thể hiện phí môi giới. Trên thực tế, các nhà môi giới truyền thống hoặc ngân hàng đầu tư tính phí hoa hồng cho các hoạt động mua và bán, trong khi các nhà môi giới giao dịch CFD trực tuyến tính phí chênh lệch bằng pip.

Vì vậy, dù đầu tư vào cổ phiếu thông qua ngân hàng địa phương hay giao dịch CFD thông qua nhà môi giới trực tuyến, nhà giao dịch đều phải cân nhắc chi phí giao dịch.

Rõ ràng là mức chênh lệch giá của một tài sản càng thấp thì chi phí giao dịch nó càng thấp. Trong giao dịch Forex CFD trực tuyến, mức chênh lệch càng cao thì tỷ lệ phần trăm mà nhà môi giới giữ khi bắt đầu giao dịch càng cao.

Mức chênh lệch trong giao dịch thay đổi tùy thuộc vào loại công cụ tài chính. Hầu hết các nhà môi giới đều có mức chênh lệch giá khác nhau đối với hàng hóa, cổ phiếu, chỉ số, ngoại hối và tiền điện tử.

Ngoài ra, mức chênh lệch trong giao dịch thay đổi dựa trên sự biến động của tài sản. Điều này áp dụng cả nói chung, tùy thuộc vào loại công cụ và trong các trường hợp cụ thể, tùy thuộc vào thời điểm.

Ví dụ: khi một tài sản cụ thể trở nên biến động hơn do một thông báo tin tức có tác động lớn, nhà môi giới có thể quyết định tăng chênh lệch giá trên công cụ đó.

Lý do đằng sau hoạt động này là vì lợi nhuận của nhà giao dịch đến từ sự thay đổi giá, nên về mặt lý thuyết, những thay đổi này càng lớn và mạnh do sự biến động, thì lợi nhuận của nhà giao dịch càng lớn (và tổn thất càng lớn).

Khi điều ngược lại xảy ra, chênh lệch trong giao dịch cũng giãn ra, khi tính thanh khoản và biến động rất thấp, đặc biệt là vào đầu giờ giao dịch hàng ngày. Với việc thị trường không thu hút được bất kỳ sự quan tâm nào từ các nhà đầu tư, các nhà môi giới đã mở rộng chênh lệch giá để trang trải chi phí của họ.

Trên các loại tài sản khác nhau, mức chênh lệch thấp nhất thường áp dụng cho CFD FX, đặc biệt là cặp tiền tệ EUR-USD vì đây là loại tiền tệ có tính thanh khoản cao nhất Với các cặp tiền tệ mạnh , sự cạnh tranh giữa các nhà môi giới cũng gay gắt hơn.

Forex Spreads

As we saw above, Forex spreads are a transaction cost applied by the broker, also part of their revenue. Forex spreads are measured in pips (percentage in point), the smallest price change a currency pair can make.

Tùy thuộc vào cặp tiền tệ, 1 pip là một pip (0,0001) đối với tất cả các cặp tiền ngoại trừ Yên Nhật, chẳng hạn như EUR/USD hoặc USD/CHF. Báo giá EUR/USD có thể trông giống như 1,1994.

Đối với các loại tiền tệ cơ bản được giao dịch so với đồng Yên Nhật, 1 pip là 0,01, chẳng hạn như USD/JPY hoặc CHF/JPY. Báo giá USD/JPY có thể trông giống như 105,26.

Một số nhà môi giới CFD trực tuyến sẽ hiển thị báo giá của họ ở định dạng 5 chữ số. Sử dụng mức giá 5 chữ số, EUR/USD được niêm yết ở mức 1,19945 và USD/JPY ở mức 105,265. Những phần nhỏ này của một điểm thường được gọi là "pipet".

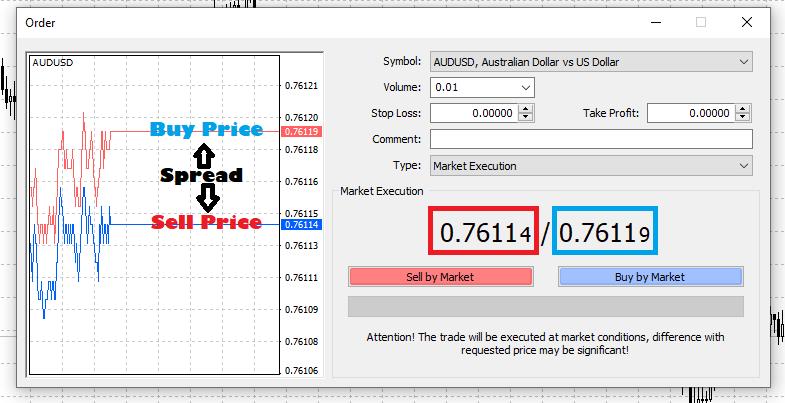

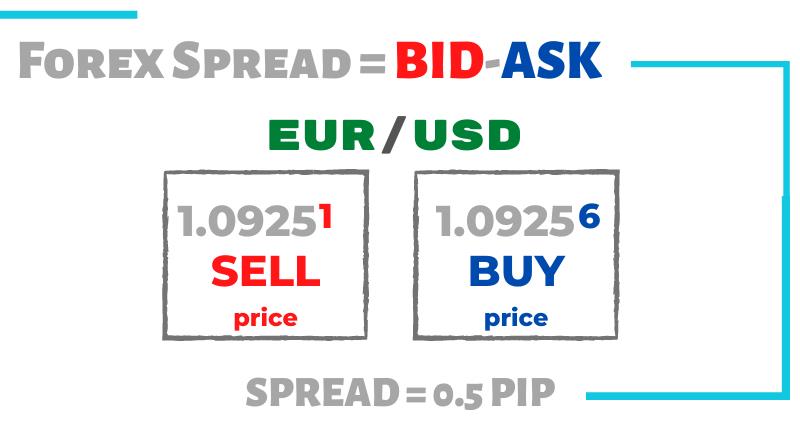

Các nhà môi giới ngoại hối sẽ báo giá hai mức giá khác nhau cho một cặp tiền tệ trên nền tảng giao dịch của họ. Giá chào mua và giá chào bán.

Ví dụ: đối với CFD EUR/USD, giá hiển thị có thể là: Bán 1,19945 và Mua 1,19950, nghĩa là chênh lệch EUR/USD là 0,5 ( nửa điểm).

Trong trường hợp hiếm hoi của một nhà môi giới Forex 4 chữ số, báo giá có thể là 1,1994 để bán và 1,1995 để mua, điều đó có nghĩa là chênh lệch EUR/USD là 1 giờ.

Chênh lệch ngoại hối là cách các nhà môi giới "miễn phí hoa hồng" kiếm được lợi nhuận. Những nhà môi giới này không tính phí hoa hồng bổ sung cho giao dịch mà thay vào đó thêm phí vào báo giá.

Nhưng không chỉ các nhà môi giới "không có hoa hồng". Mặc dù các nhà môi giới theo phong cách giao dịch ECN tính phí hoa hồng giao dịch nhưng họ cũng tính phí chênh lệch, vẫn thấp hơn một chút so với các loại nhà môi giới khác.

Về cơ bản, chênh lệch giá Forex là cách các nhà môi giới kiếm tiền theo hai cách giống nhau:

Bằng cách bán loại tiền được báo giá cho nhà giao dịch ở mức giá cao hơn giá mua của nhà giao dịch.

Bằng cách mua loại tiền cơ bản từ một nhà giao dịch ở mức giá thấp hơn giá mà nhà giao dịch bán nó.

Sự khác biệt này là chênh lệch tỷ giá hối đoái.

Chênh lệch giá thầu

Chênh lệch giá chào mua là chênh lệch giữa giá mua và giá bán của một chứng khoán. Giá dự thầu là giá mà người mua sẵn sàng mua một công cụ tài chính. Giá chào bán là mức giá mà người bán sẵn sàng bán công cụ tài chính.

Giá chào bán (còn gọi là giá chào bán) luôn cao hơn giá chào mua. Các nhà đầu tư có ý định mua chứng khoán hoặc sản phẩm CFD sẽ luôn mua ở mức giá chào bán thấp nhất. Các nhà đầu tư có ý định bán sản phẩm chứng khoán hoặc CFD sẽ luôn bán ở mức giá chào mua cao nhất. Giá thầu tốt nhất là giá thầu cao nhất hiện có trên thị trường. Tương tự như vậy, giá chào bán tốt nhất là giá chào bán thấp nhất trên thị trường.

Báo giá thị trường có thể hiển thị giá chào mua và giá chào bán tốt nhất hiện có trên thị trường, được gọi là BBO (Giá thầu và Bán tốt nhất). Trong trường hợp này, chênh lệch giá chào bán là sự khác biệt giữa giá chào bán tốt nhất và giá chào mua tốt nhất hiện có trên thị trường.

Đối với hoạt động của đại lý, chênh lệch giá chào mua là tỷ suất lợi nhuận gộp của bên trung gian đó nếu giao dịch chứng khoán nằm trong danh mục đầu tư của chính họ, còn được gọi là dưới dạng hàng tồn kho hoặc Nếu là nhà giao dịch trung gian, nó sẽ yêu cầu báo giá từ các nhà cung cấp thanh khoản và thêm họ vào lợi thế của mình. Giống như những gì các nhà môi giới Forex CFD trực tuyến làm.

Đối với các nhà đầu tư, chênh lệch giá chào mua thể hiện chi phí giao dịch tiềm ẩn, khác với chi phí giao dịch rõ ràng chính, chẳng hạn như trả tiền cho đại lý/người môi giới để Ủy ban thương mại về giao dịch.

Khái niệm chênh lệch giá chào bán cũng áp dụng cho các thị trường khác, do đó, đây là sự khác biệt giữa giá thầu tốt nhất và giá thầu tốt nhất trên thị trường.

Cược chênh lệch

Cả hai loại nhà môi giới đều có ưu điểm và nhược điểm.

Có hàng chục nhà môi giới có chênh lệch giá cố định, một số có mức chênh lệch cố định thấp tới 1 pip EUR/USD. Ưu điểm của thiết lập này là rõ ràng: các nhà giao dịch tin rằng họ luôn có thể duy trì mức chênh lệch thấp, cố định, ngay cả trong những giai đoạn thị trường biến động, chẳng hạn như trong các sự kiện tin tức có tác động lớn. Các nhà môi giới chênh lệch giá biến đổi có thể tăng mức chênh lệch của họ để bù đắp rủi ro biến động. .

Nhà môi giới ngoại hối có chênh lệch cố định

Các nhà giao dịch thậm chí có thể nhận được mức chênh lệch thấp, cố định trong các khoảng thời gian thanh khoản thấp chẳng hạn như phiên châu Á, khi các nhà môi giới có mức chênh lệch giá thay đổi thường tăng mức chênh lệch để bù đắp rủi ro thanh khoản.

Tuy nhiên, một số nhà môi giới có mức chênh lệch cố định sẽ báo mức chênh lệch cao hơn trong những khoảng thời gian yên tĩnh hơn như phiên châu Á (ví dụ: nếu EUR/CHF ở vào thời điểm 2 giờ trong ngày , sau đó là 4 hoặc 5 giờ đêm) và điều tương tự cũng được công bố trong bản tin.

Nếu các nhà môi giới thông thường thay đổi chênh lệch giá qua đêm hoặc trong thời gian có tin tức, họ sẽ đưa ra cảnh báo trên trang web của mình. Mọi cú sốc nghiêm trọng trên thị trường: tin tức, thay đổi kinh tế hoặc các sự kiện toàn cầu khác sẽ ngay lập tức khiến chênh lệch cố định tăng lên, trừ khi nhà môi giới hứa sẽ không bao giờ mở rộng chênh lệch.

Nếu bạn quan tâm đến một nhà môi giới có chênh lệch cố định, vui lòng kiểm tra chính sách chênh lệch của nhà môi giới trước khi đăng ký tài khoản.

Nhà môi giới ngoại hối có chênh lệch biến đổi < /h3>

Gần đây, số lượng chênh lệch môi giới biến đổi đã tăng lên. Chênh lệch biến đổi có thể tốn kém. Chênh lệch biến đổi sẽ thay đổi dựa trên sự biến động và tính thanh khoản của thị trường. Biến động cao hơn – chênh lệch cao hơn, biến động thấp hơn – chênh lệch thấp hơn.

Trong thời gian bình thường của một ngày, một cặp tiền tệ có thể có biến động bình thường và do đó chênh lệch vẫn cố định, nhưng khi biến động thay đổi do tin tức hoặc sự kiện địa chính trị có thể tăng khi bạn tăng, có thể từ 1 pip đến 3-4 pip, thậm chí lên tới 10 pip nếu tin tức đủ mạnh. Đồng thời: thanh khoản cao hơn - chênh lệch thấp hơn, thanh khoản thấp hơn - chênh lệch cao hơn.

EUR/USD là một ví dụ điển hình về loại tiền tệ có tính thanh khoản cao hơn với mức chênh lệch thấp hơn (đôi khi khoảng 0,5 pip), trong khi EUR/AUD là một ví dụ về tiền tệ cặp có tính thanh khoản thấp hơn và chênh lệch cao hơn (thường khoảng 2 pip).

Hãy cẩn thận với chênh lệch "thấp đến" (ví dụ: chênh lệch GBP/USD "thấp đến mức " 1 pip), để thu hút các nhà giao dịch tham gia vào các giao dịch như vậy. Mặc dù mức chênh lệch giá từ "thấp đến" này có thể thấp đến mức đáng ngạc nhiên; nhưng bạn có thể không bao giờ kết thúc giao dịch với mức chênh lệch giá này vì chúng xảy ra trong vòng vài giây trong khoảng thời gian 24 giờ.

Thay vì tập trung vào mức chênh lệch giá từ "thấp đến", hãy tập trung vào mức chênh lệch giá "điển hình", đôi khi do chính các nhà môi giới công bố. Một cách đọc trải rộng "điển hình" sẽ tốt trong hầu hết các trường hợp, nhưng đôi khi định nghĩa về điển hình có thể mơ hồ.

Tốt hơn hết, hãy cố gắng đạt được mức chênh lệch trung bình. Nó công bằng hơn vì nó tính đến mọi biến động điểm trong suốt ngày giao dịch. Rất ít nhà môi giới hiển thị mức chênh lệch giá trung bình, vì vậy tốt nhất nên vẽ biểu đồ mức chênh lệch trung bình bằng cách sử dụng các công cụ và trang web được đăng ở trên.

Các nhà môi giới ECN: chênh lệch thấp hơn, nhưng...

Một số nhà môi giới được gọi là nhà môi giới ECN (Mạng Truyền thông Điện tử) thu thập báo giá tốt nhất từ một số ngân hàng đầu tư và cố gắng hiển thị giá chào mua hoặc giá chào bán tốt nhất.

Họ cũng tính phí hoa hồng thay vì tính chênh lệch giá ban đầu để cho phép khách hàng của họ giao dịch ở mức giá gần với giá của ngân hàng hơn. Do đó, lợi thế lớn nhất khi giao dịch với nhà môi giới ECN là chênh lệch chênh lệch đáng kể. Nhưng có một nhược điểm (xem ghi chú bên dưới).

Lưu ý: Đối với các nhà môi giới ECN, ngoài hoa hồng, chi phí chênh lệch cũng phải được xem xét, mặc dù chênh lệch + hoa hồng có thể thấp hơn so với các nhà môi giới tạo lập thị trường thông thường hoặc nhiều mức chênh lệch cho các nhà môi giới xử lý xuyên suốt (STP).

Ngoài ra, còn có lợi thế thứ hai. Trong suốt thời kỳ biến động (hoặc thời kỳ thanh khoản thấp), các nhà môi giới Forex ECN sẽ cố gắng hiển thị mức giá tốt nhất hiện có thay vì đánh dấu chênh lệch để bù đắp rủi ro.

Nhược điểm của nhà môi giới ECN là bạn có thể lầm tưởng rằng chi phí giao dịch của mình thấp, trong khi thực tế chi phí giao dịch của bạn có thể bằng với các nhà môi giới khác hoặc cao hơn. Vì tất cả chúng ta đều được đào tạo để xem xét chênh lệch giá nên chúng ta có thể có xu hướng chọn nhà môi giới ECN có mức chênh lệch thấp nhất.

Tuy nhiên, chi phí hoa hồng được thêm vào mỗi giao dịch khiến các nhà môi giới ECN kém hấp dẫn hơn nhiều so với một số nhà môi giới hấp dẫn hơn với mức chênh lệch thấp và không có hoa hồng. .

Ví dụ: bạn có thể thấy một nhà môi giới ECN đưa ra mức chênh lệch 0,5 đối với EUR/USD, nhưng khi nhà môi giới này cũng thêm hoa hồng 6 USD cho mỗi 100.000 lô , thì bạn thực sự đang giao dịch với một nhà môi giới có chi phí giao dịch là 1,1 pip.

Vì vậy, nếu bạn đang tìm kiếm một nhà môi giới ECN tốt, bạn phải xem xét mức chênh lệch trung bình và chi phí hoa hồng rồi cộng chúng lại.

Đôi khi việc tìm kiếm mang lại kết quả: có một số nhà môi giới Forex ECN xuất sắc thực sự có chi phí giao dịch (chênh lệch + hoa hồng) tốt nhất trong kinh doanh Forex.